Wyoming Labor Law Guide

A comprehensive guide to Wyoming labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- Regular employees in Wyoming are entitled to the federal minimum wage of $7.25 per hour

- Tipped employees, earning over $30 in tips per month, receive a minimum of $2.13 per hour

- Nonexempt employees are eligible for overtime pay, which is 1.5 times the regular rate of pay for hours worked beyond 40 in a workweek

- Exempt employees are not entitled to overtime pay and must meet specific criteria related to their job duties and salary level to qualify for exemption

- Wyoming labor laws do not specify rest or meal breaks

- Wyoming workers have the right to take unpaid leave for reasons such as serious health conditions, parental leave and family military leave.

Minimum Wage Regulations in Wyoming

Wyoming has precise guidelines concerning minimum wage, which set forth separate minimum hourly rates for regular and tipped employees, outlining the mandated compensation for employers to provide their workforce.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

Wyoming shares the nation's lowest minimum wage, set at $5.15 per hour, with the state of Georgia. However, it's essential to note that Wyoming workers are entitled to the federal minimum wage of $7.25 per hour unless they qualify for exemptions under the Fair Labor Standards Act (FLSA).

Tipped Employees

In Wyoming, a tipped employee is defined as someone who earns over $30 in tips per month. Tipped employees, such as restaurant servers and bartenders, are required to receive a minimum of $2.13 per hour. However, student workers and interns may receive 85% of the minimum wage rate, which amounts to $6.16 per hour.

Overtime Rules and Regulations in Wyoming

Overtime rules and regulations play a crucial role in upholding workers' rights and guaranteeing equitable compensation for additional work hours. In Wyoming, these rules apply differently to nonexempt and exempt employees.

Accurately determining whether employees are nonexempt or exempt, following the criteria outlined in the Fair Labor Standards Act (FLSA) and state labor laws, is a critical responsibility for employers. Misclassification of employees can result in legal complications and potential breaches of wage and hour laws.

Nonexempt Employees

Wyoming state law does not have specific overtime regulations, but it generally follows the FLSA standards. Thus, nonexempt employees in Wyoming are entitled to overtime pay as per federal standards, which include 1.5 times the regular rate of pay for hours worked beyond 40 in a workweek.

Exempt Employees

Exempt employees are not eligible for overtime pay regardless of the number of hours worked. To qualify for exemption, employees must meet the following criteria related to their job duties and salary level, as set by the U.S. Department of Labor:

- Job duties: Exempt employees typically perform work that requires advanced education or training, such as professionals like lawyers, architects and registered nurses. Skilled trades, mechanical arts or work that does not necessitate a college or postgraduate degree are not considered exempt.

- Salary level: Exempt employees must meet the salary threshold of $684 per week, or $35,568 annually.

Break Periods in Wyoming

Under Wyoming labor laws, there are no specific provisions mandating rest breaks or meal breaks for employees. However, if an employer chooses to offer breaks, there may be federal work-hour rules, such as those outlined in the FLSA, that apply.

Under the FLSA, short rest breaks (typically 5 to 20 minutes) are considered compensable work hours, and employees must be paid for this time. Meal breaks, which are typically longer and allow employees to be entirely relieved of their work duties, do not need to be compensated.

Family and Medical Leave Laws in Wyoming

Employers in Wyoming, similar to employers across the United States, are obligated to adhere to the federal Family and Medical Leave Act (FMLA). This federal law permits eligible employees to take 12 workweeks of unpaid leave in a 12-month period for reasons such as:

- Serious health condition: Employees can take FMLA leave for their own serious health condition that makes them unable to perform their job or for the serious health condition of a spouse, child or parent.

- Parental leave: FMLA provides for parental leave, allowing eligible employees to take time off for the birth, adoption or placement of a foster child.

- Family military leave: This includes "qualifying exigency leave" for eligible employees with a covered family member on active military duty and "military caregiver leave" for caring for a covered service member with a serious injury or illness.

Beyond the federally mandated FMLA, there are no state-specific Wyoming laws that demand private sector employers to offer employees additional paid or unpaid sick leave.

Workplace Safety and Health Regulations in Wyoming

In Wyoming, workplace safety and health regulations are primarily overseen by the Wyoming Occupational Safety and Health Administration (Wyoming OSHA), which adopts federal Occupational Safety and Health (OSHA standards) with minor exceptions.

Federal OSHA standards are designed to ensure safe working conditions in various industries. They cover general industry, construction and specific hazards such as fall protection, chemical safety, and more.

While it cannot enforce standards stricter than corresponding federal ones, Wyoming can establish unique standards in areas such as oil and gas well drilling, servicing, special servicing and anchor safety, where federal counterparts are absent.

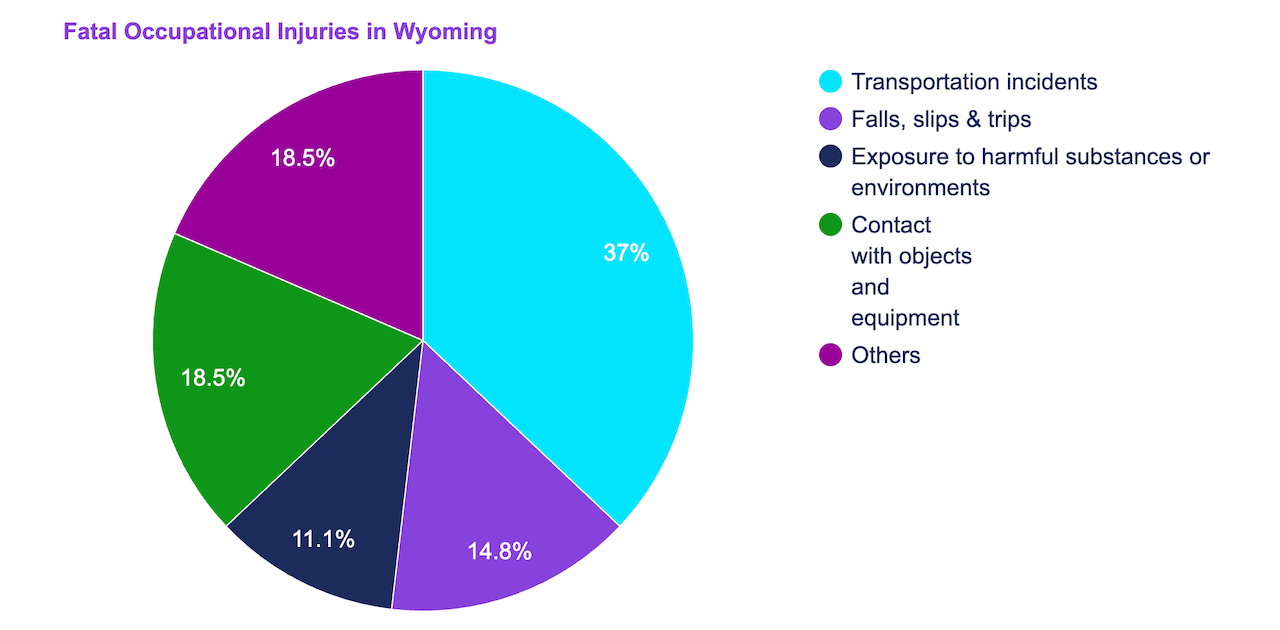

[Source: U.S. Bureau of Labor Statistics]

There were 27 fatal occupational injuries in Wyoming in 2021, which is about 22% lower compared to 35 in 2020.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

In total, the number of fatal injuries in Wyoming is 73% lower than the average number of fatal injuries in all states at 102 fatal work injuries.

Wyoming OSHA conducts inspections and enforces safety standards, often using worker compensation rates and local emphasis programs to schedule inspections.

They also offer voluntary consultation programs to assist employers in maintaining safe workplaces and provide a process for resolving cases through informal conferences and appeals.

Anti-Discrimination and Fair Employment Practices in Wyoming

The Wyoming Fair Employment Practices Act prohibits employers from refusing to hire, discharge promote, demote or discriminate against qualified individuals, including those with disabilities, based on sex, race, age, national origin, ancestry or pregnancy.

A person who believes they have experienced discriminatory or unfair employment practices can file a written complaint within six months of the alleged incident. This complaint should include the name and address of the involved parties, details about the incident and any required information.

Independent Contractor Classification in Wyoming

In Wyoming, the classification of an independent contractor is defined as an individual who provides services to another individual or entity and meets the following criteria:

- Operates without external control or direction over the specifics of service performance, whether by contractual agreement or in practice

- Publicly presents their services as those of a self-employed individual or independent contractor

- Has the option to delegate their services to another person if desired

Termination and Final Paychecks in Wyoming

In Wyoming, the payment of wages upon termination of employment is regulated as follows:

- Termination pay: Employers in Wyoming are required to pay an employee all wages owed for work performed before the termination of employment. This payment must be made on or before the day the employee would have received their regular wages if the employment had not been terminated.

- Notice of termination: Wyoming does not mandate that employers allow employees to work the full notice period specified in employment contracts or policies. Likewise, employers are not obliged to pay employees for the time not worked during the notice period, unless it is expressly provided for in an employment agreement, contract or company policy.

- Unused vacation at termination: Whether unused vacation leave is payable upon termination in Wyoming depends on the employer's written policy and whether it was communicated to the employee at the time of hiring. If the employer lacks a written policy limiting compensation for accrued leave upon termination, the terminated employee is entitled to receive the cash value of any unused earned vacation leave, provided it was otherwise usable.

- Unused sick leave at termination: Sick leave in Wyoming is typically intended for use in cases of illness or medical attention. Its use is restricted to these situations, and it cannot be claimed in the same manner as unused vacation leave upon termination unless expressly allowed by an employment contract or the employer's policy.

When navigating Wyoming labor laws and termination procedures, ensure you're equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state's tax laws.

Summary of Wyoming Labor Laws

Wyoming, together with Georgia, has the lowest state-set minimum wage in the United States. Still, Wyoming workers are entitled to the federal minimum wage, which is $7.25 per hour.

Wyoming may not have specific mandates for rest breaks or meal breaks, but it complies with federal guidelines on these matters. Employers are also obligated to follow the federal Family and Medical Leave Act, and Wyoming OSHA keeps a close eye on workplace safety standards.

To protect against workplace discrimination, Wyoming enforces the Fair Employment Practices Act. Wyoming labor laws also provide clarity on independent contractor classification and termination regulations.

Frequently Asked Questions About Wyoming Labor Laws

Is Wyoming a right-to-work state?

Yes, Wyoming is a right-to-work state. Right-to-work laws in Wyoming prohibit employers and unions from requiring employees to join or financially support a union as a condition of employment.

What are the legal hours to work in Wyoming?

Wyoming state law and federal regulations do not establish limits on the number of hours that can be worked in a day or week. Employees aged 16 or older have the freedom to work as many hours per day or week as they choose.

Does Wyoming have paid sick leave?

Wyoming does not have a state sick leave law. While 23 U.S. states currently offer sick leave, Wyoming is not one of them.

Can you sue for wrongful termination in Wyoming?

In Wyoming, employment is typically at-will, which means that employers can terminate employees for various reasons, as long as they do not violate specific anti-discrimination or retaliation laws. Employees can sue for wrongful termination if they believe their firing was unlawful, such as in cases of discrimination, retaliation or violations of employment contracts.

Is nepotism illegal in Wyoming?

Nepotism is strictly prohibited only for municipal officials in Wyoming. This means that they are not allowed to advocate for or be involved in the hiring, appointment, promotion or advancement of a family member, which includes spouses, parents, siblings, children, grandparents or grandchildren.

Additionally, municipal officials cannot supervise or manage a family member. These prohibitions are extensive and unequivocal, leaving no room for exceptions.

Disclaimer: This information serves as a concise summary and educational reference for Wyoming state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.