North Carolina Labor Law Guide

A comprehensive guide to North Carolina labor laws: Covering essential topics like minimum wage guidelines, overtime regulations, mandatory rest breaks and other key employment provisions specific to the Tar Heel State.

Key Takeaways

- In North Carolina, the minimum wage for non-tipped employees aligns with the federal minimum wage, currently standing at $7.25 per hour

- The North Carolina Wage and Hour Act do not mandate rest breaks or meal breaks for employees aged 16 or older

- Both federal and North Carolina laws mandate employers to compensate eligible employees at a rate of 1.5 times their regular rate for hours worked beyond the standard 40-hour workweek

- An employer in North Carolina is required to pay the final paycheck to an employee by the next regular payday after separation from employment

Minimum Wage Regulations in North Carolina

In North Carolina, the minimum wage for non-tipped employees aligns with the federal minimum wage, standing at $7.25 per hour.

The last increase in North Carolina's state minimum wage occurred in 2008, with the wage increasing from $6.55 to $7.25 per hour.

[Source: FRED]

The Raising Wages NC coalition advocates for a $15 per hour increase over five years, but as of now, the minimum wage in North Carolina is expected to remain at the federal level due to a lack of bipartisan support for a statewide increase beyond 2023.

You can also compare the North Carolina minimum wage with the minimum wage in other US states by checking the table below.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Tipped Minimum Wage

In North Carolina, the minimum cash wage for tipped employees is $2.13 per hour, provided that each employee receives enough tips to bridge the gap between the hourly wages paid and the standard minimum wage of $7.25.

Employers must pay more than the $2.13 hourly cash wage if a tipped employee's total earnings, including tips, fall below the credit amount per hour.

It is the employer's responsibility to ensure that all tipped employees earn at least the minimum wage when considering both cash wages and tips.

Exceptions to Minimum Wage Requirements

Governed by the Federal Fair Labor Standards Act (FLSA), in North Carolina certain occupations are exempt from the minimum wage requirements, including:

- Bona fide executives, administrative workers, learned and creative professionals: Individuals in these roles are exempt from minimum wage regulations if they are paid on a salary basis and earn not less than $684 per week

- Computer employees: Employees in computer-related roles are exempt if they earn $684 per week or at least $27.63 per hour

- Certain highly compensated employees: Individuals earning $107,432 or more annually fall under the exemption from minimum wage requirements

- Outside sales employees: Employees engaged in outside sales are exempt from minimum wage regulations

Subminimum Wage

A provision under FLSA allows employers to pay a subminimum wage of $4.25 per hour during the initial 90 days of employment to employees under 20 years of age.

Once this introductory period concludes or when the employee reaches the age of 20, the standard minimum wage of $7.25 per hour comes into effect.

Additionally, full-time students may be subject to a subminimum wage rate under federal law, allowing employers to pay them 85% of the regular minimum wage, or around $6.16.

When discussing wages, it’s important to keep in mind the taxes for complete financial clarity.

Our North Carolina Paycheck Calculator gives you an estimate of your earnings after accounting for taxes and deductions, in adherence to your state’s tax laws.

Overtime Rules and Regulations in North Carolina

In North Carolina, overtime regulations are primarily governed by federal laws outlined in the Fair Labor Standards Act (FLSA), with some additional state-specific considerations.

Both federal and North Carolina laws mandate employers to compensate eligible employees at a rate of 1.5 times their regular rate for hours worked beyond the standard 40-hour workweek. Overtime for tipped employees should be at least $10.88 per hour (1.5 times the state minimum wage).

The law mandates that overtime pay calculations must be based on a single workweek, even if employees are paid bi-weekly, semi-monthly or monthly.

Overtime Exceptions

In North Carolina, some jobs are exempt from overtime pay, allowing employers not to pay extra for overtime work in those specific cases. These exemptions include the following:

Executive exemption:

- Definition: Full-time responsibility for managing two or more employees

- Time allocation: No more than 20% of working time on other activities (40% in a retail environment)

- Employment type: Salaried position

Administrative exemption:

- Definition: Primary duty involves non-manual work related to business operations, management policies, or administrative training

- Time allocation: No more than 20% of working time on non-exempt activities (40% in a retail environment)

- Employment type: Salaried position

Professional Exemption:

- Definition: Primary duties require advanced knowledge and extensive education (e.g., artists, certified teachers, skilled computer professionals)

- Job characteristics: Salaried, primarily intellectual, discretion and judgment expected

- Time allocation: No more than 20% on non-professional activities

- Employment type: Salaried position

Outside Sales Exemption:

- Definition: Main duties involve making sales or taking orders outside the employer's main workplace

- Time allocation: No more than 20% on non-sales activities

- Employment type: Salary position or commission-based

The exemptions apply only if the employee meets certain salary thresholds ($684 per week for most exemptions, $27.63 per hour for computer employees). Independent contractors, some transportation workers, certain agricultural and farm workers and live-in employees like housekeepers are also exempt from overtime laws.

Rest and Meal Breaks

The North Carolina Wage and Hour Act does not mandate rest breaks or meal breaks for employees aged 16 or older. If an employer chooses to provide breaks, they are not obligated to offer breaks of a specific duration.

Generally, breaks of less than 30 minutes are considered work time and must be paid by the employer.

Consequently, if an employer opts to grant breaks, a break must typically be at least 30 minutes for the employer to deduct the time from an employee's pay.

Family and Medical Leave Laws in North Carolina

In North Carolina, Family and Medical Leave Laws provide a range of options for eligible employees, including those covered by the Family and Medical Leave Act (FMLA).

Eligibility includes full-time, part-time (with at least 1,040 hours in the last year) or temporary/intermittent/part-time employees (with at least 1,250 hours in the last year).

Under FMLA, eligible employees can take up to 12 weeks of unpaid, job-protected leave within a 12-month period for reasons such as:

- Caring for a newborn, adopted or foster child

- Tending to a sick family member

- Dealing with personal illness

Under the Family Illness Leave, catering to eligible employees can take up to 52 weeks of unpaid leave to care for a child, parent or spouse in a 5-year period, after they exhaust the FMLA benefits.

For those celebrating the arrival of a new family member, Paid Parental Leave offers a span of 4 to 8 weeks of paid leave for recovery from childbirth or bonding with the employee's newborn.

Organ donors can receive up to 30 days of paid leave, fostering a supportive environment for participation in donation programs.

Family Members That Qualify for FMLA

In North Carolina, qualifying family members for FMLA include:

- Spouses: As recognized by the state of North Carolina

- Parents, parents-in-law, grandparents and great-grandparents: Along with those related by marriage, including step-relations

- Children, stepchildren, children-in-law, grandchildren and great-grandchildren: As well as those related by marriage, including step-relations.

- Siblings, half-siblings or siblings-in-law: This category embraces individuals who depend on the employee and share the same residence

The inclusivity of the FMLA provisions in North Carolina ensures that employees can attend to the needs of a broad spectrum of family members during significant life events or health-related circumstances.

Holiday Leave

In North Carolina, the state designates several days each calendar year as state holidays.

These holidays include:

Important note: If a holiday falls on a Sunday, it is observed on the following Monday. If it falls on a Saturday, it is observed on the prior Friday.

The rules for holiday leave for public employees include:

- Compensatory time: Those required to work on a legal holiday must be granted compensatory time within 90 days of the holiday

- Compensatory time use period: If not used within the relevant period, compensatory time must be compensated at the straight hourly rate, unless an extension has been granted by the Budget and Control Board

- Holiday allocation: Employees not on a Monday through Friday schedule must be awarded the same number of holidays as those on such a schedule

The rules for holiday leave for private employers include:

- Closure requirement: Private employers in North Carolina are not mandated to close on state holidays

- Time off policies: Private employers are not required to allow employees time off, paid or unpaid, on holidays

- Premium wages: Private employers are not obligated to pay premium wage rates to employees working on holidays

- Policy establishment: Private employers can establish their own policies or practices for holidays, and if established, compliance may be required

Workplace Safety and Health Regulations in North Carolina

In North Carolina, workplace safety and health regulations are overseen by the Occupational Safety and Health Division (OSH). The regulations apply not only to the private sector but also extend to cover all state and local government agencies.

OSH provides free services to over 260,000 private and public employers through its Consultative Services Bureau. This bureau offers assistance to enhance workplace safety and health practices.

OSH's Education, Training, and Technical Assistance Bureau delivers a range of training and outreach services to the public, contributing to increased awareness and understanding of safety protocols.

OSH conducts approximately 4,500 inspections annually through its Compliance Bureaus. These inspections ensure that workplaces adhere to safety and health regulations, fostering a secure working environment.

While the NC OSH Division adopts most OSHA standards, it maintains unique standards in various areas, including:

- General Industry

- Electric power generation, transmission and distribution

- Hazardous waste operations and emergency response

- Communication towers

- Construction

- Personal protective equipment and life-saving equipment

- Steel erection

- Bloodborne pathogens

- Blasting and use of explosives

- Non-Ionizing radiation

- Agriculture

- Field sanitation

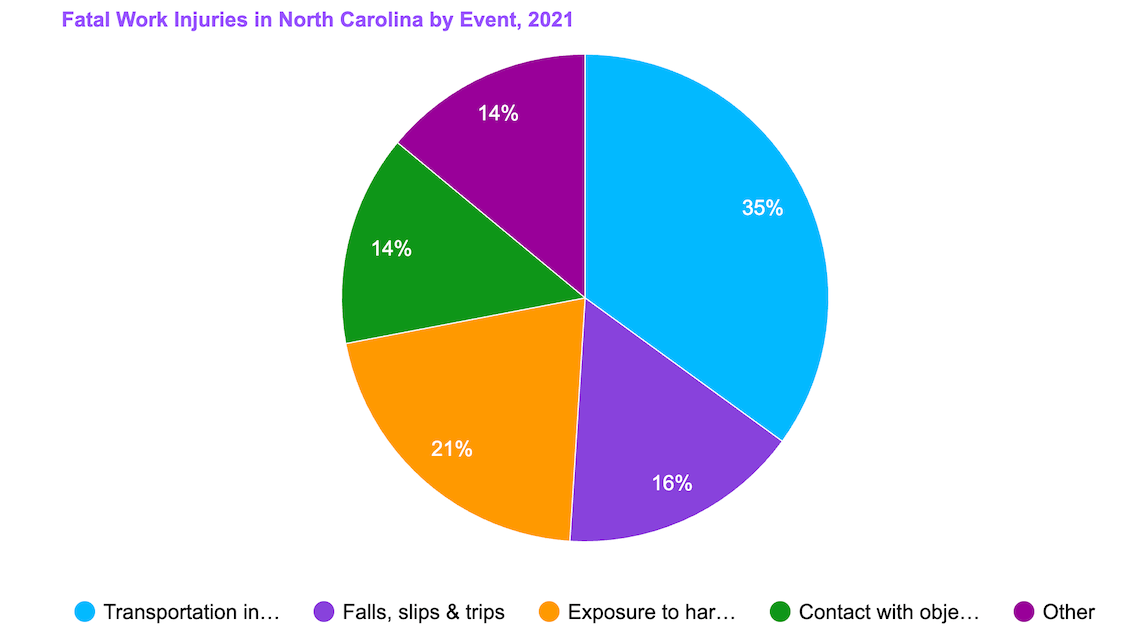

Even with the comprehensive state plan for health and safety, the last known data shows there have been 179 fatal occupational injuries in the North Carolina state.

[Source: U.S. Bureau of Labor Statistics]

You can see how North Carolina compares to other states in the US when it comes to occupational fatal injuries by browsing our table below.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Child Labor Laws in North Carolina

North Carolina's Wage and Hour Act includes specific provisions designed to safeguard the well-being of minors, regulating the types of employment and the number of hours for youths aged 14 to 17.

While federal standards are adopted, the state imposes additional, more stringent requirements for non-farm employers.

Notably, farm work is entirely exempt from the provisions of the North Carolina Wage and Hour Act, and hazardous or detrimental occupations are strictly prohibited for individuals under 18.

14- and 15-year-olds can work no more than three hours a day during the school session (up to eight hours when school is not in session), and are limited to work between 7 a.m. and 7 p.m. (extended to 9 p.m. from June 1 through Labor Day when school is not in session).

They can work a maximum of 18 hours per week during the school session or 40 hours per week when school is not in session and only outside school hours.

These minors are entitled to a mandatory 30-minute break after any continuous five-hour work period.

16- and 17-year-olds enrolled in grades 12 or lower cannot work between 11 p.m. and 5 a.m. when there is school the next day.

Youths 14-15 years old can work in retail businesses, food service establishments, service stations and offices.

Youths less than 14 years old are generally not permitted to work, except when employed by their parents, in-home delivery of newspapers or in modelling or acting in a movie or theatre production.

The Wage and Hour Act, aligned with the Fair Labor Standards Act, outlines seventeen hazardous occupations where no youth under 18 may be employed. These restrictions apply universally, even when employed by a parent or legal guardian.

Examples include manufacturing explosives, coal mining, exposure to radioactive substances, power-driven woodworking machines and roofing operations.

Anti-Discrimination and Fair Employment Practices in North Carolina

In North Carolina, the Equal Employment Practices Act (EEPA) is in charge of preventing employment discrimination.

This statute prohibits employment discrimination based on:

- Race

- Religion

- Color

- National origin

- Age

- Sex

- Handicap

- HIV/AIDS status

The Retaliatory Employment Discrimination Act (REDA) prohibits retaliation against employees acting in good faith under various North Carolina laws.

REDA defines retaliatory actions and provides protection against discrimination and retaliation. The statute also specifies protected acts, defines retaliation and addresses employer vicarious liability.

Independent Contractor Classification in North Carolina

In North Carolina, the classification of a worker as an employee or an independent contractor is determined through the application of the following four-factor model:

- The right or exercise of control: An employer-employee relationship is indicated when the employer directs or has the right to control the worker's activities, even if that right is not always exercised. Employees typically receive instructions on when and how to perform their jobs and may be subject to supervision. Independent contractors, on the other hand, have more autonomy, deciding their own hours, and methods of work, and often work without direct supervision.

- Furnishing of equipment: If the employer provides tools, equipment or materials necessary for the job, it leans towards an employee classification. Employees use the employer's resources at the employer's expense (e.g., company-provided computers, tools, or workspaces). Independent contractors use their own tools and materials at their own cost.

- Method of payment: The method of payment can be indicative of the worker's status. Time-based payment arrangements may suggest an employer-employee relationship, while project-based payment tends to align with independent contractor relationships.

- Right to fire: North Carolina follows at-will employment principles, allowing employers to terminate employees without further obligations, assuming the termination is lawful. Independent contractor agreements may include provisions specifying payment in case of unexpected termination before the job's completion.

Termination and Final Paycheck Laws in North Carolina

An employer is required to pay the final paycheck to an employee by the next regular payday after separation from employment, regardless of the reason behind separation.

The final paycheck can be distributed through the regular pay channels or by mail if the employee makes such a request.

Wages based on bonuses, commissions or other calculations should be paid on the first regular payday after the amount becomes calculable when a separation occurs.

Wages, including those based on bonuses or commissions, may not be forfeited unless the employee has been properly notified of the employer's policy or practice leading to forfeiture. Employees not notified are not subject to such loss or forfeiture.

Summary of North Carolina Labor Laws

In North Carolina, the minimum wage for non-tipped employees aligns with the federal minimum wage, currently standing at $7.25 per hour.

Tipped employees in North Carolina have a minimum cash wage of $2.13 per hour, provided their tips bridge the gap to reach the standard minimum wage of $7.25.

Both federal and North Carolina laws mandate employers to compensate eligible employees at a rate of 1.5 times their regular rate for hours worked beyond the standard 40-hour workweek.

The North Carolina Wage and Hour Act does not mandate rest breaks or meal breaks for employees aged 16 or older.

In North Carolina, workplace safety and health regulations are overseen by the Occupational Safety and Health Division. The regulations apply not only to the private sector but also extend to cover all state and local government agencies.

FAQs About North Carolina Labor Laws

For more info, find frequently asked questions about the labor laws in North Carolina below.

Can your boss refuse to give you a break in North Carolina?

No, neither federal nor North Carolina labor laws require employers to give employees rest or meal breaks if they are over the age of 16.

How many consecutive hours can you legally work in North Carolina?

In North Carolina, there is no legally mandated limit on the number of consecutive hours an adult employee may be required to work.

The decision to structure work schedules, whether in eight-hour shifts, 12-hour shifts, 16-hour shifts, or any other configuration, is entirely at the discretion of the employer.

Additionally, the decision to call an employee back to work on a scheduled day off is also entirely up to the employer.

Can you be fired for discussing your salary in North Carolina?

In North Carolina, employers cannot legally prohibit their employees from discussing wages and compensation.

Employees have the right to engage in discussions about pay with their coworkers, whether it's outside of work, during breaks or even at work as long as it doesn't interfere with their job responsibilities.

Is North Carolina a right-to-work state?

Yes, North Carolina is a right-to-work state. The state's right-to-work law was ratified on March 18, 1947.

This law significantly restricts the power of labor unions within the state. Specifically, the statute makes the closed shop illegal, wherein union membership is a condition for both being hired and maintaining employment.

In a right-to-work state like North Carolina, individuals are not obligated to join a union or pay union dues as a condition of employment.

Is it illegal to withhold pay in North Carolina?

In North Carolina, it is generally illegal for employers to withhold or divert a portion of a current employee's wages for reasons such as cash shortages, inventory shortages or loss or damage to an employer's property.

Employers may make deductions from wages, but they are required to provide seven days' notice to employees in addition to complying with other deduction provisions.

These provisions often include obtaining written consent from the employee before making any deductions from their wages.

Disclaimer: This information serves as a concise summary and educational reference for North Carolina state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.