If you’re working in the Golden State, you should be aware of what makes the state more lenient in its overtime pay regulations and why California’s Overtime Law is way ahead of the proposed rule on overtime pay issued by the U.S. Department of Labor.

What Is California’s Overtime Law?

California’s Overtime Law is all about fairness—designed to protect the rights of employees and ensure they are fairly compensated for working extra hours.

Whether you’re punching in or signing paychecks, knowing these rules is a must to keep things running smoothly.

- Daily overtime: As per California Labor Code 510, the standard workday in California is limited to eight hours for most nonexempt employees aged 18 and above, or eligible minors aged 16 or 17 not required to attend school or otherwise prohibited by law from working. If your workday extends beyond these eight hours, you’re entitled to one and one-half times your regular rate of pay for all hours worked over eight hours in any workday, up to and including 12 hours.

- Weekly overtime: Additionally, if you find yourself working on the seventh consecutive day of the workweek, the first eight hours of that day are also subject to one and one-half times your regular rate of pay.

- Double time: California’s Overtime Law mandates double the employee’s regular rate of pay for all hours worked in excess of 12 hours in any workday. Double time also applies when you work more than eight hours on the seventh consecutive day of your workweek.

California Overtime Laws for Hospitality Workers

Managers and supervisors in hospitality are often classified as exempt employees, but this exemption comes with specific requirements under California law. To qualify as exempt:

- The manager must earn at least twice the state minimum wage for full-time employment.

- The primary duties must involve management, such as hiring, training, or supervising employees, rather than performing regular tasks like waiting tables or working the front desk.

- The employee must regularly exercise discretion and independent judgment.

If a manager spends more than 50% of their time performing non-exempt tasks (e.g., serving customers or cleaning rooms), they may no longer qualify as exempt and could be entitled to overtime pay. This is particularly relevant in small hotels or restaurants where managers often perform mixed duties.

How Is Overtime Pay Calculated?

For hospitality workers, calculating the regular rate of pay can include tips, service charges, or commission-based earnings, depending on the circumstances. Employers must ensure that:

- Tip Credit: California does not allow tip credit toward minimum wage, but tips and service charges can factor into the employee’s regular pay rate for overtime purposes.

- Multiple Pay Rates: For employees working multiple roles (e.g., a bartender who also serves as a host), overtime must be calculated based on a weighted average of all pay rates.

For example, if a banquet server works an event and earns additional service charges during overtime hours, those service charges must be included in the overtime pay calculation.

Essentially, depending on your work arrangement, you can calculate your regular rate of pay in the following ways:

Hourly Workers

Your regular rate of pay includes not just your base hourly wage but also any extras like shift differentials or additional compensation you get per hour.

- Example: If your base hourly wage is $15, and you receive a $2 shift differential for working the night shift, your regular rate of pay for overtime purposes would be $17 per hour.

Salaried Workers

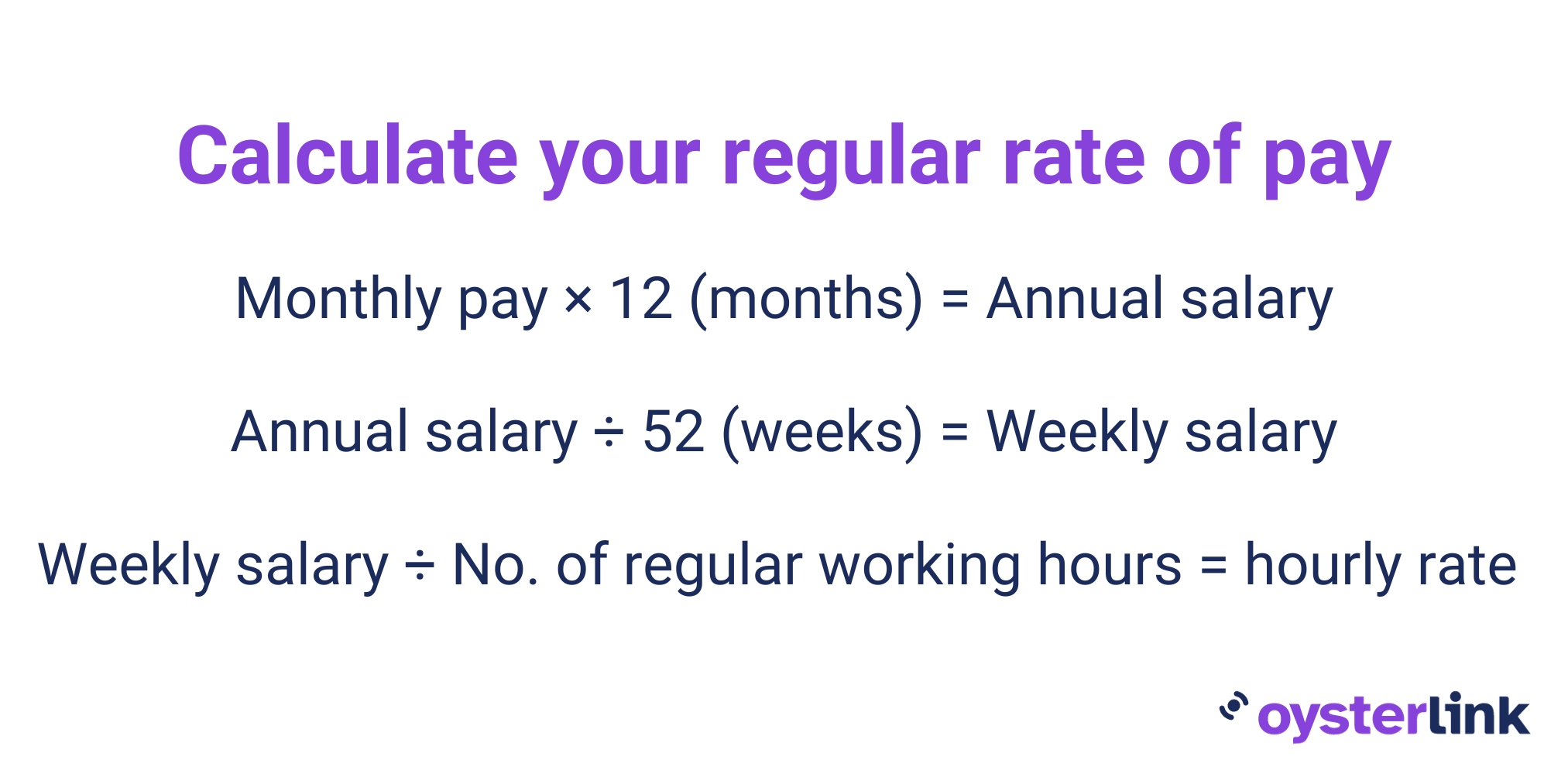

Multiply your monthly salary by 12 to get your annual salary. Divide the value by 52 to find your weekly salary. Lastly, divide your weekly salary by the legal maximum regular hours (usually 40) to determine your regular hourly rate.

[Source: California Department of Industrial Relations]

Piece-Rate or Commission-Based Workers

Use your piece or commission rate as your regular rate and get one and half this rate for the first four overtime hours in a day, and double time for any hours beyond 12 in a day.

Or add up all your weekly earnings, including overtime hours. Then, divide that by the total hours worked during the week, including overtime.

For each overtime hour, you get an extra half of your regular rate for hours needing time and a half, and the full rate for double time.

Group Piece-Rate Workers

Divide the total pieces produced by the group by the number of workers.

Different-Rate Workers

If you’re juggling different rates for various tasks or hours, calculate your regular rate as the “weighted average” by dividing your total weekly earnings by the total hours worked during the week, including overtime hours.

Get more job insights straight to your inbox

Overtime Pay Calculations Examples

Now, to understand things better, let’s take a look at how you would calculate 10 hours’ worth of overtime pay for each work arrangement.

- Hourly workers:

- Regular rate: $15 per hour

- Overtime rate (time and a half): $15 x 1.5 = $22.50 per hour

- Total overtime pay for 10 hours: $22.50 x 10 hours = $225

- Salaried workers:

- Regular rate: If your monthly salary is $3,000, your regular hourly rate would be calculated as ($3,000 x 12) / (52 weeks x 40 hours) = $17.31 per hour.

- Overtime rate (time and a half): $17.31 x 1.5 = $25.96 per hour

- Total overtime pay for 10 hours: $25.96 x 10 hours = $259.60

- Piece-rate or commission-based workers (with the piece rate as the regular rate):

- Regular rate: Suppose your commission rate is 10% per sale, and you make $100 in commissions on a regular workday. Your regular rate is $10 per hour.

- Overtime rate (time and a half): $10 x 1.5 = $15 per hour

- Total overtime pay for 10 hours: $15 x 10 hours = $150

- Piece-rate or commission-based workers (with total earnings as the regular rate):

- Regular rate: $1,000 / (40 regular hours + 10 overtime hours) = $20 per hour

- Overtime rate (time and a half): $20 x 1.5 = $30 per hour

- Total overtime pay for 10 hours: $30 x 10 hours = $300

- Group piece-rate workers:

- If the group produced a total of 1,000 pieces and there are 5 workers in the group, each worker’s regular rate would be based on their share of the total pieces:

- Regular rate: 1,000 pieces / 5 workers = 200 pieces per worker (Let’s assume each piece is valued at $2.)

- Overtime rate (time and a half) for each worker: 200 pieces x 1.5 = 300 pieces

- Overtime pay for each worker for 10 hours: 300 pieces x $2/piece = $600.

- Different-rate workers (using weighted average):

Let’s say you worked 32 hours at $11.00 an hour and 10 hours during the same workweek at $9.00 an hour:

Remember: Overtime pay is just one aspect of your overall take-home pay. To determine your take-home pay, you must consider taxes, deductions and exemptions.

OysterLink has available paycheck calculators for every state in the U.S., so you can estimate your earnings accurately.

Paycheck Calculator

Disclaimer: Please note that this paycheck calculator is designed to provide an estimate and should not be considered as professional tax advice. The actual withholding amounts and taxes owed may vary depending on individual circumstances and other factors. For accurate and personalized tax advice, we recommend consulting with a tax professional.

If your gross pay is $62,000.00 per year in the state of Florida, your net pay (or take home pay) will be $51,576.50 after tax deductions of 16.81% (or $10,423.50). Deductions include a total of [1] 9.16% (or $5,680.50) for the federal income tax, [2] 0.00% (or $0.00) for the state income tax, [3] 6.20% (or $3,844.00) for the social security tax and [4] 1.45% (or $899.00) for Medicare.

The Federal Income Tax is collected by the government and is consistent across all U.S. regions. In contrast, the State Income Tax is levied by the state of residence and work, leading to substantial variations. The Social Security Tax is used to fund Social Security, which benefits retirees, persons with disabilities and survivors of deceased workers. Medicare involves a federal payroll tax designated for the Medicare insurance program. As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming do not levy a state income tax.

Overtime Pay Calculator

If you’re looking to calculate your overtime pay quickly and accurately, our Overtime Pay Calculator is here to help. This user-friendly tool takes the hassle out of manual calculations and provides you with precise results in no time.

Here’s how it works:

- Create your own copy of the document.

- Choose which sheet applies to you depending on your work arrangement (hourly, salaried or piece-rate or commissioned).

- Enter your name or the workers’ name.

- Specify the number of hours you worked during your regular workweek.

- Indicate the number of hours you worked in excess of your regular workweek (overtime hours).

- Input other information as needed. Please only fill in the white cells only.

Once you’ve filled in these details, the calculator will automatically generate your overtime pay for the given period. It’s a straightforward and efficient way to ensure you’re compensated accurately for your extra hours on the job.

Make sure to enter your information in the designated fields for accurate results. Calculate your overtime pay with ease using our Overtime Pay Calculator today!

Download our Overtime Pay Calculator today

Who Qualifies for Overtime Pay in California?

California’s Overtime Law is designed to protect employees’ rights and ensure fair compensation for extra hours worked. These laws apply to most nonexempt employees aged 18 and above, or eligible minors aged 16 or 17 not required to attend school or otherwise prohibited by law from working.

Minimum wage plays a crucial role in the context of California’s Overtime Law as it serves as the foundation for determining an employee’s regular rate of pay, which is a key factor in calculating overtime pay.

California’s minimum wage is $15.50 for employees. This does not vary whether you are an adult or a minor. However, this amount can be higher depending on the city or county you are based in.

Some employees are exempted from this minimum wage, including the direct family of the employer, apprentices following the State Division of Apprenticeship Standards and outside salespersons. For a list of California’s minimum wages per city and county, check out this list by UC Berkeley.

Who Is Exempt from California’s Overtime Law?

California Labor Code Section 511 encompasses both exemptions from standard overtime rules and the provisions related to alternative workweek schedules.

Under California’s Overtime Law, certain categories of employees are exempt from standard overtime pay requirements, which mandate that employees be paid additional compensation for working more than a set number of hours per day or per week.

These exemptions are typically based on an employee’s job duties, salary level and other factors. Common exemptions include:

- Executive Exemption: Employees who primarily manage the business, supervise employees and exercise discretion and independent judgment may be exempt from overtime pay.

- Administrative Exemption: Employees engaged in administrative or office work that involves the exercise of discretion and independent judgment in significant matters may be exempt.

- Professional Exemption: Employees in certain professional roles, such as doctors, lawyers and architects, may be exempt from overtime requirements.

- Outside Sales Exemption: Employees who spend the majority of their time outside the office making sales or servicing clients may be exempt.

- Computer Professional Exemption: Certain computer professionals meeting specific criteria may be exempt from overtime pay.

These exemptions have specific criteria that must be met to qualify, and employers must ensure they comply with these criteria to classify employees as exempt from overtime.

Alternative Workweek Schedules

California Labor Code Section 511 also addresses the implementation of alternative workweek schedules. These schedules allow employers and employees to arrange work hours differently from the traditional five-day, eight-hour workweek. Common alternative workweek schedules include four-day workweeks with extended daily hours.

Key points regarding alternative workweek schedules include:

- Election and Approval: Employers must seek employee approval through a secret ballot election to adopt an alternative workweek schedule, requiring at least a two-thirds majority vote in favor.

- Overtime Pay: Employees working beyond the established daily or weekly hours under the alternative schedule are entitled to overtime pay as per California’s Overtime Law.

- Meal and Rest Breaks: Employers must continue to provide employees with required meal and rest breaks during extended workdays.

- Regular Rate of Pay: The law specifies how to calculate the regular rate of pay for employees on alternative workweek schedules for overtime pay purposes.

- Revocation and Repeal: Employees have the right to request the repeal of an alternative workweek schedule through a secret ballot election, but this can only occur one year after the schedule’s adoption.

What Are the Penalties for Violating California’s Overtime Law?

Employers who violate wage and hour laws should be aware of the penalties stipulated in Labor Code 558. Initially, the penalty amounts to $50 for the first violation, and for subsequent violations, it increases to $100.

It is imperative to emphasize that these penalties are entirely separate from any outstanding wages that employers are obligated to remunerate their affected employees.

If you’re an employee experiencing nonpayment of overtime wages, you can either file a wage claim or a lawsuit in court against your employer. Don’t hesitate to report any violation and get the pay you deserve.

[Source: CBS News]

Common Hospitality Overtime Violations in California

Hospitality businesses frequently encounter compliance challenges with overtime laws. Common violations include:

- Failing to Track Hours: Some employers improperly track “off-the-clock” work, such as side duties (rolling silverware or cleaning after closing).

- Illegal Tip Pools: When tip pooling policies are mismanaged, and tips are used to offset overtime pay, this violates state law.

- Misclassification: Classifying line cooks or shift supervisors as exempt employees to avoid paying overtime.

- Missed Breaks: With fast-paced environments, hospitality workers often miss legally mandated breaks, resulting in additional penalties.

Employers must remain vigilant to avoid hefty fines and lawsuits stemming from these violations.

Take Control of Your Overtime Pay in California

California’s Overtime Law protects your rights and ensures fair compensation for your hard work. With OysterLink’s Overtime Pay Calculator, navigating complex overtime rules is effortless. Take charge of your earnings, stay compliant, and unlock financial clarity today. Visit OysterLink for expert tools, insights, and resources tailored to your success!

FAQs About California’s Overtime Law

Overtime in California typically applies when an employee works more than 8 hours in a workday or 40 hours in a workweek.

The overtime pay rate in California is 1.5 times the regular rate of pay for most employees. For hours beyond 12 in a day, it’s double the regular rate.

Yes, California has a daily overtime limit of 8 hours.

California’s Overtime Law CAN offer employers “comp time,” or compensatory time-off, to certain employees who aren’t exempt from state wage orders. Comp time means they can get extra time off instead of overtime pay, but there are some rules to follow:

- Employees need to ask for it in writing.

- Employers must keep good records of how much employees earn and use comp time.

- There’s a limit on how much comp time can pile up.

- The employee can request cash payment instead of time off.

- Any unused comp time must be paid out to the employee upon termination.

Here’s the catch: If an employer has to follow federal labor laws (the Fair Labor Standards Act or FLSA), offering comp time in California might break those rules if nonexempt employees work more than 40 hours a week.

Overtime pay should be included in your regular paycheck as per California’s Overtime Law. It should be paid on a regular payday for the pay period in which the overtime was earned.

For official resources and support regarding California’s Overtime Law, visit the California Department of Industrial Relations website or contact your local labor board. They can provide guidance and assistance with any concerns or disputes related to overtime pay.

Written by Jericka Orellano

Jericka is a published author who has had a decade of experience in publishing, editorial work, localization and media. Having spent eight years as a professional trainer and supervisor for other writers and editors, she excels in research, copyediting, proofreading and quality assurance. She now works with OysterLink as a content specialist.

Reviewed by Stefan Petrov

With over 10 years of experience as a writer and editor, Stefan has worked in the automotive, IT, health and hospitality industries. Familiar with Google Search Console and other SEO tools like Ahrefs and Semrush, Stefan uses his experience to create content that’s visually appealing to the user but also ranks in the SERPs.