Paycheck Calculator: Calculate Federal, State & Local Taxes

Estimate the amount of money you’ll receive after accounting taxes as an hourly and salaried employee in the United States.

- State-specific calculators: We offer calculators tailored for each state in the U.S. to account for local tax laws and deductions

- Easy-to-use interface: Calculate your paycheck in seconds

- Comprehensive results: Get detailed breakdowns including gross pay, deductions, and net pay

- Precise and reliable: Our algorithm is optimized to provide you with the most accurate results

Paycheck Calculator

Disclaimer: Please note that this paycheck calculator is designed to provide an estimate and should not be considered as professional tax advice. The actual withholding amounts and taxes owed may vary depending on individual circumstances and other factors. For accurate and personalized tax advice, we recommend consulting with a tax professional.

If your gross pay is $84,000.00 per year in the state of California, your net pay (or take home pay) will be $62,761.43 after tax deductions of 25.28% (or $21,238.57). Deductions include a total of [1] 13.39% (or $11,248.10) for the federal income tax, [2] 4.24% (or $3,564.47) for the state income tax, [3] 6.20% (or $5,208.00) for the social security tax and [4] 1.45% (or $1,218.00) for Medicare.

The Federal Income Tax is collected by the government and is consistent across all U.S. regions. In contrast, the State Income Tax is levied by the state of residence and work, leading to substantial variations. The Social Security Tax is used to fund Social Security, which benefits retirees, persons with disabilities and survivors of deceased workers. Medicare involves a federal payroll tax designated for the Medicare insurance program. As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming do not levy a state income tax.

Meanwhile, get ahead with our free resources:

How Does The Paycheck Calculator Work?

Using the Paycheck Calculator is a simple, four-step process:

- Step 1: Input your gross earnings, i.e., the total amount of money you receive before any deductions or taxes.

- Step 2: Select your pay frequency, i.e., how often you get your paycheck — hourly, daily, weekly, biweekly, monthly, or annually.

- Step 3: Choose the state where you’re employed.

- Step 4: Press the Calculate Tax button.

*Note: Selecting your pay frequency will be automatically reflected in the Preferred Result Breakdown. Feel free to modify this option to see net earnings for a specific time period — hourly, daily, weekly, biweekly, monthly, or annually.

After subtracting taxes, deductions and other withholdings from your gross earnings, the calculator provides you with an estimate of your net pay, i.e., the actual amount you’ll take home when you receive your paycheck.

Paycheck Calculators By State

Who Can Benefit?

- Employees: Understand your take-home pay and plan your budget.

- Employers: Easily generate payroll calculations for your team.

- Freelancers: Estimate your earnings after taxes and deductions.

- Financial Advisors: Provide more accurate advice based on precise paycheck estimates.

Median Household Income In The United States

Our Paycheck Calculator integrates up-to-date statistics on median household income as a reference point, offering valuable insights into your own financial standing.

It helps you compare your earnings to a broader economic landscape, aiding in more informed financial decisions.

For instance, despite fluctuations over the years, with periods of growth and occasional periods of stagnation, the typical income of households in the United States has steadily grown over ten years, reaching the median of $63,062 in 2021. State-specific median income data is available in individual calculators.

| Year | Median Household Income |

|---|---|

| 2021 | $63,062 |

| 2020 | $57,703 |

| 2019 | $59,227 |

| 2018 | $55,462 |

| 2017 | $52,594 |

| 2016 | $50,860 |

| 2015 | $49,426 |

| 2014 | $47,463 |

| 2013 | $46,036 |

| 2012 | $45,040 |

| 2011 | $44,299 |

What Is A Paycheck?

A paycheck is a payment made by an employer to an employee as compensation for the work performed during a specific pay period.

Paychecks can be physical or electronic documents that are typically issued on a regular basis, such as weekly, biweekly, or monthly, depending on the employer’s payroll schedule.

Types Of Paychecks

In the United States, most employees receive their paychecks electronically — the money is transferred into their bank account.

Some employers, though, still give their staff printed checks.

Another way of compensating employees is by giving them paycards.

Paycards are prepaid debit cards onto which employers load an employee’s pay. So, instead of receiving a traditional check or having funds directly deposited into a bank account, this option is a convenient and practical payment method for some employees, especially those without access to traditional banking services.

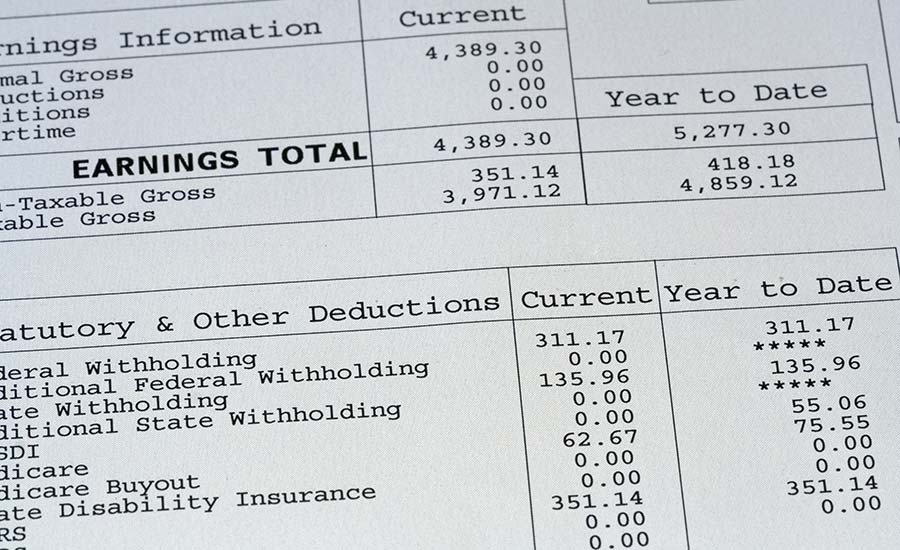

How To Read A Paycheck

Reading a paycheck is essential to ensure data accuracy and to verify that you are receiving the correct compensation.

Information Found On A Paycheck

- Check number

- Employee’s details (name and address)

- Employer’s details (name and address)

- Check date

- Payment amount

- Employer’s bank account

- Check memo (optional)

Information Found On A Pay Stub

A pay stub is a document that contains detailed information about an employee’s earnings and deductions for a specific pay period.

Pay stubs are usually included with the paycheck or provided electronically when payments are made via bank transfer.

Details typically included in pay stubs are:

- Pay period

- Regular hours worked

- Overtime hours worked

- Gross earnings

- Tax deductions

- Retirement contributions

- Medicare taxes

- Social Security taxes

- Year-to-Date information

- Paid Time Off (PTO) balances

- Personal information

Pay stubs may vary depending on the state because each state has its own set of labor laws and regulations governing what information must be included on a pay stub.

These laws may dictate specific details that must be provided to employees. If employers fail to comply with these regulations, they risk getting penalties.

Understanding Paychecks — Withholdings And Deductions

When you receive a paycheck, you’ll notice that the amount you get to take home is smaller than your gross salary.

That’s because of the taxes, withholdings and deductions such as:

- Federal income tax withholding

- FICA withholding

- State and local tax withholding

- Benefit deductions

- Local factors

1. Federal Income Tax Withholding

Federal income tax withholding is the process by which employers deduct a portion of an employee’s pay to cover their federal income tax liability.

This withholding is a mandatory requirement by the United States federal government, and it ensures that individuals pay their federal income taxes throughout the year instead of one lump sum at the end of the tax year.

When an employee starts a new job, they must fill out a W-4 form, a.k.a., the Employee’s Withholding Certificate.

On this form, the employee indicates their:

- filing status (single, married, or head of household)

- the number of allowances they want to claim; the number of allowances determines the amount of tax withheld from each paycheck

2. FICA Withholding

FICA stands for the Federal Insurance Contributions Act.

It refers to the deduction of Social Security and Medicare taxes from an employee’s pay and it is a U.S. federal law that mandates the collection of these taxes to fund both social security and medicare.

Employers and employees both pay 1.45% for Medicare and 6.2% for Social Security.

Social Security has a pay base limit, i.e., the maximum pay that’s subject to the tax for that year.

In 2023, the pay base is $160,200.

Individuals with earnings beyond a specific threshold defined by their tax filing status are obligated to pay the Additional Medicare Tax.

If an employee is earning more than $200,000 per year, the employer must deduct 0.9% from the employee’s pay as Additional Medicare Tax.

As for Medicare, the pay base doesn’t exist, meaning that all wages are subject to this tax.

3. State And Local Tax Withholding

State and local tax withholding refers to the deduction of taxes from an employee’s pay for state and local income taxes.

These taxes are separate from federal income taxes and are collected by state and local governments to fund various public services and programs, such as:

- State Income Tax Withholding

- Local Income Tax Withholding

- Short-term Disability

- Paid Family Medical Leave

- State Unemployment Tax (SUTA)

4. Benefit Deductions

Benefit deductions refer to the amounts withheld from an employee’s paycheck to provide employees with access to various benefits and insurance programs offered by their employer.

Some common benefit deductions include:

- Health insurance

- Dental and vision insurance

- Retirement contributions

- Life insurance

- Disability insurance

Frequently Asked Questions About Paychecks

1. What is gross pay?

Gross pay is the total amount of money an employee earns before any deductions or taxes are withheld.

It represents the employee’s total compensation for a specific pay period, such as a week, two weeks, or a month.

2. If my paycheck has a bonus, is it taxed differently?

Although bonuses are always welcome, they are subject to taxation and are taxed differently than regular income.

The IRS sees bonuses as supplemental wages. The federal supplemental tax rate is currently 22% for bonuses over $1 million and 37% for supplemental wages of over $1 million. State supplemental tax rates may also apply.

3. How do I know if I’m exempt from federal taxes?

Whether you are exempt from federal taxes depends on your individual circumstances and the information you provide on your Form W-4.

On the Form-W4, there’s a specific box you can check in case you believe you are exempt from federal income tax withholding.

To qualify for this exemption, you must meet two conditions:

- You had no federal income tax liability in the previous tax year

- You expect to have no federal income tax liability in the current tax year

You may also be eligible to claim exemption from federal taxes if your total income for the year is below the standard deduction amount for your filing status.

You can visit the official IRS website and complete an online interview which will help you determine if your pay is exempt from federal tax withholding.

To complete the interview, you need to provide:

Information about your prior year income (a copy of your return if you filed one)

An estimate of your income for the current year

4. Is a pay stub the same as a paycheck?

A pay stub and a paycheck usually go hand in hand, but they serve different purposes.

A pay stub is a detailed document that provides employees with information about earnings and deductions for a specific pay period.

A paycheck is the actual payment an employee receives from an employer for their work during a specific pay period. It represents the net pay — the amount an employee takes home after all deductions have been subtracted from their gross earnings.

5. What should a pay stub look like?

A pay stub should include essential information to help employees understand their earnings and deductions.

While the specific design and format of pay stubs can vary by employer and state, the key elements that a typical pay stub should include are:

- Employee Information: Employee’s name, employee’s address and employee identification number

- Employer Information: Employer’s name, employer’s address and employer’s contact information

- Pay Period Dates: The start and end dates of the pay period for which the paycheck is issued

- Earnings: Regular hours, overtime hours, pay rate and gross earnings

- Taxes and Deductions:

- Federal Income Tax

- State Income Tax

- FICA (Federal Insurance Contributions Act) Taxes

- Social Security

- Medicare

- Other Deductions — e.g., 401(k), health insurance premiums, and any other voluntary deductions

- Net Pay: Net pay (take-home pay)

- Year-to-Date (YTD) Information: YTD Earnings and YTD Taxes Withheld

- Employer Contributions: Some pay stubs may list employer contributions to retirement plans, health insurance, or other benefits.

- Check or Direct Deposit Information: Check number and direct deposit details

- Additional Information: Pay stubs may include additional details, such as paid time off balances, vacation hours accrued, or special notations from the employer.

6. What should you do with your paycheck stub?

Employees should review their pay stubs regularly to verify the accuracy of the details displayed on the pay stub.

While employees aren’t required to save their paycheck stubs, employers are obligated to keep payroll records for a specific period defined by federal and state governments.

7. What should you do if you don’t receive your paycheck or your paycheck is late?

You should reach out to your employer’s HR or payroll department immediately to inquire about the delay. They may be able to provide information about when you can expect to receive your paycheck.

Mistakes or delays can happen for various reasons, and a courteous approach is more likely to lead to a resolution.