Rhode Island Labor Law Guide

A comprehensive guide to Rhode Island labor laws: Covering essential topics like minimum wage guidelines, overtime regulations, mandatory rest breaks and other key employment provisions specific to the Ocean State.

Key Takeaways

- As of January 1, 2024, the minimum wage in Rhode Island is $14.00 per hour

- The minimum wage for tipped employees is $10.50

- Employers can use a maximum tip credit of $6.61

- Employees in Rhode Island are entitled to overtime pay at a rate of 1.5 times their regular pay rate for all hours worked beyond 40 in a workweek

- Employees in Rhode Island are entitled to a 20-minute meal break for every six hours of work, extending to 30 minutes for eight-hour shifts

- Rhode Island follows federal OSHA standards for workplace safety and health

Minimum Wage Regulations in Rhode Island

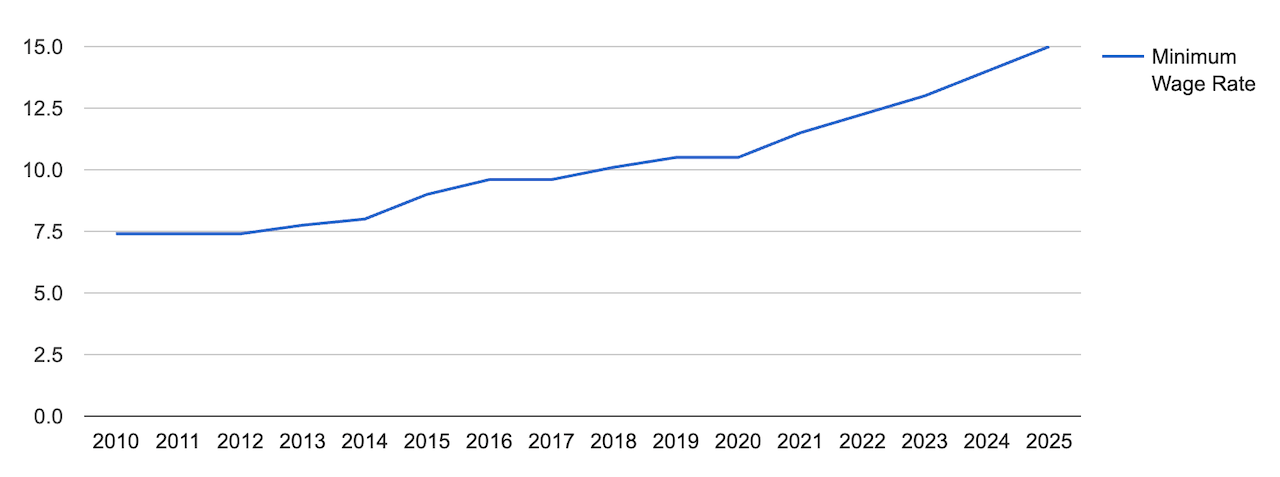

As of January 1, 2024, the minimum wage in Rhode Island stands at $14.00 per hour.

Looking ahead, the minimum wage is set to further increase. Starting from January 1, 2025, it is set to rise to $15 per hour.

[Source: FRED]

You can also compare the Rhode Island minimum wage with the minimum wage in other US states by interacting with the map below.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Tipped Minimum Wage

The tipped minimum wage in Rhode Island is set at $10.50 for tipped employees such as servers or bartenders.

To be classified as a tipped employee in Rhode Island, an individual must receive more than $30 in tips on a monthly basis.

Employers in Rhode Island can use a maximum tip credit of $6.61, allowing them to offset this amount from the minimum wage by considering tips received by employees.

If a tipped employee doesn't earn enough tips to reach the regular minimum wage of $14/hr (when combining the direct hourly wage and tips), the employer is responsible for making up the difference.

Exceptions to Minimum Wage Requirements

Rhode Island's minimum wage requirements include exceptions for specific occupations, including:

- Workers employed in domestic service in or about a private home

- Federal service employees

- Voluntary service employees in educational, charitable, religious or nonprofit organizations where traditional employer/employee relationships do not exist

- Occupations in resort establishments serving meals to the general public that are open for less than 6 months during the year

- Individuals employed by organized camps with a structured program, operating for no more than 7 months in any calendar year, and not on an annual full-time basis

Subminimum Wage

Full-time students under 19 years of age working in nonprofit religious, educational or community service organizations are eligible for a subminimum wage and they can receive a subminimum wage of $11.90 per hour.

When discussing wages, it’s important to keep in mind the taxes for complete financial clarity. Our Rhode Island Paycheck Calculator gives you an estimate of your earnings after accounting for taxes and deductions, in adherence to your state’s tax laws.

Overtime Rules and Regulations in Rhode Island

According to the Rhode Island Minimum Wage Act and the Fair Labor Standards Act (FLSA), employees are entitled to overtime pay at a rate of 1.5 times their regular pay rate for any hours worked beyond 40 in a workweek.

Overtime is calculated on a weekly basis, not daily, and is applicable to both salaried and hourly employees.

The regular rate for salaried employees is determined by dividing the salary by the intended number of compensable hours.

For instance, let's say a salaried employee earns an annual salary of $50,000 and the intended number of compensable hours for the year is 2,080 (40 hours per week for 52 weeks).

The regular rate and the overtime compensation for this salaried employee would be calculated as follows:

Regular Rate = $50,000 / 2,080

Regular Rate= $24.04 per hour

Overtime Compensation = $24.04 x 1.5 = $36.06 per every hour over 40 hours in a week

Overtime Exceptions and Exemptions

Rhode Island, acknowledges specific exemptions for certain types of employees, relieving them from the requirement of receiving overtime pay.

Common exemptions include:

- Computer employees: Individuals engaged in computer-related roles may be exempt from overtime.

- Executives: Employees in executive positions, typically responsible for managing and overseeing the work of others, may be exempt.

- Managers with supervisory role: Managers whose primary job function is supervision and overseeing the work of other employees may be exempt from overtime.

- Administrators: Certain administrative positions may be exempt from overtime requirements.

- Commissioned salespeople: Employees primarily earning through commissions may be exempt from overtime regulations.

- Learned professionals: Professionals such as doctors and lawyers, who require specialized education and training, may be exempt from overtime pay.

Rest and Meal Breaks

In Rhode Island, employees are entitled to a 20-minute mealtime for every six hours of work. For shifts lasting eight hours, the meal break extends to 30 minutes.

If an employee is required to work through a meal break, that time must be compensated. Short breaks, lasting from five to 20 minutes, are considered part of the workday and must be paid.

However, employers are not obliged to pay for bona fide meal breaks (a genuine, uninterrupted break during which the employee is completely relieved of work duties to have a meal).

Rhode Island's law applies to employers with at least five employees, and employers with fewer than three employees on a shift are not required to provide a meal break.

Family and Medical Leave Laws in Rhode Island

Employees who have worked at least twelve months and at least 1250 hours within the previous twelve months qualify for the Family Medical Leave Act (FMLA).

Under FMLA, eligible employees can take up to twelve work weeks of leave over a 12-month period for various reasons, including:

- Birth, adoption, or foster placement of a child

- Care for an employee's spouse, child or parent with a qualified serious health condition

- An employee's own qualifying serious health condition

- Situations when an employee's family member is a military member on "covered active duty"

- Care for a covered service member with a serious injury or illness

Employees who have worked at least 12 consecutive months and an average of 30 hours weekly are eligible for Rhode Island Parental and Family Medical Leave (RIPFML).

Under RIPFML, eligible employees can take up to 13 work weeks of leave in a consecutive 24-month period for the following reasons:

- Birth, adoption or foster placement of an employee's child

- Care for an employee's spouse, qualifying domestic partner, parent, child or parent-in-law with a serious illness

- Employee's own qualifying serious illness

- Attend a child's qualifying school activities (limited to ten hours in a twelve-month period)

Family Members That Qualify for FMLA

In Rhode Island, both the FMLA and the RIPFML provide leave options for eligible employees to care for certain family members. Family members that qualify for FMLA:

- Spouse

- Child

- Parent

Family members that qualify for RIPFML:

- Spouse

- Qualifying Domestic Partner

- Parent

- Child

- Parent-in-law

Holiday Leave

In Rhode Island, holiday leave regulations differ for public and private sector employees.

Public employees in Rhode Island are entitled to paid time off for the following state holidays:

Additionally, if a holiday falls on a weekend, public employers typically provide a compensatory day off during the week.

Public employers must also offer overtime pay at a rate of 1.5 times the regular hourly wage to employees working on a holiday.

Rhode Island State Holidays for private sector employees:

Private employers in Rhode Island are not legally required to provide paid or unpaid time off for state holidays.

However, if a private employer chooses to offer paid holidays, they must provide paid time off for the aforementioned holidays.

Workplace Safety and Health Regulations in Rhode Island

The Rhode Island State lacks an independent state-level program for workplace safety and health, commonly known as a "state plan." Instead, Rhode Island residents are governed by federal Occupational Safety and Health Administration (OSHA) standards.

In Rhode Island, OSHA functions with key components:

- Regulations: OSHA establishes and enforces safety and health regulations applicable to a diverse range of industries and workplace hazards in the private sector.

- Inspections: Regular inspections, prompted by complaints or incidents, are conducted by OSHA to evaluate compliance with safety and health regulations in Rhode Island.

- Penalties: Non-compliance with OSHA regulations may lead to penalties, including fines, citations, and requirements to address safety hazards in Rhode Island.

- Training and outreach: OSHA in Rhode Island offers training and outreach programs to educate both employers and employees on matters related to safety and health in the workplace.

- Whistleblower protection: OSHA is dedicated to protecting employees in Rhode Island who report safety or health violations by their employers.

- Emergency response: OSHA provides guidance on emergency response and preparedness in Rhode Island, ensuring workplaces are adequately equipped to handle various emergency situations, such as fires, chemical spills and natural disasters.

- Small business assistance: OSHA extends specialized assistance and consultation services to small businesses in Rhode Island, helping them meet safety and health requirements while considering the unique challenges they may encounter.

- Partnerships: OSHA actively collaborates with various organizations, industries and labor groups in Rhode Island, fostering partnerships and alliances to enhance workplace safety through shared knowledge and resources.

In the latest data, Rhode Island has recorded 5 fatal occupational injuries. While this might appear modest, it's crucial to consider that Rhode Island's population counts just over one million residents.

You can see how Rhode Island compares to other states in the US when it comes to occupational fatal injuries by browsing our interactive map below.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Child Labor Laws in Rhode Island

Rhode Island maintains strict regulations on the employment of minors, aligning with both state and federal laws designed to safeguard younger workers from extended hours and potentially hazardous jobs.

To legally work in Rhode Island, individuals must be at least 14 years old.

The permissible jobs for youth include a diverse range of fields such as:

- Office and clerical work

- Retail and sales

- Advertising

- Price marketing and tagging

- Bagging and carrying out orders

- Errand and delivery work

- Cleanup tasks

- Group maintenance

- Kitchen work

- Waitstaff

However, there are certain jobs deemed unsuitable for youth employment, including:

- Manufacturing various products

- Mining

- Logging and sawmilling

- Wrecking demolition and shipbreaking

- Positions requiring the operation of power-driven machines

- Roofing

- Excavating

For 14 and 15-year-olds, the regulations include working up to but not exceeding 40 hours per week or 8 hours per day.

They are not allowed to start work before 6:00 AM or continue after 7:00 PM, with a curfew of 9:00 PM during school vacations.

Additionally, they must have an 8-hour rest period between the end of one shift and the start of the next. As for 16 and 17-year-olds, they can work up to but not exceeding 48 hours per week or 9 hours per day.

Work hours are restricted between 6:00 AM and 11:30 PM on school days, extending to 1:30 AM if there is no school the next day.

There is no curfew for non-students, and they must also have an 8-hour rest period between shifts.

Anti-Discrimination and Fair Employment Practices in Rhode Island Discrimination in the workplace is strictly prohibited in Rhode Island under RI General Law 28-5-7, marking any discriminatory act as an unlawful employment practice.

This comprehensive law covers various aspects of employment, including:

- Recruiting

- Hiring

- Firing

- Refusing reasonable accommodation

- Compensation

- Employee assignment or classification

- Transfer

- Promotion

- Layoff

- Recall

- Training and apprenticeship programs

- Pay

- Retirement plans

- Fringe benefits

- Disability leave

Illegal discriminatory practices specified by the law include harassment based on:

- Race

- Color

- Religion

- Sex

- Sexual orientation

- Gender identity or expression

- Disability

- Age

- Country of ancestral origin

Furthermore, denying employment opportunities to an individual based on their marriage to or association with someone of a particular race, religion, national origin or an individual with a disability is prohibited.

Additionally, pre-employment questions on interviews or applications that inquire about certain protected characteristics are not permitted.

Retaliation against individuals for filing a discrimination complaint, participating in an investigation or hearing, or opposing discriminatory practices is also considered unlawful.

Independent Contractor Classification in Rhode Island

An employee is defined as an individual performing services for an employer who controls the work and dictates how it is done. On the other hand, an independent contractor operates an independent business, trade or profession.

They offer services to the public and retain the right to control the methods and means of their work.

Rhode Island courts apply a Worker Classification Test based on three Internal Revenue Service (IRS) categories:

- Behavioral

- Type of relationship

- Financial

Key aspects of determining an independent contractor in Rhode Island include:

- Whether the work performed is integral to the employer's business

- If the worker's management skills impact opportunities for profit or loss

- Who invests in facilities and equipment

- The worker's level of skill and initiative

- The permanence of the working relationship

- The nature and degree of employer control

Independent contractors in Rhode Island have distinct rights and responsibilities compared to employees.

While they lack entitlements such as minimum wage, employee benefits and overtime pay, they enjoy the freedom to choose which projects to accept or decline.

They also have autonomy in determining where and how they complete assigned tasks, highlighting the flexibility inherent in the independent contractor classification.

Termination and Final Paycheck Laws in Rhode Island

In Rhode Island, termination and final paycheck laws are governed by R.I. Gen. Laws § 28-14-4. According to this statute, when an employee is terminated, the employer is required to issue the final paycheck on or before the next regularly scheduled pay date.

Similarly, if an employee decides to quit, they are entitled to receive their final paycheck on or before the next regularly scheduled pay date.

Employers in Rhode Island are legally obligated to comply with these timelines, providing financial closure for both parties involved in the employment relationship.

Summary of Rhode Island Labor Laws

As of January 1, 2024, the minimum wage in Rhode Island is $14.00 per hour. It is set to increase to $15.00 per hour on January 1, 2025.

Tipped employees, such as servers or bartenders, have a tipped minimum wage of $10.50, with a maximum tip credit of $6.61.

Employees in Rhode Island are entitled to overtime pay at a rate of 1.5 times their regular pay rate for any hours worked beyond 40 in a workweek.

Employees are entitled to a 20-minute meal break for every six hours of work, extending to 30 minutes for eight-hour shifts, and short breaks lasting from five to 20 minutes are considered part of the workday and must be paid. Employers are not obligated to pay for bona fide meal breaks.

Rhode Island follows federal OSHA standards for workplace safety and health.

Discrimination in the workplace is strictly prohibited, covering various aspects of employment. The law prohibits discriminatory practices based on race, color, religion, sex, sexual orientation, gender identity, disability, age and country of ancestral origin.

Termination and final paycheck laws require employers to issue the final paycheck on or before the next regularly scheduled pay date, whether an employee is terminated or decides to quit.

FAQs About Rhode Island Labor Laws

For more info, find frequently asked questions about the labor laws in Rhode Island below.

What are the blue laws in Rhode Island?

Rhode Island had a historical blue law that prohibited forcing children or employees to work on Sundays.

This law aimed to restrict or ban certain activities on Sundays for religious or secular reasons, emphasizing the observance of a day of worship or rest.

The repealed edict specified that engaging in any labor, business or work of one's ordinary calling on the first day of the week (Sunday), as well as using games, sports, plays or recreations, unless for works of necessity and charity, was prohibited.

Parents, employers or individuals allowing such activities by their children, servants or apprentices could face fines.

For the first offense, the fine was not to exceed $5, and for subsequent offenses, it could go up to $10.

This regulation aimed to uphold the sanctity of Sundays and promote a day of rest, aligning with the tradition of blue laws observed in various states for religious or secular reasons.

As of now, Rhode Island enforces a unique "blue law" that mandates employers to pay hourly workers time-and-a-half on Sundays and holidays.

This law, rooted in colonial-era statutes and initially adopted for religious reasons, is designed to restrict certain activities on Sundays and religious holidays.

Is holiday pay mandatory in Rhode Island?

Yes, holiday pay is mandatory in Rhode Island. According to state regulations, employees must be paid at least one and one-half times their normal rate of pay for any work performed on Sundays and holidays.

Is 32 hours per week considered full-time employment in Rhode Island?

In Rhode Island, labor laws do not have a specific definition for part-time and full-time employment.

However, it is common for many employers in the state to designate employees who work between 35 to 40 hours per week as full-time.

Is Rhode Island a right-to-work state?

Rhode Island is not a right-to-work state. This means that union membership can be a condition of employment in the state.

Does sick time get paid out in Rhode Island?

Under Rhode Island law, employers with 18 or more employees are mandated to offer paid sick and safe leave.

For businesses with fewer than 18 employees, sick and safe leave must be provided, but it does not necessarily have to be paid.

Covered employees in Rhode Island are entitled to take up to 40 hours of leave for qualifying reasons.

Disclaimer: This information serves as a concise summary and educational reference for Rhode Island state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.