Oregon Labor Law Guide

A complete guide into Oregon labor laws: Covering vital topics including minimum wage regulations, overtime provisions, required rest breaks and a myriad of other important employment regulations.

Key Takeaways

- The minimum wage for non-tipped employees in Oregon is $14.20 per hour

- The minimum wage for tipped employees stands at $5.40 per hour

- Overtime pay is 1.5 times the regular hourly rate for hours worked over 40 in a workweek

- South Dakota does not have specific state regulations for rest and meal breaks; it's at the employer's discretion

Minimum Wage Regulations in Oregon

As mentioned, Oregon's minimum wage rates vary depending on your work location. For the period spanning from July 1, 2023, to June 30, 2024, the following rates apply:

- Portland Metro $15.45 per hour: This rate applies to areas within the urban growth boundary, including parts of Clackamas, Multnomah and Washington Counties.

- Standard $14.20 per hour: This applies to workers in Benton, Clatsop, Columbia, Deschutes, Hood River, Jackson, Josephine, Lane, Lincoln, Linn, Marion, Polk, Tillamook, Wasco, Yamhill and parts of Clackamas, Multnomah and Washington Counties outside the urban growth boundary are entitled to this rate.

- Non-urban $13.20 per hour: This rate is for employees in Baker, Coos, Crook, Curry, Douglas, Gilliam, Grant, Harney, Jefferson, Klamath, Lake, Malheur, Morrow, Sherman, Umatilla, Union, Wallowa and Wheeler Counties.

Any increases to the minimum wage are based on inflation, if applicable, and they take effect on July 1st of each year.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Tipped Minimum Wage

In Oregon, the tipped minimum wage is in alignment with the state's minimum wage law. This means that, in most cases, you must be paid at least Oregon's minimum wage, with a few exceptions which we will cover in our next section.

Whether you receive compensation through piece rates, hourly wages, commissions or daily pay, the total amount you earn for each hour worked must meet or exceed the minimum wage set for the state.

Tips are treated separately and cannot be counted as part of your wages. In Oregon, the use of tip credits is prohibited by law.

Moreover, it's important to understand that you cannot enter into any agreement that pays you less than the established minimum wage. This rule applies equally to both adults and minors.

Try our easy-to-use paycheck calculator to determine the exact amount of money you’ll receive working in Oregon.

Exceptions to Minimum Wage Requirements

In accordance with Oregon's minimum wage regulations, these are specific exemptions that apply to certain categories of employees:

- Administrators

- Outside salespersons

- Computer employees

- Agricultural workers

- Livestock range producers

- Childcare service individuals

- Casual domestic workers

- United States Government employees

- Primary or secondary education employees

- Taxicab operators

- Emergency and occasional duty workers

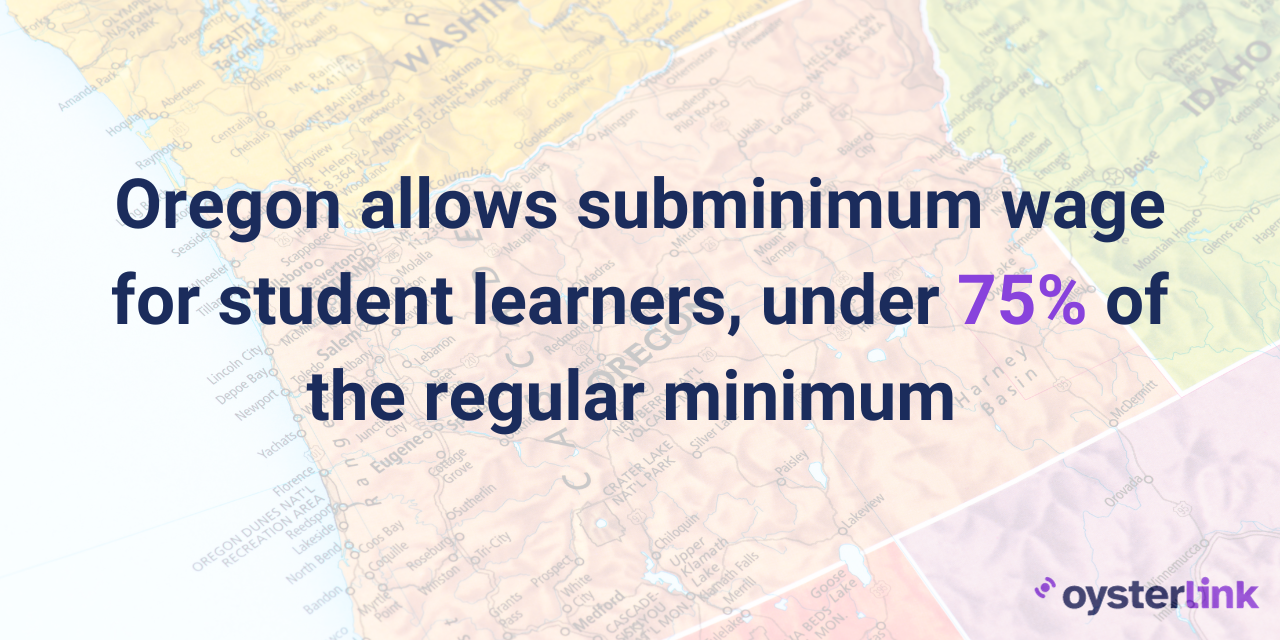

Subminimum Wage

Under Oregon's minimum wage laws, employers have the option to pay student learners a subminimum wage rate, which is set at less than 75% of the regular minimum wage.

This provision applies specifically to student learners who are actively enrolled in accredited educational institutions such as schools, colleges or universities. These individuals must also be employed on a part-time basis as part of a legitimate professional training program.

To implement this subminimum wage rate for student learners, employers are required to submit an application to the Bureau of Labor and Industries.

This application must receive approval before the subminimum wage can be paid to eligible student learners.

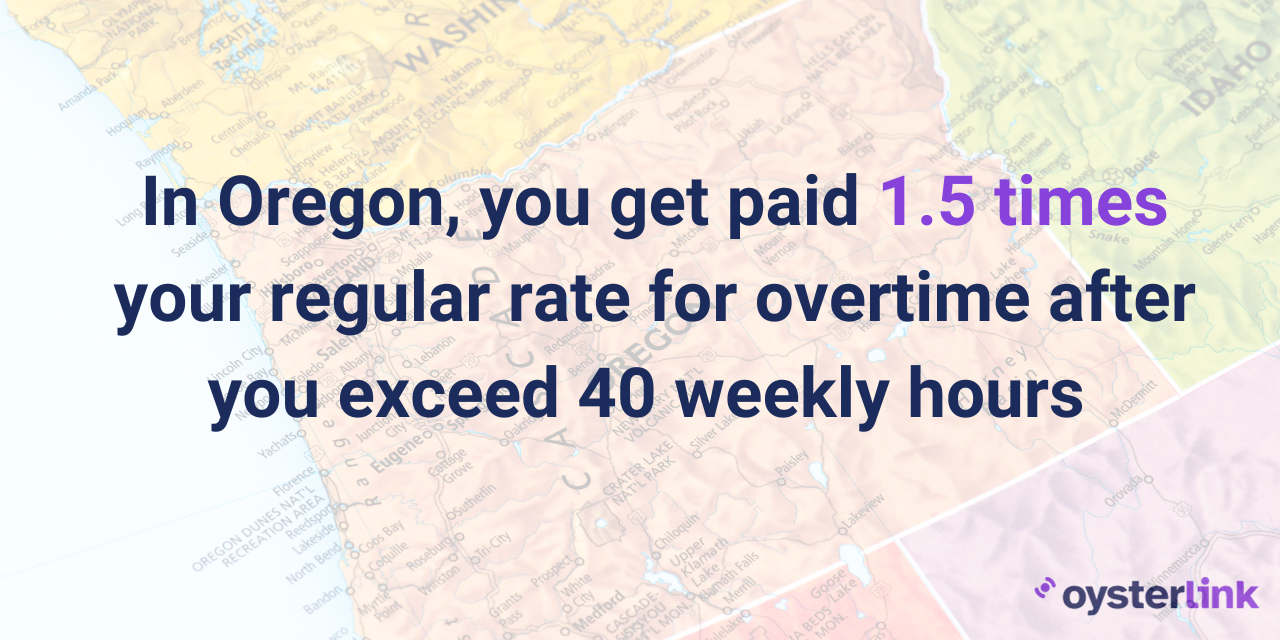

Overtime Rules and Regulations in Oregon

In most cases, employers must pay overtime at a rate of 1.5 times the regular pay rate for hours worked beyond 40 in a workweek.

Overtime calculations depend on the workweek, with hours exceeding 40 in the workweek qualifying for overtime pay. The regular rate of pay varies depending on whether the employee is paid hourly or salaried, with certain considerations for bonuses.

All salaried employees must be paid overtime unless they meet the exempt status criteria defined by federal and state laws. Misclassifying salaried employees as exempt can lead to unpaid overtime liability.

Generally, there are no daily limits on work hours for adult workers. However, manufacturing employees may receive overtime after 10 hours in a day, and special rules apply to certain sectors.

Overtime is based on hours actually worked, excluding sick leave, vacation time, holidays or other paid time off.

Employers can adjust work hours within a workweek to avoid overtime, as long as wage and hour laws are observed.

Overtime Exceptions and Exemptions

Oregon's state law lists various categories of employees who are exempt from overtime pay, including:

- Executives of companies

- Administrative employees

- Outside salespeople

- Supervisors

- Employees involved in forest fire fighting

- Agricultural workers and farmworkers

- Employees of irrigation system districts

- Employees engaged in fire protection or law enforcement activities, including security personnel in correctional institutions

- Employees operating hospitals

- Members of the organized militia while on state active duty

Rest and Meal Breaks

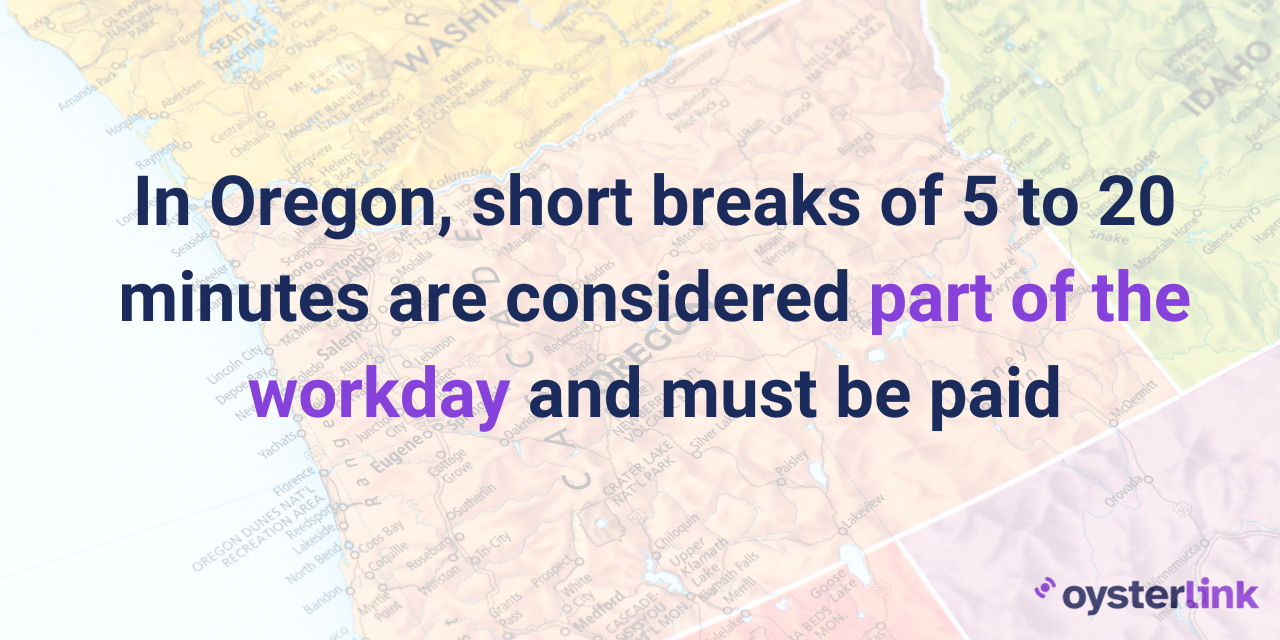

Under federal law, employees must be paid for all hours worked, including certain designated "breaks."

For instance, if an employee works through a meal break, they must be compensated for that time. The same applies to situations where employees have to remain on duty, such as a receptionist answering phones during lunch.

Short breaks lasting from 5 to 20 minutes are considered part of the workday and must be paid.

Employers are not obligated to pay for bona fide meal breaks during which employees are completely relieved of all duties for the purpose of eating.

These meal breaks typically last at least 30 minutes, although shorter breaks may qualify depending on circumstances. However, federal law doesn't require employers to provide breaks; it only dictates compensation if breaks are allowed.

In contrast, Oregon state law mandates both meal and rest breaks for employees.

Meal Breaks: Employers in Oregon must offer a 30-minute meal break to employees who work at least six hours. If an employee can't be relieved of all duties during this break, it must be paid.

Shorter meal breaks of at least 20 minutes may be provided if industry standards or customs justify them, but they must also be paid.

For shifts lasting seven hours or less, the meal break should fall between the second and fifth hours of work. For shifts exceeding seven hours, it should occur between the third and sixth hours.

Rest Breaks: Oregon employees are entitled to a paid ten-minute rest period for every four hours worked, or a major fraction thereof. These rest breaks should ideally be spaced in the middle of the work period.

Rest breaks are separate from meal breaks and cannot be combined or used to shorten the total hours worked.

Certain adult employees working alone in retail or service establishments do not require paid rest breaks, but they must have access to restroom facilities.

While employers can require employees to stay on the premises during breaks, employees must be completely relieved of all work responsibilities. Being on-call during breaks does not qualify as complete relief.

Smokers do not receive additional rest breaks.

It is not acceptable to skip required breaks and leave early or work through breaks to make up time. Breaks must be taken as required by law, in the middle of each four-hour work segment.

Combining breaks and meal breaks into a longer break is not allowed. All breaks must be taken separately and evenly spaced as required by law.

Exceptions to Break Laws

There are exceptions to these rules if all of the following conditions are met:

- You work less than 5 hours within any 16-hour period

- You work alone

- You work in retail or service

Family and Medical Leave Laws in Oregon

The Oregon Family Leave Act (OFLA) typically offers a maximum of 12 weeks of protected leave each year for the following reasons:

- Parental leave: Parents can take time off for childbirth, adoption or fostering a child. Parents who use 12 weeks of OFLA for parental leave may also take an additional 12 weeks for sick child leave.

- Serious health condition leave: You can take this leave either for your own serious health condition or for caring for a family member.

- Pregnancy disability leave: Applicable before or after childbirth or for prenatal care. OFLA provides up to 12 weeks of pregnancy disability leave, in addition to the 12 weeks for other qualifying reasons.

- Sick child leave: You can use this leave for your child's illness or injury requiring home care.

- Military family leave: You are entitled to up to 14 days if your spouse or domestic partner is a service member called to active duty or is on leave from active duty.

- Bereavement leave: You can get up to 2 weeks of leave following the death of a family member.

Family Members That Qualify for Paid Leave Care

Effective September 3, 2023, OFLA's definition of a family member has expanded according to SB 999 (2023) and it now includes:

- A spouse or domestic partner

- A child of a covered individual or the child's spouse or domestic partner

- A parent of a covered individual or the parent's spouse or domestic partner

- A sibling or stepsibling of a covered individual or the sibling's or stepsibling's spouse or domestic partner

- A grandparent of a covered individual or the grandparent's spouse or domestic partner

- A grandchild of a covered individual or the grandchild's spouse or domestic partner

- Any individual related by blood or affinity whose close association with a covered individual is the equivalent of a family relationship

For parental leave and sick child leave, the child must either be under the age of 18 or an adult dependent child significantly limited by a physical or mental impairment.

Determining Your Salary Percentage During Paid Leave Laws

Oregon's wage replacement rates for leave are designed to be progressive, ensuring that lower-income workers receive a higher percentage of their own income while on leave, while still maintaining affordability for the program.

Workers receive:

- 100% of the portion of their weekly wages that is less than or equal to 65 % of the state average weekly wage

- 50% of the portion of their weekly wages which is more than 65 % of the state average weekly wage.

Benefits are capped at 120% of the state average weekly wage. Currently, the maximum weekly benefit stands at $1,523.68, while 65 percent of the state average weekly wage equals $825.30.

Workplace Safety and Health Regulations in Oregon

In Oregon, occupational safety and health jurisdiction is primarily governed by the federal Occupational Safety and Health Act (OSH Act), which permits states to assume their own responsibilities in this area, provided their programs are "at least as effective" as the federal program.

Oregon operates its own official state plan, which covers state and local government workers, as well as most private sector workers within the state. While Oregon has adopted many federal OSHA standards, it maintains its unique standards for others.

The administration of Oregon's state plan falls under the purview of the Oregon OSHA division, which operates as part of the Department of Consumer and Business Services.

However, a small group of individuals in Oregon remains under federal OSHA jurisdiction. This group includes:

- Federal employees

- Employees of the U.S. Postal Service and private contractor-operated facilities engaged in USPS mail operations

- Private-sector employees working on or near navigable waters in the U.S.

- All private-sector establishments within the boundaries of Indian reservations or lands held in trust by the federal government for these tribes

- Private-sector employees at Crater Lake National Park or the U.S. Department of Energy's Albany Research Center (ARC)

- Federal military reservations employees, with the exception of private contractors working on US Army Corps of Engineers dam construction projects

- Employees in any hazard, industry, area, operation or facility where the State Plan is unable to effectively exercise jurisdiction

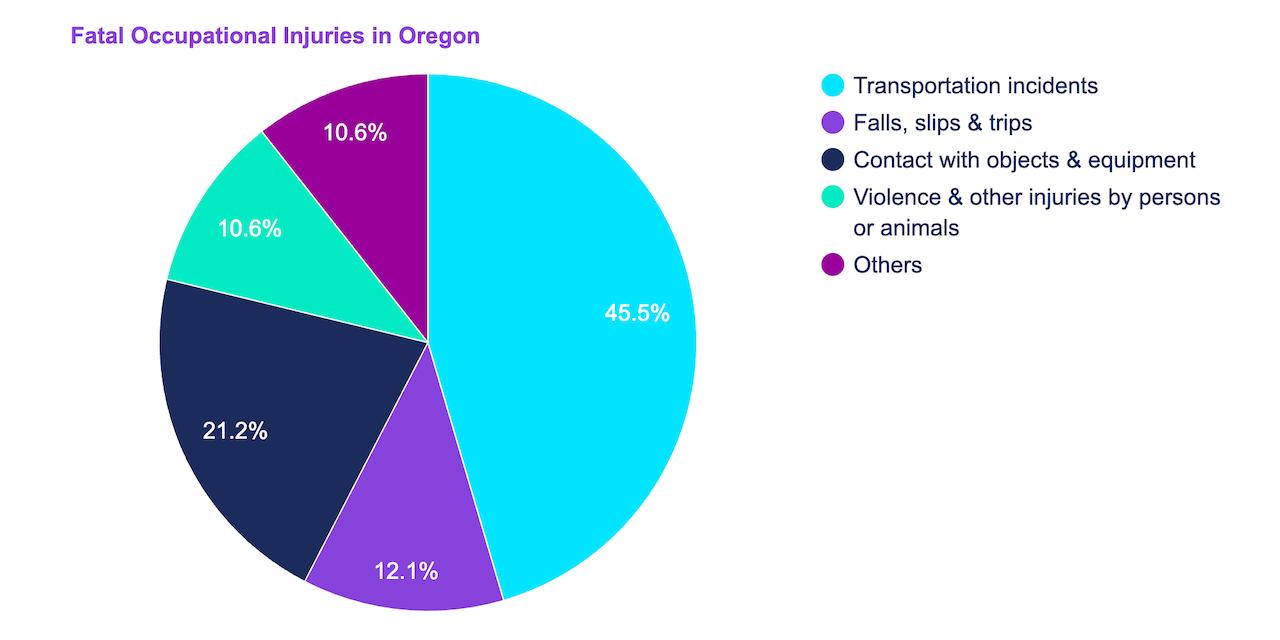

[Source: U.S. Bureau of Labor Statistics]

There were 66 fatal occupational injuries in Oregon in 2021, which is about 10% higher compared to 60 in 2020.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

In total, the number of fatal injuries in Oregon is 35% lower than the average number of fatal injuries in all states at 102 fatal work injuries.

Anti-Discrimination and Fair Employment Practices

In Oregon, laws are in place to safeguard employees from workplace discrimination. This means that individuals cannot face termination, demotion, unequal pay or differential treatment based on specific characteristics.

Discrimination is prohibited on the grounds of:

- Race

- National origin

- Color

- Sex

- Gender identity

- Sexual orientation

- Age

- Religion

- Physical or mental disability

- Military status

- Marital or family status

Furthermore, it is against the law for employers to retaliate against their workers if they make a good faith complaint about their unlawful actions.

All employers are required to establish a written policy aimed at reducing and preventing harassment, discrimination and sexual assault in the workplace.

This policy must be provided to all employees upon hiring and should be readily accessible to all workers. A template policy, available in both English and Spanish, is provided to assist employers in creating their policies.

Independent Contractor Classification

The distinction between an independent contractor and an employee hinges on specific criteria evaluated by courts and state regulatory bodies. The key factors considered are:

- Freedom from direction and control: Examining whether the worker operates independently without significant direction or control from the hiring entity

- Economic independence: Assessing whether the worker, from an economic perspective, functions as an autonomous entity separate from the business to which services are rendered

It's crucial to understand that several factors are not conclusive in determining worker classification:

- Business entity: Merely establishing a business entity, such as a corporation or LLC, for service provision does not automatically indicate independent contractor status

- Contract terminology: Labelling a worker as an "independent contractor" in a contract does not solely determine their classification

- Tax reporting: The method of payment reporting, whether through Form 1099 or Form W2, is not the sole determinant of worker classification

Termination and Final Paychecks in Oregon

If an employee quits with less than 48 hours' notice (excluding weekends and holidays), their paycheck and any owed wages must be provided within five business days or on the next regular payday, whichever arrives first.

When an employee resigns with at least 48 hours' notice, their final check is due on their last day of work, unless that day falls on a weekend or holiday. In such cases, the paycheck is due on the next business day.

If an employer terminates or fires an employee, the final paycheck must be issued by the end of the following business day.

In cases where both the employer and employee mutually agree to terminate the employment, the final payment must be made by the end of the subsequent business day.

Failure to adhere to these payment timelines may result in penalties. Employers who do not provide final wages on time may face a penalty wage equivalent to eight times the employee's regular wage rate for each day of delay, up to 30 days.

Exceptions may apply, and employers can limit this liability to 100% of unpaid wages by paying the final wages within 12 days of receiving written notice from the employee.

Additionally, Oregon law imposes a $1,000 civil penalty for willful failure to pay wages at termination, along with covering costs, interest and attorney fees.

Summary

In the Portland Metro area, the minimum wage stands at $15.45 per hour.

While in non-urban areas, encompassing several counties, the minimum wage is set at $13.20 per hour.

Oregon's tipped minimum wage is in alignment with the standard minimum wage. It's worth stating that tips cannot be considered part of an employee's wages, and the law prohibits the use of tip credits.

In most cases, Oregon employers are required to compensate employees for overtime at a rate of 1.5 times their regular pay for hours worked beyond 40 in one week.

FAQs

How many sick days do you get in Oregon?

In Oregon, you earn at least 1 hour of sick time for every 30 hours you work. However, your employer can limit you to taking 40 hours of that accrued time every year. This means that you can potentially accrue more sick time, but you can use up to 40 hours of it in a year, as per the state's regulations.

How many consecutive hours can you legally work in Oregon?

In Oregon, for most adult workers, there are no limits on daily work hours. Theoretically, employers may schedule employees to work seven days a week, 24 hours per day, as long as minimum wage and overtime laws are observed.

However, manufacturing employees are limited to 13 hours of work in a 24-hour period under state regulations.

Can you be forced to work overtime in Oregon?

Yes, in Oregon, your employer has the authority to dictate your work schedule and hours, which may include overtime. Employers can require employees to work scheduled overtime, and employees who refuse to do so may face discipline or even termination.

If your employer paid you for 43 hours of wages during the last workweek, it indicates that you worked overtime, and you should be compensated according to state overtime laws.

Do you have to give a two-week notice in Oregon?

In Oregon, you are not legally obligated to provide a two-week notice before leaving your job. The state follows "at-will" employment laws, which allow both employers and employees to terminate the employment relationship without notice and without cause.

While it's not required by law, giving a notice is considered a professional courtesy and is often expected by employers.

Is paid vacation mandatory in Oregon?

Paid vacation is not mandatory in Oregon. However, if your employer has a policy or agreement in place regarding holiday and vacation pay, they are obligated to honor it. In cases of employment termination, if your employer has a policy of paying out benefits such as accrued vacation or severance pay, they must adhere to that policy and provide the benefits accordingly.

Disclaimer: This information serves as a summary and educational resource. It is not legal advice. For legal counsel, consult an attorney. While we strive to keep this content up-to-date, we do not guarantee its currency. We encourage you to review relevant laws and regulations independently and seek legal advice when necessary.