New Jersey Labor Law Guide

A comprehensive guide to New Jersey labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- New Jersey's minimum wage is set at $15.13 per hour for regular employees as of January 1, 2024.

- Nonexempt employees in New Jersey are entitled to overtime pay at 1.5 times their regular hourly wage when working over 40 hours in a workweek.

- New Jersey has robust family and medical leave laws that provide up to 12 weeks of job-protected leave for various personal and family-related challenges.

- Most employees in New Jersey accrue earned sick leave at a rate of 1 hour for every 30 hours worked, with a maximum of 40 hours per benefit year.

- Meal breaks for adult employees are generally determined by company policies rather than statutory requirements.

Minimum Wage Regulations in New Jersey

Minimum wage regulations in New Jersey are designed to protect the rights of workers and ensure fair compensation. These regulations apply differently to regular employees and tipped employees.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

Here's an overview of regulations that apply to regular employees in the state of New Jersey:

- Minimum wage rate: Effective January 1, 2023, the minimum wage for most regular employees in New Jersey is $15.13 per hour.

- Overtime pay: The New Jersey State Wage and Hour Law mandates that regular employees must receive overtime pay for working over 40 hours in a workweek. This overtime pay is typically calculated at 1.5 times their regular rate of pay.

- Rate reduction: Employers can reduce an employee's rate of pay, but they must provide advance notice of the reduction, and it cannot be made retroactively. The reduction also cannot bring the employee's rate of pay below the minimum wage.

- Pay frequency: Most employers are required to pay wages at least twice during each calendar month, on predetermined regular paydays. However, certain special classes of workers may receive payment once a month if a regularly established schedule exists.

- Deductions and benefits: Employers are allowed to make deductions for specific items, such as those authorized by employees or their collective bargaining agents for the rental of work clothing or uniforms or for laundering or dry cleaning. Deductions may also be made for payments related to health benefits plans and other agreed-upon benefits.

Tipped Employees

Tipped employees, such as restaurant servers, have a different minimum wage rate structure. Effective January 1, 2023, the required minimum wage for tipped employees is $5.26 per hour.

However, it's essential to note that the total earnings of a tipped employee (hourly wage plus tips) must equal at least the regular minimum wage rate. If the total falls short, the employer is required to make up the difference.

Since tip pooling is allowed in New Jersey, tips received by employees may be pooled and distributed among eligible staff, such as food bussers and bartenders. However, tips can't be shared with non-tipped employees, like managers or kitchen staff.

Overtime Rules and Regulations in New Jersey

Overtime rules and regulations are essential to protect the rights of workers and ensure fair compensation for their extra hours of work. These rules are applied differently to nonexempt and exempt employees in New Jersey.

Nonexempt Employees

Under the New Jersey State Wage and Hour Law, nonexempt employees in New Jersey are entitled to overtime pay when they work more than 40 hours in a single workweek. Overtime pay is calculated at a rate of 1.5 times their regular hourly wage.

For example, if a nonexempt employee's regular hourly wage is $10, they would be paid $15 per hour for each hour worked beyond 40 in a week.

Employers can require nonexempt employees to work overtime, provided they pay the appropriate overtime wages. They must inform nonexempt employees of their right to overtime pay and provide clear records of hours worked, including overtime hours.

New Jersey labor laws require that nonexempt employees receive meal breaks, but these breaks are not considered part of the 40-hour workweek for overtime calculations. Meal breaks are typically unpaid, and the 40-hour threshold must be reached after excluding meal break hours.

Employees Exempt From Overtime Rules and Regulations

Exempt employees are those who are exempt from overtime pay requirements because they fall into specific categories outlined by federal and state labor laws. These categories typically include executive, administrative, professional and some computer-related positions.

Exempt employees must be paid a predetermined salary that meets certain minimum requirements established by labor laws. They are not eligible for overtime pay regardless of the number of hours they work in a week.

If the employer happens to close operations due to a weather-related emergency or another unforeseen disaster for a period of less than a full workweek, they must pay an exempt employee their full salary for that week.

The number of days or hours worked doesn’t matter because deductions cannot be applied for periods when work is not available. This policy guarantees that exempt employees receive their complete salary, safeguarding their financial stability during unexpected workweek disruptions.

Break Periods in New Jersey

New Jersey State Wage and Hour Law mandates that minors under the age of 18 are entitled to a 30-minute meal period after five consecutive hours of work. This provision aims to protect the health and vitality of young workers, allowing them the opportunity to rejuvenate during their shifts.

As for meal breaks for adult employees, the state's regulations align with company policies rather than imposing specific statutory requirements. The scheduling and duration of meal breaks for workers over the age of 18 are generally determined by the discretion of the employer.

Family and Medical Leave Laws

Several family and medical leave laws exist in the state of New Jersey to provide support and protection for workers facing various personal and family-related challenges.

New Jersey Family Leave Act (NJFLA)

The New Jersey Family Leave Act provides eligible employees with up to 12 weeks of job-protected leave during any 24-month period to care for a family member's serious health condition, bond with a new child (including adoption or foster care placement) or address issues related to domestic violence or sexual assault.

Eligible employees under NJFLA include those who have worked for their current employer for at least 12 months and have accumulated a minimum of 1,000 base hours in the 12-month period preceding the leave request.

NJFLA ensures that employees can take time off to handle family and health matters without the fear of losing their jobs.

Other Leave Laws

Besides the NJFLA, New Jersey has the following acts and programs in place to help employees balance their work responsibilities with important family and health needs. These include:

- Temporary Disability Insurance (TDI): This program allows eligible employees to receive partial wage replacement benefits when they are unable to work due to a non-work-related illness, injury or other disability.

- Family Leave Insurance (FLI): FLI complements NJFLA by providing wage replacement benefits to eligible employees who need to take time off to care for a seriously ill family member or bond with a new child.

- Earned Sick Leave: Under New Jersey's Earned Sick Leave law, most employees have the right to accrue sick leave at the rate of 1 hour for every 30 hours worked, up to a maximum of 40 hours of leave per benefit year.

- New Jersey SAFE Act: The New Jersey Security and Financial Empowerment (SAFE) Act provides eligible employees with up to 20 days of unpaid leave in a 12-month period to address issues related to domestic or sexual violence.

Workplace Safety and Health Regulations in New Jersey

The state of New Jersey has established robust workplace safety and health regulations, overseen by the New Jersey Department of Labor and Workforce Development. These regulations are in place to protect workers, prevent accidents and maintain a safe working environment.

Let’s explore some key aspects of these regulations and how they contribute to fostering a secure and healthy work environment for employees in the state of New Jersey.

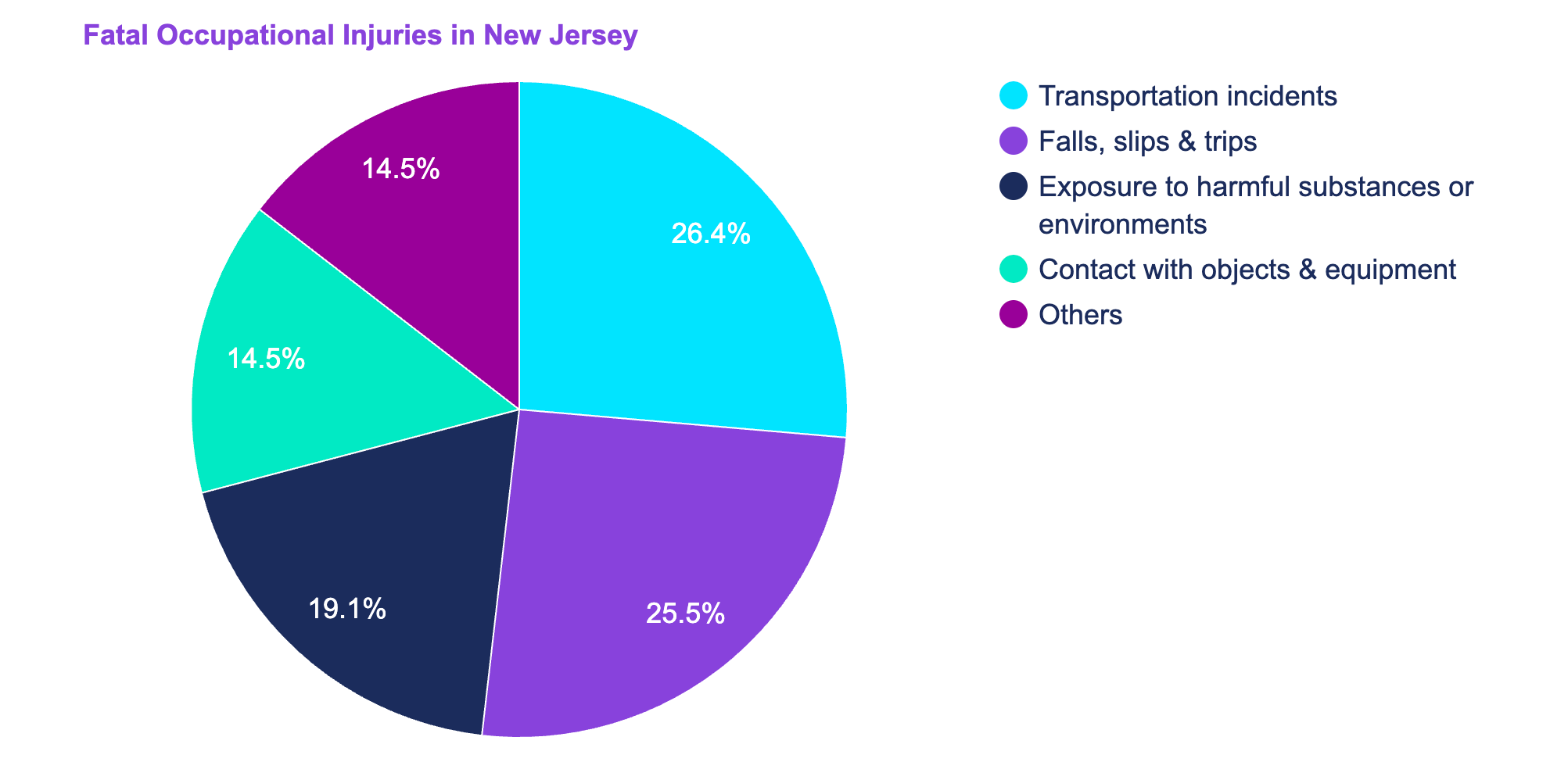

[Source: U.S. Bureau of Labor Statistics]

There were 110 fatal occupational injuries in New Jersey in 2021, which is about 34% higher compared to 82 in 2020.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

In total, the number of fatal injuries in New Jersey is 8% higher than the average number of fatal injuries in all states at 102 fatal work injuries.

Occupational Safety and Health Administration (OSHA)

New Jersey's workplace safety regulations align with the federal OSHA standards. New Jersey’s Public Employees Occupational Safety and Health (PEOSH) Program, enforces these standards for public sector employers and employees.

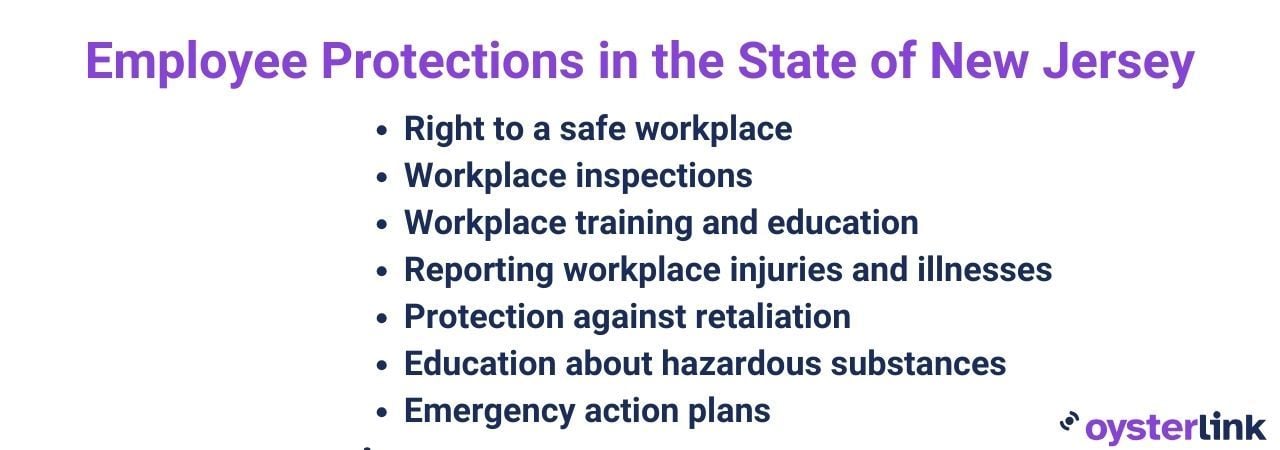

Employee Protections

New Jersey labor laws provide various protections for employees, including:

- Right to a safe workplace: Employers are legally obligated to provide a working environment that is free from recognized hazards and complies with safety standards. Workers can report unsafe conditions to their employer or contact OSHA or PEOSH if their concerns are not addressed.

- Workplace inspections: Both public and private sector workplaces in New Jersey are subject to inspections by relevant authorities. These inspections ensure that employers adhere to safety regulations and take corrective actions when violations are identified.

- Workplace training and education: Employers are responsible for providing training and education to employees about workplace safety and health hazards.

- Reporting workplace injuries and illnesses: Employers are required to keep records of workplace injuries and illnesses and report them to OSHA or PEOSH

- Protection against retaliation: New Jersey law prohibits employers from retaliating against employees who report workplace safety concerns or exercise their rights to a safe workplace.

- Education about hazardous substances: Employers must inform workers about the presence of hazardous substances in the workplace. This includes providing access to Safety Data Sheets (SDS) and proper training on handling hazardous materials.

- Emergency action plans: Employers are mandated to develop emergency action plans, including fire prevention measures, to protect workers in the event of emergencies.

Anti-Discrimination and Fair Employment Practices in New Jersey

The state of New Jersey has enacted laws and regulations that prohibit discrimination in employment based on various protected characteristics. Here is an overview of anti-discrimination and fair employment practices in New Jersey:

New Jersey Law Against Discrimination

The New Jersey Law Against Discrimination (NJLAD) is a comprehensive state law that prohibits discrimination based on various protected characteristics, including race, color, religion, sex, national origin, disability, age, sexual orientation, gender identity or expression, genetic information and more.

NJLAD applies to employers of all sizes, including public and private sector employers, labor organizations and employment agencies.

Other Anti-Discrimination Laws

Here are other anti-discrimination laws effective in the state of New Jersey:

- New Jersey Civil Union Act: This act legally recognizes civil unions established by two eligible individuals of the same sex. Parties entering into a civil union are entitled to the same benefits and protections and share the same responsibilities as spouses in a legal marriage.

- New Jersey Conscientious Employee Protection Act (CEPA): CEPA safeguards employees by prohibiting adverse employment actions against those who disclose, object to or refuse to participate in actions they reasonably believe to be illegal or against public policy.

- New Jersey Domestic Partnership Act: This law protects same-sex couples who have entered into domestic partnerships, as well as heterosexual couples over the age of 62, under the New Jersey Law Against Discrimination. Additionally, it grants these covered individuals access to various tax, health, pension and retirement benefits.

- New Jersey Equal Pay Act (NJEPA): NJEPA is aimed at eliminating gender-based wage disparities. It makes it illegal for employers to discriminate against employees in terms of pay rate or method based on their gender.

Independent Contractor Classification in New Jersey

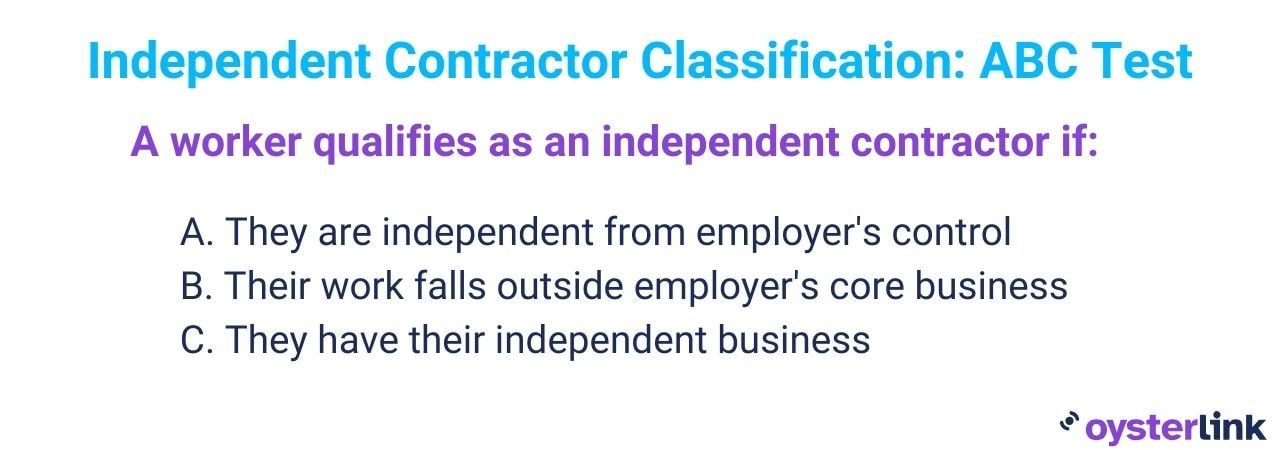

Independent Contractor Classification in the state of New Jersey holds considerable importance for both businesses and workers. Distinguishing between employees and independent contractors is a critical matter, given its substantial legal and financial consequences.

New Jersey employs a three-pronged "ABC" test to determine whether a worker qualifies as an independent contractor. It presumes that a worker is an employee unless all three of the following criteria are met:

- Independence: The worker must be free from the employer's control and direction in performing the work, both under the contract's terms and in practice.

- Outside usual course of business: The work performed by the individual must be outside the employer's usual course of business. In other words, the worker should not be performing tasks central to the employer's core operations.

- Independently established business or trade: The worker should have their own independently established business or trade, which includes performing the same services for other clients or customers beyond the hiring company.

Misclassifying workers as independent contractors, when they should be considered employees, can result in legal repercussions. Workers may be denied important employment benefits, such as minimum wage, overtime pay, workers' compensation and unemployment insurance. Employers who misclassify workers may also face fines, penalties and potential lawsuits.

Termination and Final Paychecks in New Jersey

New Jersey labor laws don’t require employers to provide advance notice to employees before terminating their employment unless otherwise specified in an employment contract or collective bargaining agreement.

Upon termination, employers are required to provide an employee's final paycheck promptly. The final paycheck should include all wages and compensation owed to the employee, including:

- Regular wages earned up to the date of termination.

- Accrued and unused vacation pay or other paid time off if company policy or an employment agreement provides for such payment.

- Any commissions, bonuses or fringe benefits owed to the employee based on prior agreements or company policies.

The final paychecks must be issued within the following timeframes:

- If an employee is terminated, final wages are generally due on the next regular payday after termination

- If an employee resigns and provides at least one pay period's notice, the final paycheck is due on the last day of employment

- If an employee resigns without providing notice or with less than one pay period's notice, the final paycheck is due within the time period that the notice should have been provided

When navigating New Jersey labor laws and termination procedures, ensure you're equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state's tax laws.

Summary of New Jersey Labor Laws

New Jersey's labor laws encompass a wide range of workplace aspects. The state upholds a $15.13 minimum wage for regular employees and a unique $5.26 minimum wage for tipped employees, ensuring fair compensation.

Overtime rules mandate time-and-a-half pay for nonexempt employees working over 40 hours weekly, while exempt employees are exempt from overtime pay requirements. New Jersey emphasizes family and medical leave, granting job-protected leave under the NJ Family Leave Act.

Robust anti-discrimination laws, workplace safety regulations aligned with OSHA standards and clear guidelines for independent contractor classification further safeguard workers' rights in the state.

Frequently Asked Questions About New Jersey Labor Laws

Is it illegal to work eight hours without a break in NJ?

In New Jersey, it is generally not illegal to work eight hours without a break for adults. However, specific industries or collective bargaining agreements may have different rules regarding breaks, so it's advisable to check with your employer or union if applicable.

What are the legal working hours in New Jersey?

In New Jersey, there is no specific set of legal working hours for adults. However, the standard workweek typically consists of 40 hours for nonexempt employees. If a nonexempt employee works more than 40 hours in a workweek, they are entitled to receive overtime pay for those additional hours, typically at a rate of one and one-half times their regular hourly wage.

Are breaks paid in NJ?

The state does not mandate paid breaks for adult employees, but meal breaks and rest breaks might be paid if stipulated in your employment contract or collective bargaining agreement.

Is paid vacation mandatory in NJ?

New Jersey does not have a mandatory paid vacation law. Paid vacation is typically provided at the discretion of the employer or as outlined in employment contracts or collective bargaining agreements.

Do you have to give a two-week notice in NJ?

While there is no legal requirement in New Jersey for employees to give two-week notice before resigning, providing notice is considered a professional courtesy and can help maintain a positive professional relationship.

Does NJ have a fair workweek law?

Yes, New Jersey has a fair workweek law, the New Jersey Fair Workweek Act. This act grants employees the right to request changes to their work schedules without facing retaliation or negative consequences. Furthermore, it mandates that employers must genuinely consider and evaluate these requests in good faith.

Can you be forced to work overtime in NJ?

Your employer can require you to work overtime hours, and they can terminate your employment if you refuse to do so. There are no specific restrictions on the amount of overtime your employer can demand, as long as they adhere to the established overtime regulations.

How many sick days do you get in NJ?

In New Jersey, you accrue earned sick leave at a rate of one hour for every 30 hours worked, with a maximum of 40 hours of leave per benefit year. For instance, if you work 40 hours a week, you will accumulate approximately 5.33 hours of earned sick leave over the course of four weeks.

Disclaimer: This information serves as a concise summary and educational reference for New Jersey state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.