Form 843: Key Takeaways

- Purpose – Use Form 843 to request a refund or abatement of certain IRS-assessed penalties, interest, fees, or specific non-income taxes.

- Eligibility Matters – It’s only for specific situations (e.g., IRS errors, reasonable cause penalties, excess Social Security tax from one employer).

- Strong Documentation – A clear written explanation and supporting evidence greatly improve approval chances.

- Deadlines Apply – File within 2 years of payment or 3 years from return filing, whichever is later, and mail to the correct IRS address.

When to File for IRS Form 843

You’d reach for Form 843 when:

- The IRS slapped you with interest or penalty by mistake.

- You paid a branded prescription drug fee or an annual health insurance provider fee, and you’re in the clear to request a refund

- You’re an employee who’s had excess Social Security, Medicare, or RRTA tax withheld by one employer, and that employer can’t (or won’t) fix the overcollection

- You’re facing fees or penalties tied to incorrect IRS advice, dyed fuel misuse, misstatements due to appraisals, or trust fund recovery—basically a list of very specific exemptions.

Don’t use Form 843 to fix an ordinary income tax return or to ask for a refile of FICA. That’s handled with other forms like Form 941‑X, etc.

Overview: Your Step-by-Step Journey to Filling Form 843

- Confirm eligibility: Does your situation match one of the acceptable reasons above?

- Gather your documentation:

- IRS notice (if one was issued), including section numbers for penalties you’re challenging.

- Records of payment or assessed penalties.

- Any supporting evidence: correspondences, receipts, medical records, legal advice or specific IRS guidance.

- Fill in the form:

- Personal and taxpayer details.

- Clearly check the box that matches your reason for filing.

- Craft a persuasive statement and attach documents.

- Sign and date properly:

- Joint filers must both sign.

- Corporations require an officer’s signature and title.

- Estates or trusts use a fiduciary signature.

- Submit it:

- Mail to the address specified on any IRS notice you received.

- If it's a branded drug fee, send it to the designated IRS address in Ogden, UT.

- Keep track of timing:

- File within two years from payment of tax or three years from filing the return, whichever is later.

- After filing:

- If the IRS denies your claim or doesn’t respond within six months, you can file a suit in U.S. District Court or U.S. Court of Federal Claims.

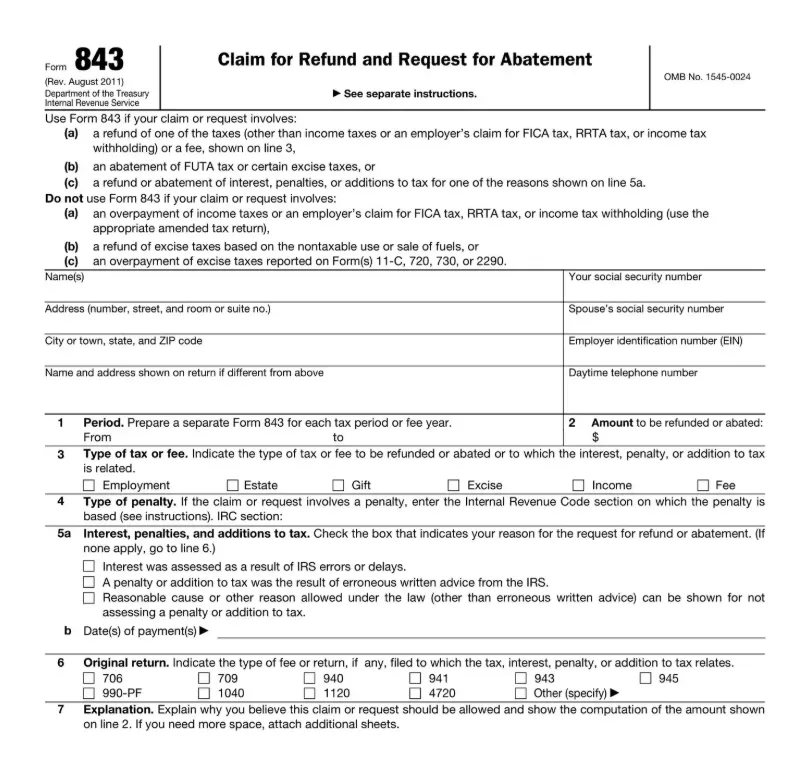

Form 843 Structure: Section-by-Section Breakdown

Let’s walk through the structure of Form 843—you’ll want to navigate with confidence and clarity.

Header: Boxes for Your Reason

Start strong—select the box that best explains your reason:

- Abatement/refund of non-income tax (excluding FICA, RRTA).

- Employee refund of excess Social Security, Medicare, or RRTA tax.

- Penalty abatement due to reasonable cause or IRS error.

- Specialty categories like dyed fuel misuse, branded prescription drug fee, or fees for health insurance providers.

1–3: Identification

- Line 1–3: Name, address, and taxpayer identification number (SSN or EIN depending on entity).

4: Penalty Section Number (if applicable)

- For penalty abatement, write the Internal Revenue Code section number of the penalty you're contesting (e.g., 6676, 6672

5a: Type of Request

- Tick the category (abatement, refund, interest, fee, etc.) that aligns with your situation.

6: Tax Period

- Identify the tax year or period relevant to your claim.

7: Explanation of Facts

- This is your stage. Write a detailed, factual narrative—explain exactly what happened, why it was erroneous or unfair, and what relief you’re seeking.

- Provide documentation such as IRS notices, timelines, third-party statements, or rationale (e.g., illness, reliance on incorrect advice).

- Be concise, yet vivid and clear in describing your cause.

Attachments

Include any relevant files, labeled and referenced in your explanation. Whether it’s a damaged receipt, a physician’s note, or a corrected affidavit—label clearly.

Signature Section

- Individuals/joint filers: Both spouses sign.

- Corporations: Must include officer title.

- Estates/Trusts: Fiduciary signature required.

Tips For Making Your Form 843 Submission Shine

- Match precision: State “Reasonable cause: [insert explanation]” and back it up with proof—doctor’s notes, weather delays, death certificates, legal counsel, or correspondence.

- Label everything: For complex cases, use 'Attachment A – IRS Notice dated MM/DD/YYYY' and reference it in your narrative.

- Stay within limits: Don't overexpand—let your core story shine. If possible, keep your statement to one or two well-crafted pages.

- Deadline savviness: If you're close to the limitation period but still building evidence, file a protective claim to preserve your right while gathering proofs.

- Follow‑up: Mark your calendar—if no reply in six months, you may escalate to court.

Filing Addresses & Logistics

- Use IRS notice instructions first: If you’ve received a notice, it usually tells you where to send your reply.

- Typical special case: For branded prescription drug fee refunds, mail to:

Internal Revenue Service

Mail Stop 4921 BPDF

1973 N. Rulon White Blvd.

Ogden, UT 84404

- Track your submission: Send via certified mail or priority post, keep copies and tracking info.

What to Expect Next

- Acknowledge receipt: The IRS may send a confirmation.

- Processing: Typically up to 6 months—during which they may ask for more information.

- Approval or denial: If accepted, you get a refund or abatement. If denied, you’re entitled to petition the courts.

Simplified Workflow at a Glance

| Step | Action |

|---|---|

| 1 | Confirm eligibility—match your case to IRS categories |

| 2 | Gather documentation—notice, proof, narrative |

| 3 | Complete form—precise checkboxes, explanation Included |

| 4 | Sign appropriately—joint, officer, or fiduciary per entity |

| 5 | Mail to the correct IRS address—special labels if needed |

| 6 | Keep records—tracking, copies, deadlines |

| 7 | Follow up if no response by 6 months |

| 8 | If denied, consider court petition |

Loading comments...