In this blog post, we’ll talk about the critical topic of working off the clock and explore how you can protect your time and rights while still excelling in your career.

What Is Off-The-Clock Work?

Off-the-clock work refers to any tasks or job-related activities that an employee performs outside of their regular working hours but is not compensated for.

It often occurs when employees voluntarily or involuntarily engage in work-related activities before or after their scheduled shifts or during unpaid breaks.

This habit of engaging in work-related communications during personal time can blur the lines between work and personal life, leading to increased stress and potential legal issues regarding unpaid labor.

In essence, off-the-clock work is one form of wage theft because it involves employees not being properly compensated for the hours they have worked. Employers who engage in this practice effectively steal their employees’ wages by not paying them for all the time and effort they put into their jobs.

Common scenarios of off-the-clock work include unpaid pre-shift activities like setting up equipment, post-shift duties such as cleaning workstations and administrative tasks performed during unpaid breaks. These practices not only violate labor laws but also contribute to employee burnout and decreased job satisfaction.

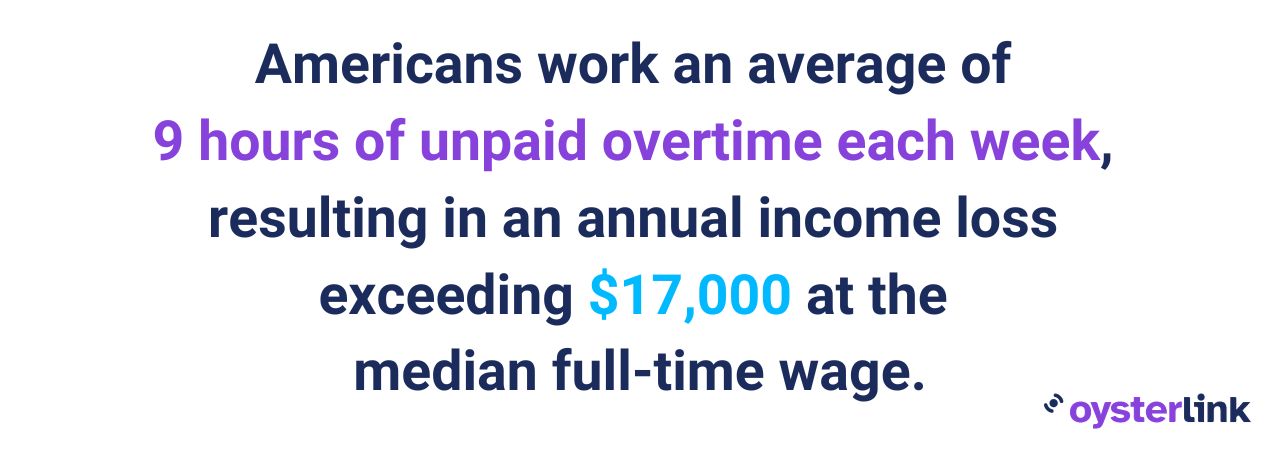

This issue is particularly prevalent in the United States, where Americans work an average of nine hours of unpaid overtime each week, resulting in an annual income loss exceeding $17,000 at the median full-time wage. This staggering amount of unpaid overtime underscores the prevalence of off-the-clock work and the financial impact it has on workers across various industries.

Unfortunately, wage theft often goes unpunished, even though each state has systems in place to combat this issue.

Types of Off-The-Clock Work

While off-the-clock work can take various forms, it’s essential to recognize these common examples as they all contribute to wage theft:

- Emails and communication: Checking and responding to work emails outside of official working hours is a common example of off-the-clock work.

- Preparation and planning: Some employees feel pressured to prepare for the next day’s tasks or meetings before or after their shifts. This might involve researching, organizing or strategizing, all of which can eat into personal time.

- Administrative tasks: Completing paperwork, data entry or other administrative duties after work hours without compensation is another example of off-the-clock work. These tasks may seem minor, but they add up over time.

- Travel time: If your job involves travel, the time spent commuting to and from work-related locations, conferences or client meetings may not always be properly accounted for, leading to unpaid hours.

- Unpaid breaks: Some employers may pressure employees to work through their designated breaks, which should be paid.

- Training and meetings: Attending training sessions, workshops or meetings outside of regular hours can be considered off-the-clock work if employees are not compensated for their attendance and participation.

- Clean-up and closing duties: For employees in industries like retail and hospitality, closing duties and cleanup tasks performed after regular business hours may often go unpaid.

Common Examples of Off-the-Clock Work in Hospitality

In the hospitality industry, off-the-clock work can manifest in various forms, often leading to unintentional labor law violations. Common scenarios include:

- Pre-Shift Preparations: Employees setting up dining areas or kitchen stations before officially clocking in.

- Post-Shift Duties: Staff members cleaning up or closing the establishment after clocking out.

- Mandatory Training Sessions: Attending required training or meetings outside of paid working hours.

- Responding to Work Communications: Answering work-related calls, emails, or messages during off-hours.

Recognizing these instances is crucial for both employers and employees to ensure compliance with labor laws.

Is It Illegal To Work Off the Clock?

Yes, working off the clock without proper compensation is illegal in the United States. Employers are legally obligated to accurately record and pay for all hours worked by their employees.

Off-the-clock work is a frequent point of contention in wage and hour lawsuits. Wage and hour lawsuits are legal actions filed by employees against their employers for various violations related to wages, hours and labor practices.

Get the latest restaurant job openings delivered to your inbox

Working Off the Clock Laws

In the United States, laws regarding working off the clock encompass both federal and state regulations. Given the potential discrepancies between federal and state laws, you should be well-informed about both sets of regulations and consult your state’s labor department or legal experts for tailored guidance.

Let’s explore these two levels of legislation to gain a thorough understanding of how they impact your rights as an employee:

Federal Level Labor Laws

The Fair Labor Standards Act (FLSA) is the cornerstone of labor laws at the federal level, governing off-the-clock work and related wage and hour issues. Even though this act was passed in 1938 to protect workers, 43% of U.S. business owners still don’t know what the FLSA is.

Here are the key aspects of the FLSA:

- Minimum wage: The FLSA establishes the federal minimum wage, which employers must adhere to. However, this minimum wage rate can change over time due to federal legislation or executive orders.

- Overtime pay: Under the FLSA, eligible employees are entitled to receive overtime pay at a rate of one and a half times their regular hourly wage for hours worked beyond 40 in a workweek.

- Record-keeping: Employers covered by the FLSA must maintain accurate records of employees’ work hours, wages and other employment-related information. These records are crucial for addressing wage and hour disputes, including working-off-the-clock allegations.

Today, only 15% of employers are covered by the FLSA, compared to over 60% in 1975. Moreover, it’s important to underscore that FLSA-related litigation has seen a substantial uptick in recent years.

FLSA lawsuits have experienced a significant increase of 417% over the past two decades, demonstrating the growing importance of wage and hour issues in today’s workforce. These lawsuits serve as a crucial avenue for workers to assert their rights and seek redress when they believe they have been subjected to off-the-clock work or other wage violations.

It’s worth bringing up that certain employees are classified as “exempt” from the FLSA’s minimum wage and overtime pay provisions. Being classified as exempt means that these employees are not entitled to receive overtime pay for working more than 40 hours in a workweek, and they are not subject to the federal minimum wage.

Exempt employees typically fall into specific categories and must meet certain criteria to qualify for exemption. The most common categories of exempt employees under the FLSA are:

- Executive exemption: Employees in executive roles who have management duties, such as supervising two or more employees, having the authority to hire or fire and exercising discretion and independent judgment in their work.

- Administrative exemption: Employees who perform primarily office or non-manual work related to the management or general business operations of the employer, and whose work involves the exercise of discretion and independent judgment.

- Professional exemption: This category includes two subcategories:

- Learned Professionals: Employees with advanced knowledge in a field of science or learning acquired through prolonged education or specialized training.

- Creative Professionals: Employees who perform work in artistic or creative fields, such as writers, musicians or graphic designers.

- Computer employee exemption: Employees who work in computer-related occupations, such as computer programmers, software engineers and systems analysts.

- Outside sales exemption: Employees whose primary duty is making sales, contracts or obtaining orders, and who regularly work away from the employer’s place of business.

Keep in mind that meeting the job duties alone is not sufficient for exemption; employees must also meet certain salary thresholds set by the FLSA. As of now, the salary threshold for exempt status is set at $684 per week (equivalent to $35,568 annually) for most exempt categories.

To prevent off-the-clock work, employers should implement clear policies that prohibit unpaid labor and ensure all work hours are properly tracked. Utilizing time-tracking software can aid in monitoring employee hours and ensuring compliance with labor laws.

State Level Labor Laws

States possess the authority to enact their own labor laws, which can augment federal regulations and offer additional protections to employees. These state-level distinctions may include:

- Higher minimum wages: Many states have adopted minimum wage rates that exceed the federal minimum wage. Employees in these states are entitled to the higher state-mandated wage.

- Overtime provisions: State-level overtime regulations may vary, with some states imposing lower thresholds for overtime eligibility or higher rates of overtime pay than those stipulated by federal law.

- Meal and rest breaks: States often dictate specific requirements for meal and rest breaks, including their duration and when they should be provided during work shifts.

- Wage theft protections: Certain states have implemented stringent wage theft laws to bolster employee protections and impose more severe penalties on employers found guilty of wage theft practices, including off-the-clock work violations.

In situations where state laws offer greater protections or mandate higher wage rates, these state-level laws take precedence.

How To Avoid Working Off the Clock

To protect your time and ensure fair compensation, here are some strategies to avoid working off the clock:

- Know your rights: Familiarize yourself with both federal and state labor laws to understand your rights as an employee. Consult your state’s labor department or legal experts for specific guidance when needed.

- Track your hours: Keep accurate records of your work hours, breaks and any off-the-clock activities. Modern technology, such as time-tracking apps, can be helpful in this regard.

- Discuss expectations: Clarify expectations with your employer regarding when and where work is expected to be performed. Set boundaries for after-hours communication and tasks.

- Report violations: If you believe you’ve been asked to work off the clock or have experienced wage theft, report it to your HR department or supervisor. Follow your company’s internal procedures for addressing such concerns.

- Seek legal advice: If your employer continues to engage in off-the-clock work practices or wage theft, consider seeking legal counsel or contacting a labor attorney. They can help you navigate the complexities of wage and hour laws and pursue remedies if necessary.

- Document everything: Maintain a record of any discussions or requests related to off-the-clock work. This documentation can be valuable if you need to prove your case in the future.

- Know your exemptions: Be aware of your employment classification. As mentioned above, employees classified as exempt under the FLSA are not entitled to overtime pay.

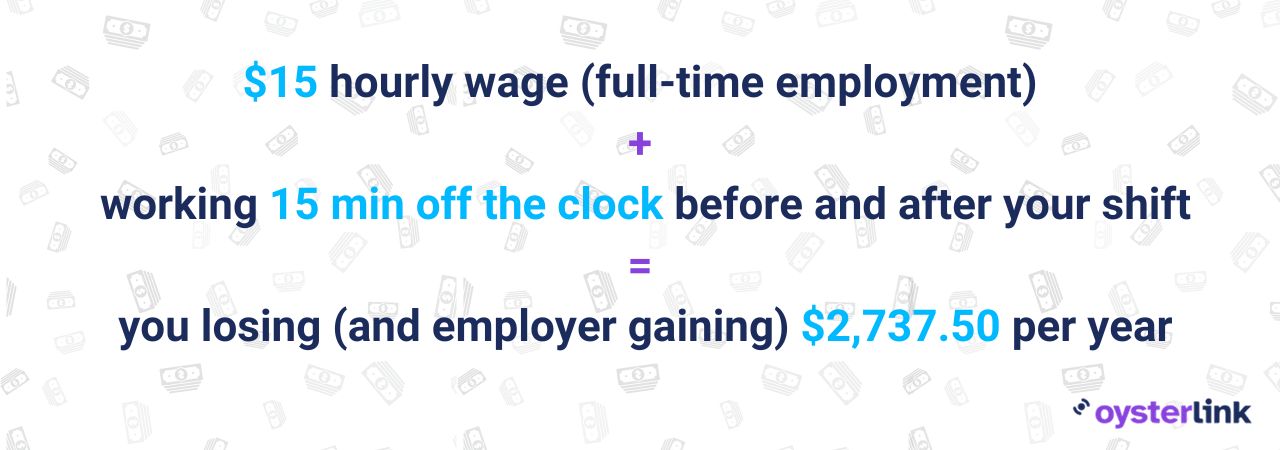

Besides being illegal, working off the clock can significantly impact your finances, potentially resulting in the loss of hundreds of dollars annually. Let’s look at the exact amount of money you would lose if you were a full-time employee earning a $15 hourly wage who dedicates half an hour to off-the-clock work each day:

By taking proactive measures to avoid working off the clock, you can protect both your time and your hard-earned income, ensuring that you receive fair compensation for your efforts in the workplace.

Remember that knowledge and vigilance are key to safeguarding your rights as an employee and maintaining a healthy work-life balance.

Preventing Off-the-Clock Work: Tips for Managers

To maintain compliance and promote fair labor practices, employers in the hospitality sector can implement the following strategies:

- Establish Clear Policies: Develop and communicate explicit policies prohibiting off-the-clock work, ensuring all employees understand the expectations.

- Comprehensive Training: Provide training sessions for both management and staff to recognize and prevent off-the-clock work scenarios.

- Accurate Timekeeping Systems: Implement reliable time-tracking systems to monitor all hours worked, including pre- and post-shift activities.

- Open Communication Channels: Encourage employees to report any instances of off-the-clock work without fear of retaliation.

Employees have the right to be compensated for all work performed, including any tasks completed outside of their scheduled hours. Employers are responsible for maintaining accurate records of all hours worked and must ensure that no work is performed off the clock. Failure to adhere to these responsibilities can lead to legal disputes and financial liabilities.

Find High-Paying Jobs With OysterLink

Interested in finding a high-paying job in the restaurant or hotel industry that values your time and dedication? Discover exciting opportunities that align with your skills and aspirations with OysterLink.

Frequently Asked Questions About Working Off the Clock

In the U.S., employers are not allowed to fire employees for refusing to work off the clock. Working off the clock without proper compensation is illegal under the FLSA, and employers can face penalties for such violations.

In many workplaces, employers may occasionally send texts or make calls to employees outside of their regular working hours. However, it’s crucial to understand that taking calls or answering texts from home or outside of normal working hours is actually considered working time for which your employer must pay you.

This is in accordance with labor laws, which require employers to compensate employees for all hours worked, including off-the-clock tasks.

While some professions may require employees to be available for communication outside of work hours, employers should respect employees’ personal time and boundaries. It’s essential to clarify expectations and boundaries regarding after-hours communication with your employer to maintain a healthy work-life balance.

If you feel that excessive off-hours contact is disrupting your personal life or are unsure about your rights, consider discussing the issue with your employer or HR department to find a mutually acceptable solution.

Volunteering to work off the clock is generally not advisable and can lead to legal and labor rights issues. Under labor laws, employees must be compensated for all hours worked, and voluntary work should be treated the same as regular work hours.

If you’re interested in contributing additional time or effort to your job, it’s recommended to discuss this with your employer and explore options for overtime pay or alternative arrangements that comply with labor laws and regulations.

Working off the clock can have significant disadvantages, including:

- Wage theft: When you work off the clock, you are essentially giving your employer free labor. This can amount to wage theft, where you are not paid for the hours you’ve worked, which is both unethical and illegal.

- Burnout: Continuously working off the clock can lead to burnout and negatively impact your work-life balance. It can make it challenging to disconnect from work and relax during your personal time.

- Diminished job satisfaction: Uncompensated work can lead to reduced job satisfaction and morale. Feeling undervalued or taken advantage of can erode your enthusiasm for your job.

- Legal consequences: While employees can face consequences for working off the clock, employers can also face legal repercussions if they are found to be requiring or knowingly allowing employees to work without compensation.

- Inaccurate records: Working off the clock can lead to inaccurate time records, making it challenging to track your actual work hours, which may impact benefits, overtime pay and other entitlements.

To recover wages for off-the-clock work, you should first have a conversation with your supervisor or manager about the issue. Express your concerns and provide evidence if possible.

If this doesn’t resolve the problem, you can reach out to your company’s HR department or payroll team for assistance. If all else fails, consider filing a wage claim with your state labor department or the U.S. Department of Labor.

Rounding down hours worked to the nearest hour, often referred to as “rounding time,” is a practice that some employers use to simplify timekeeping and paycheck calculations.

However, it’s essential to understand that the legality of rounding time is subject to specific regulations and guidelines, primarily governed by the Fair Labor Standards Act.

Let’s look into these regulations:

- The FLSA allows employers to round employees’ time to the nearest quarter-hour (15-minute increments) as long as certain conditions are met. This practice is typically acceptable if it doesn’t consistently result in employees losing compensable time over an extended period.

- To be legal, rounding must be conducted fairly and consistently. This means that over time, employees’ time should be rounded both up and down, with no systematic bias that consistently favors the employer.

- Employers must ensure that their rounding practices do not result in significant underpayment of wages. If the rounding consistently results in employees losing substantial compensable time, it may be deemed illegal.

If you suspect that your employer’s rounding practices are consistently resulting in unpaid time that adds up significantly over time, consult your company’s HR department or take legal action.

Written by Sasha Vidakovic

Sasha is an experienced writer and editor with over eight years in the industry. Holding a master’s degree in English and Russian, she brings both linguistic expertise and creativity to her role at OysterLink. When she’s not working, she enjoys exploring new destinations, with travel being a key part of both her personal and professional growth.

Reviewed by Marcy Miniano

Marcy is an editor and writer with a background in public relations and brand marketing. Throughout her nearly decade-long career, she has honed her skills in crafting content and helping build brands across various industries — including restaurant and hospitality, travel, tech, fashion and entertainment.