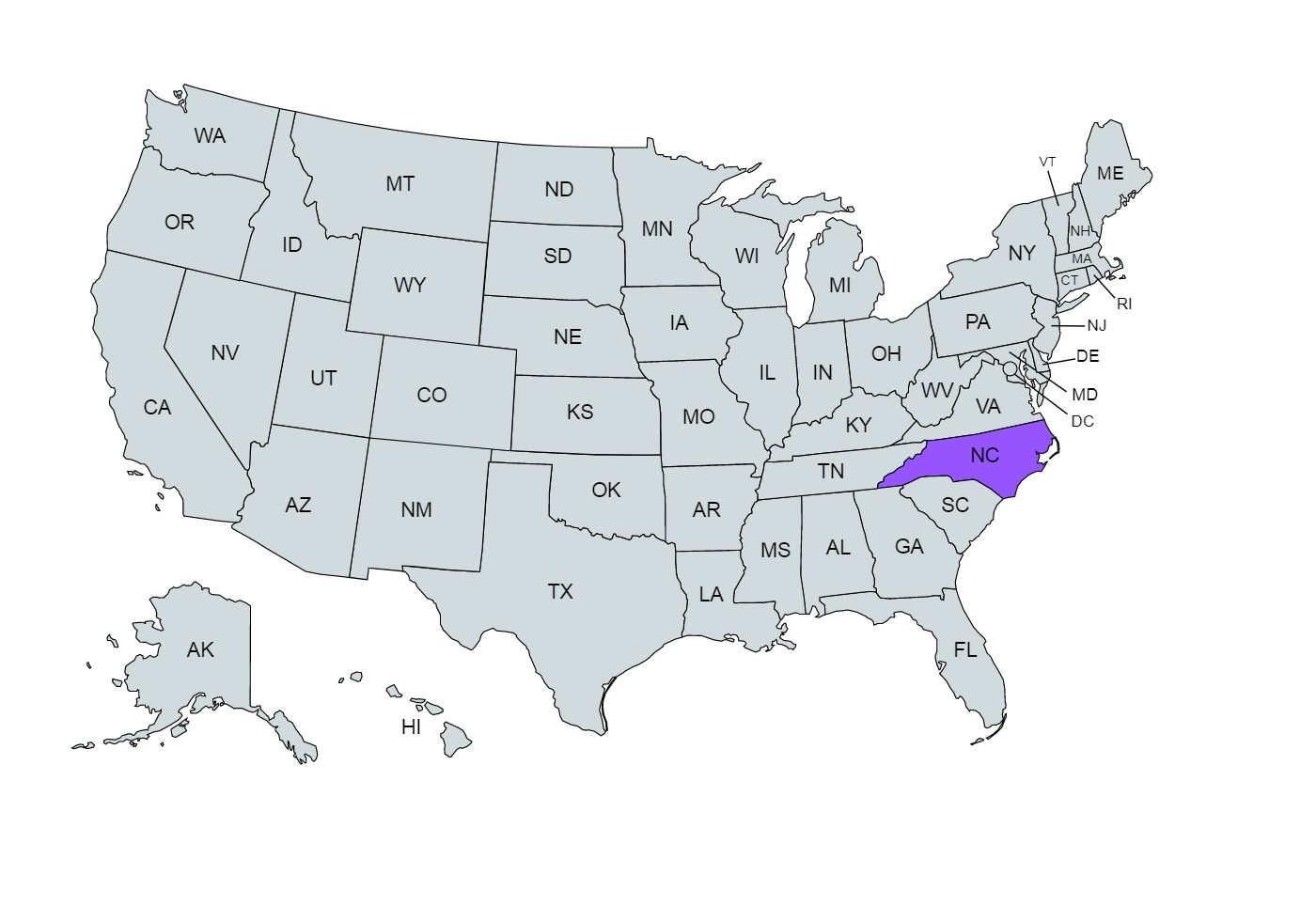

If you’re wondering, “How do I figure out how much money I take home in North Carolina” we’ve got you covered.

Use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in North Carolina.

Paycheck Calculator

Disclaimer: Please note that this paycheck calculator is designed to provide an estimate and should not be considered as professional tax advice. The actual withholding amounts and taxes owed may vary depending on individual circumstances and other factors. For accurate and personalized tax advice, we recommend consulting with a tax professional.

If your gross pay is 0 per - in the state of F, your net pay (or take home pay) will be $1,343.17 after tax deductions of 0% (or $ 156.83). Deductions include a total of [1] 0% (or $0.00) for the federal income tax, [2] 0% (or $0.00) for the state income tax, [3] 6.20% (or $0.00) for the social security tax and [4] 1.45% (or $0.00) for Medicare.

The Federal Income Tax is collected by the government and is consistent across all U.S. regions. In contrast, the State Income Tax is levied by the state of residence and work, leading to substantial variations. The Social Security Tax is used to fund Social Security, which benefits retirees, persons with disabilities and survivors of deceased workers. Medicare involves a federal payroll tax designated for the Medicare insurance program. As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming do not levy a state income tax.

How Does the Paycheck Calculator Work?

Input your salary information, such as wage and pay frequency, and our tool will handle the tax calculations for you. Once you’ve filled in all the information, click the “Calculate Tax” button, and the calculator will provide an estimate of your net or “take home” pay for the specified pay period.

Overview of North Carolina Taxes

In 2019, North Carolina’s total gross state product was approximately $591 billion.

There is a notable disparity in economic growth between North Carolina’s urban and rural areas. Major cities like Charlotte, Raleigh, and Greensboro have experienced rapid population and economic growth in the past three decades.

An interesting fact about the North Carolina state is its connection to the first gold nugget found in the U.S., discovered in Cabarrus County in 1799.

If you decide to start a new job in the “Tar Heel” state, here’s what to expect tax-wise.

North Carolina has a flat income tax rate of 4.99%, which applies uniformly to all taxpayers, making state tax filing relatively straightforward. There are no local income taxes in any North Carolina cities.

When you receive your paycheck in North Carolina, it includes withheld amounts for FICA (Federal Insurance Contributions Act), federal income taxes, and state income taxes.

FICA tax covers both Social Security (6.2%) and Medicare (1.45%), with your employer matching these rates. If you earn over $200,000, there’s an additional 0.9% Medicare surtax, but employers don’t match this payment.

North Carolina previously had a progressive income tax system but switched to a flat rate of 4.99% in 2014 through the North Carolina Tax Simplification and Reduction Act.

The “Tar Heel” state generally offers a favorable tax environment with its flat income tax rate, no local income taxes, and recent tax reforms, but the level of favorability depends on individual financial circumstances and priorities.

Median Household Income in North Carolina

Salary in each state is typically based on the cost of living. While salaries vary widely based on position, the median household income in your state can give you a glimpse at the average salary a household is earning in your region.

| Year | Median Household Income |

|---|---|

| 2021 | $61,972 |

| 2020 | $56,642 |

| 2019 | $57,341 |

| 2018 | $53,855 |

| 2017 | $52,752 |

| 2016 | $50,584 |

| 2015 | $47,830 |

| 2014 | $46,556 |

| 2013 | $45,906 |

| 2012 | $45,150 |

| 2011 | $43,916 |

In 2011, the median income stood at $43,916. From 2012 to 2016, there was a gradual, yet continuous rise in income, with each year surpassing the previous one.

However, the most remarkable change occurred in 2021, with a substantial increase to $61,972.

On the other hand, 2020 recorded a dip in median income to $56,642, which is notably lower than the previous year. This decline likely reflects the economic challenges posed by the COVID-19 pandemic, including job losses and reduced economic activity.

Overall, the data portrays a positive trajectory in median household income over the decade, marked by significant fluctuations.

Tips for Maximizing Your Paycheck

Here are some tips to help you maximize your paycheck:

- Become familiar with your payroll deductions

- Understand techniques for reducing your tax

- Fully utilize your work-related perks

- Develop a financial plan and define financial goal

- Look into additional income through extra hours or performance incentives

- Regularly check your pay stubs for inaccuracies

For a better understanding, check out our guide on how to keep more out of your paycheck.