Pennsylvania Labor Law Guide

A comprehensive guide to Pennsylvania labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

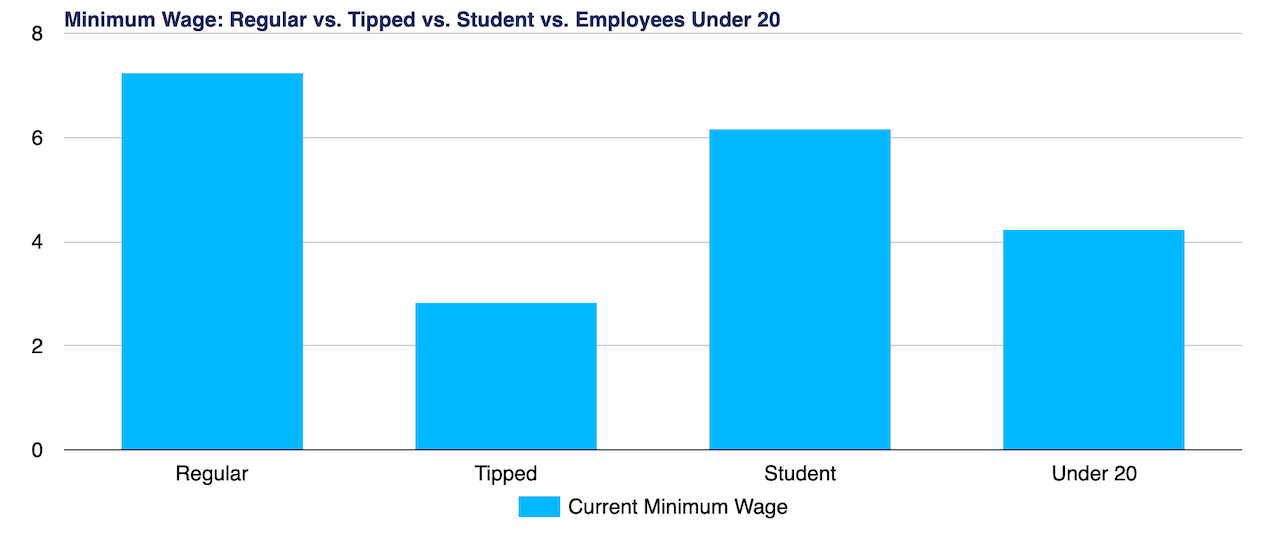

- Pennsylvania's minimum wage stands at $7.25 per hour, which is aligned with the Federal Minimum Wage rate

- The tipped minimum wage is $2.83 per hour

- Employees who work over 40 hours in a week are entitled to 1.5 times their regular rate of pay

- Pennsylvania does not have a daily overtime limit

- Minors aged 14 to 17 must receive at least 30 minutes of break for shifts over 5 hours

- Employers aren't required to provide breaks for employees aged 18 and over

Minimum Wage Regulations in Pennsylvania

The last adjustment to Pennsylvania's minimum wage occurred in 2008 when it was increased by $0.10, moving from $7.15 to $7.25.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Currently, Pennsylvania's state minimum wage rate still stands at $7.25 per hour, which is aligned with the federal minimum wage rate.

Tipped Minimum Wage

The tipped minimum wage in Pennsylvania is $2.83 per hour. This rate applies to employees, such as restaurant servers or bartenders, who receive tips as part of their compensation.

As of August 5, 2022, Pennsylvania introduced the 80/20 rule. This means that employees can be specified as tipped workers as long as they spend no more than 20% of their workweek, which usually spans seven days, on tasks that don't directly result in tips.

This rule aims to ensure that employees who primarily rely on tips for income are still fairly compensated when they perform non-tip-generating tasks.

Employers are required to ensure that their tipped workers earn at least the tipped minimum wage when their tips are combined with their hourly wage.

If an employee's tips, when added to their hourly wage, do not meet the regular minimum wage of $7.25 per hour, the employer is responsible for making up the difference.

Exceptions to Minimum Wage Requirements

The categories of workers in Pennsylvania who are not covered by the standard minimum wage requirements include:

- Farm laborers

- Independent contractors

- Executive, administrative or professional employees

- Domestic employees

- Educational, charitable, religious or nonprofit organization volunteers

- Seasonal employees 18 years of age or younger (age 24 or younger for students)

- Religious or nonprofit educational conference center employees

- Golf caddies

- Newspaper delivery and publication employees

- Public amusement, recreational establishment or organized camp employees

- Switchboard operators working for an independently owned public telephone company with no more than 750 stations

Subminimum Wage

In Pennsylvania, there are specific subminimum wage rates that apply to certain categories of workers, such as:

- Employees under 20: Federal law permits employers in Pennsylvania to pay new employees under the age of 20 a training wage of $4.25 per hour for the first 90 days of their employment.

- Student employees: Full-time high school or college students who work part-time may be paid 85% of the Pennsylvania minimum wage, which equates to $6.16 per hour. This reduced wage only applies to students working up to 20 hours per week and is commonly seen in work-study programs at universities.

[Source: Department of Labor & Industry]

When discussing wages, it’s important to keep in mind the taxes for complete financial clarity. Our Pennsylvania Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state’s tax laws.

Overtime Rules and Regulations in Pennsylvania

As per Pennsylvania Overtime Law, employees who fall under the state or federal overtime requirements are generally entitled to receive 1.5 times their regular rate of pay for all hours worked over 40 in a work week.

Pennsylvania does not have a daily overtime limit based on the number of hours worked in a day to receive overtime pay.

If an employee works 40 hours in a week at a regular rate of $15 per hour, their regular rate time is calculated as follows:

40 Regular Rate Hours x $15 Per Hour Regular Rate = $600

To determine the overtime rate, you calculate it as follows:

$15 Per Hour Regular rate x 1.5 Overtime Premium = $22.50 Per Hour Overtime Rate

If the employee works 10 overtime hours, the overtime pay is calculated by multiplying those hours by the overtime rate:

10 Overtime Hours x $22.50 = $225

Overtime Exceptions and Exemptions

In Pennsylvania, the general rule is that all employees are eligible to receive overtime pay unless they meet the criteria for an exemption.

However, it's essential to note that employees earning less than $684 per week ($35,568 per year) in wages are eligible for overtime pay, regardless of other factors.

Employees who are exempt from overtime requirements, provided they meet salary threshold-specific criteria, are:

- Executive workers: Employees in this category must have a primary duty of managing a business or department, directing the work of at least two other full-time employees, and have the authority to hire or fire employees.

- Administrative workers: Administrative exempt employees perform office or non-manual work related to business operations and exercise discretion and independent judgment in important matters.

- Professional: Employees in this category have a primary duty requiring advanced knowledge or work in a recognized field of artistic or creative endeavor.

Additional Pennsylvania overtime exemptions apply to:

- Farm laborers

- Seamen

- Domestic service workers

- Taxicab drivers

- Outside salesmen

- Salesmen or mechanics primarily engaged in selling and servicing vehicles

- Newspaper delivery workers

- Announcers, news editors and chief engineers at radio or television stations

- Volunteers in educational, charitable, religious or nonprofit organizations

- Golf caddies

- Seasonal workers under 18 years old

- Student workers under 24 years old in specific roles

- Workers in public amusement or recreational establishments, organized camps and religious or nonprofit educational conference centers under certain conditions

- Switchboard operators employed by independently owned public telephone companies with fewer than 750 stations

Pennsylvania does not have a daily overtime limit based on the number of hours worked in a day to receive overtime pay. Overtime is generally calculated based on hours worked beyond the standard 40-hour workweek.

Rest and Meal Breaks

Pennsylvania employers are required to provide break periods of at least 30 minutes for minors ages 14 through 17 who work five or more consecutive hours.

At the same time, employers are not required to give breaks for employees 18 and over. If your employer allows breaks, and they last less than 20 minutes, you must be paid for the break.

If your employer allows meal periods, the employer is not required to pay you for your meal period if you do not work during your meal period and it lasts more than 20 minutes.

Family and Medical Leave Laws in Pennsylvania

Pennsylvania's approach to employee leave is a combination of federal requirements and some regional nuances.

Pennsylvania does not have a state-wide employee leave law. Instead, the state follows federal regulations, particularly the Family and Medical Leave Act (FMLA), which sets the standard for employee leave.

No state law in Pennsylvania mandates paid vacation, severance, sick or holiday leave. Whether employees are entitled to paid leave depends on whether their weekly hours exceed 40, and on the employer’s own policies.

Pennsylvania employers are required to grant unpaid leave for employees serving on jury duty. However, private employers are not obliged to pay employees for time spent on jury duty or in court appearances.

Members of the National Guard or U.S. Reserves are entitled to Pennsylvania military leave. During the first 30 days of military duty, employers are required to maintain health insurance and benefits at no cost to the employee.

After this initial period, employees have the option to continue their benefits at their own expense. Employers must also ensure that employees are reinstated to their previous or a similar position upon completing military service.

The Pennsylvania Living Donor Protection Act (LDPA) mandates that employers provide leave for employees who are organ or tissue donors for preparation and recovery. Eligible employees can take up to 12 work weeks of unpaid organ donor leave per year.

They are entitled to return to their previous or equivalent position after the leave. This law applies to FMLA-covered employers with 50 or more employees.

Specific regions in Pennsylvania, including Philadelphia, Pittsburgh and Allegheny County, have their own local employee sick leave laws, as follows:

- Philadelphia sick leave: In Philadelphia, businesses with 10 or more employees are required to offer paid sick leave, while those with 9 or fewer employees must provide unpaid sick leave.

- Allegheny County sick leave: Allegheny County's paid sick leave law applies to employers with 26 or more employees.

- Pittsburgh sick leave: Pittsburgh, located within Allegheny County, has its own paid sick leave law. Employers with fewer than 15 employees must provide their employees at least one hour of paid sick time for every 35 hours worked, with a cap of 24 hours per year. Employers with 15 or more employees must allow their employees at least one hour of sick time for every 35 hours worked, with a cap of 40 hours per year.

Exceptions to the Pennsylvania Paid Leave Program

As mentioned, Pennsylvania does not have a state-wide employee leave law. Unless you are a resident of the above-mentioned regions, you will not be entitled by law to any paid leave.

The exceptions to the Paid Leave Programs in Philadelphia, Allegheny County and Pittsburgh regions can vary based on the specific local laws in these areas. It's essential to understand that each region may have its own set of rules and exceptions related to paid leave.

Here are some common exceptions you might encounter in these local paid leave programs:

- Independent contractors

- State and federal employees

- Seasonal employees

- Members of a construction union covered by a collective bargaining unit

Family Members That Qualify for FMLA

The family members who qualify for the FMLA in Pennsylvania include:

- Spouse

- Children

- Parents

Salary During Paid Sick Leave Employees who work in the aforementioned Pennsylvania regions typically receive their usual wage or salary for the hours they are absent due to illness.

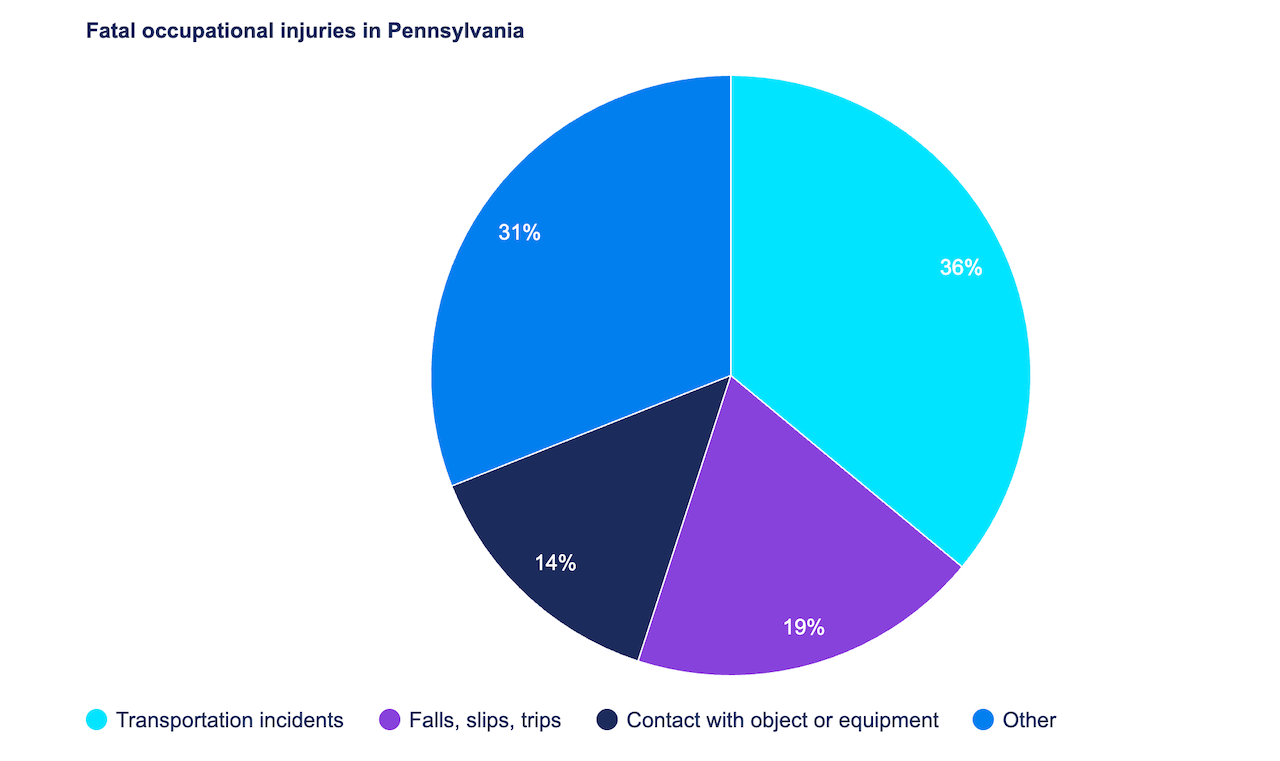

Workplace Safety and Health Regulations in Pennsylvania

Pennsylvania falls under the jurisdiction of the federal Occupational Safety and Health Act (OSHA), which applies to the majority of private-sector employees in the state. However, state and local government employees are not subject to federal OSHA regulations.

Federal OSHA is a U.S. government agency responsible for ensuring workplace safety and health. Here are their main fields of action:

- Regulations: OSHA establishes and enforces safety and health regulations for most private sector employers. These regulations cover a wide range of industries and workplace hazards.

- Inspections: OSHA conducts inspections of workplaces to ensure compliance with safety and health regulations. Inspections can be routine or in response to complaints or accidents.

- Penalties: Non-compliance can result in penalties, including fines, citations and requirements to correct hazards. OSHA has the authority to impose significant fines for serious violations.

- Training and outreach: OSHA provides training and outreach programs to educate employers and employees about safety and health issues. This includes resources for training and compliance assistance.

- Whistleblower protection: OSHA protects employees who report safety or health violations from retaliation by their employers.

- Emergency response: OSHA provides guidance on emergency response and preparedness, ensuring that workplaces are ready to handle emergencies such as fires, chemical spills and natural disasters.

- Small business assistance: OSHA offers specialized assistance and consultation services for small businesses to help them meet safety and health requirements.

- Partnerships: OSHA collaborates with various organizations, industries and labor groups to enhance workplace safety through partnerships and alliances.

[Source: U.S. Bureau of Labor Statistics]

Anti-Discrimination and Fair Employment Practices in Pennsylvania

The Pennsylvania Human Relations Commission (PHRC) has introduced new regulations aimed at strengthening anti-discrimination and fair employment practices in the state.

These regulations were officially published in the Pennsylvania Bulletin on June 17, 2023, and have been effected since August 16.

These laws encompass the Pennsylvania Human Relations Act (PHRA), which addresses discrimination in various areas such as employment, housing, commercial property, education, and public accommodations.

Under the PHRA, Pennsylvania law prohibits discrimination based on a variety of factors, including:

- Race

- Color

- Age (40 and over)

- Sex

- Ancestry

- National origin

- Religion

- Disability

The new regulations aim to broaden the definition of the protected class of 'sex' to encompass various aspects, including:

- Pregnancy status

- Childbirth status

- Breastfeeding status

- Sex assigned at birth

- Gender identity or expression

- Affectional or sexual orientation

- Differences in sex development

This expanded definition has been in use as a guideline since 2018 and was officially approved by the Independent Regulatory Review Commission in 2022.

Furthermore, the regulations provide a more precise definition of “religious creed,” encompassing all facets of religious observance and practice, as well as belief.

Independent Contractor Classification in Pennsylvania

In Pennsylvania, the classification of a worker as an employee or an independent contractor hinges on specific criteria. To be categorized as an independent contractor, the following conditions must be met to the satisfaction of the department:

- Freedom from control: The individual should demonstrate that they have been and will continue to be free from control or direction over the performance of the services. This independence should exist both under the contract of service and in practice.

- Independently established trade: The individual must be engaged in an independently established trade, occupation, profession, or business related to the services they provide.

For workers in the construction industry, additional criteria apply under the Construction Workplace Misclassification Act (Act 72).

Termination and Final Paycheck Laws in Pennsylvania

State law in Pennsylvania mandates that when an employee is separated from their employment for any reason, the employer must provide their final paycheck no later than the next regular payday.

Summary of Pennsylvania Labor Laws

Pennsylvania's minimum wage is $7.25 per hour, aligned with the federal minimum wage rate. The tipped minimum wage is $2.83 per hour, with rules regarding tip-related work.

Employees who work over 40 hours a week are entitled to 1.5 times their regular rate of pay. Pennsylvania does not have a daily overtime limit.

Minors aged 14 to 17 must receive at least 30 minutes of break for shifts over 5 hours. Employers aren't required to provide breaks for employees aged 18 and over.

Pennsylvania doesn't have state-mandated paid leave, and it depends on an employer's policies.

At the same time, Specific regions like Philadelphia, Pittsburgh, and Allegheny County have their own sick leave laws.

Pennsylvania falls under the federal Occupational Safety and Health Act (OSHA) for private-sector employees.

The Pennsylvania Human Relations Commission (PHRC) enforces anti-discrimination laws, including protection against discrimination based on race, color, age, sex, religion, and more.

FAQs About Pennsylvania Labor Laws

In case you still have questions, check out some of the most frequently asked questions regarding Pennsylvania labor laws.

Can you be forced to work 7 days a week in Pennsylvania?

In Pennsylvania, employees can work for seven consecutive days after which employers are required to provide a day off.

Is “under the table” pay illegal in Pennsylvania?

Yes, paying employees "under the table" in Pennsylvania is illegal. In essence, paying employees in cash “under the table” allows employers to avoid their financial obligations and is considered an unlawful employment practice.

How many hours is considered part-time employment in Pennsylvania?

In Pennsylvania, part-time employment is typically defined as working fewer than 40 hours per workweek.

What is the blacklist law in Pennsylvania?

In Pennsylvania, the term "blacklisting" pertains to a situation where an employer takes retaliatory actions against an employee for engaging in protected activities, such as reporting wage and hour violations or filing a complaint with the Equal Employment Opportunity Commission (EEOC).

Retaliation in the form of negative references or other adverse employment actions is unlawful and can have legal consequences for employers. The blacklist law is designed to ensure that employees are not unfairly penalized for seeking to enforce their rights or uphold workplace standards.

Do employers need a reason to fire you in Pennsylvania?

In Pennsylvania, as in many other at-will states, the general rule is that employees can be fired or demoted at any time without a specific reason, as long as there is no union agreement or an individual employment contract specifying otherwise.

This means that employers have the discretion to terminate or demote employees without the need to provide a specific cause or justification, as long as they do so for legal reasons.

Despite the at-will nature of employment, there are exceptions and limitations, such as anti-discrimination laws that protect employees from being terminated for reasons related to their race, gender, age or other protected characteristics.

Disclaimer: This information serves as a concise summary and educational reference for Pennsylvania state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.