Are you familiar with the concept of federal withholding tax and how it affects your paycheck? This critical element of the tax system can sometimes be confusing, but understanding how federal withholding is calculated is essential to ensure a smooth tax season without any surprising setbacks.

Federal withholding tax is an amount deducted from your paycheck by your employer and sent directly to the federal government to cover your income tax obligations. Its purpose is to prevent individuals from owing large sums of money at the end of the tax year by spreading out their tax liability over the course of the year.

However, failing to grasp how federal withholding is calculated can lead to unexpected outcomes when you file your taxes. It’s crucial to familiarize yourself with the factors that influence the calculation, such as your income, filing status, and allowances claimed on your W-4 form. Understanding these key elements will empower you to plan and adjust your finances accordingly, avoiding any unpleasant surprises come tax season.

Read on to gain a clear understanding of how federal withholding is calculated and take control of your financial future.

Overview of Federal Withholding Calculation

Understanding how federal withholding is calculated is crucial in determining the appropriate amount of federal income tax to withhold from an employee’s paycheck. The Internal Revenue Service (IRS) provides guidelines through withholding tables, which help employers calculate the correct withholding amount based on an individual’s taxable income.

When calculating federal withholding, the first step is to determine an individual’s taxable income. Taxable income is the amount of income subject to federal income tax after deductions and exemptions have been applied.

The IRS withholding tables play a vital role in this calculation. These tables provide employers with the necessary information to calculate the correct withholding amount based on an employee’s income, filing status, and number of allowances claimed on Form W-4.

Completing and updating Form W-4 is an essential step in the federal withholding calculation process. Form W-4 allows employees to declare their filing status and the number of allowances they are claiming. Making changes to Form W-4, such as updating personal information or claiming additional allowances, can impact the amount of federal income tax withheld.

It is important to understand that an individual’s filing status also plays a role in determining federal withholding. Different filing statuses, such as single, married filing jointly, or head of household, have specific tax rates and brackets.

Allowances claimed on Form W-4 also have an impact on federal withholding. An allowance is a deduction that reduces the amount of income subject to withholding. The more allowances claimed the less federal income tax will be withheld from an employee’s paycheck.

Another factor to consider in federal withholding calculation is the understanding of tax brackets. Tax brackets are ranges of taxable income with corresponding tax rates. As an individual’s income increases, they may move into higher tax brackets, resulting in a higher percentage of federal income tax being withheld.

Exploring additional withholding options is also possible. Employees who anticipate owing more taxes can choose to have an additional amount withheld from their paychecks. This helps to ensure that enough tax is withheld to cover their tax liability.

Deductions and credits also have an impact on federal withholding. Certain deductions and credits reduce an individual’s taxable income, resulting in a lower federal income tax liability. It’s important to consider these when calculating federal withholding.

State income tax withholding is interconnected with federal withholding. The amount of federal income tax withheld may affect the amount of state income tax liability. It’s crucial to consider this relationship when calculating federal withholding.

For certain individuals, estimated tax payments may be required. Self-employed individuals or those with other taxable income that is not subject to withholding may need to make estimated tax payments throughout the year to cover their tax liability.

In conclusion, federal withholding calculation is based on an individual’s taxable income, filing status, allowances claimed, and other factors that impact federal income tax liability. Understanding these factors and using the IRS withholding tables can help employers determine the correct amount to withhold from an employee’s paycheck.

Understanding Taxable Income

When it comes to calculating federal withholding, understanding taxable income is essential. Taxable income refers to the portion of your earnings that is subject to federal income tax. It is important to be familiar with the various components that contribute to your taxable income. Here’s what you need to know:

- Wages and Salaries: Any money you earn through employment is considered taxable income. This includes regular salary, overtime pay, bonuses, and commissions.

- Tips: If you receive tips as part of your job, they are also considered taxable income. Make sure to report them accurately to avoid any discrepancies.

- Self-Employment Income: If you are self-employed or have a side business, the income you generate from these activities is subject to federal income tax. Keep detailed records of your self-employment income and expenses.

- Other Taxable Sources: In addition to the above, income from sources such as rental properties, investments, and alimony may also be included in your taxable income. Consult a tax professional to ensure proper reporting.

It is crucial to avoid any misconceptions or common mistakes when determining your taxable income. Some individuals mistakenly believe that certain types of income are not subject to taxation. However, most forms of income fall under the umbrella of taxable income. By understanding and accurately calculating your taxable income, you can ensure that your federal withholding is calculated correctly.

IRS Withholding Tables

When it comes to calculating federal withholding taxes, the IRS withholding tables play a crucial role in ensuring accuracy and compliance. Designed with the intent of determining the correct amount of federal income tax that should be withheld from employee paychecks, these tables take into account various factors that influence the withholding amount.

One of the key factors considered in the IRS withholding tables is the filing status of the employee. Whether an individual is filing as single, married filing jointly, married filing separately, or head of household, the tables provide specific instructions to calculate the right withholding amount.

Additionally, the pay frequency of the employee also plays a significant role in the IRS withholding tables. Whether an employee is paid weekly, biweekly, monthly, or on any other schedule, the tables have designated columns to ensure accurate withholding calculation based on the pay frequency.

Another essential factor taken into consideration is the number of allowances claimed by the employee on their Form W-4. The IRS withholding tables align the number of allowances with the corresponding withholding amount, allowing employers to deduct the correct federal tax from employee wages.

To better understand how these tables work, let’s consider an example. Suppose a married employee chooses the filing status as married filing jointly, with a biweekly pay frequency and claiming two allowances. By referring to the IRS withholding tables, the employer can easily determine the appropriate amount to withhold from each paycheck.

By utilizing the IRS withholding tables, employers can be confident that they are accurately calculating the federal withholding tax for their employees. It eliminates the guesswork and ensures compliance with the federal tax regulations.

Completing and Updating Form W-4

When it comes to calculating federal withholding, one crucial document plays a significant role—Form W-4. This form is not just a mundane administrative task; it determines the amount of federal withholding from your paycheck. Ensure you complete and update this form accurately to avoid unnecessary tax surprises or potential penalties. Here’s a helpful guide to assist you:

Understanding the Significance of Form W-4

Form W-4 is an essential document that allows you to instruct your employer on the correct amount of federal income tax to withhold from your paycheck. By accurately completing this form, you can ensure that the appropriate amount of taxes is withheld, helping you meet your tax obligations without underpaying or overpaying.

It’s important to note that your employer relies on the information provided on Form W-4 to determine how much federal income tax to withhold from your wages. Therefore, updating this form whenever there are significant changes in your personal or financial circumstances is crucial to avoid any discrepancies.

Tips for Completing Form W-4 Correctly

Completing Form W-4 might seem overwhelming, but with a few tips and best practices, you can navigate it successfully. Here are some important considerations:

- Marital Status: Your marital status is a key factor in determining your federal withholding. Whether you’re single, married, or married filing separately affects how much tax is withheld from your paycheck.

- Dependents: If you have dependents, indicating this on Form W-4 can help reduce your federal withholding. Ensure you accurately enter the number of eligible dependents to benefit from the appropriate allowances.

- Adjustments and Additional Income: Form W-4 allows you to make adjustments and declare additional income sources. If you have multiple jobs, self-employment income, or other sources of income, it’s essential to fill out this information carefully to avoid under or over-withholding.

Remember, the goal of completing Form W-4 accurately is to ensure your tax withholding aligns with your overall tax liability. This way, you won’t end up with a significant tax bill when you file your tax return or receive a substantial refund due to overpaying.

Impact of Filing Status on Federal Withholding

When it comes to calculating federal withholding, your filing status plays a crucial role. Let’s take a closer look at the different filing statuses and how they can impact your federal withholding calculations.

1. Single: This filing status is for individuals who are unmarried or legally separated. If you choose to file as single, more federal tax will be withheld from your paycheck compared to other filing status options.

2. Married Filing Jointly: Married couples can choose to file jointly, combining their incomes and deductions. This filing status often results in a lower overall tax rate and lower federal withholding compared to filing as single.

3. Head of Household: This filing status is for individuals who are unmarried and provide the main financial support for a qualifying child or dependent. Choosing head of household can result in lower federal withholding compared to filing as single.

It’s important to choose the appropriate filing status because it can directly impact the amount of federal withholding tax withheld from your paycheck. If you choose the wrong filing status, you may end up with too little or too much withheld, which can affect your tax liability when you file your return.

By accurately selecting your filing status, you can ensure that the right amount of federal tax is withheld from your paycheck throughout the year. This can prevent any unwanted surprises come tax time, ensuring that you are in compliance with your tax obligations.

Significance of Allowances on Form W-4

When completing Form W-4, one of the important aspects to consider is the number of allowances to claim. Allowances represent the number of dependents or situations that could potentially reduce your taxable income. Understanding the significance of allowances is crucial in accurately calculating your federal withholding.

The number of allowances declared on Form W-4 directly influences the amount of federal income tax withheld from your paycheck. Each allowance you claim reduces the amount of your taxable income subject to withholding. Therefore, the more allowances you claim, the less money will be withheld from your paycheck for federal taxes.

It is important to note that claiming too many allowances can result in underpayment of taxes, leading to a potential tax liability when you file your tax return. Conversely, claiming too few allowances may result in overpaying taxes, which could mean a smaller refund or a larger tax payment when you file your return.

To determine the appropriate number of allowances to claim on Form W-4, it is essential to consider your personal circumstances. Factors such as the number of dependents, filing status, additional sources of income, and eligibility for tax credits or deductions should be taken into account.

If you have several dependents or qualify for various deductions and credits, claiming more allowances may be appropriate to reduce your withholding and increase your take-home pay. However, if you anticipate having substantial taxes due at the end of the year or prefer receiving a larger refund, it may be wise to claim fewer allowances to ensure adequate withholding.

While the IRS provides a withholding calculator to help individuals determine the correct number of allowances, consulting with a tax professional can also provide valuable guidance tailored to your specific situation.

Understanding Tax Brackets

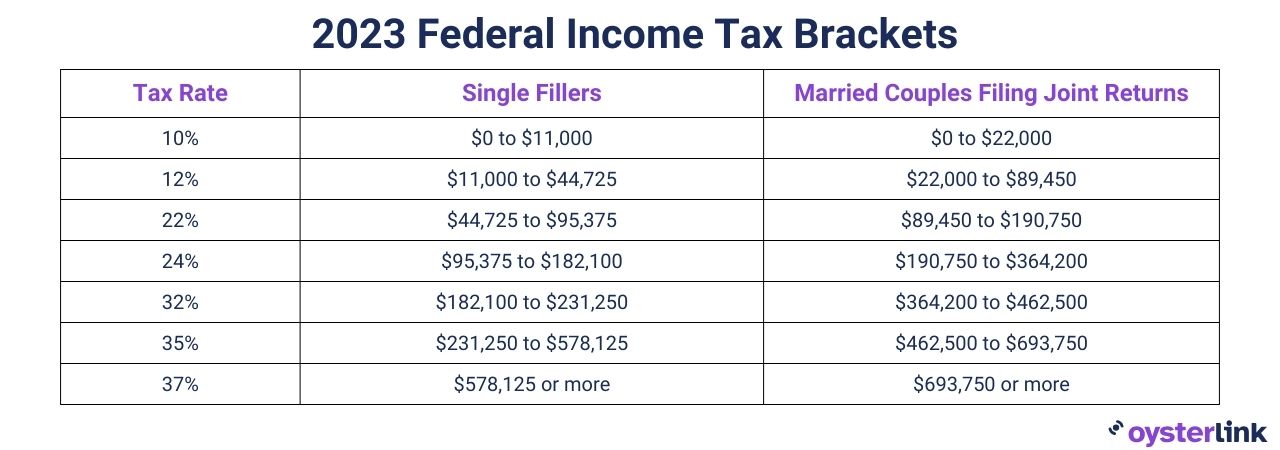

One crucial aspect of federal withholding calculations is understanding tax brackets. Tax brackets refer to the different income ranges that determine the tax rates individuals are subject to. These tax rates play a significant role in calculating the amount of federal withholding tax.

The concept of tax brackets is based on progressive taxation, which means that individuals with higher incomes are taxed at higher rates than those with lower incomes. In other words, as your income increases, the tax rate applied to your income also increases.

There are several tax brackets in the United States, each with its own corresponding tax rate. These tax brackets are divided based on income thresholds set by the Internal Revenue Service (IRS). It’s important to note that tax brackets may change from year to year, as determined by tax laws and regulations.

Let’s take a look at an overview of the different tax brackets and their corresponding tax rates for the current tax year:

- 10% tax bracket: This bracket applies to individuals with a lower income range. It means that the first portion of their taxable income is subject to a 10% tax rate.

- 12% tax bracket: This bracket applies to individuals with a slightly higher income range than the 10% tax bracket. Here, the portion of their taxable income that exceeds the threshold of the 10% bracket is subject to a 12% tax rate.

- 22% tax bracket: This bracket applies to individuals with a higher income range than the 12% tax bracket. The portion of taxable income exceeding the 12% bracket threshold is subject to a 22% tax rate.

- 24% tax bracket: This bracket applies to individuals with a higher income range still. The portion of taxable income exceeding the 22% bracket threshold faces a 24% tax rate.

- And so on…

It’s important to understand that an individual’s income isn’t taxed at a single rate across the entire income range. Instead, it is a combination of tax rates from different tax brackets that are applied to specific portions of the income.

For example, if an individual’s taxable income falls within the 22% tax bracket, only the portion exceeding the 12% bracket’s threshold will be taxed at 22%. The income within the 10% and 12% brackets will be taxed at their respective rates.

This interplay between tax brackets allows the federal withholding tax to accurately reflect an individual’s income level, ensuring that the appropriate amount is withheld throughout the year.

Exploring Additional Withholding Options

Are you interested in taking more control over your federal tax withholding? You’ll be glad to know that you have the option to request additional federal withholding from your paychecks, if desired. This allows you to have more taxes taken out upfront, ensuring that you won’t owe a large sum when tax season rolls around.

There are several reasons why someone might choose to have extra federal taxes withheld. One common reason is to avoid underpayment penalties. By having a higher percentage of your income withheld, you reduce the risk of owing an unexpected amount when filing your tax return. This can save you from the stress and financial burden that comes with a large tax bill.

Furthermore, choosing to have extra federal taxes withheld can also lead to a larger tax refund. If you prefer receiving a lump sum of money at tax time, rather than smaller amounts throughout the year, you can adjust your withholding to achieve that. It can feel like a financial reward and provide a boost to your savings or help fund important expenses.

Remember, it’s important to strike a balance when adjusting your federal withholding. While it may be tempting to have a significant amount withheld to maximize your refund, keep in mind that you’ll be sacrificing some of your take-home pay throughout the year. Make sure to consider your current financial situation and budget accordingly.

If you’re interested in exploring additional withholding options, consult with your employer’s human resources or payroll department. They can guide you through the necessary steps to adjust your withholding and ensure that your extra federal taxes are withheld correctly.

Influence of Deductions and Credits on Federal Withholding

When it comes to calculating federal withholding, deductions and credits play a pivotal role in determining the amount of taxes you owe. They have the potential to significantly impact your tax liability, allowing you to reduce the amount of federal withholding tax. Let’s dive deeper into the influence of deductions and credits on federal withholding calculations.

Impact of Deductions:

Deductions lower your taxable income, which in turn can decrease the amount of federal withholding tax. For example, if you have a mortgage and pay interest on it, you may be eligible to deduct the mortgage interest from your taxable income. By doing so, your taxable income decreases, resulting in a lower federal withholding amount.

Similarly, if you have student loans and pay interest on them, you may qualify for a deduction. By deducting the student loan interest from your taxable income, you can potentially lower your federal withholding tax.

Impact of Credits:

Credits directly reduce the amount of tax you owe, and they can therefore impact federal withholding calculations. Let’s take the Child Tax Credit as an example. If you have qualifying children, you may be eligible to claim this credit. By doing so, the amount of federal withholding tax can be reduced, allowing you to keep more of your hard-earned money.

Other common credits that can influence federal withholding include the Earned Income Tax Credit and the American Opportunity Tax Credit. Depending on your eligibility and circumstances, these credits can greatly affect the amount of federal withholding tax deducted from your paycheck.

It’s important to note that the impact of deductions and credits on federal withholding can vary based on individual factors, such as income level, filing status, and the specific deductions or credits claimed. Consulting with a tax professional or using an online tax calculator can help you determine how deductions and credits impact your federal withholding calculations.

Interconnection with State Income Tax Withholding

State income tax withholding is calculated based on the requirements of each individual state and is interconnected with federal withholding.

When calculating federal withholding, it is important to consider the state income tax withholding requirements as well. Depending on the state you reside in, you may need to adjust your federal withholding accordingly.

For example, some states have their own specific withholding tables that differ from the IRS withholding tables. These tables take into account the state’s tax rates, exemptions, and other factors.

If your state has higher tax rates or different withholding requirements compared to the federal government, you may need to increase or decrease your federal withholding accordingly. This ensures that you are properly accounting for your state income tax obligations.

Additionally, certain states may require you to fill out an additional state withholding form, which provides information on your state tax obligations. This form may include details such as your filing status, exemptions, and any additional adjustments specific to your state.

By accurately completing both your federal Form W-4 and any required state withholding forms, you can ensure that your overall tax withholding adequately covers both your federal and state tax liabilities.

Estimated Tax Payments for Certain Individuals

As a freelancer, self-employed individual, or someone with other types of income not subject to regular withholding, you may need to make estimated tax payments. Understanding this process is crucial to ensure you meet your tax obligations.

Calculating Estimated Tax Payments

Estimated tax payments are calculated based on the amount of income you expect to earn throughout the year. To determine the amount to pay, you’ll need to estimate your total taxable income, taking into account any deductions and credits you anticipate.

There are two primary ways to calculate estimated tax payments:

- Annualized Method: This approach allows you to adjust your payment amounts based on the actual income you received each quarter. It takes into consideration any fluctuations in your income throughout the year.

- Regular Installments: With this method, you divide your estimated tax liability equally among the four quarterly payment dates. This provides a consistent payment amount, regardless of fluctuations in your income.

Payment Due Dates

Estimated tax payments are typically due on a quarterly basis. The due dates for each payment are as follows:

- April 15th: First payment

- June 15th: Second payment

- September 15th: Third payment

- January 15th of the following year: Fourth payment

It’s important to note that these due dates may vary slightly if they fall on a weekend or holiday. In such cases, the payment is due on the next business day.

Avoiding Underpayment Penalties

Failure to make sufficient estimated tax payments may result in underpayment penalties imposed by the IRS. To avoid penalties, it’s crucial to accurately estimate your tax liability and make timely payments.

Additionally, keep in mind that estimated tax payments are not the same as filing your annual tax return. Even if you have made estimated tax payments throughout the year, you still need to file your tax return by the designated deadline.

By understanding the process of estimated tax payments and ensuring you stay compliant, you can effectively manage your tax obligations as a freelancer, self-employed individual, or someone with other types of income not subject to regular withholding.

Conclusion

In conclusion, understanding how federal withholding is calculated is essential for individuals to ensure accurate tax withholding from their paychecks. Throughout this content, we have covered various key points:

- Overview of federal withholding calculation and the importance of taxable income

- Utilizing IRS withholding tables to determine the appropriate amount of withholding

- Completing and updating Form W-4, considering filing status, allowances, and additional withholding options

- An overview of tax brackets and their impact on federal withholding

- The influence of deductions, credits, and state income tax withholding

- Estimated tax payments for individuals with specific situations

However, it is crucial to note that the information provided in this content is intended as a general guide. Tax laws and regulations may change, and individual circumstances can vary. It is always advisable to consult with a tax professional or visit the official Internal Revenue Service (IRS) website for further information and personalized advice.

Calculator

When it comes to calculating federal withholding, a calculator can be a valuable tool to simplify the process. It allows individuals to estimate the amount of federal taxes that will be withheld from their earnings based on various factors.

Whether you are employed or self-employed, using a calculator can help you understand how much of your income will be set aside to fulfill your federal tax obligations.

Here are some important aspects to consider when using a federal withholding calculator:

- Income: Your total income, which includes not only your salary but also any additional income sources such as dividends or rental income.

- Filing Status: Your filing status plays a significant role in determining the amount of federal tax you will owe. Whether you are single, married, or head of household affects your tax bracket and the corresponding withholding rate.

- Allowances: The number of allowances you claim can impact your federal withholding. Each allowance reduces the amount of taxable income subject to withholding.

- Additional Withholding: If you want to have extra money withheld from each paycheck to cover any potential tax liability, you can choose to have additional funds withheld voluntarily.

By inputting these variables into a federal withholding calculator, you can obtain an estimate of how much federal tax will be withheld from your paycheck. This can help you plan your budget and ensure you are withholding the appropriate amount to avoid any surprises come tax time.