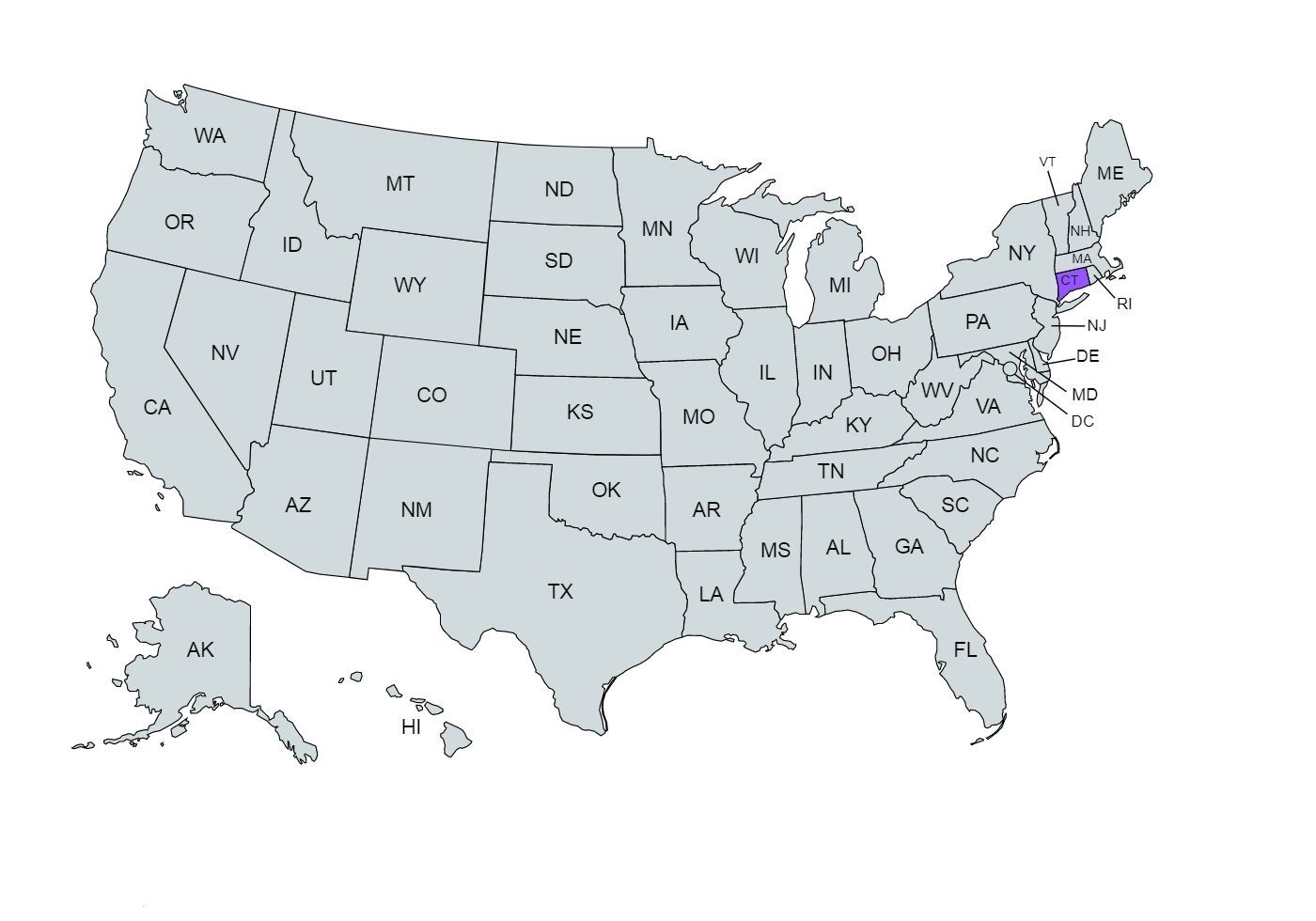

Connecticut Paycheck Calculator: Calculate Your Net Pay

If you’re wondering, “How do I figure out how much money I take home in Connecticut” we’ve got you covered.

Use our simple net income calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in Connecticut.

Paycheck Calculator

Meanwhile, get ahead with our free resources:

How Does the Paycheck Calculator Work?

Input your salary information, such as wage and pay frequency, and our tool will handle the tax calculations for you. Once you’ve filled in all the information, click the “Calculate Tax” button, and the calculator will provide an estimate of your net or “take home” pay for the specified pay period.

Overview of Connecticut Taxes

In 2013, the state boasted the highest per capita personal income in the nation at $60,847.

However, this prosperity was accompanied by a stark income inequality, ranking second in the U.S. for the gap between the top 1% and the bottom 99% in terms of average incomes.

Furthermore, a study in 2013 revealed that Connecticut had the third-highest number of millionaires per capita in the United States, with a ratio of 7.32%.

If you decide to start a new job in the "Constitution State", here's what to expect tax-wise.

While the state offers a range of deductions and credits to ease tax burdens, including personal, earned income, and property tax credits, the income tax rates are progressive, ranging from 3.0% to 6.99% depending on income and filing status.

Additionally, Connecticut's statewide sales tax rate is 6.35%, and property tax rates are determined at the local level. Capital gains are taxed at the same rates as other income, and there is an estate tax imposed on estates exceeding $9.1 million.

In essence, Connecticut's tax structure is comprehensive, reflecting both progressive income tax rates and various credits aimed at supporting residents and businesses, but with specific income thresholds for filing obligations and taxes on property, capital gains, and large estates.

Median Household Income in Connecticut

Salary in each state is typically based on the cost of living. While salaries vary widely based on position, the median household income in your state can give you a glimpse at the average salary a household is earning in your region.

In 2021, the median household income in Connecticut reached its highest point at $83,771, showing a steady increase from $65,753 in 2011.

This consistent growth in median income indicates an overall improvement in the economic well-being of households in Connecticut during this period.

Connecticut's median household income figures reflect a positive trend, with households experiencing improved financial stability and an overall higher standard of living over the past decade.

Tips for Maximizing Your Paycheck

Here are some tips to help you maximize your paycheck:

- Become familiar with your payroll deductions

- Understand techniques for reducing your tax

- Fully utilize your work-related perks

- Develop a financial plan and define financial goal

- Look into additional income through extra hours or performance incentives

- Regularly check your pay stubs for inaccuracies