The restaurant industry has always faced fierce competition, thin margins and high failure rates — and recent data on restaurant bankruptcies highlights how the COVID-19 pandemic intensified these financial pressures.

Below, we examine the key causes of bankruptcy and financial distress, which segments are most affected and what recent trends suggest about the future of U.S. restaurants.

Restaurant Bankruptcy Trends: What the Data Shows

COVID-19 didn’t just disrupt the restaurant industry — it reshaped it.

Lockdowns forced closures and pushed restaurants to adopt delivery, redesign menus and rethink operations. Consumer habits shifted toward home cooking and online ordering, and many never returned to dine-in routines.

Labor shortages drove up wages and limited operating hours.

Even after reopening, many restaurants struggled. Rising costs, reduced foot traffic and high debt loads — especially for casual dining chains and bars — led to continued instability.

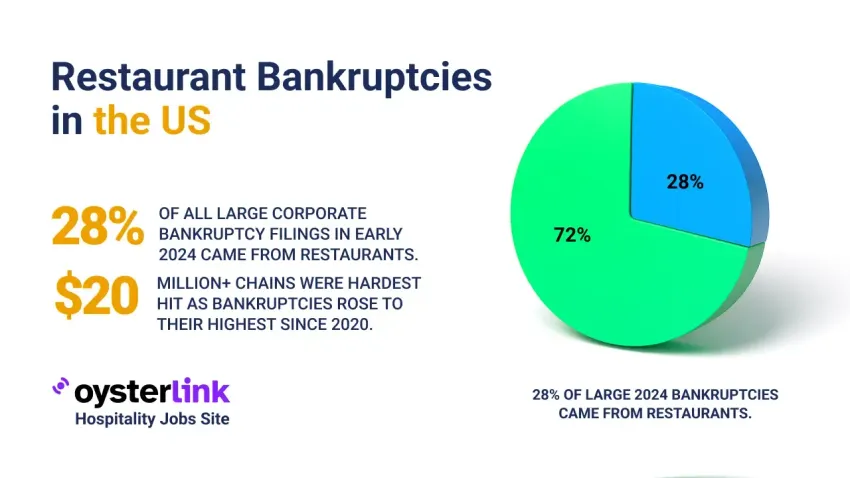

According to Bloomberg, restaurant bankruptcies in 2024 hit their highest levels since the pandemic began, with chains earning over $20 million annually among the hardest hit.

Cornerstone Research reported that restaurants made up 28% of all large corporate bankruptcies in early 2024, signaling sustained financial pressure across the sector.

What Is Chapter 11 Bankruptcy?

Many operators facing overwhelming debt have turned to Chapter 11 bankruptcy as a way to reorganize rather than shut down.

This legal process under U.S. law allows businesses to continue operating while they work out a plan to repay creditors, reduce liabilities or shed unprofitable parts of the business.

For restaurants, Chapter 11 often means the ability to:

- Renegotiate leases or terminate those that are unsustainable.

- Restructure outstanding debt to free up cash flow.

- Sell off underperforming locations.

- Keep daily operations running under court oversight.

Unlike Chapter 7 bankruptcy, which results in liquidation and permanent closure, Chapter 11 gives struggling restaurants a second chance to stabilize — particularly those with brand value, loyal customer bases or multiple units.

In 2024, a growing number of mid-size and large restaurant chains took this route, hoping to survive by adapting to new financial and operational realities.

Notable Restaurant Bankruptcies: Chains That Collapsed

These high-profile cases underscore the ongoing challenges faced by the sector, including rising operational costs, shifting consumer preferences and the lingering impacts of the COVID-19 pandemic.

1. Red Lobster

.jpg)

Red Lobster filed for Chapter 11 on May 19, 2024, closing over 120 locations while continuing operations at approximately 545 sites. The company struggled with rising operational costs, internal mismanagement, and a changing consumer landscape.

2. TGI Friday’s

.jpg)

TGI Friday’s filed for Chapter 11 on November 2, 2024, after a proposed sale to U.K. franchisee Hostmore collapsed.

The company closed around 80 locations throughout the year. The filing affected 39 U.S. corporate-owned locations, while 122 domestic and 316 international franchised units remained operational.

3. Buca di Beppo

.jpg)

Buca di Beppo filed for Chapter 11 on August 4, 2024, and later sold its 44 corporate-owned restaurants to Main Street Capital for $27 million as part of its court-approved reorganization plan.

4. Bar Louie

.jpg)

Bar Louie filed for Chapter 11 on March 26, 2025, listing $1 million to $10 million in assets and $50 million to $100 million in liabilities.

It closed 13 corporate-owned locations during the process and now operates 48 locations, down from a peak of 134 in 2020.

5. Rubio’s Coastal Grill

.jpg)

Rubio’s filed for Chapter 11 in June 2024, citing unsustainable lease costs and consumer behavior shifts. The chain closed 48 California locations and was sold to its lenders for approximately $40 million.

6. Melt Bar and Grilled

This Ohio-based chain filed for Chapter 11 in June 2024, citing inflation and operational costs. It closed all remaining locations by January 2025.

7. Little Big Burger

Little Big Burger, owned by Amergent Hospitality Group, filed for Chapter 11 in July 2024 following a $316,500 settlement involving withheld tips at 14 locations.

8. DMD Ventures (Twin Peaks Franchisee)

.jpg)

DMD Ventures, which operated six Twin Peaks franchise locations in Florida, filed for Chapter 11 on January 6, 2025, amid a $12 million lawsuit by a creditor. The affiliated entities owned and managed separate Twin Peaks sites in the state.

| Restaurant/Company | Bankruptcy Filing Details | Impact on Locations |

| Red Lobster | Filed for Chapter 11 due to rising operational costs, mismanagement and changing consumer behavior | Closed 120 locations; 545 remain operational |

| TGI Friday’s | Filed for Chapter 11 after the collapse of a proposed sale; closed 80 locations | Affected 39 U.S. corporate locations; 122 domestic and 316 international franchised units remain |

| Buca di Beppo | Filed for Chapter 11 and sold 44 corporate-owned restaurants for $27 million | 44 corporate-owned locations sold |

| Bar Louie | Filed for Chapter 11 with $1 million to $10 million in assets and $50 million to $100 million in liabilities | Closed 13 corporate-owned locations; 48 remaining |

| Rubio’s Coastal Grill | Filed for Chapter 11 citing unsustainable lease costs and consumer shifts | Closed 48 California locations; sold to lenders for $40 million |

| Melt Bar and Grilled | Filed for Chapter 11 due to inflation and operational costs. Closed all locations by January 2025 | All locations closed |

| Little Big Burger | Filed for Chapter 11 following a $316,500 settlement involving withheld tips | 14 locations affected |

| DMD Ventures (Twin Peaks Franchisee) | Filed for Chapter 11 amid a $12 million lawsuit by a creditor | 6 Twin Peaks locations in Florida affected |

Pandemic-Era Restaurant Bankruptcies: Facts to Know

The wave of restaurant bankruptcies seen in 2024–2025 has roots in the COVID-19 pandemic. Between 2020 and 2021, dine-in restrictions, shifting consumer habits and ongoing debt obligations drove many well-known chains into bankruptcy.

Notable pandemic-era filings included:

- CEC Entertainment (Chuck E. Cheese, Peter Piper Pizza), filed in June 2020 and restructured by January 2021.

- California Pizza Kitchen, filed in July 2020 and emerged from bankruptcy in November.

- NPC International, a major franchisee of Pizza Hut and Wendy’s, filed in July 2020 and later sold its units to Flynn Restaurant Group.

- Sustainable Restaurant Holdings (Bamboo Sushi, QuickFish), TooJay’s, Le Pain Quotidien (U.S.), and Twisted Root Burger Co.

- Golden Corral and Souplantation/Sweet Tomatoes, with the latter closing all locations permanently.

- Wisconsin Apple LLC (Applebee’s) and 1069 Restaurant Group LLC (Golden Corral), both filed as franchise operators.

These early filings set the stage for continued financial instability, especially for brands already struggling with high debt loads or overexpansion.

Restaurant Bankruptcies: Trends and Causes

Rising costs, changing consumer habits and pandemic-era debt have made it harder for restaurants to stay profitable, pushing many toward bankruptcy and restructuring.

1. Rising Operational Costs

Restaurants face rising labor, insurance and supply costs. Many relied on pandemic subsidies and loans they now struggle to repay.

Food, energy and supply chain expenses have surged, but operators hesitate to raise prices, fearing pushback from cost-sensitive diners.

2. Consumer Behavior Shifts

Many consumers now eat at home more and dine out less — dropping from several times a week to only occasionally.

They also prioritize convenience and value, favoring fast-casual, takeout or delivery options. Brand loyalty has weakened and diners are more selective.

3. Disposable Income Pressures

Inflation has hit lower-income households the most, affecting quick-service and casual chains. Higher food and rent costs have led many to cut back on dining out.

Weekday traffic, especially at lunch, has slowed as more people work from home or limit spending. These drops in non-peak hours strain already thin margins.

4. Failed Deals and Overexpansion

TGI Friday’s and others were affected by failed acquisition deals. Some chains closed locations to cut debt tied to leases that no longer make sense.

Many brands expanded too quickly before the pandemic and are now stuck with underperforming stores. Bankruptcy offers a way to exit bad leases, reduce debt and attempt a leaner comeback.

Restaurant Bankruptcies: Conclusion

The early 2025 slowdown in major filings doesn’t mean restaurant bankruptcies are over. High costs, labor shortages, and the end of COVID relief still strain mid-size chains. Chapter 11 and Subchapter V offer restructuring paths, but not all survive.

While some brands adapt through AI or ghost kitchens, many still shut down. The recent spike in restaurant bankruptcies shows the industry remains under pressure.

Loading comments...