Whether you’re a recent high school graduate embarking on your first job or someone who’s simply never had the need to examine the intricacies of pay stubs before, we’re here to help. In this article, we will talk about what a pay stub is, shedding light on its components and explaining its significance.

What Is a Pay Stub?

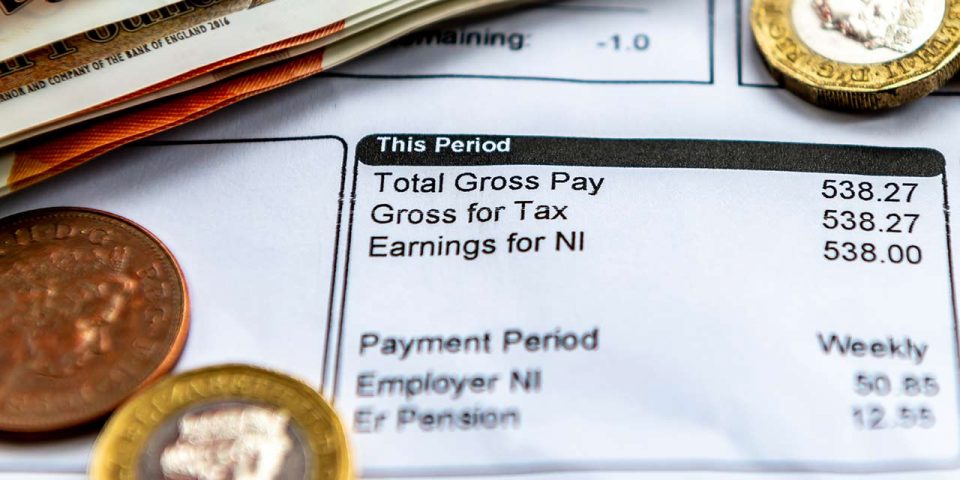

A pay stub or wage statement is a document that accompanies your paycheck and provides a detailed breakdown of your earnings and deductions for a specific pay period. It’s an essential financial record that not only helps you understand how much money you’ve earned but also where your money is going.

This document can also act to show compliance of your employer with labor laws and tax regulations. It attests to the fact that your employer has withheld the appropriate taxes and other statutory deductions as mandated by the law, sparing you from legal complications down the road.

What Is a Pay Stub Used for?

A pay stub serves several important purposes, making it a valuable document for both employees and employers. Let’s see what these are:

- Income verification: Pay stubs provide a detailed record of your earnings, including your gross pay and deductions. This information is often required when applying for loans, renting an apartment or making significant financial decisions. Lenders and landlords use pay stubs to verify your income and assess your ability to meet financial obligations.

- Tax reporting: Pay stubs help you keep track of your income for tax purposes. They show the amount of income tax, Social Security tax and Medicare tax withheld from your earnings. This information is crucial when you file your annual income tax return, as it helps you determine whether you owe additional taxes or are eligible for a tax refund.

- Budgeting and financial planning: By examining your pay stub, you can understand how much money you’re earning, the deductions being taken out, and the net amount you receive. This information is valuable for creating a budget, managing your expenses and planning for future financial goals.

- Verification of work hours: Pay stubs often include details about the hours worked, such as regular hours and overtime hours (remember that working off the clock is illegal). This helps you verify that you’ve been paid accurately for the time you’ve worked. If there are discrepancies, you can use your pay stub as evidence to resolve any issues with your employer.

- Benefit enrollment: Some employers provide benefits such as health insurance, retirement plans or flexible spending accounts. Pay stubs may show deductions for these benefits and contributions made on your behalf. Reviewing your pay stub can help you understand the cost of these benefits and track your contributions.

- Record keeping: Pay stubs serve as a record of your employment history with a particular employer. You should retain copies of your pay stubs for your records, as they can be useful for various purposes, including verifying employment history, addressing discrepancies or applying for government assistance programs.

- Protecting employee rights: Pay stubs also help protect employees’ rights. They ensure transparency in the payment process by providing a breakdown of earnings and deductions. If you suspect any wage discrepancies or unauthorized deductions, your pay stub can serve as evidence in resolving such issues.

What Important Information Is Available on a Pay Stub?

Now that we’ve established the purpose of pay stubs, let’s examine the specific information you can expect to find in this document. A pay stub typically holds:

- Personal information: Your pay stub usually includes your name, address and sometimes your employee ID or social security number. This helps ensure that your earnings are correctly attributed to you.

- Earnings: The most significant part of your pay stub is the earnings section, which details your gross pay. This is the amount you’ve earned before any deductions. It’s typically divided into two main categories:

- Regular pay: This is your base salary or hourly wage. It reflects the amount you earned based on your regular work hours and pay rate.

- Overtime pay: If you’ve worked more hours than your regular schedule or have exceeded the threshold for overtime, this section shows the extra pay you’ve earned at a higher rate.

- Deductions: This is where the pay stub gets more complex. Deductions are the amounts taken out of your gross pay before you receive your net pay (the amount you take home). Common deductions include:

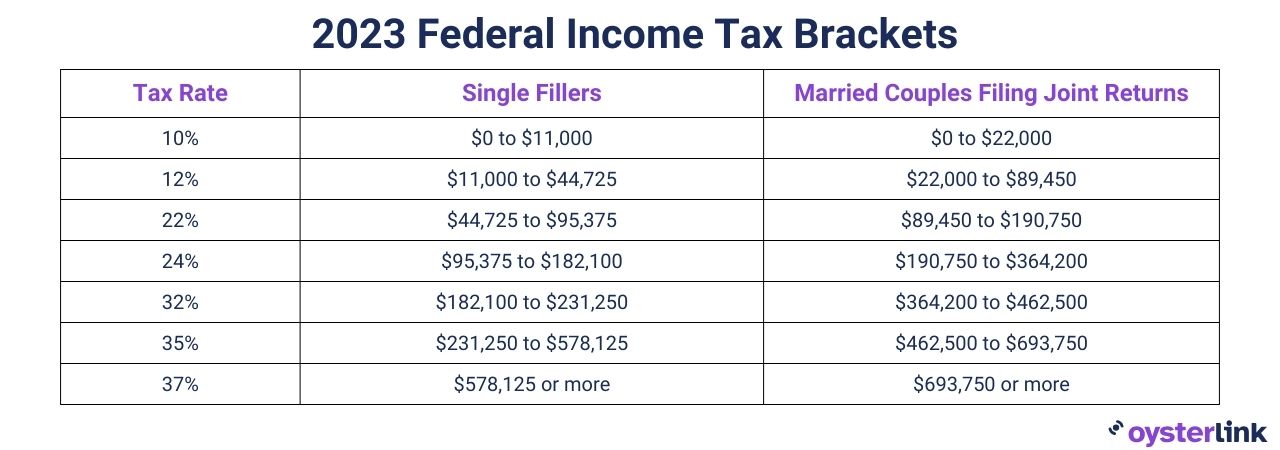

- Federal income tax: This is the money withheld by your employer to cover your federal income tax liability. The exact amount depends on your income and the information you provided on your W-4 form.

- State income tax: If your state has an income tax, a portion of your earnings may be withheld to cover your state tax liability.

- Social Security and Medicare taxes: These are payroll taxes that fund Social Security benefits and Medicare health coverage for retirees. Both you and your employer contribute to these taxes.

- Health insurance premiums: If your employer provides health insurance, the cost of your premiums may be deducted from your paycheck.

- Retirement contributions: If you participate in a retirement plan, such as a 401(k), your contributions may be deducted from your gross pay.

- Other deductions: These can include items like union dues, garnishments for outstanding debts or contributions to other benefits like life insurance or flexible spending accounts.

- Net pay: After all deductions are subtracted from your gross pay, you’re left with your net pay, which is the amount you receive in your paycheck. This is the money you can use for your day-to-day expenses or save for your financial goals.

- Year-to-date (YTD) totals: Your pay stub may also include year-to-date totals for your earnings and deductions. These figures provide a summary of your financial activity for the current calendar year.

Stay informed about the latest salary trends

Other Information

Besides the information typically required on a pay stub, it’s important to be aware of other requirements that may differ from state to state. These include:

- Hours worked: Some states may mandate that pay stubs include detailed information about the number of hours worked during the pay period. This is especially relevant for hourly employees and those eligible for overtime.

- Accrued paid time off (PTO): In states with paid leave laws, pay stubs may be required to display accrued paid time off, such as vacation days or sick leave, so employees can keep track of their available leave balances. These states are California, Colorado, Connecticut, Delaware, Massachusetts, Maryland, New Jersey, New York, Oregon, Rhode Island and Washington, along with Washington, D.C.

- Rate of pay: Certain states may require that the pay stub includes the employee’s rate of pay, which specifies the hourly rate or salary basis for their compensation.

- Breakdown of deductions: Some states have specific rules about how deductions should be itemized.

- Employer information: Certain states may stipulate that the pay stub must prominently display the legal name and address of the employer, ensuring clarity in identifying the employer entity.

- Electronic pay stubs: In states that allow electronic pay stubs, there may be requirements regarding employee consent, access and the format of electronic delivery.

- Languages: In states with diverse populations, there may be requirements for pay stubs to be provided in multiple languages to accommodate non-English-speaking employees.

- Recordkeeping: While not always displayed on the pay stub itself, some states may have specific requirements for how long employers must retain pay stub records for auditing and employee verification purposes.

- Penalties for non-compliance: States may impose penalties on employers who fail to provide accurate and complete pay stubs. These penalties can vary widely, depending on the state and the severity of the violation.

- Additional state-specific deductions: Certain states may have unique deductions or requirements, such as state disability insurance deductions or contributions to state-specific programs.

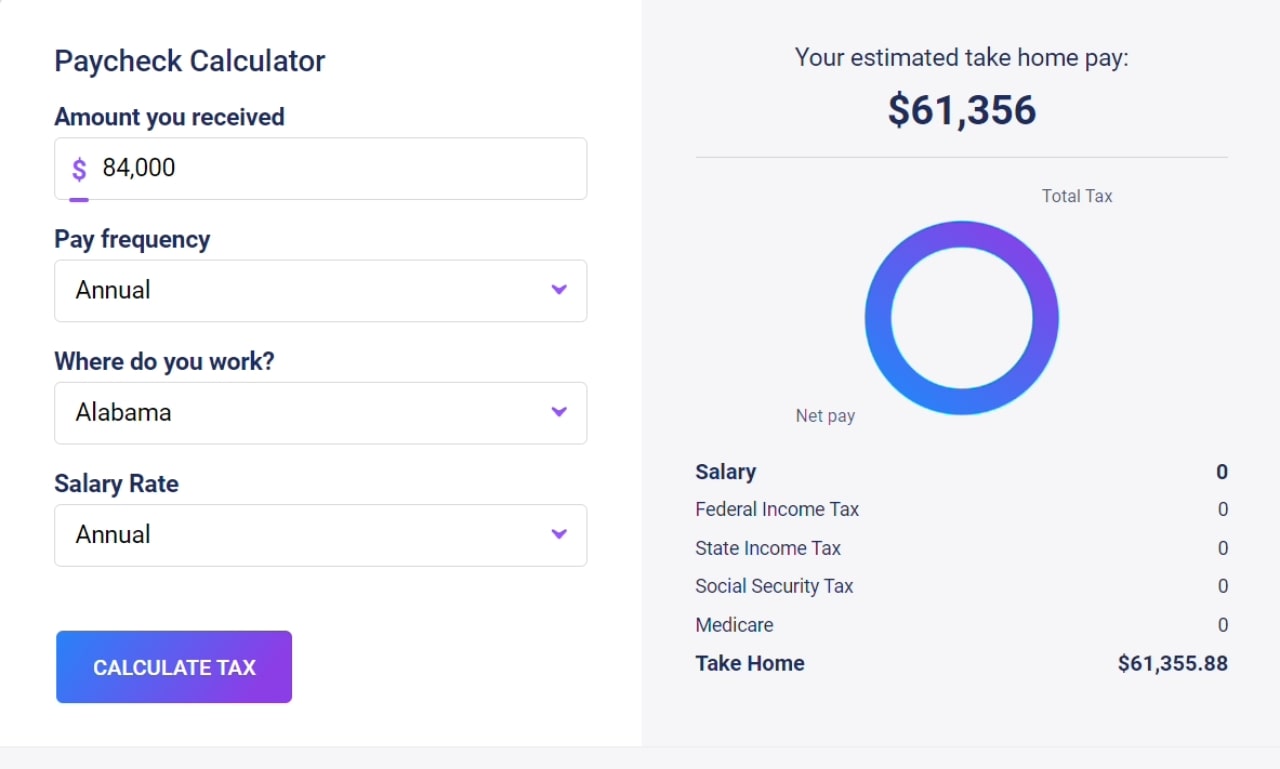

To calculate state-specific deductions, use our Paycheck Calculator. All you need to do is:

- Input your gross earnings

- Select your pay frequency

- Choose the state where you’re employed

- Click the Calculate Tax button

Pay Stub Examples

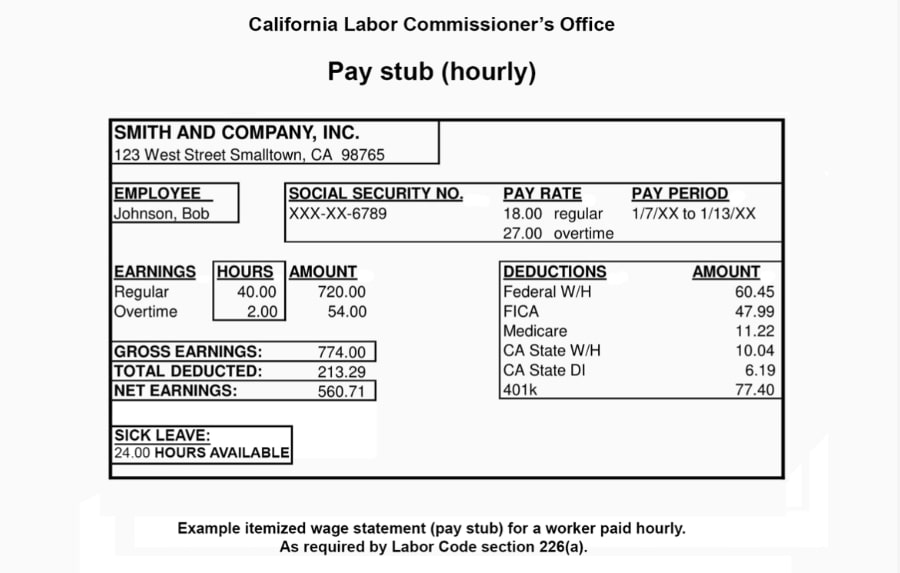

Here are some pay stub examples to further illustrate everything we’ve discussed so far:

Example A

Source: State of California Department of Industrial Relations

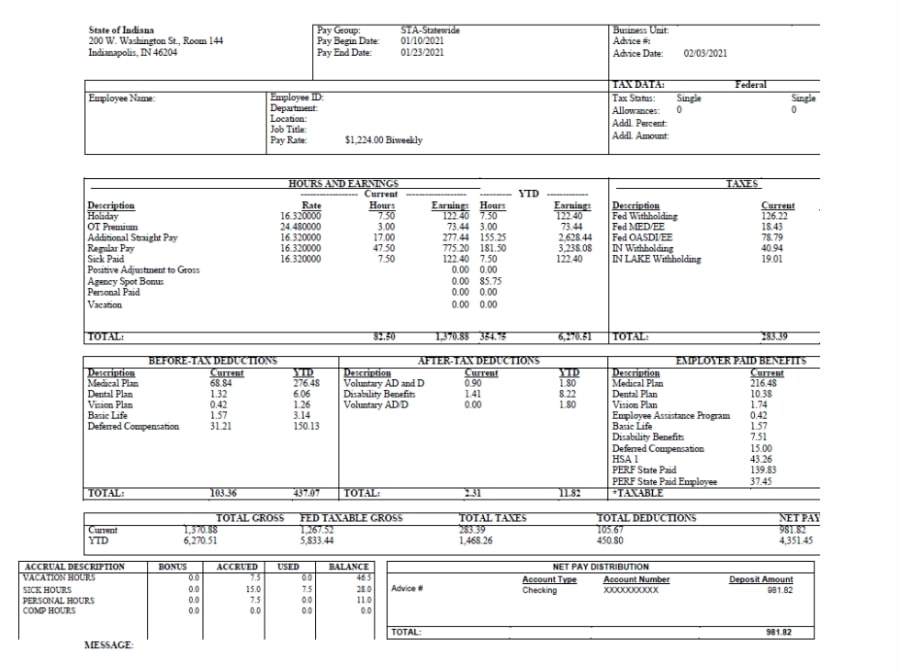

Example B

Source: Indiana State Government

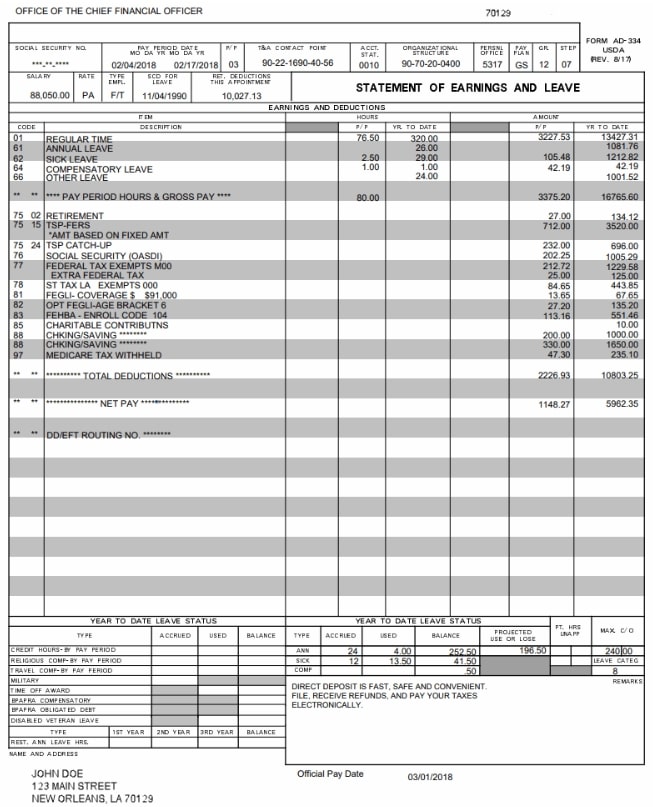

Example C

Source: U.S. Department of Agriculture

Pay Stub Requirements by State

Although there is no federal law governing the provision of pay stubs, each state has its own labor laws and regulations that dictate what information must be included on this financial document.

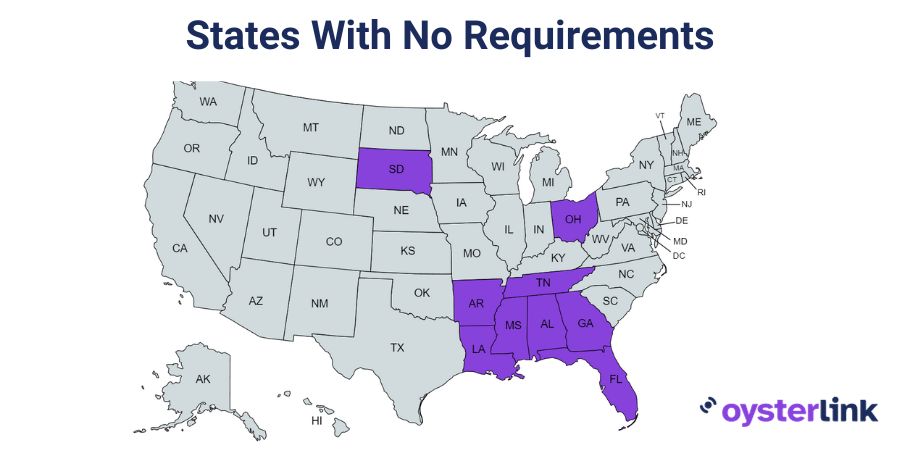

States With No Pay Stub Requirements

Employers in Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, Ohio, South Dakota and Tennessee are not legally obligated to provide pay stubs, but they may choose to do so voluntarily.

However, even in states with no specific requirements, employers must still comply with federal laws related to wage and hour regulations, tax withholding and recordkeeping.

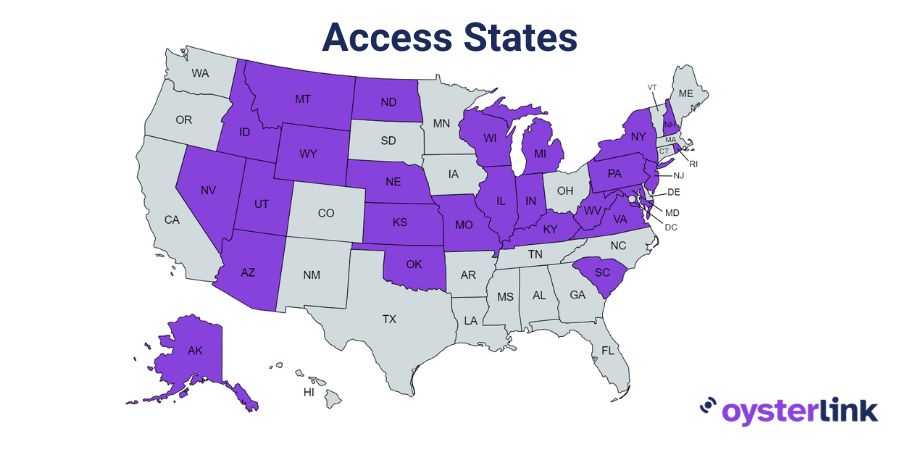

States That Require Employers to Provide Access to Pay Stub Information

Alaska, Arizona, Idaho, Illinois, Indiana, Kansas, Kentucky, Maryland, Michigan, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New York, North Dakota, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Utah, Virginia, West Virginia, Wisconsin and Wyoming have laws that require employers to provide employees with access to their pay stub information, either in a physical or electronic format.

However, these states may not prescribe specific details that must be included on the pay stub itself. Employees have the right to request and view their pay-related information but may not receive a formal pay stub with detailed earnings and deductions unless the employer chooses to provide one voluntarily.

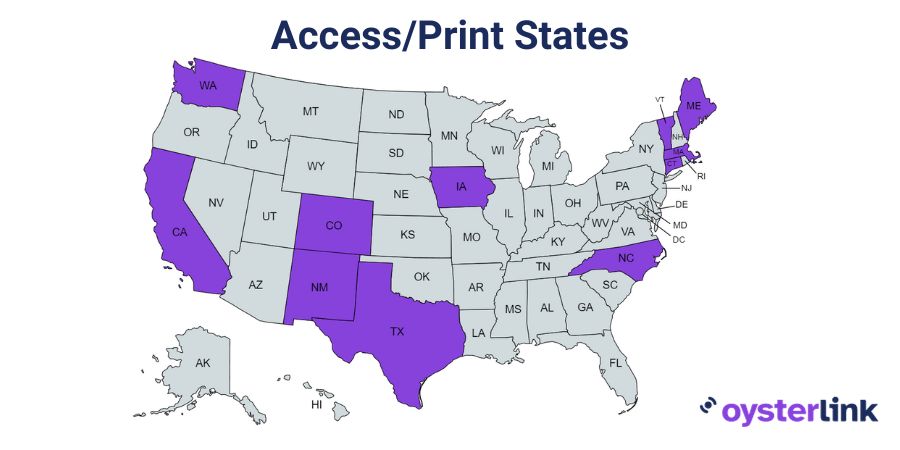

States That Require Employers to Provide Formal Pay Stubs

The states of California, Colorado, Connecticut, Iowa, Maine, Massachusetts, New Mexico, North Carolina, Texas, Vermont and Washington require employers to provide employees with access to their pay stub information and often mandate that employers also provide a physical or electronic pay stub that includes specific details about earnings and deductions.

These states ensure that employees not only have the right to access their pay information but also receive a formal pay stub as a standard practice.

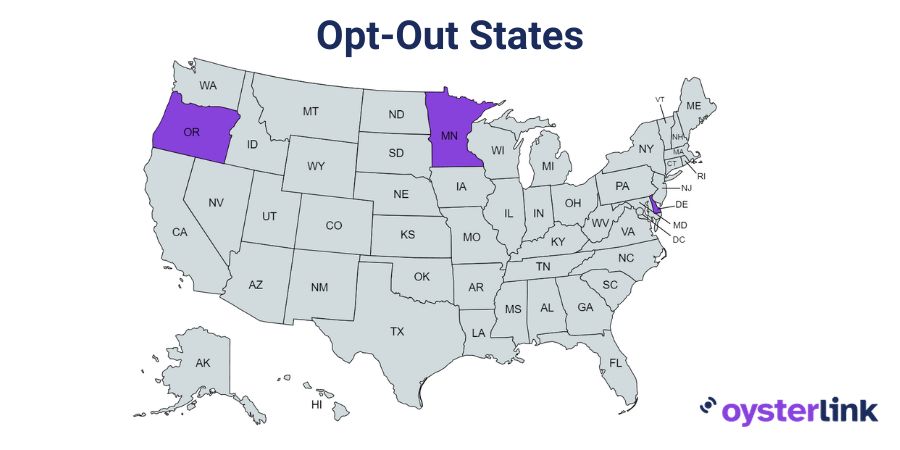

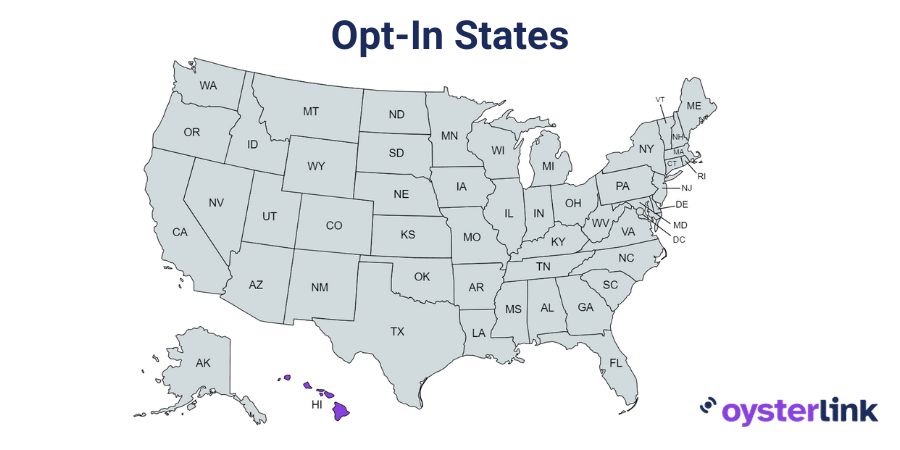

States That Allow Employees To Opt Out of Electronic Pay Stub Delivery

In Delaware, Minnesota and Oregon, employees receive pay stubs electronically by default, but they have the choice to opt out of electronic delivery and request paper pay stubs instead.

States That Are Required to Provide Paper Pay Stubs

Employers in Hawaii are required to provide paper pay stubs to employees as the default option. However, employees can choose to opt-in to electronic delivery of their pay stubs if they prefer to access them electronically.

Frequently Asked Questions About Pay Stubs

Typically, your employer provides you with pay stubs as part of your regular paycheck. Pay stubs can be provided in either paper or electronic format, depending on your employer’s practices. If you haven’t received pay stubs or need copies of previous ones, here’s what you can do:

To verify a pay stub, confirm with the employer, check for detailed and accurate information, ensure consistency with your pay history, cross-reference tax data with official documents, and assess the formatting for professionalism.

Yes, you can create your own pay stubs, but it’s essential to ensure they accurately represent your income and withholdings. Self-generated pay stubs are often used by self-employed individuals or freelancers who need to document their income for various purposes.

You should immediately report the issue to your employer or HR department to address discrepancies. Retain all supporting documents to resolve the matter quickly.

It depends on your state. Some states mandate employers to provide detailed pay stubs, while others only require access to pay information. Check your local labor laws for specifics.

Written by Sasha Vidakovic

Sasha is an experienced writer and editor with over eight years in the industry. Holding a master’s degree in English and Russian, she brings both linguistic expertise and creativity to her role at OysterLink. When she’s not working, she enjoys exploring new destinations, with travel being a key part of both her personal and professional growth.

Reviewed by Marcy Miniano

Marcy is an editor and writer with a background in public relations and brand marketing. Throughout her nearly decade-long career, she has honed her skills in crafting content and helping build brands across various industries — including restaurant and hospitality, travel, tech, fashion and entertainment.