New York Minimum Wage vs Tipped Minimum Wage: Key Takeaways

- As of January 1, 2025, New York State's standard minimum wage is $16.50/hr in NYC, Long Island and Westchester; $15.50/hr elsewhere.

- Tipped workers in hospitality receive lower cash wages: $11.00/hr (NYC, Long Island, Westchester food service) with tip credits filling the remainder.

- Tip credits can't be claimed if tipped workers spend over two hours or 20% of shift on non-tipped tasks.

Understanding the differences between New York's standard and tipped minimum wage is crucial for employers and employees alike.

This guide explains current wages, tip credit rules and upcoming changes for tipped workers in New York.

Hiring in New York? Learn how to post jobs for tipped employees.

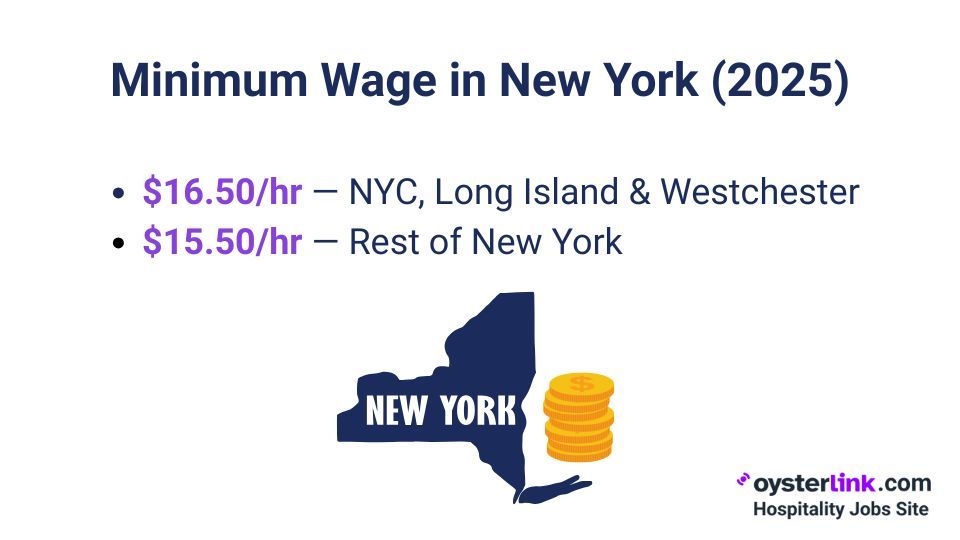

New York Standard Minimum Wage Overview

In 2025, New York enforces region-specific standard minimum wages reflecting local economic conditions.

Major urban areas including New York City, Long Island and Westchester County have a higher minimum wage at $16.50 per hour.

Meanwhile, the rest of New York State maintains a minimum wage of $15.50 per hour.

These rates form the baseline pay employers must meet or exceed when hiring non-tipped workers.

For a broader view, compare restaurant wages by state.

Tipped Minimum Wage Rates in New York State

Employees in the hospitality industry who customarily receive tips are paid a lower cash wage combined with tips that must total at least the standard minimum wage.

This arrangement is known as a tip credit, allowing employers to credit a portion of an employee’s tips toward minimum wage obligations.

Here’s how tipped minimum wages break down by region and worker classification for 2025:

1. Food Service Workers

- NYC, Long Island, Westchester: $11.00 cash wage / $5.50 tip credit (total $16.50 minimum wage)

- Remainder of state: $10.35 cash wage / $5.15 tip credit (total $15.50 minimum wage)

2. Service Employees (Non-Food Service)

- NYC, Long Island, Westchester: $13.75 cash wage / $2.75 tip credit (total $16.50 minimum wage)

- Remainder of state: $12.90 cash wage / $2.60 tip credit (total $15.50 minimum wage)

Tip Credit Limitations and Eligibility in New York

New York places important restrictions on when employers may apply a tip credit.

If a tipped employee spends more than two hours per shift, or over 20% of their total work time, performing non-tipped duties, the employer cannot claim a tip credit for those hours.

This rule ensures employees are fairly compensated for work that does not generate tips, such as cleaning or stocking.

Employers must carefully track hours spent on tipped versus non-tipped tasks to remain compliant.

To distribute tips fairly and compliantly, use our tip pooling template.

Overtime Pay for Tipped Workers in New York

Tipped employees also qualify for overtime pay under state law.

Overtime is calculated at 1.5 times the standard minimum wage, from which the applicable tip credit is subtracted.

This means both the base pay and tips contribute to meeting overtime wage requirements.

Use our Overtime Pay Calculator to see how wages — including tips — are calculated for tipped workers in New York.

See also: New York Overtime Rights for Hospitality Employees

Future Minimum Wage Increases and Indexing

New York’s minimum wage will rise by an additional $0.50 per hour on January 1, 2026.

Starting in 2027, annual adjustments will be tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) for the Northeast region.

This indexing aims to keep wages in line with inflation and living costs over time.

Importance of Understanding New York Minimum vs Tipped Wage

Employers must accurately classify employees as tipped or non-tipped and ensure pay complies with minimum wage laws.

Misclassification or failure to comply with tip credit limitations can expose employers to legal risks and penalties.

For employees, understanding these distinctions helps ensure they receive all wages and tips they are entitled to.

Also review hospitality job posting compliance to avoid penalties.

Additional Resources for Minimum Wage Information in New York

For more detailed or updated information, visit the following official resources:

- New York State Department of Labor: Minimum Wage for Tipped Workers

- New York State’s Minimum Wage Information

- Governor Kathy Hochul's Announcement on Minimum Wage Increase

New York Minimum Wage vs Tipped Minimum Wage: Conclusion

New York’s minimum wage system balances regional wage variation with accommodations for tipped workers through tip credits.

Knowing the exact cash wage and tip credit applicable in your region and industry is essential to comply with the law.

Ongoing wage increases guided by inflation ensure compensation remains fair in the evolving economic climate.

Stay informed through official state resources to navigate these requirements confidently.

Loading comments...