Processing payroll for a dozen employees can be an arduous task and for companies that operate in multiple states it can be even more complicated. While payroll refers to the process of paying the employee and calculating taxes and other deductibles, multiple state payroll refers to that same process – across a number of states.

Keep reading to find out more about how it works, what is nexus and what taxes you’re paying.

What Is Multiple State Payroll?

Multistate payroll refers to the process of managing payroll where multiple state laws apply. There are several ways through which this can occur:

- The employer’s business operates in multiple states

- A business is located close to the border of one state, so employees commute from another state to work

- Employees are working from a different state (remote)

- Employees travel to other states for assignments

To successfully navigate multiple state payroll, employers must adhere to both federal and state legislations.

What Federal and State Laws Apply?

There are multiple state and federal laws that apply to multiple state payroll. On a federal level, all employers can refer to Fair Labor Standards Act (FLSA).

FLSA regulates:

- Minimum wage

- Overtime

- Recordkeeping

- Child labor standards

It does not regulate days off or paid holidays, for example.

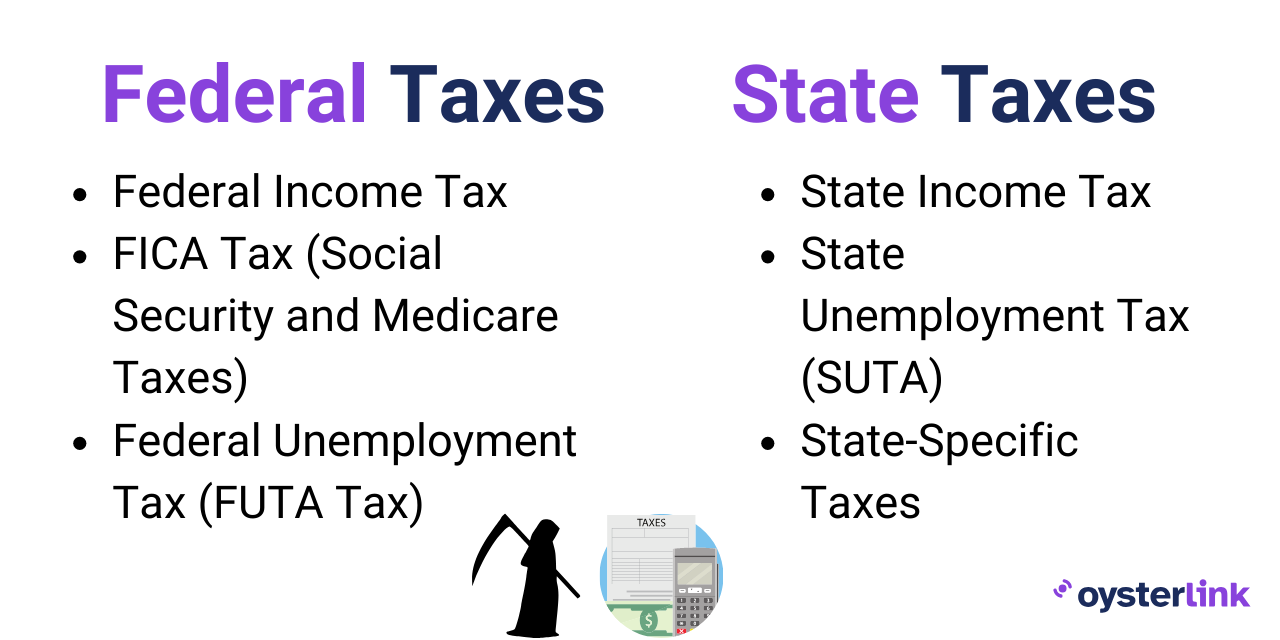

From there, we can look at all the taxes an employer must withhold, on a federal and state level.

Federal taxes:

- Federal income tax

- FICA tax (Social Security and Medicare taxes)

- Federal unemployment tax (FUTA tax)

State taxes:

- Income tax

- Unemployment tax (SUTA)

- Specific local taxes

Regardless of how many states your business operates in, nothing releases an employer from withholding federal taxes. In other words, employers must always withhold federal income tax, FICA, or FUTA.

What Does Multistate Payroll Mean for Employers?

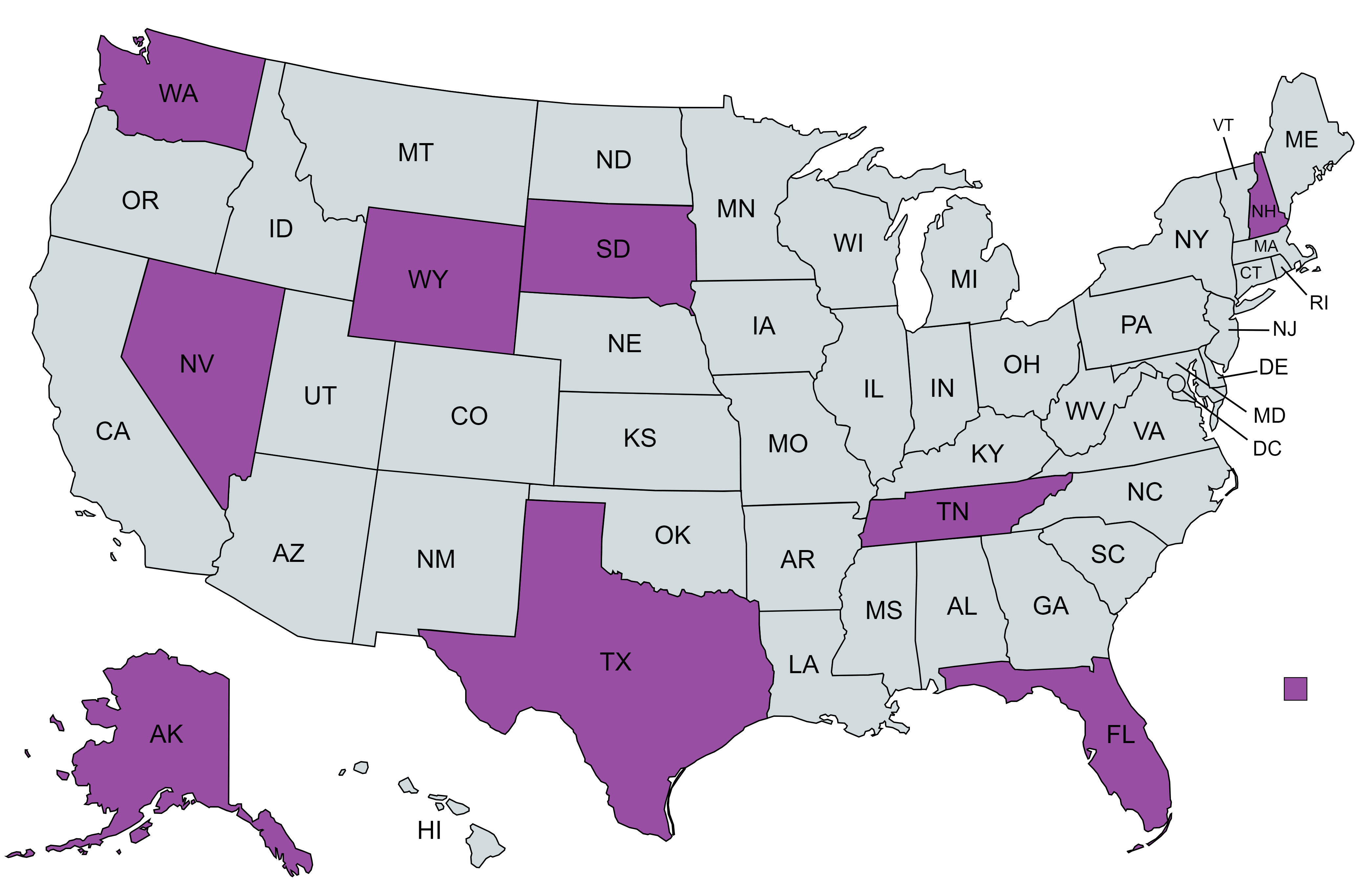

All employers operating a business in states that have income tax have payroll tax withholding. The employer must withhold appropriate taxes from the employee’s wage and remit to state, unless the business operates in a state which has no income tax.

It is important to note that employees who work outside of the state in which the business operates are taxed based on the state laws in which they work, not state laws that apply to the firm or the resident state.

Some states have no income tax, while others have a flat income tax. States with no income tax are:

- Alaska

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Wyoming

- New Hampshire

- Washington

The multiple state payroll took off in the post-pandemic world. In the contemporary professional landscape, when workers are remotely working and receiving paychecks in non-residential states, employers have additional challenges to take into account when processing payroll such as tax nexus and reciprocity agreement.

What Is a Tax Nexus?

With the expanding remote workforce, the complexity of payroll expanded as well. Not only do businesses operate in several states, their employees can be working in one but living in another. To tackle that bureaucratic issue, we can refer to the nexus.

If a business has a “nexus” somewhere, it simply means that they have a taxing presence in that location. Their business is thus under the jurisdiction of state laws in which the nexus is found.

Although nexus requirements differ in various states, usually an organization has a nexus in a state if they have property (whether owned or leased), capital, or employees that perform tasks within the state.

That said, there are exemptions, and it is important to hire tax consultants that have expert knowledge on specific states’ requirements. Even though the nexus defines the minimum of threshold activity (such as having capital or property) within a state for it to be a taxing presence, this threshold isn’t the same across the U.S.

What Is a Reciprocity Agreement?

In simple terms, a reciprocity agreement is an agreement between two parties to back each other up. In tax terms, reciprocity agreements refer to bilateral agreements between two states in which the income of workers commuting from one state to another is not taxed.

People living in one state but working in another are liable to double taxation. To avoid it, these individuals are eligible for tax credit in the state in which they live.

So, if you’re working in one state, you can check with your employer how they deal with the tax reciprocity. By filling out a withholding exemption request, the employees can only be taxed in the state in which they perform business.

The employer should review tax policies for the state out of which their business operates, states in which their employees live and provide employees with appropriate tax forms.

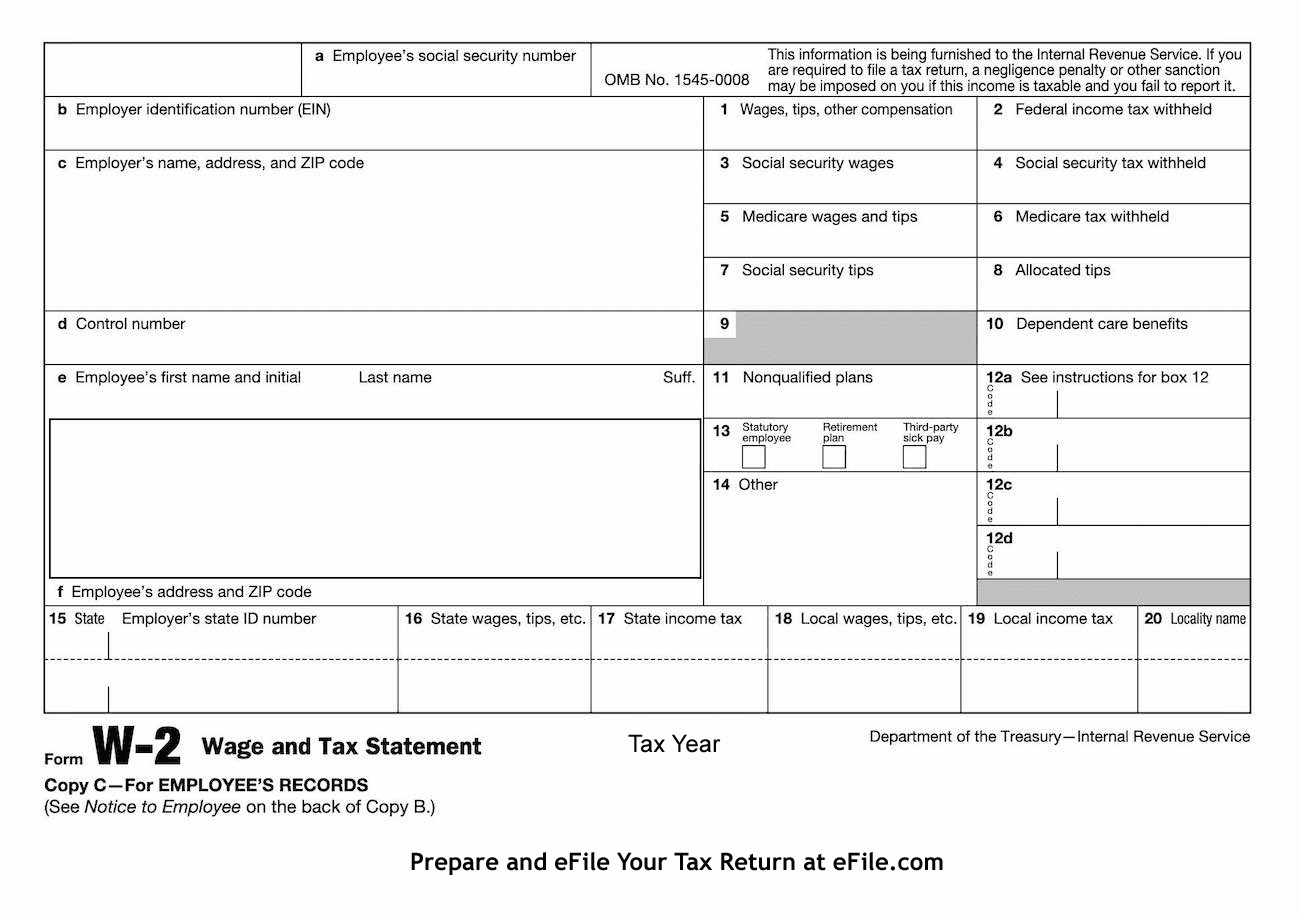

Understanding Your Tax Forms

Understanding your taxes is a crucial step toward financial clarity. Among these forms, the W-2 stands out as one of the most important for employees in the United States.

What is a W-2 form?

A W-2 form shows how much tax the employer withheld from the employee in the previous year. Consequently, every employee thus sees how much they made in the previous year, and they use the W-2 form to prepare their tax returns.

A W-2 form is a form that every employer would give out to their employees in January, if the employee earned more than $600 throughout the year.

Every employer must file a W-2 if they withheld from their employee any of the following:

- Income, Social Security, or Medicare tax

- Income tax would be deducted if the employee had either declared only one withholding allowance or had not requested exemption from withholding on Form W-4

What Taxes You’re Paying

Interested to know more about multiple state payroll or what taxes apply to you? Fret not, OysterLink is here to help.

We’ve developed paycheck calculators to help you estimate how much money you will keep after taxes as a salaried or hourly worker in the US. Simply find your state and input your data!