Ohio Labor Law Guide

A comprehensive guide to Ohio labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- Ohio's current standard minimum wage is $10.45 per hour for employers whose gross receipts are greater than $342,000 per year

- Overtime rules apply to nonexempt employees, with a rate of 1.5 times their regular wage for hours beyond 40 in a week.

- Break periods are mandated for young workers but left to employer discretion for adults, following federal guidelines.

- Ohio follows federal FMLA regulations but adds state-specific provisions, including military family leave and leave for victims of domestic violence.

- Workplace safety is governed by federal OSHA standards and Ohio's PERRP program for public sector employers.

- Anti-discrimination laws under the Ohio Civil Rights Act protect against various biases.

Minimum Wage Regulations in Ohio

Ohio, like many states in the United States, has specific regulations governing minimum wage. These regulations establish distinct minimum hourly rates for regular and tipped employees, dictating what employers must pay their workers.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

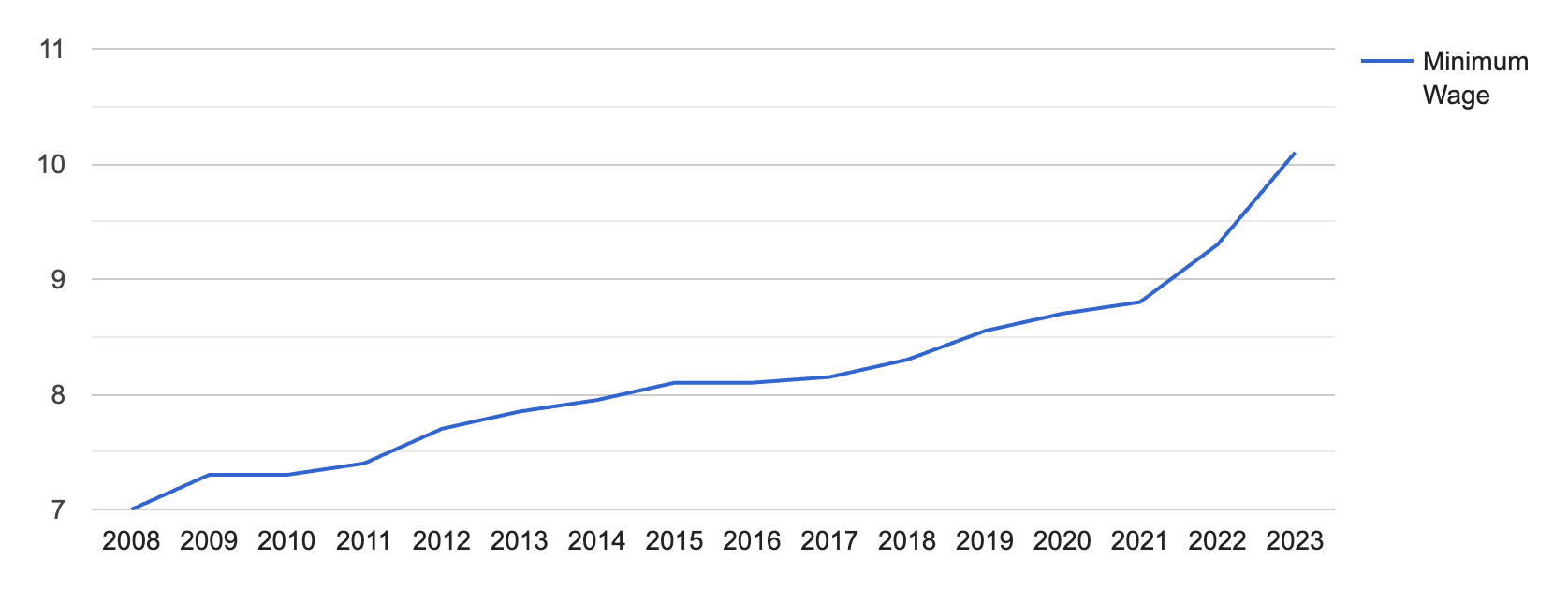

[Source: FRED]

Regular Employees

Ohio's current standard minimum wage is $10.45 per hour for employers whose gross receipts are greater than $342,000 per year. Employers with annual gross receipts of less than $342,000 are required to pay their employees at least the federal minimum wage, which is currently $7.25 per hour.

[Source: FRED]

Ohio labor laws allow employers to pay employees with disabilities a wage rate that is lower than the standard minimum wage. An employer must have a special license to pay disabled employees the subminimum wage. The special license may be obtained from Ohio’s Department of Commerce.

Tipped Employees

The state’s minimum wage for tipped employees like restaurant servers and food runners is $5.25 per hour. To pay this lower rate, employers must ensure that tipped employees' total earnings, including tips, meet or exceed the standard minimum wage.

Overtime Rules and Regulations in Ohio

Overtime rules and regulations hold significant importance in safeguarding workers' rights and guaranteeing fair compensation for extra work hours. In Ohio, these regulations apply differently to nonexempt and exempt employees.

Precise classification of employees as either nonexempt or exempt, under criteria outlined in the Fair Labor Standards Act (FLSA) and state labor laws, is of utmost importance for employers.

Misclassifying employees can result in legal complexities and potential breaches of wage and hour regulations.

Nonexempt Employees

Non-exempt employees in Ohio are entitled to overtime pay when they work more than 40 hours in a workweek. The overtime rate for nonexempt employees is 1.5 times their regular hourly wage for each hour worked beyond the 40-hour threshold.

Exempt Employees

Exempt employees in Ohio do not qualify for overtime pay. To be considered exempt, employees must meet specific criteria outlined in both the FLSA and Ohio labor laws. These criteria typically involve earning a minimum salary and performing specific job duties that are considered exempt. Common categories of exempt employees include:

- Executive roles

- Administrative roles

- Professional roles (work that requires advanced knowledge, such as law, medicine, science, etc.)

- Certain outside sales roles

Break Periods in Ohio

For employees under the age of 18 working more than five consecutive hours, Ohio labor laws require employers to provide a 30-minute uninterrupted break. This break allows young workers to rest and recharge during their shifts.

For adult employees, the state doesn’t mandate specific break periods, leaving this matter to employer discretion. However, employers must follow federal guidelines regarding paid and unpaid breaks and provide lactation breaks as required by federal law for nursing mothers.

Family and Medical Leave Laws in Ohio

Family and medical leave laws in Ohio are governed primarily by federal regulations under the Family and Medical Leave Act (FMLA), but Ohio employers must also adhere to state-specific provisions.

Federal FMLA

Under federal law, the Family and Medical Leave Act (FMLA) grants eligible employees the right to take unpaid leave for specific family and medical reasons without risking their job security. Key provisions include:

- Eligibility: To qualify for FMLA leave, employees must have worked for their employer for at least 12 months, completed at least 1,250 hours of work in the past year

- Leave entitlement: Eligible employees can take up to 12 weeks of unpaid leave during a 12-month period for reasons such as the birth or adoption of a child, caring for a spouse, child or parent with a serious health condition or addressing their own serious health condition.

- Job protection: FMLA ensures that employees who take qualified leave are entitled to return to the same or an equivalent position with the same pay, benefits and working conditions.

Ohio-Specific Provisions

While Ohio primarily follows federal FMLA guidelines, it also adds some state-specific regulations and protections:

- Ohio Military Family Leave: Employers with at least 50 employees must provide eligible employees with time off for specific military family-related reasons, such as when a family member is called to active duty or injured during military service. Eligible employees can take up to 80 hours or 10 days of unpaid leave.

- Leave for Victims of Domestic Violence and Sexual Assault: Ohio law allows victims of domestic violence and sexual assault to take unpaid leave to seek medical attention, legal assistance, counseling and safety planning.

- Leave to Care for a Child With a Disability: Ohio law grants eligible employees who are parents, guardians or custodians the right to take unpaid leave to care for a child with a disability. Employers with at least 50 employees must provide up to eight hours of leave per month, up to a maximum of 48 hours per year.

- Pregnancy Disability Leave: Pregnant employees in Ohio are eligible for up to 12 weeks of unpaid leave.

Workplace Safety and Health Regulations in Ohio

Workplace safety and health regulations in Ohio are primarily governed by federal laws and regulations, with oversight and enforcement carried out by the Occupational Safety and Health Administration (OSHA).

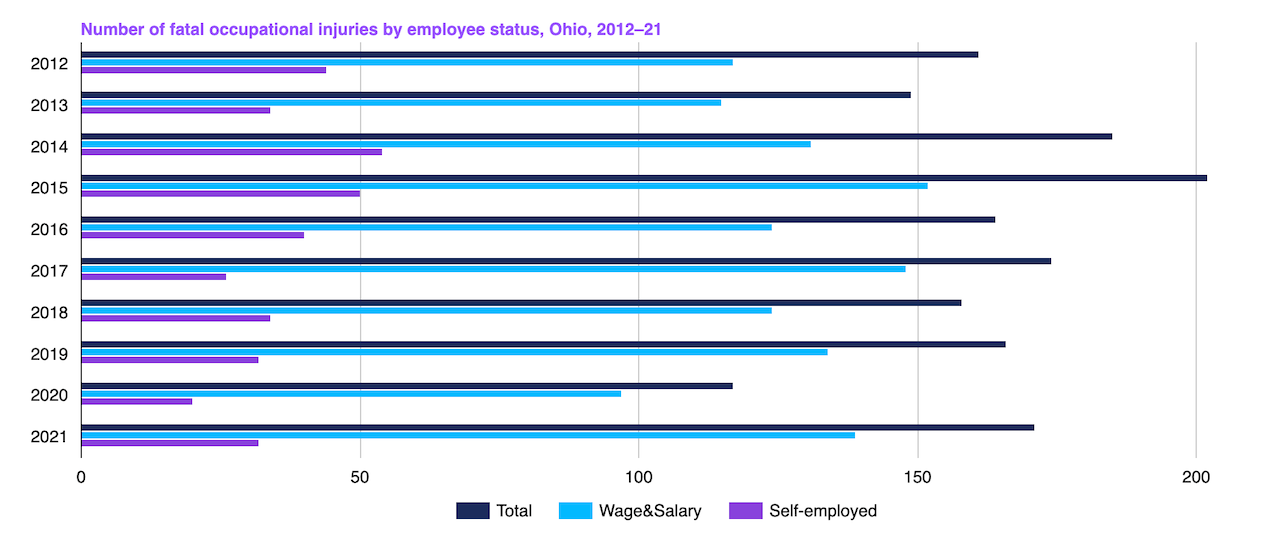

[Source: U.S. Bureau of Labor Statistics]

However, Ohio has its own state plan for workplace safety and health known as the Ohio Public Employment Risk Reduction Program (PERRP), which covers public sector employers and employees.

Federal OSHA Regulations

Federal OSHA regulations set forth the standards and requirements for workplace safety and health in the private sector. Key provisions include:

- General workplace safety: Federal OSHA standards encompass a wide range of safety and health issues, such as hazard communication, personal protective equipment, fall protection and electrical safety.

- Recordkeeping and reporting: Employers are required to maintain records of workplace injuries and illnesses and report severe incidents to OSHA. This helps identify and address safety hazards.

- Inspections and enforcement: OSHA conducts inspections to ensure compliance with safety regulations. Employers found in violation of these standards may face penalties and citations.

Ohio’s Public Employment Risk Reduction Program

PERRP operates separately from federal OSHA and is responsible for enforcing workplace safety and health regulations in the public sector, covering state and local government agencies, schools and other public employers. Key features of PERRP include:

- Inspections and enforcement: PERRP conducts inspections of public sector workplaces to ensure compliance with safety regulations. Like federal OSHA, it issues citations and penalties for violations.

- Employee rights and protections: Public sector employees in Ohio have the right to report safety concerns and request workplace inspections without fear of retaliation.

- Training and outreach: PERRP provides training and educational resources to public sector employers and employees to promote workplace safety and health.

- Complaints and reporting: Workers in the public sector can file complaints about unsafe working conditions, and PERRP investigates these complaints to address potential hazards.

Anti-Discrimination and Fair Employment Practices in Ohio

Ohio's primary anti-discrimination law is the Ohio Civil Rights Act (OCRA). It prohibits discrimination in employment based on race, color, religion, sex, national origin, disability, age and ancestry.

The OCRA applies to both public and private employers with at least four employees. However, it does not cover religious organizations or employers with employees performing domestic service.

Under the OCRA, employers are prohibited from discriminating against employees in areas such as hiring, promotion, compensation and termination based on the protected characteristics mentioned above. The law also includes protections against sexual harassment in the workplace.

Individuals who believe they have experienced workplace discrimination in Ohio can file complaints with the Ohio Civil Rights Commission (OCRC) or the U.S. Equal Employment Opportunity Commission (EEOC), depending on whether the claim falls under state or federal jurisdiction.

Independent Contractor Classification in Ohio

In Ohio, as in many states, the classification of workers as either employees or independent contractors is a critical aspect of labor regulations. Accurately classifying workers is essential for compliance with state and federal employment laws.

Independent contractors are individuals or businesses hired to perform specific tasks or projects. They are not considered employees and, therefore, do not receive traditional employee benefits or protections, such as minimum wage, overtime pay, workers' compensation or unemployment benefits.

Employees, on the other hand, work under the direction and control of the employer. They are entitled to various legal protections, including minimum wage, overtime pay, workers' compensation coverage and unemployment benefits.

Misclassifying employees as independent contractors can result in penalties and fines from the Ohio Bureau of Workers' Compensation.

Termination and Final Paychecks in Ohio

Ohio is generally an at-will employment state, which means that both employers and employees can terminate the employment relationship at any time and for any reason unless there is a valid employment contract stating otherwise. However, employers are encouraged to provide notice of termination whenever possible, and employees are expected to do the same.

When it comes to final paychecks, Ohio labor laws require that an employer must pay an employee their final wages by the next regular payday following the termination of employment or within 15 days, whichever comes first. This applies to both voluntary and involuntary terminations.

Employers are permitted to make deductions from an employee's final paycheck in certain circumstances. Deductions may be made for items such as taxes, Social Security, Medicare and court-ordered garnishments.

Moreover, If an employee is entitled to accrued commissions, bonuses or other forms of variable compensation, the employer must include these amounts in the final paycheck if they are due and determinable at the time of termination.

Ohio labor laws do not require employers to compensate employees for unused vacation or paid time off (PTO) upon termination.

When navigating Ohio labor laws and termination procedures, ensure you're equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state's tax laws.

Summary

Ohio labor laws are comprehensive, covering a range of vital aspects including minimum wage, overtime, break periods, family leave and more. For regular employees, the state's minimum wage is $ 10.45 per hour. Tipped employees have a minimum wage of $5.25.

Overtime rules distinguish between nonexempt and exempt employees, with nonexempt employees earning 1.5 times their hourly wage for hours exceeding 40 in a week. Young workers under 18 get a mandated 30-minute break after five consecutive hours, while adult employees' breaks are at the employer's discretion, following federal guidelines.

Ohio adheres to federal FMLA regulations but adds state-specific provisions, including military family leave and leave for victims of domestic violence. Workplace safety falls under federal OSHA standards and Ohio's own program, PERRP, for public sector employers.

Anti-discrimination laws protect against various forms of bias, enforced by the Ohio Civil Rights Act. Ohio labor laws also outline independent contractor classification criteria and termination and final paycheck procedures.

Frequently Asked Questions About Ohio Labor Laws

Is it illegal to work eight hours without a break in Ohio?

No, it’s not illegal to work eight hours without a break in Ohio. For adult employees, specific break periods are not mandated by the state, leaving this matter to the employer's discretion.

Can you be forced to work overtime in Ohio?

If your employer requires you to work overtime in Ohio, then you are generally obligated to do so. Refusing to work overtime can lead to potential discipline or termination by your employer unless prior agreements or collective bargaining have modified this rule.

Is monthly pay legal in Ohio?

No, monthly pay isn’t legal in the state of Ohio. According to Ohio Rev. Code § 4113.15, employers are obligated to pay their employees at least twice per month.

Is holiday pay mandatory in Ohio?

Ohio labor laws do not require employers to provide holiday pay. Whether or not an employer offers holiday pay is typically a matter of company policy or employment contract.

Is there a paid leave in Ohio?

The Family and Medical Leave Act (FMLA) provides eligible employees with up to 12 weeks of job-protected leave for specific circumstances and up to 26 weeks for military caregiver leave. This allows employees to take extended time off while ensuring their job security under certain conditions.

Is it illegal to not get paid on time in Ohio?

Ohio labor laws require that an employer must pay an employee their final wages by the next regular payday following the termination of employment or within 15 days, whichever comes first. Failure to do so could result in legal consequences.

Disclaimer: This information serves as a concise summary and educational reference for Ohio state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.