Sous Chef Salary in the United States

How Much Does a Sous Chef Make in the US?

The average Sous Chef salary in the U.S. is $56,013 per year*. For ways to earn more money in this role, keep reading for useful tips and insights in the next sections.

* According to the most recent data gathered using our salary estimate methodology

How Much Does a Sous Chef Make Monthly?

The monthly Sous Chef salary is $4,667.75 a month.

How Much Does a Sous Chef Make Hourly?

The average hourly pay for Sous Chefs is $26.93. However, Sous Chefs are usually paid biweekly or monthly salaries rather than hourly wages.

How Much Does a Sous Chef Make Weekly?

The average weekly pay for Sous Chefs in the U.S. is $1,077.17.

That said, many Sous Chefs are considered “learned professionals” under the Fair Labor Standards Act (FLSA). Learned professionals are those who make at least $684 per week and whose regular tasks require having advanced knowledge.

As such, employees like Sous Chefs who fall under this FLSA category may be exempt from overtime pay.

For more Sous Chef employment trends, check out this article on Sous Chef demographics and statistics.

Average Sous Chef Salary by State

Below is a table showing the average salaries for Sous Chefs in all 50 states plus Washington, D.C.

As seen above, the average Sous Chef salary varies per state or district because of factors like local economic conditions.

For example, in the District of Columbia, Washington and California, Sous Chef salary averages are likely to be higher so Sous Chefs can keep up with costs of living. This is especially true if they are based in a major metropolitan area like Greater Los Angeles.

Moreover, these three places are known for having lively tourism industries, as they receive plenty of local and foreign tourists each year. As such, many of the dining establishments in these areas are more inclined to look for highly skilled Sous Chefs to keep up with the high number of visitors.

On the other hand, Sous Chef salary averages in states like Arkansas, Mississippi and West Virginia are often relatively lower following relatively lower costs of living.

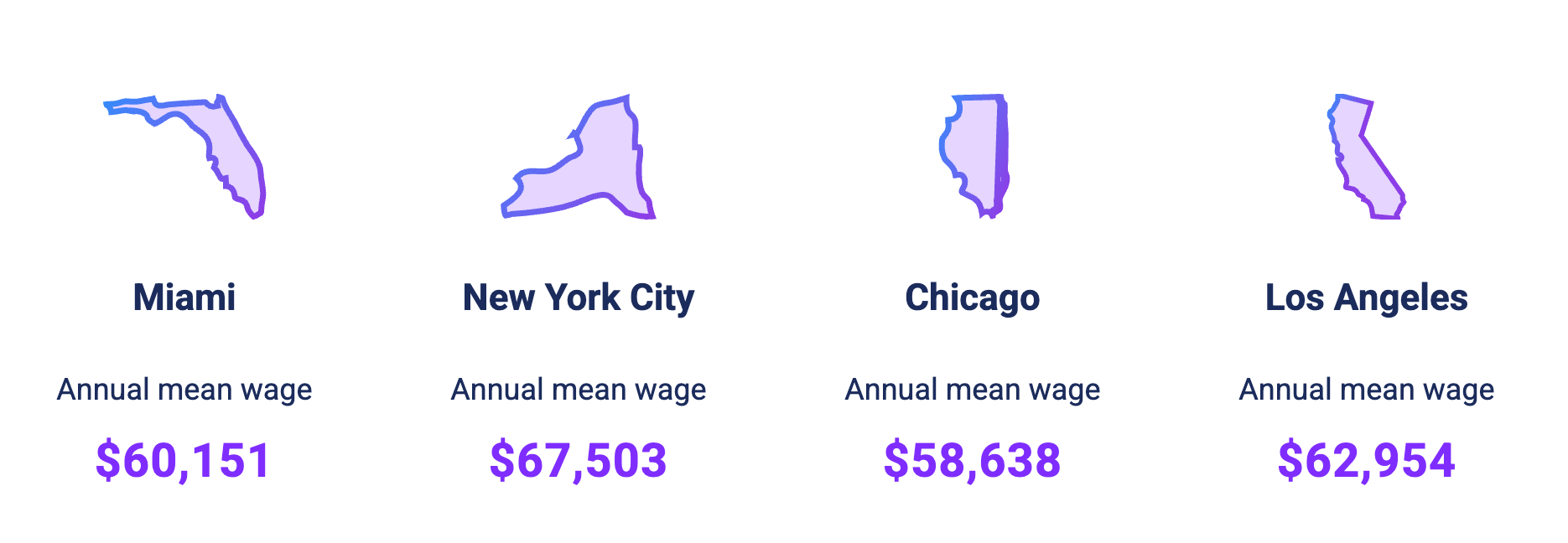

Sous Chef Salary in Major US Cities

When it comes to the four major U.S. cities, NYC is where Sous Chefs are most likely to earn the highest salaries. There, the average annual salary for Sous Chefs is $67,503.

Factors That Affect Sous Chef Salary

Aside from geographic location and cost of living, here are other factors that may influence how much money a Sous Chef makes.

1. Benefits and other compensation

Oftentimes, a Sous Chef’s base salary is not the only compensation they receive from employers. They also get several job benefits and perks, which are part of their overall compensation package. Some of these may significantly boost a Sous Chef’s overall income, while others are meant to help cover certain personal expenses.

Full-time employees within the U.S. culinary industry usually get healthcare insurance, 401(k) plans, paid time off, discounts on company products and employee assistance programs.

However, those in supervisory roles like Sous Chefs may also receive additional perks and benefits such as bonuses, equity or profit sharing, travel opportunities and possibly even educational assistance.

It's best to discuss benefits and perks like this during your interview as a Sous Chef so you can weigh the pros and cons when evaluating a job offer.

2. Experience and industry background

Sous Chefs with more years of culinary experience have higher chances of being offered competitive salaries and generous benefits packages.

The same can also be said for Sous Chefs who work or have previously worked in reputable dining establishments. These Sous Chefs have valuable skills and experience they can bring to the table, such as managing kitchen staff and maintaining high food quality standards.

Check out our article on how to become a Sous Chef so you can grow your career and level up your earnings.

3. Culinary education and additional qualifications

Sous Chefs with formal culinary education or certifications are more likely to receive higher compensation, given their credentials.

4. Particular establishment or company

A company or establishment’s scale of operations and budget might also determine how much they pay their Sous Chefs.

For example, a Sous Chef employed in a restaurant company that has many stores across the U.S. would typically earn more than one who works in an independent establishment.

Additionally, companies or establishments with bigger budgets are more likely to offer higher salaries and more benefits for supervisory employees like Sous Chefs.

5. Negotiation skills

A Sous Chef can also gain a competitive salary and benefits package if they are able to negotiate effectively during the hiring process.

Meanwhile, Sous Chefs who are not applying for a new job could ask for a raise during performance reviews or separate discussions with their employer.

In both cases, a Sous Chef must be able to articulate their culinary skills and experience, as well as their contributions to current and previous kitchen teams that they’ve been part of.

How Can I Make Extra Income as a Sous Chef?

Apart from the salary and benefits they receive from their main job, a Sous Chef can also take up side projects to make additional income.

Here are some common options that you might want to consider doing during your free time if you’re a Sous Chef:

- Start a food- or cooking-centric social media account, blog or YouTube channel. With these, you may have opportunities to earn commissions through affiliate marketing.

- Sell ready-made meals in small batches. If your employment contract allows you to, you can offer packaged homecooked meals to people within your local area.

- Teach a cooking class or facilitate culinary workshops. These can either be a single session on how to make certain types of dishes or a multi-week program that covers various culinary techniques.

How To Estimate Your Take-Home Pay

If you’re a Sous Chef working in the U.S., you can use our Paycheck Calculator — which is designed to help you accurately determine your take-home pay.

You can also use the Salary To Hourly Calculator below so you can plan your finances and understand your salary potential.

How Much Do Careers Similar to a Sous Chef Get Paid?

In the U.S., the average Sous Chef salary is generally higher than that of Prep Cooks and Line Cooks but slightly lower than that of Sushi Chefs.