Nebraska Labor Law Guide

A comprehensive guide to Nebraska labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways of Nebraska Labor Laws

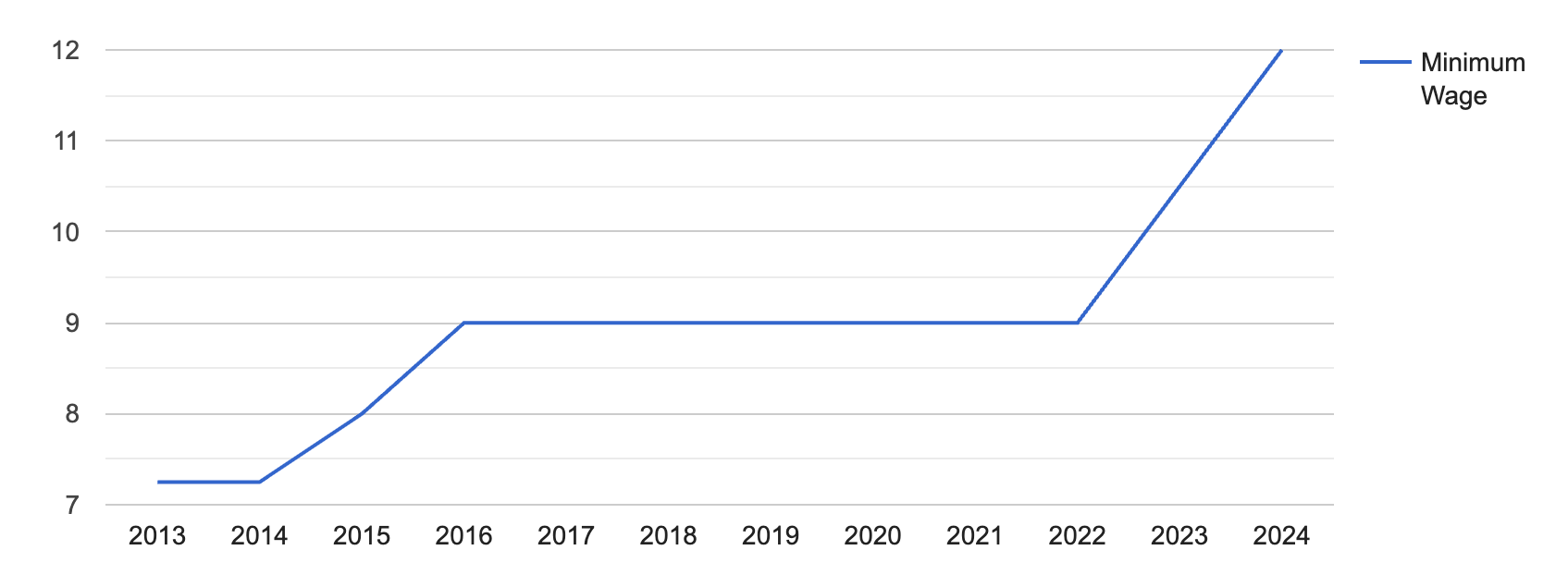

- Nebraska’s minimum wage is $12.00 per hour.

- Employers in Nebraska are not required to provide paid breaks to employees.

- Eligible employees in Nebraska are entitled to overtime pay of 5 times their regular pay (time and a half) for work hours exceeding 40 in 1 workweek.

- Nebraska follows at-will employment policies, wherein employers and employees can terminate a working relationship without cause.

- Nebraska observes right-to-work policies.

Minimum Wage Regulations in Nebraska

The minimum wage in Nebraska is $12.00 per hour. This is applicable to employers with four or more employees.

This is part of the Nebraska Minimum Wage Statute Initiative, wherein the state’s minimum wage will continue to increase every year until reaching $15 per hour in 2026.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

Nebraska has increased the minimum wage to $12.00 per hour for regular employees, from $10.50 per hour in 2023.

This is around 65.52 higher than the federal wage rate of $7.25 per hour.

[Source: FRED]

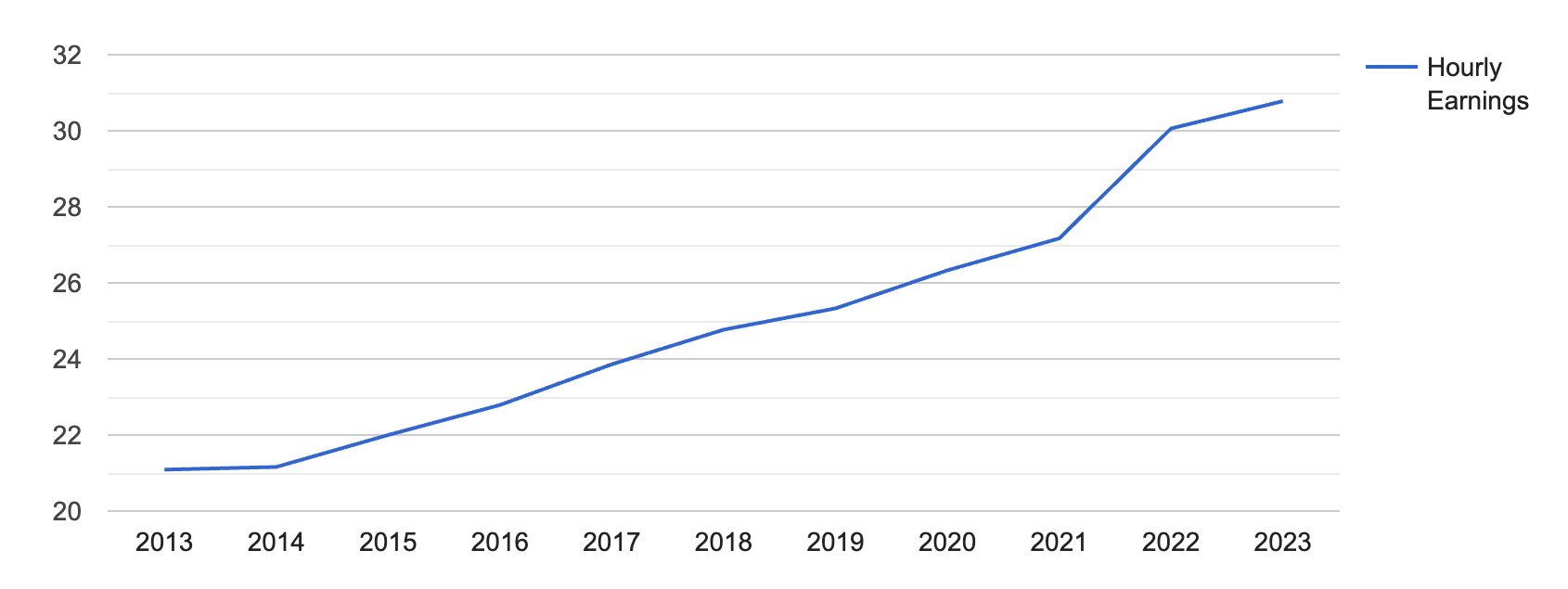

Keep in mind that the minimum wage is not a reflection of the average hourly earnings in the state, which are at $30.78 per hour in 2023.

[Source: FRED]

Tipped Employees

In Nebraska, tipped employees, such as servers and bartenders, can be paid a lower hourly wage than the standard minimum wage, provided that their tips bring their total earnings up to at least the minimum wage level.

For tipped employees, provided that they earn over $30 per month, the minimum hourly wage is $2.13.

If they are paid $2.13 and adding their tips to that does not equal the minimum wage of $12.00 per hour, the employers should make up the difference.

State Income Taxes

Nebraska levies a graduated individual income tax, with tax rates ranging from 2.46% to 6.64%. Additionally, Nebraska imposes a corporate income tax with rates ranging from 5.58% to 7.25%.

Check out the Nebraska Department of Revenue for a full rundown of taxes depending on the income amount.

Regular and tipped employees can easily calculate their earnings, factoring in taxes and deductions, with OysterLink’s Paycheck Calculator.

Exceptions to Minimum Wage Requirements

The federal Fair Labor Standards Act (FLSA) has identified specific occupations as exempt from both state and federal minimum wage regulations.

Those occupations include, but are not limited to:

- Certain salaried professionals and employees in managerial positions

- Farm laborers

- Seasonal employees

- Newspaper carriers

- Informal laborers like babysitters

- Employees in certain computer-related occupations

Subminimum Wage

In Nebraska, subminimum wages come into play when earnings fall below the established minimum wage.

For example, if you’re a student in Nebraska, you can receive compensation equal to 75% of the applicable state or federal minimum wage.

Or, if you’re an individual with mental or physical disabilities, you may receive a special subminimum wage proportionate to your reduced productivity.

Nebraska also permits employers to offer a training wage of $4.25 per hour to employees under 20 years old during their initial 90 days of employment.

Overtime Rules and Regulations in Nebraska

Nebraska follows federal FLSA regulations when it comes to overtime pay.

Nonexempt Employees

Nonexempt employees in Nebraska must receive 1.5 their regular hourly rate, or time and a half, for all hours worked over 40 in a workweek.

Only employees who earn below a minimum salary of at least $455 per week or $23,660 per year are typically eligible to receive overtime pay for any hours they work beyond 40 in a week.

If your salary falls below this threshold, you are more likely to be eligible for overtime pay under federal law.

To easily check your overtime pay, check out our time and a half calculator.

Exempt Employees

Exempt employees, such as salaried professionals and professionals in certain managerial positions whose earnings amount to at least $455 per week, are not entitled to overtime pay under Nebraska labor laws.

Other exempt employees include:

- External salespeople (who often set their own hours)

- Certain types of computer-related workers

- Independent contractors (those who not considered legal employees)

- Certain transportation workers

- Certain agricultural and farm workers

- Certain live-in employees, such as housekeepers

Rest and Meal Breaks in Nebraska

The state of Nebraska does not prescribe specific rest and meal break rules for most adult employees.

However, there are some exceptions, particularly for those working in certain industries.

Rest and Meal Break Exceptions

Nebraska labor laws have some set rest and meal break rules for adult employees working in assembling plants, mechanical establishments or workshops.

If you fall into these categories and work a shift of at least 8 hours, you should receive a 30-minute lunch break during your shift.

Still, employers often provide short breaks to boost employee productivity and well-being.

If you are provided a rest break, but it is less than 20 minutes long, you should know that breaks of these lengths are considered part of your workday, and they must be paid as per federal law.

Additionally, if you work during your meal break, you are typically entitled to be paid for that time, as unpaid meal breaks are generally intended for employees to have a designated period to rest and eat without performing work-related tasks.

Family and Medical Leave Laws in Nebraska

When it comes to family and medical leave laws, the state does not establish detailed rules that apply universally to all employees.

Instead, specific provisions and eligibility criteria exist, offering certain exceptions and protections, particularly for those facing family and medical circumstances.

For example, eligible employees in Nebraska are entitled to up to 12 weeks of job-protected (unpaid) leave for qualified family and medical reasons, as per the federal Family and Medical Leave Act (FMLA).

Some of the qualified reasons include serious health conditions (such as surgery, cancer, dialysis, etc.), bonding with a newborn baby, or caring for a seriously ill family member.

To qualify for FMLA leave, you must meet the following conditions:

- Your employer has employed you for at least one year.

- You have worked at least 1,250 hours in the 12 months leading up to your leave request.

- You work at a site where the employer has a workforce of at least 50 employees within a 75-mile radius.

Family Members Who Qualify for Paid Leave Care

Unfortunately, Nebraska does not have a statewide paid family and medical leave program in place.

However, the FMLA guarantees a maximum of 12 workweeks for unpaid leave care if you are:

- A parent or an adoptive parent caring for the newborn child within one year of birth

- A family member taking care of their spouse, child (including adult children) or parent (including stepparents and those who acted as parents when the employee was a child) with a serious health condition

- An employee taking care of his own serious health condition

- Family members taking care of military members (spouse, child, parent or next of kin) on “covered active duty”

Child Labor Laws in Nebraska

Nebraska state labor laws are incorporated with federal law in its regulations for youth employment.

Work Hours

For minors aged 14 and 15, they can work from 7:00 a.m. to 7:00 p.m. on school days, which can be extended to 9:00 p.m. on non-school days.

Keep in mind that they should not work for more than 3 hours on a school day or 18 hours in a school week.

If they are on vacation (i.e., school is out), they should not work for more than 8 hours a day or 40 hours a week.

There are no laws that specify the working hours of minors aged 16 and 17.

Work Permits

Work permits are required for minors under the age of 16.

Restrictions

Minors are not allowed to work in hazardous occupations such as coal mining, logging, motor vehicle operation and so on.

Moreover, children employed by their parents are exempted from being paid the state minimum wage.

For a complete rundown of the state’s child labor laws, check the Nebraska Department of Education.

At-Will Employment in Nebraska

Nebraska labor laws follow the at-will employment doctrine, which allows employers and employees to terminate their working relationship at any time for any reason, with the following exceptions.

- Breach of contract

- Discriminatory acts

- Employment actions that infringe on public policy (e.g., employee’s rights)

- Retaliation

Right-To-Work Laws in Nebraska

Nebraska is one of the 28 states with right-to-work policies.

A state being right-to-work safeguards employees’ employment rights—ensuring that they cannot be denied employment based on their union membership, resignation, expulsion, affiliation with a labor union or their choice not to join or pay union fees.

Workplace Safety and Health Regulations in Nebraska

In Nebraska, maintaining a safe and healthy work environment is of utmost importance.

Namely, Nebraska has its own Occupational Safety and Health Administration (OSHA) program, which largely mirrors federal OSHA standards.

Under Title 230, Chapter 6, of the Nebraskan Workplace Safety Consultation Program, employers are responsible for maintaining safe and healthy work environments by taking specific measures, including:

- Controlling and responding to imminent hazards

- Training their employees

- Conducting regular safety inspections

- Implementing effective risk mitigation plans

- Reporting any accidents that occurred at the workplace

- Keeping records of said accidents

- Gathering safety committees

Apart from that, employees in Nebraska have the right to refuse dangerous work and report unsafe conditions to a supervisor or the Environmental Health & Safety EHS without retaliation.

They also have to be trained to navigate hazards such as electrical and fire hazards, ergonomic stressors, slips, trips and falls, indoor air pollutants and motor vehicle operation hazards.

In case of a workplace injury, employees can file a workers’ compensation claim. This way, they can claim a variety of benefits, including:

- Medical benefits

- Permanent disability benefits

- Death benefits

- Vocational rehabilitation

- Job protection

- Wage replacement

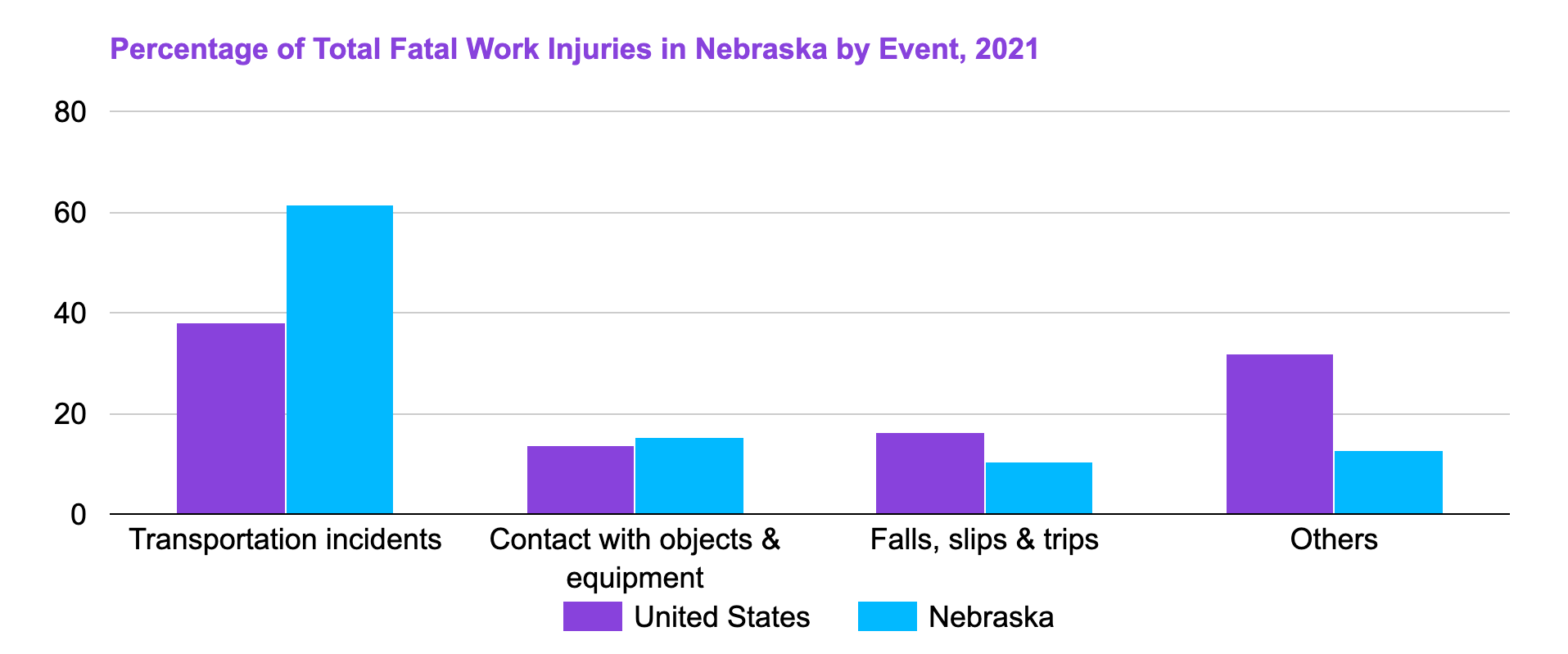

[Source: U.S. Bureau of Labor Statistics]

In 2021, there were a total of 39 fatal work injuries that occurred in Nebraska, and a whopping 62% of which (totaling 24 fatal work injuries) were due to transportation incidents.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

The total number of fatal work injuries in Nebraska (39) is around 62% lower than the national average (102).

Anti-Discrimination and Fair Employment Practices in Nebraska

In Nebraska, the Fair Employment Practice Act (FEPA) prohibits employment discrimination based on race, color, national origin, religion, sex (including pregnancy), disability or marital status.

This prohibition applies to most private and non-profit employers with 15 or more employees, state and local government entities of any size, employment agencies and labor organizations.

FEPA also includes provisions to prevent employer retaliation against individuals who report or refuse to engage in unlawful activities at the workplace.

In addition to FEPA, Nebraska has additional state and federal laws protecting against discrimination in employment.

Those include:

- Nebraska Age Discrimination in Employment Act (Age Act): This act prohibits discrimination against employees based on age.

- Equal Pay Act: This act prohibits paying lower wages for similar work based on sex.

- Nebraska Fair Housing Act: This act prohibits housing discrimination based on factors like race, religion and disability.

- The Act Providing Equal Enjoyment of Public Accommodations (PA Act): This act prohibits discrimination in places of public accommodation, such as refusal or denial of services and segregation. Limited exemptions for private clubs and religious organizations exist.

Independent Contractor Classification in Nebraska

Knowing whether a worker is an independent contractor or an employee is crucial for tax and legal purposes.

Nebraska follows federal guidelines but also has its own 10 criteria for independent contractor classification, which include:

- How much control the employer has over the work details

- Whether the person does a distinct type of job

- The usual way similar work is done in the area

- How much skill the job requires

- Who provides tools and workspace

- How long does the work last

- How the person is paid, whether by time or for the whole job

- If the work is a regular part of the employer’s business

- What do the parties believe about their relationship

- If the employer is in business.

Official Holidays in Nebraska

Nebraska labor laws do not require employers to provide time off, paid or unpaid, to employees for holidays. For a list of the official state holidays in Nebraska, see the table below.

[Source: Nebraska Department of Administrative Services]

Termination and Final Paycheck Laws in Nebraska

Nebraskan employees are entitled to their final paychecks on the next regular payday upon termination, regardless of whether they resigned or were terminated.

All earned/allowed vacation and paid time-off benefits are included in the calculation of employees’ final pay. Nebraska prohibits use-it-or-lose-it policies.

Employers are required to give their employees pay stubs or similar pay statements with every paycheck.

Summary of Nebraska Labor Laws

Labor laws in Nebraska, like in any state, exist to safeguard the rights and well-being of both employers and employees, ensuring that the workplace remains fair, safe and equitable.

The state minimum wage is $12.00 per hour in 2024.

Moreover, Nebraska follows FLSA regulations for overtime pay, wherein employees must be paid 1.5 times their regular hourly rate for all hours worked over 40 in a workweek.

Employers are also generally not required to provide rest and meal breaks.

Frequently Asked Questions About Nebraska Labor Laws

Get the information you need with these answers to frequently asked questions regarding Nebraska labor laws.

What is the legal working age in Nebraska?

Nebraskans must be at least 14 years old to be employed in the state, with restrictions on activities, working hours and occupations.

Which paid holidays are mandatory in Nebraska?

Nebraska labor laws do not entitle employees to paid or unpaid holiday leave at all.

Is there a leave of absence law in Nebraska?

Yes, following FLMA, eligible employees are entitled to up to 12 weeks of unpaid yet job-protected leave for family and medical reasons.

How does Nebraska’s minimum wage compare to the state’s living wage?

Nebraska’s minimum wage of $12.00 per hour is lower than the state living wage of $15.73 per hour, as determined by a study by MIT.

Do employers in Nebraska pay terminated employees for unused vacation time?

YES. Employees’ accrued vacation time is part of their final pay, which should be given within the next payday.

Disclaimer: This information serves as a concise summary and educational reference for Nebraska labor laws. It does not constitute legal advice. For personalized legal guidance, please consult an attorney.