A comprehensive guide to Mississippi labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- Mississippi labor laws follow federal minimum wage laws for regular and tipped employees at $7.25 per hour.

- Eligible Mississippi employees who work over 40 hours per week are entitled to overtime pay of time and a half or 1.5 times their regular pay.

- Mississippi is an employment-at-will state, allowing employers or employees to terminate employment at any time, with or without cause, unless prohibited by law.

- Mississippi is a right-to-work state, meaning employers cannot require union membership for employment.

Minimum Wage Regulations in Mississippi

Mississippi follows federal regulations when it comes to minimum wage regulations, with varying rates for regular and tipped employees. These minimum wage laws ensure that all workers receive fair compensation for their labor, and noncompliance can result in penalties for the employer.

Both employees and employers need to grasp these regulations to uphold a just and equitable work environment.

[Source: FRED]

This map is interactive. Hover your mouse over different parts of the map to see detailed data.

Regular Employees

A regular employee receives a fixed hourly wage or salary. Regular employees in Mississippi are offered the current federal minimum wage of $7.25 per hour. This change was made in 2008 when the minimum wage was raised from $6.55 to $7.25.

[Source: Fair Labor Standards Act]

Tipped Employees

A tipped employee, like a server or bartender, is a worker who typically receives more than $30 per month in tips. Tipped employees in Mississippi can receive a base wage of $2.13 per hour.

However, when you add their tips to this amount, it must total at least $7.25 per hour, which is the federal minimum wage. If their tips don’t reach $5.12 an hour, the employer is responsible for making up the difference.

Stay up to date with the latest salary trends

Overtime Rules and Regulations in Mississippi

A typical workweek comprises 40 hours. If an employee works more hours than that, they should receive overtime pay at a rate of at least 1.5 times their regular hourly wage.

Nonexempt Employees

Nonexempt employees encompass various categories, such as hourly workers, part-time staff and individuals in specific job roles or industries that do not fall under the exemptions provided by FLSA wage and hour regulations.

Nonexempt employees are eligible for overtime pay at 1.5 times their regular hourly wage for hours worked beyond the standard 40-hour workweek.

Employers in Mississippi are responsible for accurately tracking and compensating nonexempt employees in accordance with federal guidelines.

Exempt Employees

Exempt employees are typically salaried workers, receiving a fixed salary regardless of the number of hours worked and are not eligible for overtime pay.

Exempt employees in Mississippi, similar to nonexempt employees, are subject to the federal minimum wage rate of $7.25 per hour or $684 per work week.

To be considered exempt, employees must meet specific criteria set by the FLSA. These criteria usually revolve around their job responsibilities, salary and classification, such as executive, administrative, professional or other specialized categories.

It’s important for employers to accurately classify their employees as exempt or nonexempt to adhere to wage regulations. Misclassification can lead to wage and hour violations, so employers should have a solid grasp of both federal and state labor laws to avoid potential legal complications.

At-Will Employment in Mississippi

Mississippi operates under employment-at-will principles. In this framework, unless there is a specific employment contract in place, either the employer or the employee can terminate the employment relationship at any time, with or without cause and notice, except for reasons prohibited by law.

Also, employers cannot terminate employees for public policy reasons that independently violate state or federal laws, including legislative actions.

One such exception relates to reports of suspected abuse, stating that individuals making good faith reports should not face termination, demotion, rejection for promotion or other forms of retaliation.

Additionally, if an employer’s employment manual or handbook does not include disclaimers, its terms and conditions may establish contractual obligations for the employer and potentially limit the employment-at-will doctrine.

Right-To-Work Laws in Mississippi

Mississippi is a right-to-work state, which means that an employer cannot condition an employee’s right to work on their affiliation with a labor union or organization. Employers cannot also impede employees’ rights to organize or engage in collective bargaining through labor organizations.

Three new laws in Mississippi further clarify this stance:

- The Mississippi Employment Fairness Act asserts the state’s authority to mandate or agree to labor peace agreements or collective bargaining provisions as permitted by federal labor laws. However, it does not affect the state’s ability to use project labor agreements within federal labor law boundaries.

- The Prohibition Against Employer Intimidation Act prevents any entity from causing harm, threats or coercion to intimidate a business or its employees, aiming to influence them to support certain organized initiatives or objectives.

- Another act makes it illegal for unions or labor entities, either individually or collectively, to engage in mass picketing or demonstrations that obstruct free access to businesses or disrupt public entryways and streets.

These laws collectively uphold Mississippi’s right-to-work status while setting guidelines for labor practices and preventing intimidation or obstruction of businesses and employees exercising their rights.

Rest and Meal Breaks

Mississippi labor laws do not require employers to provide specific rest and meal breaks for employees.

Mississippi employers must adhere to federal rules, so although they are not obligated to provide breaks, they must pay employees for their work time and shorter breaks.

However, if an employer offers a more extended meal break where the employee is entirely relieved of duties, they don’t need to compensate the employee for that time.

Family and Medical Leave Laws

Mississippi labor laws follow the federal Family and Medical Leave Act (FMLA), which provides eligible employees with up to 12 weeks of unpaid, job-protected leave in a 12-month period for specific family and medical reasons. This allows eligible employees to take a leave in case of the following:

- Serious health condition: To address their own serious health condition, making it easier to prioritize their well-being.

- Family care: To care for an immediate family member with a serious health condition (spouse, son, daughter or parent).

- Childbirth: For the birth and care of their newborn child.

- Adoption: For adoption or foster care matters.

- Military exigency: To address matters related to a family member’s active duty in the military (e.g., military-sponsored functions, financial and legal arrangements, alternative childcare, etc.).

- Military caregiver: Employees can take up to 26 weeks of leave in a 12-month period to care for a family member in the military with a serious injury or illness.

Other Leave Laws

While Mississippi doesn’t have specific laws addressing maternity and paternity leave, it’s important to understand your options in other situations where taking leave may become necessary. Here’s a quick overview of various types of leave and how Mississippi labor laws typically handle them:

- Bereavement leave: Employers in Mississippi are not legally obligated to provide paid or unpaid bereavement leave.

- Jury duty leave: If you’re summoned for jury duty, your employer is generally required to grant unpaid time off. Keep in mind that the court pays jurors $5.00 per day and provides mileage reimbursement.

- Voting leave: Mississippi labor laws do not mandate employers to provide time off for voting.

Don’t miss out on crucial labor law insights

Workplace Safety and Health Regulations

Prioritizing workplace safety and health is paramount to creating a productive and secure work environment. Mississippi employers are subject to a combination of federal and state-specific regulations governing safety and health in the workplace.

This includes adherence to federal Occupational Safety and Health Administration (OSHA) regulations, as well as any state-specific requirements that may exist in Mississippi to ensure the safety and well-being of employees.

Occupational Safety and Health Act

Mississippi adheres to the federal Occupational Safety and Health Act (OSHA), which establishes the framework for ensuring safe and healthful working conditions for employees across the state.

However, Mississippi also has its own state agency known as the Mississippi Department of Health Occupational Health Surveillance Program, which oversees workplace safety and health enforcement.

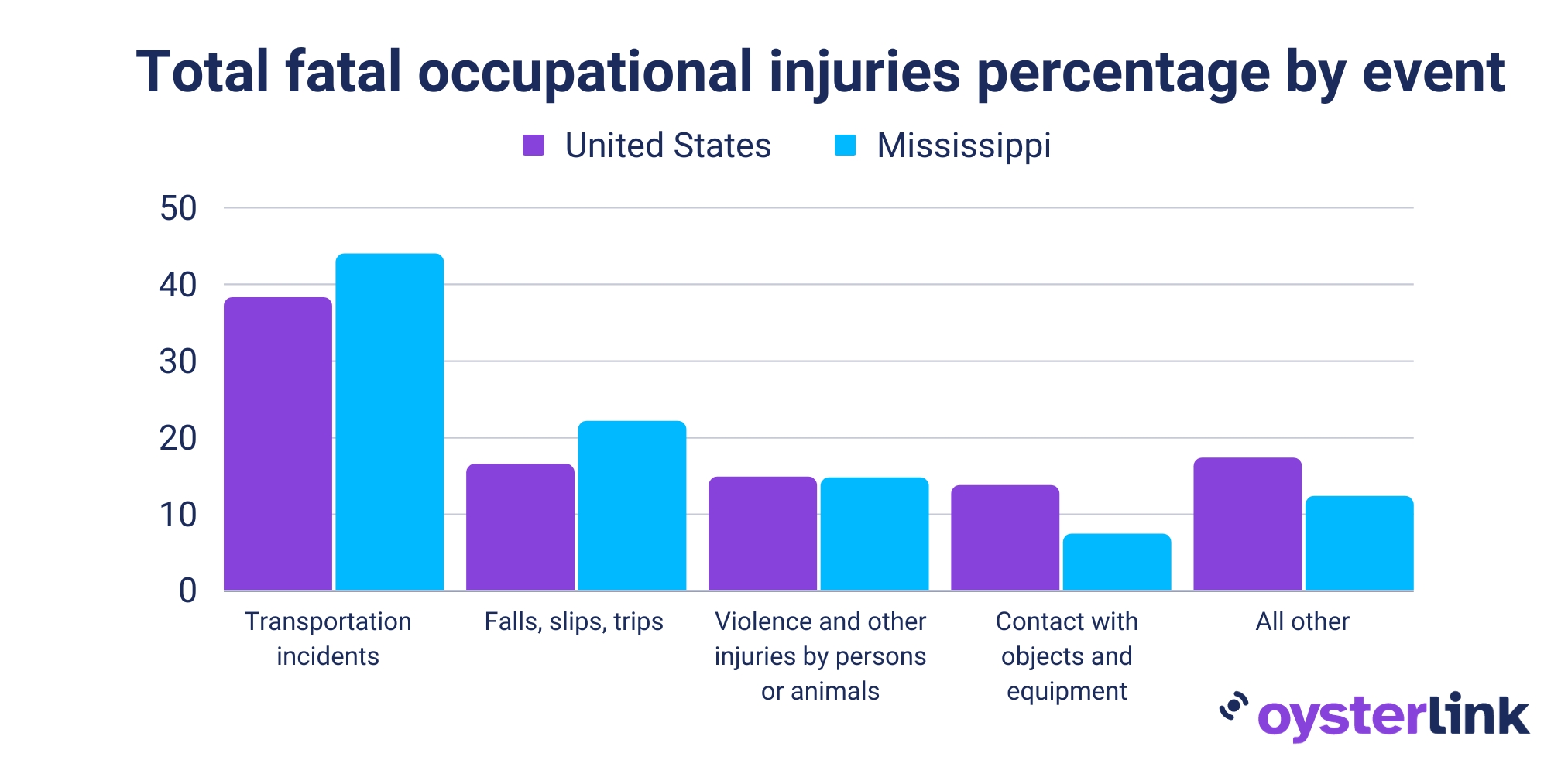

In Mississippi, workplace fatalities were attributed to various causes. Transportation incidents were the leading cause in 2021, resulting in 18 fatal work injuries, and they accounted for a significant 44 percent of all fatal workplace injuries in the state.

The second most frequent fatal work event was falls, slips, and trips, which led to nine fatalities. These statistics highlight the significance of focusing on workplace safety, particularly in sectors prone to transportation-related risks and fall hazards.

[Source: U.S. Bureau of Labor Statistics]

You can see how Mississippi compares to other states in the US when it comes to the total number of occupational fatal injuries by browsing our interactive map below.

[Source: U.S. Bureau of Labor Statistics]

This map is interactive. Hover your mouse over different parts of the map to see detailed data. </p

Employee Protections

Mississippi labor laws provide various protections for employees, including:

- Workplace safety: Mississippi enforces workplace safety regulations primarily through federal OSHA standards. Employees can and should report safety concerns without fear of retaliation.

- Whistleblower protection: Mississippi has laws that protect employees from retaliation or adverse consequences for reporting illegal or unsafe activities in the workplace

- Wage payment: Employers should pay employees accurately and on time. Failure by employers to do so may result in penalties. Employees have the right to receive detailed pay stubs that outline deductions and earnings.

- Workers’ compensation: Mississippi requires employers to provide workers’ compensation insurance, which covers employees in case of work-related injuries or illnesses. Employees have the right to file workers’ compensation claims for injuries sustained on the job.

- Union activity: Employees have the freedom to take part in lawful union activities, and they are shielded from any form of employer retaliation for their involvement in union-related actions. Participating in unions is entirely voluntary and should not be mandatory for employees by employers or any other entity.

- Privacy rights: Employees have some expectations of privacy in the workplace, such as in their personal belongings or communications. Employers must respect these privacy rights within legal boundaries.

Anti-Discrimination and Fair Employment Practices

Promoting a workplace free from discrimination and ensuring fair employment practices are fundamental principles in Mississippi labor law. These principles are upheld through various statutes and regulations, with the cornerstone being the Fair Employment and Housing Act (FEHA).

FEHA Overview

Mississippi’s Fair Employment and Housing Act (FEHA) is a critical piece of legislation that aims to prevent discrimination and promote fair employment practices within the state. FEHA aligns with federal anti-discrimination laws but extends additional protections to Mississippi workers.

These protections cover areas such as employment discrimination based on the following:

- Age: Treating employees unfairly due to age or specifying preferences for younger workers.

- Ancestry: Harassment based on perceived ancestry, unequal pay due to ancestry or national origin or cultural traits–related harassment.

- Color: Includes racial slurs, offensive remarks about race, refusal to hire based on skin color or skin color-related harassment.

- Disability: Refusing to hire based on actual or perceived disability, failing to make reasonable accommodations or engaging in offensive remarks related to disabilities.

- Gender: Not hiring or placing employees in lower-paying positions due to gender, holding different standards based on traditional gender roles or paying less for similar qualifications.

- Genetic information: Refusing employment based on genetic information or family hereditary diseases.

- Marital status: Refusing to hire or promote based on marital status, asking inappropriate questions about marital status during hiring or making adverse employment decisions related to marital status.

- Medical conditions: Failing to make reasonable accommodations for medical conditions, denying time off for medical treatment or taking adverse actions due to medical conditions.

- Military or veteran status: Making employment decisions based on military service or refusing to allow employees to return to their previous positions after military service.

- National origin: Harassment based on actual or perceived national origin, refusing to hire based on appearance or associations with certain nationalities or taking adverse actions related to national origin.

- Race: Involves racial slurs, offensive remarks, refusal to hire based on race or workplace harassment due to race.

- Religion: Failing to make religious accommodations, imposing different work requirements based on religion or excluding hiring due to religious characteristics.

- Sex (including pregnancy): Unequal pay based on gender, not hiring due to expectations about fitting into traditional gender roles, failing to promote due to gender, harassment related to pregnancy and not providing reasonable accommodations for pregnant employees.

- Sexual orientation: Giving different performance reviews, promotions or engaging in harassment based on sexual orientation.

Employers and employees should be aware of the provisions and protections offered by FEHA to ensure equal and fair treatment in the workplace.

Other Anti-Discrimination Laws

In addition to FEHA, Mississippi labor laws encompass other anti-discrimination laws designed to eliminate bias and promote equal opportunity in the workplace. These laws may address specific forms of discrimination or extend protections to certain groups of employees.

Military Protection

There shall be no discrimination following an individual’s military service.

Protecting Freedom of Conscience from Government Discrimination Act

This Act permits religious organizations to make decisions about hiring, termination or discipline of individuals whose conduct or beliefs are inconsistent with the organization’s religious tenets.

The Act also allows certain employers to establish sex-specific standards or policies related to dress, grooming or access to facilities based on sincerely held religious beliefs or moral convictions.

While the Act may grant certain freedoms to religious organizations and employers in Mississippi based on their beliefs, it does not provide a blanket exemption from anti-discrimination laws.

WARN Laws

Mississippi does not have specific labor laws regarding mass layoffs. However, following the Worker Adjustment and Retraining Notification (WARN) Act, employers are required to provide 60 days’ notice before mass layoffs and plant closings.

Stay up-to-date with Mississippi labor regulations

Independent Contractor Classification in Mississippi

Properly classifying workers as employees or independent contractors is a critical consideration for Mississippi employers. Misclassification can lead to legal and financial consequences.

Mississippi courts consider several factors to determine if a worker is an employee or an independent contractor.

These factors include the level of control over the work, the worker’s distinct occupation, required skill, provision of tools and workspace, employment duration, payment method and whether the work aligns with the employer’s regular business.

The most important factor in this determination is the extent of control exercised by the employer over the worker.

Official Holidays in Mississippi

As observed in most states, private employers in Mississippi are not required to provide paid or unpaid leave for holidays. Employers can also require all employees to work during holidays as needed. Note that many employers in Mississippi do extend the benefit of paid holidays to their staff.

When a holiday lands on a Saturday, it is observed on the preceding Friday, and if it falls on a Sunday, it is observed on the following Monday.

| Date | Holiday |

|---|---|

| January 1 | New Year’s Day |

| 3rd Monday in January | Dr. Martin Luther King, Jr. |

| 3rd Monday in February | Presidents’ Day |

| 4th Monday in April | Confederate Memorial Day |

| Last Monday in May | Memorial Day |

| July 4 | Independence Day |

| 1st Monday in September | Labor Day |

| November 11 | Veterans Day |

| 4th Thursday in November | Thanksgiving |

| Day after Thanksgiving | Thanksgiving Friday |

| December 25 | Christmas Day |

[Source: Secretary of State]

Termination and Final Paychecks

Mississippi has no specific law regarding final payments to employees. However, these payments should be given by the regular payday, ensuring they don’t fall below minimum wage. Unclaimed wages must be surrendered to the state as per the Mississippi Uniform Disposition of Unclaimed Property Act.

Understanding the intricacies of termination and final paycheck requirements is essential to avoid legal disputes and ensure a smooth transition for both employers and employees.

When navigating Mississippi labor laws and termination procedures, ensure you’re equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions tailored to your state’s tax laws.

Paycheck Calculator

Disclaimer: Please note that this paycheck calculator is designed to provide an estimate and should not be considered as professional tax advice. The actual withholding amounts and taxes owed may vary depending on individual circumstances and other factors. For accurate and personalized tax advice, we recommend consulting with a tax professional.

If your gross pay is $60,000.00 per year in the state of Mississippi, your net pay (or take home pay) will be $46,969.50 after tax deductions of 21.72% (or $13,030.50). Deductions include a total of [1] 9.07% (or $5,440.50) for the federal income tax, [2] 5.00% (or $3,000.00) for the state income tax, [3] 6.20% (or $3,720.00) for the social security tax and [4] 1.45% (or $870.00) for Medicare.

The Federal Income Tax is collected by the government and is consistent across all U.S. regions. In contrast, the State Income Tax is levied by the state of residence and work, leading to substantial variations. The Social Security Tax is used to fund Social Security, which benefits retirees, persons with disabilities and survivors of deceased workers. Medicare involves a federal payroll tax designated for the Medicare insurance program. As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming do not levy a state income tax.

Miscellaneous Mississippi Labor Laws

Mississippi labor laws encompass a variety of regulations that address specific aspects of employment and labor relations.

Immigration Verification

Mississippi requires all employers to use E-Verify for verifying employee eligibility under the Mississippi Employment Protection Act (Miss. Code Ann. § 71-11-3). Failure to comply with this can lead to severe penalties, including contract cancellations, loss of licenses and fines from $1,000 to $10,000.

Drug Testing

Mississippi enforces two workplace drug testing laws. The first follows the Drug-Free Workplace Workers’ Compensation Premium Reduction Act, which offers employers a 5% workers’ compensation premium reduction if they voluntarily implement a drug-free workplace program.

This program must follow specific state Health Department procedures, inform employees and applicants in writing, and maintain result confidentiality.

The second law (Miss. Code Ann. § 71-3-207) governs employers who voluntarily conduct drug and alcohol testing. While the choice to conduct such testing is voluntary, employers must adhere to the terms of this chapter without exception.

Mississippi allows employers to test for alcohol and substances not covered by the federal Drug-Free Workplace Act of 1988.

Additionally, employers are required to use a Medical Review Officer to review all test results. Employers should exercise caution when implementing drug and alcohol testing programs, as they can pose significant challenges.

Smoking Laws

Employers in Mississippi cannot make employment contingent on employees or job applicants refraining from smoking or using tobacco products in non-work areas during non-work hours.

However, employees must still comply with relevant smoking regulations during working hours.

While some counties have restrictions on smoking in specific settings, the state does not have a comprehensive ban on smoking in private workplaces.

Check out this list of Mississippi smoke-free communities.

Gun Laws

Mississippi labor laws permit individuals to store firearms in locked vehicles within parking areas, with private employers having the option to restrict this in areas with limited access. However, employer-owned or leased vehicles used for work purposes are exempt from these restrictions.

Frequently Asked Questions About Mississippi Labor Laws

What is the legal working age in Mississippi?

The minimum employment age in Mississippi is 14 years old. Those in fruit and vegetable canneries are exempt from this age requirement.

How many hours can you work in Mississippi?

As per federal law and Mississippi labor laws, eligible employees can work for 40 hours in a work week and any time exceeding that counts as overtime.

Can you be fired without cause in Mississippi?

As long as the termination is not due to discriminatory reasons, an employer in Mississippi can fire an employee for any or no reason.

This is because Mississippi is an employment-at-will state, which means that either the employer or the employee can end the employment relationship at any time and for any lawful reason, without the need for prior notice or cause.

Do salaried employees get overtime in Mississippi?

Many salaried employees are categorized as exempt and are not entitled to overtime pay. However, whether or not you can receive overtime pay is dependent on your salary.

If you do not meet the salary requirements or at least $684 per week, as required by the FLSA, then you will not be considered exempt and will, therefore, be eligible for overtime pay.

Do you need a work permit in Mississippi?

You do not need a work permit in Mississippi as an adult worker. A work permit is only required if you are a minor under 16. If you are under 16, a certificate must be acquired and presented to your employer.

Disclaimer: This information serves as a concise summary and educational reference for Mississippi labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.

Labor Laws By State

- Alabama Labor Law Guide

- Alaska Labor Law Guide

- Arizona Labor Law Guide

- Arkansas Labor Law Guide

- California Labor Law Guide

- Colorado Labor Law Guide

- Connecticut Labor Law Guide

- Delaware Labor Law Guide

- District of Columbia Labor Law Guide

- Florida Labor Law Guide

- Georgia Labor Law Guide

- Hawaii Labor Law Guide

- Idaho Labor Law Guide

- Illinois Labor Law Guide

- Indiana Labor Law Guide

- Iowa Labor Law Guide

- Kansas Labor Law Guide

- Kentucky Labor Law Guide

- Louisiana Labor Law Guide

- Maine Labor Law Guide

- Maryland Labor Law Guide

- Massachusetts Labor Law Guide

- Michigan Labor Law Guide

- Minnesota Labor Law Guide

- Mississippi Labor Law Guide

- Missouri Labor Law Guide

- Montana Labor Law Guide

- Nebraska Labor Law Guide

- Nevada Labor Law Guide

- New Hampshire Labor Law Guide

- New Jersey Labor Law Guide

- New Mexico Labor Law Guide

- New York Labor Law Guide

- North Carolina Labor Law Guide

- North Dakota Labor Law Guide

- Ohio Labor Law Guide

- Oklahoma Labor Law Guide

- Oregon Labor Law Guide

- Pennsylvania Labor Law Guide

- Rhode Island Labor Law Guide

- South Carolina Labor Law Guide

- South Dakota Labor Law Guide

- Tennessee Labor Law Guide

- Texas Labor Law Guide

- Utah Labor Law Guide

- Vermont Labor Law Guide

- Virginia Labor Law Guide

- Washington Labor Law Guide

- West Virginia Labor Law Guide

- Wisconsin Labor Law Guide

- Wyoming Labor Law Guide