Running payroll in the United States is already a complex process, but things get even trickier when it comes to a multi-state payroll. Whether you’re an employer navigating compliance requirements or an employee wondering why your paycheck looks a little different, you’ve come to the right place.

In this article, we’ll explore the complexities of multi-state payroll, how state tax laws affect both employers and employees as well as tools that can help simplify payroll processes and ensure compliance.

What Is Multi-State Payroll?

Multi-state payroll — aka multiple state payroll — refers to the payroll management process when employees work in (or are associated with) more than one state. Since each state has its own tax laws, wage regulations and compliance requirements, managing payroll for employees in different states can be tricky.

There are several situations when a multi-state payroll is applicable, such as:

- The employer’s business operates in multiple states

- A business is located close to the border of one state, so employees commute from another state to work

- Employees are working remotely from a different state

- Employees travel to other states for assignments

In the hospitality industry, employees often work at different locations in multiple states. For example, a hotel employee might work in California one week and Nevada the next, making the complexity of multi-state payroll even more pronounced.

Challenges of Managing Multi-State Payroll

Handling multi-state payroll presents unique challenges for employers, particularly when it comes to staying compliant with each state’s laws. Here are some of the key challenges businesses face:

- Local Tax Jurisdictions: States like Ohio and Pennsylvania impose local income taxes that require separate calculations, adding complexity to payroll processing. Employers must account for these additional taxes to avoid underpayment or compliance issues.

- City-Level Payroll Taxes: New York City applies distinct tax rates separate from New York State taxes, requiring payroll teams to manage multiple layers of withholdings. Other cities may have similar payroll tax requirements that vary by location, increasing administrative burdens.

- Varying Labor Laws: Minimum wage laws, overtime regulations, and family leave policies differ across states and cities, affecting payroll calculations. Employers must regularly update payroll systems to reflect the most current legal requirements in each jurisdiction.

- Tax Withholding Accuracy: Errors in withholding can lead to compliance issues, penalties, and unexpected tax burdens for employees. Accurate state tax withholding depends on tracking where employees physically work and applying the correct tax rules for each location.

Understanding Nexus and Source Income for Taxes

To manage multi-state payroll effectively, businesses must grasp two important concepts: nexus and source income. These terms are essential to understanding where and how businesses are required to pay taxes when they operate across state lines.

Nexus

Nexus refers to the connection between a business and a state that triggers tax obligations. If a business has a sufficient physical presence in a state — whether through an office, employees or property — it is considered to have nexus in that state.

For example, if a restaurant operates locations in both New York and New Jersey, it likely has nexus in both states and must comply with tax laws in both jurisdictions. This may include state income tax withholding, unemployment insurance contributions and more.

Source Income Principle

The source income principle dictates that income is taxed based on where it is earned, rather than where the employee resides. If an employee works in multiple states, the wages they earn in each state are subject to that state’s income tax laws.

Consider an employee who lives in Nevada but works at a hotel in California. Even though the employee resides in a state without income tax, the wages earned in California are subject to California’s income tax laws. The employer must withhold California state taxes from the employee’s paycheck for the hours worked in California.

State Tax Laws and Their Impact on Payroll

As we’ve already mentioned, multi-state payroll processing comes with the challenge of navigating state-specific tax laws. Each state has unique requirements for income tax, withholding and reporting.

Without a thorough understanding of these laws, businesses risk costly compliance issues and potential penalties. To avoid these pitfalls, let’s break down key aspects of state tax laws that employers need to address when employees work across state lines.

State Income Taxes

Most states in the U.S. require employers to withhold income tax based on where the employee physically works. For example, if an employee works in New York, the employer is responsible for withholding New York state income tax, even if the employee resides in a different state.

This can create complications for businesses that have employees working in multiple states, as they must ensure that the correct state income tax is withheld for each work location.

However, there are exceptions to this general rule, especially when states have reciprocity agreements in place.

State Unemployment Insurance (SUI)

State Unemployment Insurance (SUI) is a crucial component of payroll taxes that employers must pay to fund unemployment benefits for eligible workers. When managing multi-state payroll, it’s essential to understand each state’s SUI tax rates, wage bases, and reporting requirements, as they can vary significantly.

Employers must register for SUI in each state where they have employees and ensure timely and accurate contributions based on state-specific regulations. Failure to comply with SUI requirements can result in penalties and increased tax rates.

State Reciprocity Agreements

Reciprocal agreements between states can simplify payroll for employees who live in one state but work in another. These agreements allow employees to pay income tax only in their state of residence rather than the state where they work. This can reduce administrative burden for employers and prevent double taxation for employees.

For example, if an employee resides in Maryland but works in Virginia, a reciprocal agreement between the two states allows the employee to pay only Maryland state taxes. Employers must collect the necessary exemption certificates from employees to apply the agreement correctly.

It is estimated that 5.8 million Americans crossed state lines for work before the 2020 pandemic.

There are currently 30 reciprocal agreements across 16 states and the District of Columbia, in a corridor running from the Mid-Atlantic to the Mountain West. Kentucky participates in the most agreements with seven, followed by Michigan and Pennsylvania at six apiece. At the other end of the spectrum, Iowa, Montana, and New Jersey offer reciprocity with only one state each, while 25 states with wage income taxes do not offer such reciprocity to multistate taxpayers.

The table below outlines the states that have reciprocal agreements and their partner states:

| State | Reciprocity States |

| Arizona | California; Indiana; Oregon; Virginia |

| Illinois | Iowa; Kentucky; Michigan; Wisconsin |

| Indiana | Kentucky; Michigan; Ohio; Pennsylvania; Wisconsin |

| Iowa | Illinois |

| Kentucky | Illinois; Indiana; Michigan; Ohio; Virginia; West Virginia; Wisconsin |

| Maryland | Pennsylvania; Virginia; Washington, D.C.; West Virginia |

| Michigan | Illinois; Indiana; Kentucky; Minnesota; Ohio; Wisconsin |

| Minnesota | Michigan; North Dakota |

| Montana | North Dakota |

| New Jersey | Pennsylvania |

| North Dakota | Minnesota; Montana |

| Ohio | Indiana; Kentucky; Michigan; Pennsylvania; West Virginia |

| Pennsylvania | Indiana; Maryland; New Jersey; Ohio; Virginia; West Virginia |

| Virginia | Kentucky; Maryland; Pennsylvania; Washington, D.C.; West Virginia |

| Washington D.C. | Maryland; Virginia |

| West Virginia | Kentucky; Maryland; Ohio; Pennsylvania; Virginia |

| Wisconsin | Illinois; Indiana; Kentucky; Michigan |

Convenience of the Employer Rule

The Convenience of the Employer Rule complicates tax compliance by allowing certain states to tax employees based on the employer’s location, even if the employee works remotely in another state. This can lead to double taxation.

For instance, a Pennsylvania-based customer service representative working remotely for a hotel chain headquartered in New York might owe income tax to both states. Similarly, a remote email marketing assistant for an event company based in New York but working remotely in Florida could face similar tax obligations.

However, exceptions apply if the employer requires the remote work. States enforcing this rule include New York, Arkansas, Delaware, Nebraska and Pennsylvania.

Handling Remote Workers and Multi-State Payroll

The rise of remote work has significantly complicated payroll for companies employing staff across multiple states. Remote workers may trigger tax nexus in states where the company previously had no physical presence, leading to new tax obligations.

Employers must determine:

- Where the employee resides and performs work.

- State-specific tax thresholds and employment laws.

- Unemployment insurance registration requirements.

To manage multi-state payroll for remote workers effectively:

- Classify Employees Properly: Understand whether workers are classified as full-time employees, independent contractors, or part-time workers, as different rules may apply.

- Review Local Tax Codes: Some local jurisdictions impose municipal payroll taxes that must be considered alongside state taxes.

- Update Payroll Systems: Ensure payroll software reflects varying tax laws for remote employees across different states.

Non-Income Tax States

Some states, such as Florida, Texas and Nevada, do not impose a state income tax — which simplifies payroll management in these states. However, even in non-income tax states, employers must still be aware of other payroll tax obligations, such as state unemployment insurance taxes or other local taxes.

For instance, an employee who works in Florida but resides in a state with an income tax may still face withholding requirements in their home state. In this case, the employer in Florida must ensure that the correct income tax is withheld for the employee’s home state, even though the employee is working in a state with no income tax.

Similarly, for remote workers, a situation could arise where an employee is working remotely from a non-income tax state, like Texas, but is employed by a company based in a state with income taxes, such as New York. In this case, the employer must ensure that the appropriate state income tax is withheld for the state where the employee’s home office is located, even though the employee is physically working from a non-income tax state.

This highlights the importance of understanding the full scope of state tax laws to ensure proper payroll management.

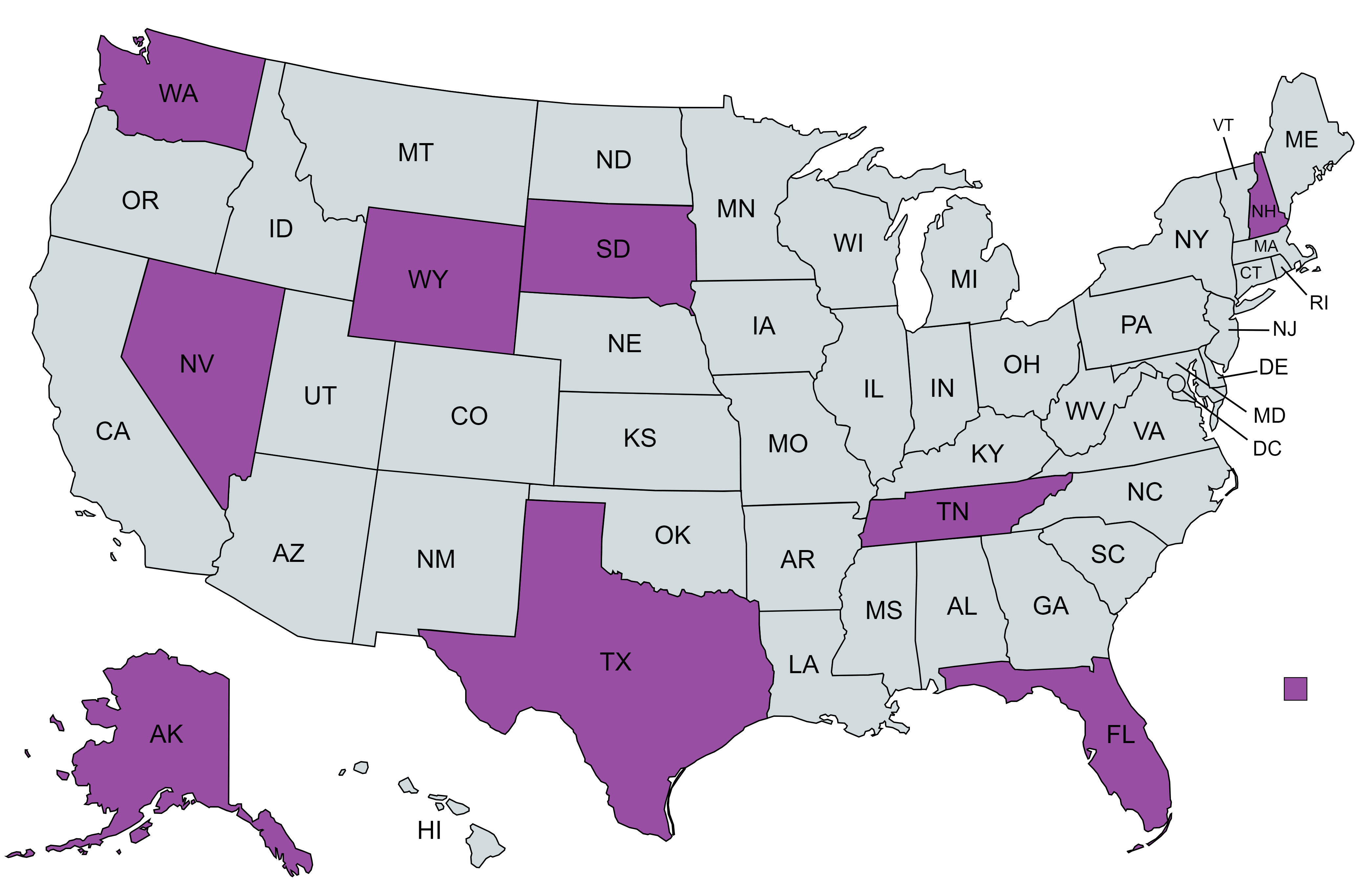

The map below highlights which states have no income tax:

Compliance With Wage and Hour Laws

Managing multi-state payroll compliance goes beyond tax regulations — employers must also navigate varying labor laws across states. Many states set their own minimum wage rates, which can exceed the federal standard, adding complexity to payroll calculations.

Overtime pay rules further complicate matters, especially for employees working across state lines. This is because each state may have different criteria for calculating overtime.

For example, California requires overtime pay for any hours worked over eight in a day, while some states may only require it after 40 hours in a week.

To stay compliant, payroll professionals must keep track of state-specific withholding, wage and hour requirements, along with any changes in state laws or business activities that could impact those obligations.

In industries like hospitality, where employees receive tips, these rules can vary significantly by state, adding another layer of complexity to payroll management.

Best Practices for Multi-State Payroll Compliance

There are several strategies businesses can adopt to stay on top of multi-state payroll compliance:

- Centralize Payroll Operations: If your business operates in multiple states, consolidating all payroll tasks into one central system or department (regardless of where your employees are located) can help streamline the system and ensure consistency.

- Consult Tax Professionals: With complex tax laws in multiple states, it’s often a good idea to consult with tax professionals who can provide expert advice and guidance on state-specific requirements.

- Track Employee Locations: In industries like hospitality, it’s essential to accurately monitor where employees work, especially when they move between locations throughout the week. Reliable time-tracking systems help ensure that payroll taxes are withheld correctly based on the employee’s work location, ensuring compliance with state-specific tax laws.

- Stay Informed on State Regulations: Regularly review and update your knowledge of state-specific tax laws, wage requirements, and employment regulations to ensure compliance.

- Utilize Advanced Payroll Software: Invest in payroll systems that can handle multi-state taxation, automate calculations, and keep up with regulatory changes.

- Maintain Accurate Employee Records: Keep detailed records of employee work locations, hours, and residency to determine correct tax withholdings and contributions.

- Consult with Tax Professionals: Engage with experts who specialize in multi-state payroll to navigate complex scenarios and ensure compliance.

- Implement Internal Audits: Regularly conduct audits of your payroll processes to identify and rectify any compliance issues promptly.

While these best practices help set a solid foundation for payroll compliance, technology can further streamline the process, making it more accurate and efficient.

5 Technology and Tools To Streamline Multi-State Payroll Management

Leveraging the right technologies can save businesses both time and money while reducing the risk of costly mistakes. Here are some key software and tools that can help streamline multi-state payroll management:

1. Comprehensive Payroll Software

One of the most effective ways to manage multi-state payroll is by using advanced payroll software, such as Gusto or QuickBooks.

These platforms automate the calculation and withholding of taxes for multiple states, ensuring that employers comply with the latest state and federal regulations.

2. Time-Tracking Tools

Accurate time tracking is crucial for multi-state payroll processing, especially when employees work in different locations throughout the week. Time-tracking tools like Clockify and Hubstaff help employers maintain accurate records of where and when employees have worked.

Using such tools ensures the right taxes are withheld based on the employee’s location.

3. Paycheck Calculators

For both employers and employees, paycheck calculators can be a game-changer in understanding how multi-state payroll affects earnings.

Tools like OysterLink’s Paycheck Calculator allow employees to input details such as their salary, work location and pay frequency to determine their net pay across multiple states. Try it out below:

Paycheck Calculator

Disclaimer: Please note that this paycheck calculator is designed to provide an estimate and should not be considered as professional tax advice. The actual withholding amounts and taxes owed may vary depending on individual circumstances and other factors. For accurate and personalized tax advice, we recommend consulting with a tax professional.

If your gross pay is $84,000.00 per year in the state of California, your net pay (or take home pay) will be $62,761.43 after tax deductions of 25.28% (or $21,238.57). Deductions include a total of [1] 13.39% (or $11,248.10) for the federal income tax, [2] 4.24% (or $3,564.47) for the state income tax, [3] 6.20% (or $5,208.00) for the social security tax and [4] 1.45% (or $1,218.00) for Medicare.

The Federal Income Tax is collected by the government and is consistent across all U.S. regions. In contrast, the State Income Tax is levied by the state of residence and work, leading to substantial variations. The Social Security Tax is used to fund Social Security, which benefits retirees, persons with disabilities and survivors of deceased workers. Medicare involves a federal payroll tax designated for the Medicare insurance program. As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming do not levy a state income tax.

4. Cloud-Based HR Solutions

Cloud-based HR software like BambooHR and Workday centralizes employee information and integrates payroll, benefits, tax filings and compliance tracking in one location.

This helps employers manage complex payroll scenarios more efficiently. Hospitality employers with employees in multiple locations benefit from having all payroll data in one place.

5. Payroll Auditing and Reporting Tools

Automated payroll auditing tools like Paycor and TriNet can identify discrepancies, ensure compliance with labor laws and produce reports that are ready for tax filings or audits.

By using payroll auditing tools, businesses can reduce the risk of errors and remain compliant with both state and federal requirements.

The Employee Perspective: What To Know

For employees working in multiple states, payroll accuracy is essential to avoid tax issues later. Here are some key points to consider:

- Check paycheck deductions: Ensure your employer is withholding the correct taxes based on where you work.

- File in both states required: In some cases, you’ll need to file tax returns in both your work and home states.

- Keep employers updated: Inform your employer of any changes in work location to avoid errors.

Let’s say you’re a Banquet Manager who splits time between Oregon and Washington. You must ensure that taxes are withheld correctly for each state. If there’s a discrepancy in withholding, it could lead to tax issues later on, potentially requiring you to file taxes in both states.

Final Thoughts

Navigating multi-state payroll processing isn’t simple, but with the right tools, systems and practices in place, it’s manageable.

Understanding the legal frameworks like nexus and source income, staying up to date with tax regulations and utilizing technology can significantly streamline operations and help businesses stay compliant.

Employees working across state lines should be aware of the tax implications for each location they work in. Keeping track of work locations and understanding how state income tax laws apply to their wages is essential to ensuring accurate withholding.

For more hospitality advice and insights to help your business stay on top of its game, explore OysterLink’s career advice section. There, you’ll find actionable strategies for improving staff recruitment, enhancing operational efficiency and navigating industry challenges to ensure your business remains successful and resilient.

FAQs About Multi-State Payroll

Yes, you can. If you work in multiple states, you may owe income tax in each state, depending on their tax laws. For example, a Waiter living in Vancouver, WA (no state income tax) but working in Portland, OR (which has income tax) would only pay Oregon income tax for hours worked in Portland.

Yes, payroll taxes vary by state. While federal taxes are the same, each state has different rules for income tax, unemployment insurance and other local taxes. For instance, states like Florida and Texas have no income tax, but employers still must handle other taxes like unemployment insurance.

Yes, you can. However, this may trigger tax obligations in both your home state and the state where your employer is located. For example, if you live in New Jersey but work remotely for a California company, you might owe income tax in both states, though credits or exemptions may apply to prevent double taxation.

The ‘convenience of the employer‘ rule applies in some states, dictating that if an employee works remotely for their own convenience rather than the employer’s necessity, their income is taxed by the employer’s state. This rule affects tax withholding and requires careful consideration in multi-state payroll scenarios.

Written by Sasha Vidakovic

Sasha is an experienced writer and editor with over eight years in the industry. Holding a master’s degree in English and Russian, she brings both linguistic expertise and creativity to her role at OysterLink. When she’s not working, she enjoys exploring new destinations, with travel being a key part of both her personal and professional growth.

Reviewed by Marcy Miniano

Marcy is an editor and writer with a background in public relations and brand marketing. Throughout her nearly decade-long career, she has honed her skills in crafting content and helping build brands across various industries — including restaurant and hospitality, travel, tech, fashion and entertainment.