Key Takeaways:

- The cooking robot market is skyrocketing from $3.87 billion in 2024 to an expected $11.04 billion by 2037, with growth rates between 8.4-16.5% annually

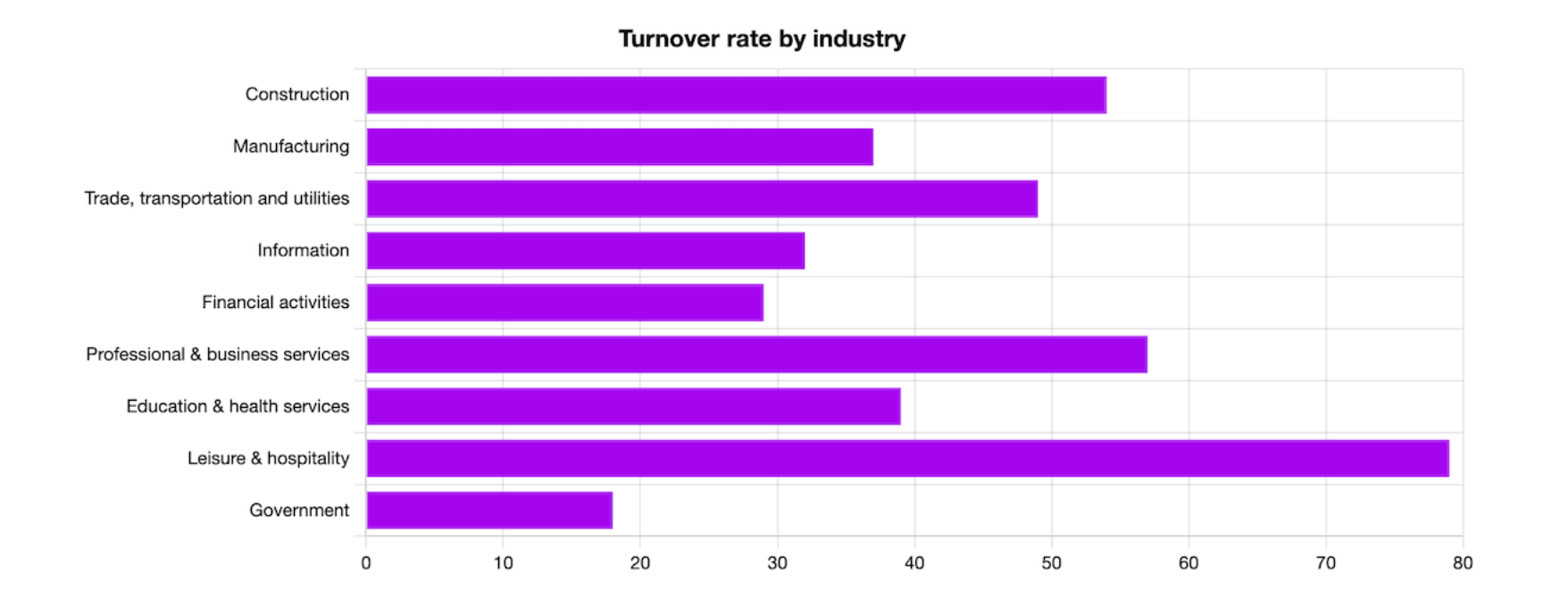

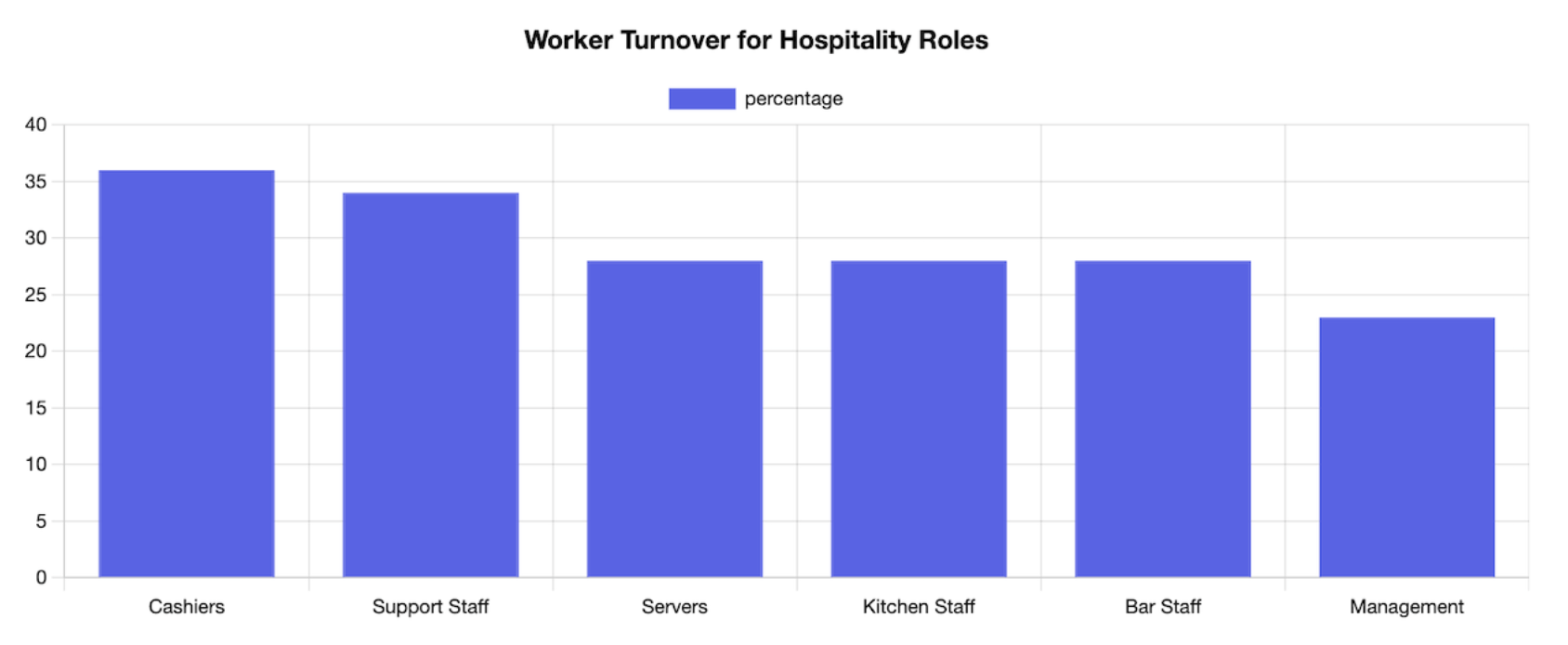

- With restaurant turnover rates hitting 74% and the hospitality industry facing a decade-long staffing crisis, robot Chefs are emerging as a critical workforce supplement

- Robot Chef systems range from $500 for basic home units to over $100,000 for full commercial installations

- Most successful implementations combine human creativity with robotic precision, rather than complete automation

- The technology promises consistency and efficiency but raises questions about authenticity, tradition and the human connection in food preparation

The robot Chef industry is on fire, with global market values set to triple in the next decade—from around $3.87 billion in 2024 to more than $11 billion by 2037.

Why? Because restaurants are in crisis. With staff turnover near 80% and labor shortages showing no signs of slowing, many kitchens simply don’t have enough hands to keep up. Enter the robots.

These machines aren’t just helping—they’re often essential. They slice, dice, grill, and fry with precision. Some can even learn and adapt.

But they’re also raising eyebrows: What does cooking mean when it’s done by a machine? Is consistency worth sacrificing soul?

Why Restaurants Are Embracing Robots

Restaurants are not turning to automation because it’s trendy. They’re doing it because they’re running out of options.

The staffing crisis in hospitality has reached breaking point. As of 2025, annual turnover across the industry sits at 74%—nearly five times higher than the national average across all sectors (12–15%).

In some fast-paced urban markets, turnover exceeds 100%, meaning operators are effectively rebuilding their workforce from scratch every 12 months.

Every time a restaurant loses a staff member, it spends close to $10,000 in recruitment, onboarding, training and lost productivity. Multiply that across dozens of roles in a mid-sized operation and it’s not just an HR problem—it’s an existential one.

Why are workers leaving so fast?

Wages are one pressure point. According to a recent industry survey cited by OysterLink, 40% of hospitality workers saw no pay increase at all in 2024, and another 25% only received a 1–2% bump—hardly enough to keep up with rising living costs.

But money isn’t the only issue. Burnout is rampant. Chronic understaffing has pushed employees to the edge: 64% of hospitality managers report employees quitting specifically because of burnout and nearly half say they themselves are on the brink.

Some roles, like Line Cooks and Housekeepers, are seeing attrition within 90 to 110 days of hire. That’s barely long enough to train them, let alone build a stable team.

To make matters worse, better-paying and more flexible work outside hospitality is luring talent away. Laid off during the pandemic, many workers simply never returned—opting instead for retail, logistics, delivery, or freelance work. The talent pool has shrunk permanently.

Automation isn’t just attractive—it’s necessary

This is the backdrop against which robot Chefs are being introduced—not as futuristic indulgences, but as stopgaps in a collapsing labor market.

In a landscape where 62% of restaurants say they are chronically understaffed, robots offer operational continuity. They don’t call out sick. They don’t need breaks. They don’t leave after two weeks because they found a gig at a warehouse that pays $2 more an hour.

For high-churn positions—Line Cooks, prep staff, fry station workers—robotics offer a stabilizing force. These machines can execute tasks like flipping burgers, frying food, portioning ingredients and assembling dishes with 95% consistency (and can often do it 30–40% faster than humans during peak hours).

The return on investment becomes clearer when looking at volume. In chain restaurants, where a 5-minute delay in one item can stall an entire shift, robots reduce bottlenecks and help ensure that quality remains high even with a smaller team.

The outcome? Higher throughput, fewer remakes, better guest satisfaction—and fewer emergency job postings every week.

What These Machines Are Actually Doing

Culinary robotics is a rapidly diversifying space, with use cases across the food chain. As of 2024, the global cooking robot market is valued between $2.55 and $3.87 billion, depending on reporting source and it's on track to hit $7.15–$11.04 billion by 2037.

You’ll find robots doing everything from flipping burgers (Miso Robotics’ “Flippy” is already in dozens of White Castle locations) to rolling sushi with precise rice-to-fish ratios in high-output Japanese chains.

In institutional kitchens—think hospitals, universities and airports—automated systems already manage everything from frying to portioning to plating, cutting labor demand by up to 40% in certain workflows.

At home, personal robotic cooking systems priced between $500 and $5,000 are becoming more common. Early adopters cite time savings of 5–8 hours per week and recipe consistency comparable to trained culinary staff.

Some units even integrate with smart appliances to manage multi-course meals without human input.

Consistency Is Powerful—But It Comes With a Price

Across chains and franchises, consistency is king. A robot doesn’t forget salt. It doesn’t over-reduce a sauce. It doesn’t have off days.

In trials conducted by Miso Robotics, Flippy reduced cooking time for burgers by 30% during peak hours, while increasing doneness accuracy to 95%. In sushi production, Suzumo machines improved yield per hour by 300%, while cutting rice waste by up to 12%.

But that precision comes with tradeoffs. What’s lost is spontaneity—improvisation born of years in the kitchen. A robot won’t adapt a dish to a guest’s mood or dietary need mid-shift.

It won’t honor the nuance of heritage recipes. And it certainly won’t experiment with new flavor profiles unless a human tells it to.

Moreover, high-end robotics come with steep costs. Full commercial installations can run $100,000+—with 60–70% of that being hardware and the rest going to integration, training and maintenance.

Software updates can temporarily shut down systems and complex parts often require factory-trained technicians. The payoff is long-term, not instant.

The Industry Isn't Going Fully Automated. It’s Getting Smarter

The winning formula isn’t full automation. It’s targeted augmentation.

Successful adopters start with single-station automation—installing robots in the fry station, grill, or prep area—and scale over time. They collect performance data, refine recipes and retrain staff into higher-value roles like plating, guest service and quality control.

In integrated environments, hybrid models increase throughput by 25–50%, according to industry pilots, while reducing workplace injuries by up to 60% in hazardous stations like fryers and grills.

Brands like Chipotle and Sweetgreen are investing in robotic line assembly, aiming to serve thousands of meals per hour with consistency down to the gram. At the same time, their front-of-house staff are being elevated into guest-experience roles—less about speed, more about connection.

Cost, Training, Maintenance—This Isn’t a Shortcut

Let’s talk hard costs. Commercial kitchen robots vary widely:

- Single-function prep robots: $15,000–$30,000

- Assembly bots (sandwiches, bowls): $40,000–$75,000

- Full-system installations: $100,000–$300,000+

Initial costs break down as follows:

- Hardware and installation: 70%

- Training and systems integration: 15–20%

- Year-one maintenance and service contracts: 10%

And that’s just CapEx. Ongoing costs include:

- Electricity use (often 15–25% higher than traditional cooking equipment)

- Technician visits (often charged hourly)

- Insurance policy adjustments

- Cleaning protocols that can take up to 2 hours per shift, depending on food type

The ROI timeline ranges from 12–24 months in high-volume environments, to 36+ months in small to mid-size kitchens. It’s worth it—but only if you do the math.

Home Kitchens: A Quieter Revolution

The home market is evolving fast. Early-stage consumer models like the Moley Kitchen or Samsung’s AI-enhanced cooktops offer all-in-one cooking platforms for $1,500–$4,500. These machines can monitor temperatures within ±1°C, adjust timing based on altitude and humidity and flag missing ingredients in real time.

By 2027, analysts expect a wave of sub-$1,000 devices with cloud recipe subscriptions, voice commands and grocery delivery integration. The global smart kitchen appliance market, which includes robotic elements, is forecast to exceed $50 billion by 2030.

But this tech isn’t about replacing family meals. It's about expanding access. Seniors, disabled users and time-starved parents are finding new freedom in automation—not in avoiding cooking, but in reimagining how and when it fits into life.

Check out The Best Robotic Kitchen Gadgets of the Year on OysterLink and discover how cutting-edge tech is transforming everyday cooking and cleanup.

What Does This Mean for Hospitality?

It means kitchens are being redefined—structurally, operationally and culturally.

In kitchens that have implemented automation well, labor reallocation is immediate. Staff take on supervisory, creative and customer-facing roles. Wages often increase, not decrease. Some restaurant groups report 20–30% higher staff retention post-automation, as burnout drops and tasks become more engaging.

New positions are emerging: Robot Operators, System Integrators, Culinary QA Analysts. In culinary schools, courses on human-robot collaboration are already being piloted.

The skillset is shifting. What’s valuable now isn’t just speed with a knife—it’s adaptability, tech literacy and creative problem-solving in tandem with intelligent systems.

Conclusion: The Future is Hybrid, Not Robotic

The heart of hospitality isn’t under threat—it’s being asked to evolve. Whether that feels like a threat or an opportunity depends on how we respond.

Robot Chefs are tools, not replacements. They’re not here to erase the human element, but to support it, protect it and - when used right - enhance it.

The question isn’t whether to adopt the technology. It’s how to use it in ways that respect the guest, support the team and elevate the dining experience.

And for an industry built on passion, adaptability and perseverance - that’s not a challenge. That’s the next chapter.

Loading comments...