Restaurant Insurance Cost and Coverage: Key Findings

- 82% of small-business owners, including restaurant operators, say insurance is “extremely or very important” for operations.

- General liability insurance costs range from $1,000 to $3,000/year or as low as $22/month, depending on location and provider.

- Business interruption insurance usually adds 10% to 30% on top of your property insurance cost.

- A restaurant insurance bundle can cost as little as $180/month or up to $10,000+/year, depending on risk exposure and coverage.

Running a restaurant comes with high stakes, from kitchen accidents to liquor liability. Having the right restaurant insurance coverage is not just a recommendation — it's a necessity.

In this guide, we break down the average restaurant insurance cost, key trends and tips on how to choose the best insurance policy for your business.

Restaurant Insurance Cost and Requirements

Restaurants need a mix of insurance policies to protect their assets, employees and customers.

Common coverage includes:

- General liability insurance: Covers third-party injuries, property damage and legal costs.

- Commercial property insurance: Protects the building, equipment and signage.

- Workers’ compensation: Covers medical expenses and lost wages for injured staff.

- Liquor liability insurance: Important if alcohol is served.

- Business interruption insurance: Covers income lost during temporary closures.

Coverage varies by location and business type.

According to a recent survey, 82% of small-business owners, including restaurant operators, consider insurance “extremely or very important” to operations.

This reflects the essential role that insurance plays in safeguarding both short-term continuity and long-term growth.

How Much Does Restaurant Insurance Cost?

Restaurant insurance costs vary based on your location, size, claims history and coverage needs. Below is a simplified breakdown of average annual costs by policy type from industry sources.

- General liability insurance: $1,000 to $3,000/year

- Liquor liability insurance: $300 to $3,000/year

- Workers' compensation: $2,000 to $10,000+/year

- Commercial property insurance: $1,500 to $5,000/year

- Business interruption insurance: Typically 10% to 30% of your property insurance cost

- Total insurance package (bundled coverage): $300 to $10,000+/year

Bundled coverage combines key policies like liability, property and workers’ comp into one plan. It’s often cheaper than buying them separately and offers broader protection for restaurants.

How To Calculate Restaurant Insurance Costs

To estimate your restaurant insurance cost:

- List required coverages: General liability, property, workers’ comp, etc.

- Estimate risk factors: Consider alcohol sales, kitchen fire exposure, delivery services, etc.

- Gather quotes: Use online tools from restaurant insurance providers or brokers to compare pricing and coverage options.

- Compare premiums and deductibles: Look beyond the monthly cost — check limits, exclusions and bundling benefits.

Difference Between Restaurant Insurance and General Business Insurance

While both restaurant insurance and general business insurance provide essential protection, restaurant-specific policies go further.

Restaurants face unique risks like foodborne illness, kitchen fires and alcohol-related liabilities.

In fact, over half of all foodborne illness outbreaks each year are traced back to restaurants, underscoring the need for food-specific coverage add-ons that general policies typically omit.

General business insurance may cover basic liability and property, but it often lacks industry-specific protections like liquor liability, food spoilage or equipment breakdown coverage — protections tailored precisely for high-risk, food-service environments.

Restaurant Insurance Cost: Industry Data and Risk Trends

The restaurant industry is no stranger to operational risks — and the data proves it.

40% of restaurant owners experienced winter weather-related property damage as of January 2025, a sign of how climate-related risks are becoming a regular threat. Even with improved preparedness, 55% of those surveyed still felt vulnerable.

According to Insureon, many small food and beverage businesses pay less than $50 per month for general liability insurance — about $525 annually.

Their internal data also shows average monthly premiums for key coverages: $44 for general liability, $58 for liquor liability, $106 for workers' comp and $148 for a business owner’s policy (BOP).

These numbers underscore how frequent and diverse restaurant risks are — and why securing the right insurance coverage is critical to protect against both everyday incidents and major disruptions.

Factors That Can Affect Restaurant Insurance Costs

Several elements influence how much your restaurant insurance costs.

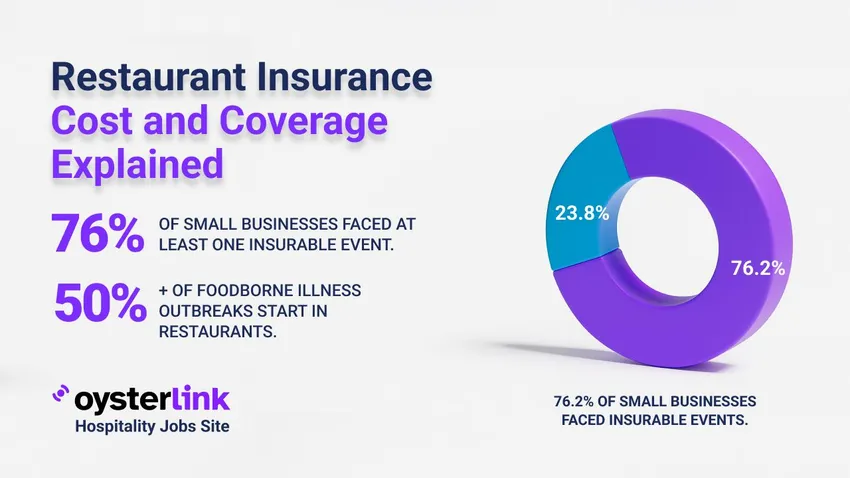

According to AdvisorSmith, 76.2% of small businesses experienced at least one insurable event in 2020 — most commonly employee injuries (31.3%), property damage (26.5%) and customer injuries (23.1%).

This underscores how real-world risks tied to people and property significantly affect restaurant premiums.

- Restaurant size and location

- Years in business

- Annual revenue and number of employees

- Type of food and drink served (e.g., alcohol increases risk)

- History of restaurant insurance claims

- Type and amount of coverage needed

Reducing Restaurant Insurance Costs and Choosing the Right Coverage

Finding affordable restaurant insurance starts with a clear cost-benefit strategy.

Cost-Saving Strategies:

- Bundle policies: Discounts often come with combining general liability, property, workers’ comp, etc.

- Implement safety protocols: Features like fire suppression systems and staff training lower risks and inform premium decisions.

- Increase your deductible: Accepting a higher deductible can reduce your monthly premiums.

- Review your policy annually: As the biBERK survey notes, 18% of small businesses don't — yet doing so helps ensure proper coverage and potentially lower costs.

- Maintain a clean claims record: Fewer claims often result in more favorable rates and fewer premium hikes.

Selecting the Right Coverage Means:

- Assessing your restaurant’s specific risk factors (e.g., dine-in, bar service, delivery).

- Comparing deductible options and coverage limits.

- Reviewing exclusions, particularly for liquor liability and off-premise events.

- Evaluating an insurer’s history with restaurant-related claims.

- Prioritizing protection — not just cost — against lawsuits, injuries or business interruptions.

Restaurant Insurance Cost: Final Thoughts

Whether you're opening a bistro or managing a national chain, having the right restaurant insurance policy can mean the difference between recovery and ruin.

Costs vary, but so does coverage. By comparing quotes, reviewing provider reputations and understanding what insurance a restaurant needs, operators can protect their livelihood against costly surprises.

Loading comments...