Restaurant Closures: Key Takeaways

- Many restaurant chains closed or downsized in 2025.

- Closures resulted from bankruptcy or strategic decisions.

- Major closures included Melt Bar and Grilled, CosMc's and a popular Mexican chain.

In 2025, several restaurant chains faced closures — some due to bankruptcy, others as strategic downsizing. This report tracks major restaurant closures, how many locations were affected and the reasons behind them.

Note: For a broader look at industry bankruptcies from 2020 through 2025, see our full report.

Notable Chains & Restaurant Closures

Throughout 2025, several well-known restaurant chains either shut down entirely or closed a large number of locations.

A video recap also highlights how widespread these closures have been across the industry.

While some closures followed formal bankruptcy filings, others were part of broader cost-cutting strategies or responses to declining sales.

This summary highlights major fast food and casual dining brands that scaled back operations or exited the market altogether.

| Restaurant/Chain | Closed Locations |

| Melt Bar and Grilled | All |

| Popular Mexican Chain (TBD) | All |

| CosMc's | All |

| Red Lobster | 120+ |

| TGI Friday’s | 80 |

| Rubio’s Coastal Grill | 48 |

| Buca di Beppo | 44 |

| Bar Louie | 13 |

| Little Big Burger | Not specified |

| Noodles & Company | TBD |

| Applebee’s | Up to 35 |

| Denny’s | Up to 150 |

| Hooters | ~40 |

| Bahama Breeze | 15 |

| Jack in the Box | 200 |

| Subway | 600+ (2024), more in 2025 |

| Red Robin | Up to 70 |

| Boston Market | Over 90% of units |

| Outback Steakhouse (Bloomin’) | 41 |

| Fernando’s Mexican Cuisine | 2 |

| Twin Peaks (DMD Ventures) | Multiple |

| Pizza Hut/Subway (regional exits) | Select states |

Impact of Restaurant Closures on Local Communities

When a major restaurant chain shuts down, the effects extend beyond lost jobs inside the restaurant.

These closures often cut feeder traffic — the flow of customers who visit nearby shops or businesses after dining.

Without that steady stream, neighboring retailers, coffee shops and convenience stores can see noticeable sales drops.

Local communities also lose accessible dining options, forcing residents to travel farther or rely on fewer establishments.

For workers, closures can mean both immediate job loss and reduced employment opportunities in the area.

Understanding 2025 Restaurant Closures

Restaurant closures in 2025 weren’t always tied to bankruptcy. Many brands, including long-established chains, opted to shut down locations due to operational hurdles and performance issues.

Margin Pressure From Rising Costs

Costs climbed across the board — from ingredients to rent.

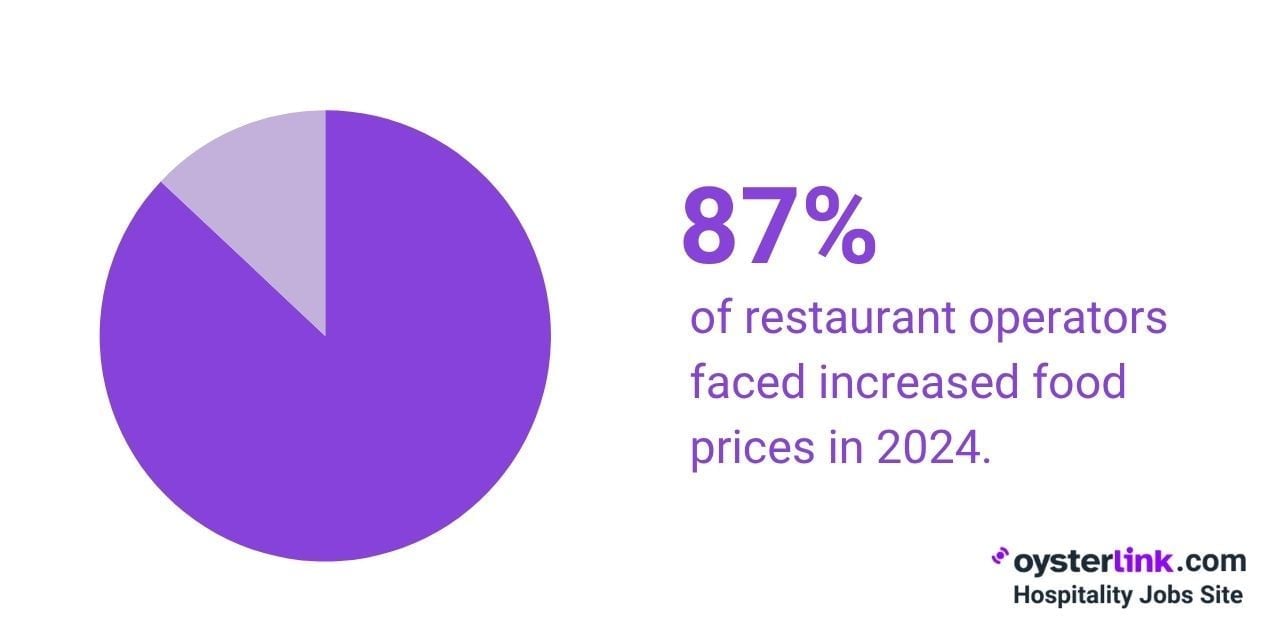

According to Restaurant Dive, 87% of operators faced increased food prices in 2024, and 88% reported higher labor costs. These pressures continued into 2025, squeezing already thin margins.

Rent hikes and utility bills further pushed some units into the red, especially in high-rent areas.

Persistent Staffing Gaps

Labor shortages remained a top concern. Over a quarter of restaurant operators listed staffing as a major issue, according to Push Operations.

Many had to shorten hours, close on slower days or limit service areas due to understaffing — impacting revenue and customer satisfaction.

Changing Dining Patterns

Takeout, pickup and delivery became the default for many diners. The National Restaurant Association reported that 75% of restaurant traffic came from off-premise orders in 2024, a trend that continued in 2025.

Restaurants that relied on in-person dining but failed to pivot to fast, reliable off-premise service struggled to maintain revenue.

Falling Foot Traffic in Key Locations

Inflation and hybrid work cut into in-store visits. High living costs led consumers to cook at home more often.

Without foot traffic, many locations couldn’t meet sales targets.

How Surviving Restaurants & Chains Are Trying To Avoid Closure

In the wake of widespread closures in 2024, many restaurant chains are shifting their strategies in 2025 to reduce costs, improve efficiency and align with evolving consumer preferences — trends also reflected in restaurant success and failure statistics.

See also: 75+ Restaurant Industry Statistics for 2025

Streamlining Menus To Control Costs

To improve kitchen efficiency and reduce waste, many full-service restaurants are cutting down on menu size.

Operators trimmed their offerings to focus on high-margin dishes and reduce complexity, especially as labor and ingredient costs continue to rise.

Investing in Restaurant Technology

Technology upgrades are central to cost-saving efforts. Restaurant operators plan to increase tech investments in 2025, focusing on tools like AI-powered inventory systems, dynamic pricing and automated staff scheduling.

These tools help operators do more with fewer resources.

Operational Adjustments Based on Demand

Chains are using data to adjust staffing, store hours and supply orders based on real-time demand.

Predictive analytics allow restaurants to minimize overstaffing and optimize resource allocation — a key tactic for brands downsizing their physical footprint but maintaining delivery or takeout operations.

Adapting to Shifting Dining Habits

Operators are also responding to broader changes in customer behavior to remain relevant and avoid closure.

- Experience-driven dining: With takeout satisfying basic food needs, more diners — especially millennials and Gen Z — now seek in-person experiences like Chef’s tables, live cooking stations or thematic concepts.

- Sustainability and local sourcing: A 2025 National Restaurant Association survey showed that 71% of diners are more likely to support eco-conscious restaurants. Chains that prioritize sustainable packaging, local ingredients, and ethical practices are more likely to retain consumer loyalty.

- Health-conscious offerings: Restaurants are expanding menus to include low-calorie, high-protein or allergen-friendly items. This shift follows consumer trends that favor clean eating and transparency over highly processed meals.

See also: Restaurant Food Waste Statistics in 2025

Restaurant Closures in 2025: Conclusion

Although the major wave of restaurant closures peaked in early 2024, many chains still face pressure from high costs and changing consumer habits.

To adapt, operators are leaning into automation and robotics and boosting off-premise sales with delivery and digital ordering. Ghost kitchens and virtual brands are also gaining traction as flexible, low-overhead alternatives.

In 2025, long-term survival hinges on adaptability. Chains that cut costs and evolve with demand are more likely to stay in business.

Loading comments...