Online Travel Booking Statistics: Key Takeaways

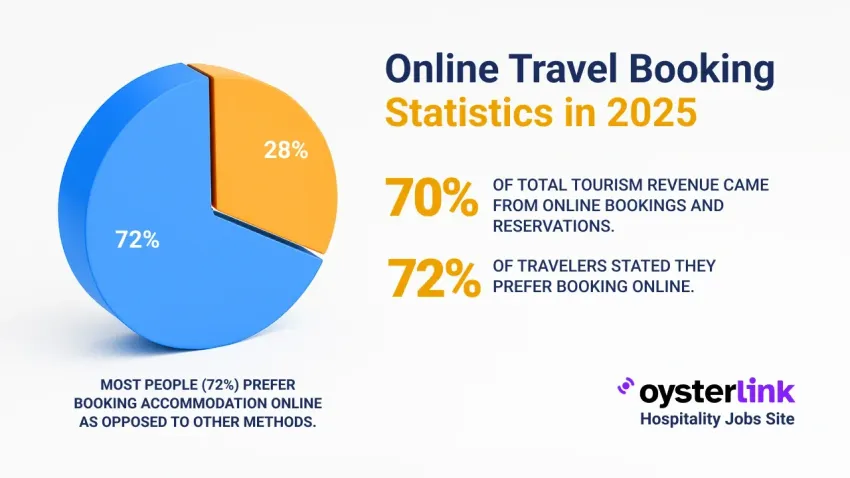

- The global travel and tourism industry relies heavily on online channels, which accounted for approximately 70% of total sector revenue in 2024.

- 72% of travelers prefer booking online, versus only 12% who favor traditional travel agencies, underscoring the industry’s shift toward digital solutions.

- In 2024, Booking Holdings reported its highest-ever revenue of nearly $24 billion.

The online travel booking industry continues to experience impressive growth and rapid innovation as consumer preferences shift toward digital solutions.

This overview highlights the most recent data and trends shaping the online travel landscape in 2025, providing insights from global market size to consumer behavior and leading companies.

Online Travel Booking: Growth Trends

- The worldwide online travel industry’s market size reached an estimated $654 billion in 2024, reflecting robust growth over recent years.

- This market is forecasted to expand to over $1 trillion by 2030 due to increasing digital adoption and emerging travel platforms.

- In 2024, the U.S. online travel industry experienced a significant rebound, growing from a pandemic low of $58.6 billion in 2020 to nearly $144 billion.

- The mobile travel booking market was valued at $228 billion in 2024 and is projected to exceed $526 billion by 2032.

- North America accounts for about 35% of the market, thanks to high smartphone use, widespread internet access and strong mobile commerce.

Leading Travel Websites and Companies

- In July 2025, Booking.com maintained its position as the most visited travel and tourism website worldwide, with nearly 519 million visits during that month.

- Following closely were Tripadvisor.com and wetter.com, with roughly 133 million and 108 million visits respectively.

- In 2024, Booking Holdings reported its highest-ever revenue of nearly $24 billion.

- Expedia Group generated nearly $14 billion in revenue in 2024.

Market Cap and Bookings

- As of July 2025, Booking Holdings boasted the highest market capitalization among online travel agencies, valued at almost $185 billion.

- Booking volumes for Booking Holdings increased by 10% in 2024 compared to the previous year, with room nights surging past 1.1 billion.

- Notably, airline ticket bookings saw the most significant year-on-year increase, soaring 36% in 2024.

Online Travel Booking Consumer Preferences

- 72% of travelers prefer booking online, versus only 12% who favor traditional travel agencies, showing the massive shift the industry is experiencing in adopting modern digital solutions.

- Among online bookers, 53% cited the speed of planning as a primary reason, especially for last-minute trips, while 47% appreciated the ease of comparing prices and 42% sought better deals.

- 76% of travelers look for travel apps that minimize stress and streamline their online journey.

- Over half (56%) of travelers research and book activities ahead of their trips, with 25% planning activities four or more weeks in advance.

- Despite roughly 60% of online travel traffic occurring on mobile devices, desktop remains dominant in actual bookings, accounting for about 62% of sales.

The Role of Online Travel Agencies (OTAs)

- In 2023, 51% of travelers booked via online travel agencies (OTAs), with 37% booking directly with airlines, 23% directly with hotels and 13% using vacation rental platforms like Airbnb.

- The main reasons for choosing OTAs included trust, convenience, loyalty discounts and access to credible online reviews.

- Nearly 70% of travelers find OTAs to be more secure and convenient.

- Hotels make up 70% of bookings on OTAs, while flights account for 25%.

- When booking bundled flights and hotels, 61% of travelers prefer to use online travel agencies (OTAs).

- OTAs hold a 55% share of the travel booking market, with direct suppliers capturing 45%.

Travel Industry Revenue and Future Outlook

- The global travel and tourism industry relies heavily on online channels, which accounted for approximately 70% of total sector revenue in 2024.

- As the industry continues to evolve, forecasts suggest continued growth driven by technological innovations, evolving consumer habits and expanding digital platforms.

- Online bookings are projected to make up 73% of all travel sales by 2029, fueled by advancements in digital technology and AI-driven personalized experiences.

Stay Informed and Connected in Hospitality With OysterLink

As the online travel industry continues its rapid expansion, it remains a vital part of the broader hospitality sector. Whether you're a travel agency, hotel, restaurant or hospitality professional, OysterLink provides the industry insights, tools and resources you need to thrive in this competitive environment.

From real-time data and market trends to career guidance and recruitment solutions, OysterLink helps you stay connected with opportunities and top talent across the hospitality industry.

Our platform is designed to support your growth, streamline hiring and keep you informed about the latest industry developments.

Loading comments...