A comprehensive guide to Oklahoma labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- Oklahoma follows the federal minimum wage standard of $7.25 per hour for regular employees.

- Tipped employees may be paid as little as $2.13 per hour, provided their tips bring their earnings to at least the federal minimum wage.

- Nonexempt employees are entitled to overtime pay for hours worked beyond 40 in a workweek.

- Employees typically receive a 15-minute paid rest break for every four hours on duty.

- Eligible employees can take leave for specific family and medical situations, with up to 12 weeks of leave available in a 12-month period.

- Public employers in Oklahoma must provide safe workplaces, with the PEOSH program ensuring compliance with safety and health regulations.

- Discriminatory practices based on factors like race, religion, sex, age or disability are prohibited.

- The classification of employees versus independent contractors is determined using a 20-factor test, distinguishing factors between the two.

- Oklahoma is an “at-will” employment state, allowing employers to terminate employees without notice in most cases.

- Employers must provide final wages to separated employees within three days of the regularly scheduled payday following separation.

Minimum Wage Regulations in Oklahoma

Oklahoma’s minimum wage regulations uphold fair compensation, ensuring economic stability for workers statewide. These regulations set distinct minimum hourly rates for regular and tipped employees.

[Source: FRED]

This map is interactive. Hover your mouse over different parts of the map to see detailed data.

Regular Employees

Oklahoma adheres to the federal minimum wage standard of $7.25 per hour for regular employees, which is the lowest allowable minimum wage in the United States.

Oklahoma is one of 20 states that have chosen not to set a state-specific minimum wage higher than the federal minimum wage.

Tipped Employees

Tipped employees in Oklahoma may be paid a subminimum wage, which is typically lower than the standard minimum wage. Employers are allowed to pay these employees as little as $2.13 per hour in direct wages if the sum of this direct wage and the tips received equals at least the federal minimum wage of $7.25 per hour.

It’s crucial to note that the employee must retain all their tips and must customarily and regularly receive more than $30 a month in tips for this provision to apply.

Overtime Rules and Regulations in Oklahoma

The rules and regulations governing overtime play a vital role in safeguarding workers’ rights and guaranteeing just compensation for additional hours put in. In Oklahoma, these regulations apply differently to nonexempt and exempt employees.

Nonexempt Employees

A nonexempt employee is covered by the minimum wage and overtime provisions of the Fair Labor Standards Act (FLSA) or may be granted special nonexempt status.

Non-exempt employees in Oklahoma are entitled to time-and-a-half pay for each hour they work over 40 hours in a workweek. They may also be offered compensatory time off in lieu of overtime pay, as allowed by FLSA regulations

Exempt Employees

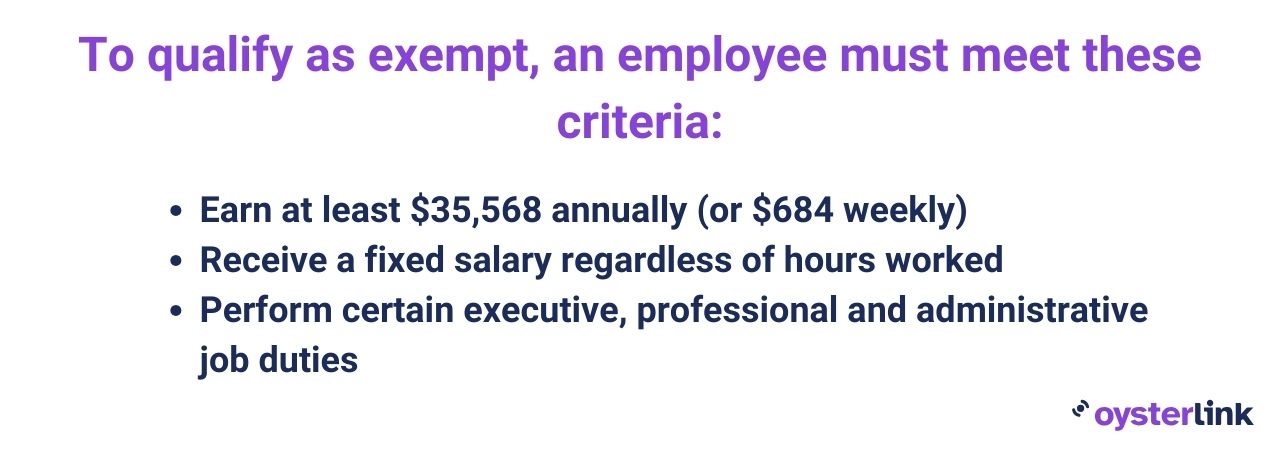

Exempt employees are not entitled to overtime pay because they are considered to be compensated for their job responsibilities, rather than for the hours they work. To be classified as exempt, an employee must meet specific criteria:

- They must be paid at least $35,568 per year (equivalent to $684 per week).

- They must be paid on a salary basis, meaning they receive a fixed salary regardless of the number of hours worked.

- They must perform “exempt job duties” that fall into one of three typical categories:

- Exempt executive job duties: These duties involve regularly supervising two or more employees, having management as the primary duty and having genuine input into decisions related to other employees’ job status (e.g. hiring, firing, promotions or assignments.)

- Exempt professional job duties: These duties pertain to learned professionals such as lawyers, doctors, dentists, teachers, architects and clergy. Registered nurses, accountants, engineers (with specific qualifications), actuaries, scientists (excluding technicians), pharmacists and other roles requiring advanced knowledge also qualify as exempt professionals.

- Exempt administrative job duties: These duties must be non-manual or office work directly related to the employer’s management or general business operations. They require the exercise of independent judgment and discretion concerning matters of significance.

Break Periods in Oklahoma

In Oklahoma, break periods for employees are governed by specific rules and regulations designed to ensure fair treatment and productivity. These regulations encompass both rest and meal breaks.

Breaks and Brief Rest Periods

Employees in Oklahoma are typically granted a 15-minute paid rest break during each four-hour period on duty. These breaks are considered as time worked, and employees are not allowed to save or use break time, counting it towards:

- Late arrivals

- Early departures

- Extended meal periods

- Flex time

- Work week adjust

- Any other work time offset

The scheduling and duration of these breaks can be adjusted as needed to accommodate staffing or business requirements.

Meal Breaks

Oklahoma employees can take at least a 30-minute non-paid meal break during each six-hour period on duty. Unlike rest breaks, meal breaks are not counted as time worked.

During meal breaks, employees are relieved of all job-related duties and are encouraged to leave their workstations or desks to make the most of this time away from their duties.

It is essential for employees to document any work-related interruptions that occur during their meal breaks and promptly inform their supervisor of such occurrences. This record-keeping is crucial to accurately track actual work hours.

In some cases, supervisors or local administrators may make occasional exceptions to the requirement for employees to take a meal break if good cause is demonstrated. However, these exceptions should not become a routine part of the employee’s schedule.

Family and Medical Leave Laws in Oklahoma

Oklahoma’s Family and Medical Leave Act (FMLA) policy, in accordance with federal law, ensures that eligible employees can take leave for specific family and medical situations.

These situations include the birth of a child, adoption, care for family members with serious health conditions and the employee’s own health issues. FMLA leave can be used intermittently and runs concurrently with other types of leave.

Eligibility for FMLA leave is based on the following criteria:

- A minimum of 12 months of employment with the State

- A total of at least 1,250 hours worked during the 12 months preceding the start of FMLA leave

- Employment at a worksite where 50 or more state employees work within 75 miles of that worksite

Workplace Safety and Health Regulations in Oklahoma

Workplace safety and health regulations in Oklahoma are essential for ensuring the well-being of public employees. The state’s Public Employees Occupational Safety and Health (PEOSH) program plays a crucial role in this regard.

The last known data shows there have been 86 fatal occupational injuries in Oklahoma state, most of which are related to transportation accidents.

[Source: U.S. Bureau of Labor Statistics]

This chart is interactive. Hover your mouse over different parts of the chart to see detailed data.

You can see how North Carolina compares to other states in the US when it comes to occupational fatal injuries by browsing our interactive map below.

[Source: U.S. Bureau of Labor Statistics]

This map is interactive. Hover your mouse over different parts of the map to see detailed data.

Oklahoma is among seven states that have chosen to enforce safety and health standards for the public sector workforce independently. This arrangement leaves the private sector workforce under federal OSHA regulations.

Public employers in Oklahoma, including state agencies, cities, counties and public schools, are legally obligated to provide safe and healthful workplaces for their employees. The PEOSH Division is instrumental in helping these public employers meet their responsibilities by ensuring compliance with safety and health regulations.

PEOSH conducts safety and health investigations in various situations, including:

- Workplace fatalities

- Clusters of five or more employee illnesses or hospitalizations resulting from a common event

- Incidents with employer incident/illness rates above the state average

- Employee complaints, consultations and outreach activities

Anti-Discrimination and Fair Employment Practices in Oklahoma

It is considered discriminatory practice for an employer to fail to hire, discharge or discriminate against an individual with respect to compensation or employment terms, conditions, privileges or responsibilities due to factors such as:

- Race

- Color

- Religion

- Sex

- National origin

- Age

- Genetic information

- Disability (unless the employer can demonstrate that accommodating the disability would pose an undue hardship on their business)

This rule doesn’t apply to employment by immediate family members (parents, spouses, children) or domestic service.

It is not considered discriminatory practice for employers, labor organizations or employment agencies to make hiring decisions based on factors like religion, sex, national origin, age, disability or genetic information if it’s necessary for the job.

Schools or educational institutions can hire employees of a specific religion if they are associated with that religion or if their curriculum is focused on it.

Independent Contractor Classification in Oklahoma

In Oklahoma, the classification of individuals as either employees or independent contractors under the Employment Security Act of 1980 is determined using the 20-factor test. While no single factor is definitive, the following distinctions can be helpful:

| Employee | Independent contractor |

|---|---|

| Works for someone else's business | Operates their own business |

| Receives compensation based on an hourly rate, salary or piece rate | Is compensated upon the completion of a project |

| Utilizes materials, tools and equipment provided by the employer | Provides their own materials, tools and equipment |

| Typically works for one employer | Works with multiple clients or on a project basis |

| Maintains a continuing relationship with the employer | Maintains a temporary relationship until the project's conclusion |

| The employer dictates when and how the work is performed | Determines when and how they perform the work |

| The employer assigns the tasks to be completed | Chooses the specific work they undertake |

Termination and Final Paychecks in Oklahoma

Oklahoma is an “at-will” employment state, which means that in most cases, employers have the right to terminate an employee’s employment for any reason, without notice and without having to establish just cause for the termination.

Likewise, employees also have the freedom to resign from their jobs at their discretion, without providing a reason or advance notice.

However, there are exceptions to this general principle. For instance, employment contracts, collective bargaining agreements or specific state or federal laws can modify the at-will employment relationship. These legal frameworks may require employers to have a valid reason for terminating an employee or impose other limitations on the termination process.

The state of Oklahoma law mandates that the employer must provide final wages to the separated employee within three days of the regularly scheduled payday that would have followed the separation.

Employees who do not receive their final wages as required by law have the option to file a Wage Claim with the Oklahoma Department of Labor. However, before proceeding with a wage claim, it is essential for the employee to make a formal request to their employer for the final wages. This is often considered a preliminary step to resolve the issue without formal intervention.

When navigating Oklahoma labor laws and termination procedures, make sure you’re equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state’s tax laws.

Disclaimer: Please note that this paycheck calculator is designed to provide an estimate and should not be considered as professional tax advice. The actual withholding amounts and taxes owed may vary depending on individual circumstances and other factors. For accurate and personalized tax advice, we recommend consulting with a tax professional.

Summary of Oklahoma Labor Laws

Oklahoma upholds the federal minimum wage, currently set at $7.25 per hour, with particular considerations for employees who rely on tips. Nonexempt employees are entitled to overtime pay of 1.5 times their regular hourly pay.

The state typically offers a 15-minute paid rest break for every four-hour duty period, which is considered as time worked. Additionally, employees can take a 30-minute unpaid meal break during each six-hour shift.

Oklahoma also complies with the Family and Medical Leave Act (FMLA), which allows eligible employees to take leave for various family and health-related situations.

Besides maintaining safety standards for their employees through the Public Employees Occupational Safety and Health (PEOSH) program, the state enforces strict anti-discrimination practices, preventing employers from discriminating against employees.

Oklahoma follows the “at-will” employment principle, allowing both employers and employees certain freedoms in the termination process, though specific conditions may apply.

The classification of individuals as employees or independent contractors is determined by a comprehensive 20-factor test, ensuring that workers receive the appropriate legal status.

Frequently Asked Questions About Oklahoma Labor Laws

For more info, find frequently asked questions about the labor laws in Oklahoma below.

How many hours is full-time in Oklahoma?

The designation of “full-time” employment typically depends on the employer’s policies and practices rather than state-specific laws. Employers commonly consider employees working around 30 to 40 hours per week as full-time.

Can overtime be mandatory in Oklahoma?

Yes, employers in Oklahoma can require employees to work overtime, subject to federal overtime regulations. Federal law mandates that non-exempt employees are entitled to one and a half times their regular rate of pay for hours worked beyond 40 in a workweek.

How does holiday pay work in Oklahoma?

Holiday pay in Oklahoma is not mandated by state law, meaning that employers in the state are not required to provide employees with extra compensation for working on holidays. The decision to offer holiday pay, as well as the rate and conditions, is typically left to the discretion of the employer.

What is the annual leave accrual rate for state employees in Oklahoma?

Newly hired state employees start accumulating annual leave at a rate of 15 days per year, with gradual increases based on their length of service. The maximum limit for annual leave accrual is set at 25 days per year.

Is Oklahoma a right-to-work state?

Yes, Oklahoma is a right-to-work state. Right-to-work laws in Oklahoma allow employees in unionized workplaces the choice of whether or not to join or financially support a labor union. These laws prohibit mandatory union membership or fees as a condition of employment.

Disclaimer: This information serves as a concise summary and educational reference for Oklahoma state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.

Labor Laws By State

- Alabama Labor Laws

- Alaska Labor Laws

- Arizona Labor Laws

- Arkansas Labor Laws

- California Labor Laws

- Colorado Labor Laws

- Connecticut Labor Laws

- Delaware Labor Laws

- Florida Labor Laws

- Georgia Labor Laws

- Hawaii Labor Laws

- Idaho Labor Laws

- Illinois Labor Laws

- Indiana Labor Laws

- Iowa Labor Laws

- Kansas Labor Laws

- Kentucky Labor Laws

- Louisiana Labor Laws

- Maine Labor Laws

- Maryland Labor Laws

- Massachusetts Labor Laws

- Michigan Labor Laws

- Minnesota Labor Laws

- Mississippi Labor Laws

- Missouri Labor Laws

- Montana Labor Laws

- Nebraska Labor Laws

- Nevada Labor Laws

- New Hampshire Labor Laws

- New Jersey Labor Laws

- New Mexico Labor Laws

- New York Labor Laws

- North Carolina Labor Laws

- North Dakota Labor Laws

- Ohio Labor Laws

- Oklahoma Labor Laws

- Oregon Labor Laws

- Pennsylvania Labor Laws

- Rhode Island Labor Laws

- South Carolina Labor Laws

- South Dakota Labor Laws

- Tennessee Labor Laws

- Texas Labor Laws

- Utah Labor Laws

- Vermont Labor Laws

- Virginia Labor Laws

- Washington Labor Laws

- West Virginia Labor Laws

- Wisconsin Labor Laws

- Wyoming Labor Laws

- District of Columbia DC Labor Laws