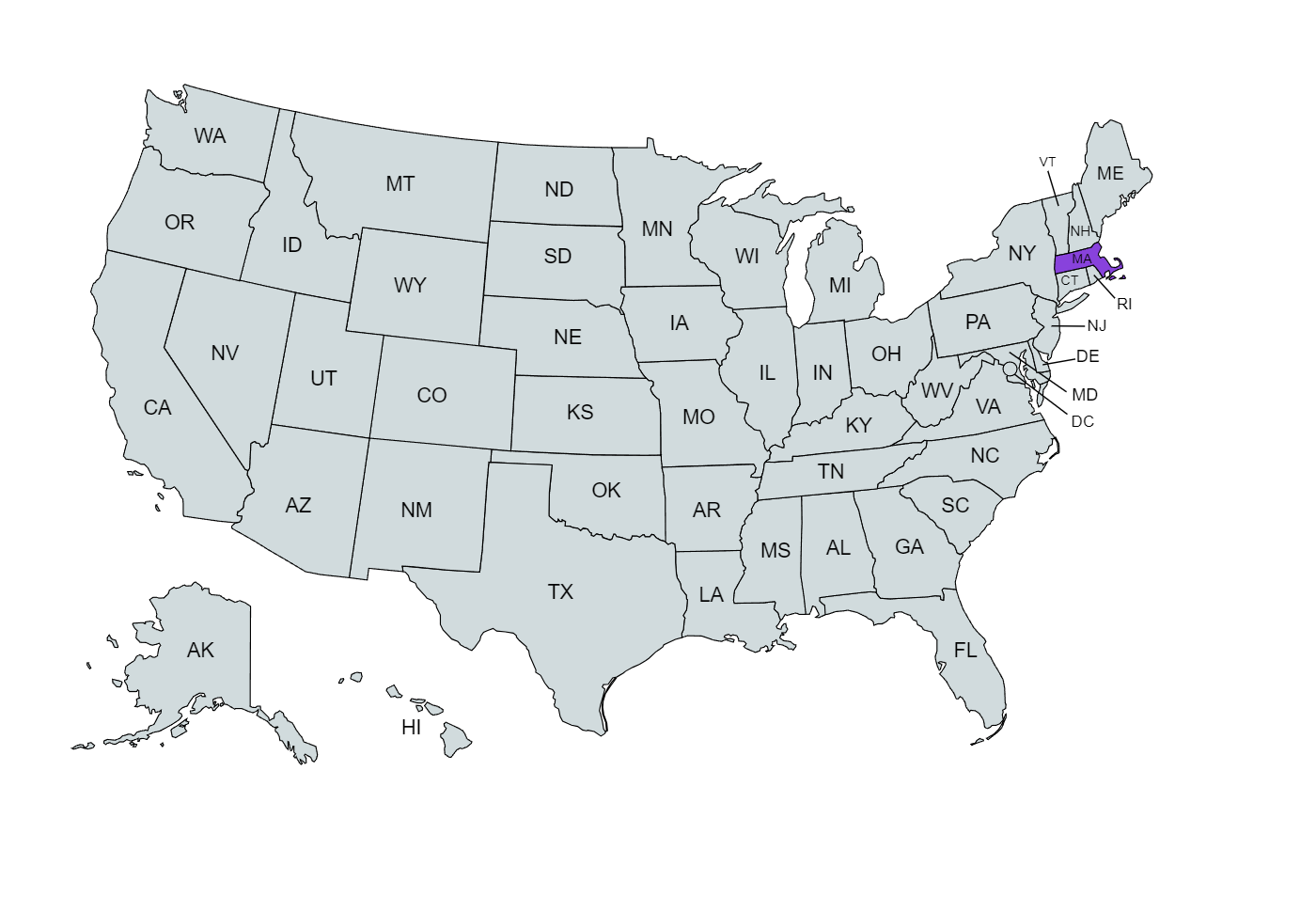

If you’re wondering, “How do I figure out how much money I take home in Massachusetts?” we’ve got you covered.

Use our simple paycheck net calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in Massachusetts.

Paycheck Calculator

Disclaimer: Please note that this paycheck calculator is designed to provide an estimate and should not be considered as professional tax advice. The actual withholding amounts and taxes owed may vary depending on individual circumstances and other factors. For accurate and personalized tax advice, we recommend consulting with a tax professional.

If your gross pay is 0 per - in the state of F, your net pay (or take home pay) will be $1,343.17 after tax deductions of 0% (or $ 156.83). Deductions include a total of [1] 0% (or $0.00) for the federal income tax, [2] 0% (or $0.00) for the state income tax, [3] 6.20% (or $0.00) for the social security tax and [4] 1.45% (or $0.00) for Medicare.

The Federal Income Tax is collected by the government and is consistent across all U.S. regions. In contrast, the State Income Tax is levied by the state of residence and work, leading to substantial variations. The Social Security Tax is used to fund Social Security, which benefits retirees, persons with disabilities and survivors of deceased workers. Medicare involves a federal payroll tax designated for the Medicare insurance program. As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming do not levy a state income tax.

How Does the Paycheck Calculator Work?

Input your salary information, such as wage and pay frequency, and our tool will handle the tax calculations for you. Once you’ve filled in all the information, click the “Calculate Tax” button, and the calculator will provide an estimate of your net or “take home” pay for the specified pay period. You can also check out our salary to hourly converter and hourly pay calculator.

Overview of Massachusetts Taxes

Massachusetts employs a graduated individual income tax system, meaning that tax rates vary based on your income. Currently, the range spans from 5% to 9%.

If your gross income exceeds $8,000, whether from in-state or out-of-state sources, you must file a Massachusetts income tax return. Those with gross incomes of $8,000 or less are exempt from filing.

For corporations operating in the Bay State, there’s a flat income tax rate of 8%. This rate applies to corporate profits earned within the state.

The state imposes a 6.25% sales tax rate on a wide range of tangible personal property, including items such as appliances and furniture. Additionally, some telecommunications services fall under this category.

Notably, Massachusetts does not levy local sales taxes, providing a straightforward sales tax experience.

If you’re a buyer, transferee, or user, who has title to or has a motor vehicle, you’re responsible for paying the sales or use tax. When you register your motor vehicle or trailer, you have to pay a motor vehicle and trailer excise.

If you’re responsible for the estate of someone who died, you may need to file an estate tax return. If the estate is worth less than $1,000,000, you don’t need to file a return or pay an estate tax.

Estate tax returns are required only if the gross estate plus adjusted taxable gifts exceeds $1,000,000.

The state of Massachusetts has numerous tax benefits for older residents, including a 65-or-over exemption, a Senior Circuit Breaker tax credit and the opportunity to volunteer n some cities and towns in exchange for a property tax bill reduction.

Median Household Income in Massachusetts

Massachusetts boasts a diverse range of industries that contribute significantly to its revenue. The top revenue-generating sectors in 2022 included Drug, Cosmetic & Toiletry Wholesaling ($68.6 billion), Life Insurance & Annuities ($66.7 billion) and Colleges & Universities, ($57.5 billion).

Businesses in Massachusetts employed a total of 4,578,740 people in 2022. The leading sectors in terms of total employment include Professional, Scientific and Technical Services, Real Estate and Rental and Leasing, and Manufacturing.

Massachusetts’ 2022 unemployment rate of 3.9% placed it 32nd among the 50 states, reflecting a slight upward trend over the past five years, albeit underperforming the broader U.S. economy.

In Massachusetts, salaries vary widely based on position. However, the median household income can give you a glimpse at the average salary a household is earning in this state.

| Year | Median Household Income |

|---|---|

| 2021 | $86,566 |

| 2020 | $87,812 |

| 2019 | $87,707 |

| 2018 | $86,345 |

| 2017 | $76,243 |

| 2016 | $72,266 |

| 2015 | $67,861 |

| 2014 | $63,151 |

| 2013 | $62,529 |

| 2012 | $63,656 |

| 2011 | $63,313 |

Tips for Maximizing Your Paycheck

Here are some tips to help you maximize your paycheck:

- Establish a detailed budget that outlines your income, expenses and financial goals

- Keep tabs on your daily expenses, including small purchases

- Review your tax withholdings to ensure you’re not overpaying taxes

- Prioritize paying off high-interest debts like credit cards

- Explore and maximize your employee benefits

- Consider diversified investments like stocks, bonds or mutual funds

For a better understanding, check out our guide on how to keep more out of your paycheck.