Massachusetts Labor Law Guide

A comprehensive guide to Massachusetts labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- The minimum wage in Massachusetts for regular employees is $15.00 per hour.

- Tipped employees in Massachusetts must receive a base wage of $6.75 per hour, provided their total earnings, including tips, meet $15.00 per hour.

- Massachusetts state law mandates overtime pay after an employee works more than 40 hours in a single workweek. This requires employers to pay at a rate of 1.5 times the employee's regular hourly wage for every hour worked beyond the standard 40 hours.

- In Massachusetts, employees who work shifts longer than six hours are entitled to a 30-minute meal break.

- Child labor hours in Massachusetts vary based on the child's age and whether the employer adheres to the Fair Labor Standards Act.

- The state aligns with Occupational Safety and Health Administration (OSHA) standards for workplace safety.

- The state follows the Family and Medical Leave Act (FMLA) to ensure workers have job-protected leave for certain family and medical situations.

- The Massachusetts Commission Against Discrimination forbids job discrimination based on factors such as race, color, religion, sex, national origin, disability and age, among others.

- The state observes the "employment at will" principle, allowing both employers and employees to end employment anytime, provided the reasons aren't illegal.

- The state mandates that final paychecks should be given immediately upon termination. If the employee resigns, their final paycheck must be given on the next regular payday.

Minimum Wage Regulations in Massachusetts

The minimum wage regulations in Massachusetts ensure fair pay, fostering economic security for the state’s workforce. These regulations include defined hourly wages for both standard and tipped employees.

Regular Employees

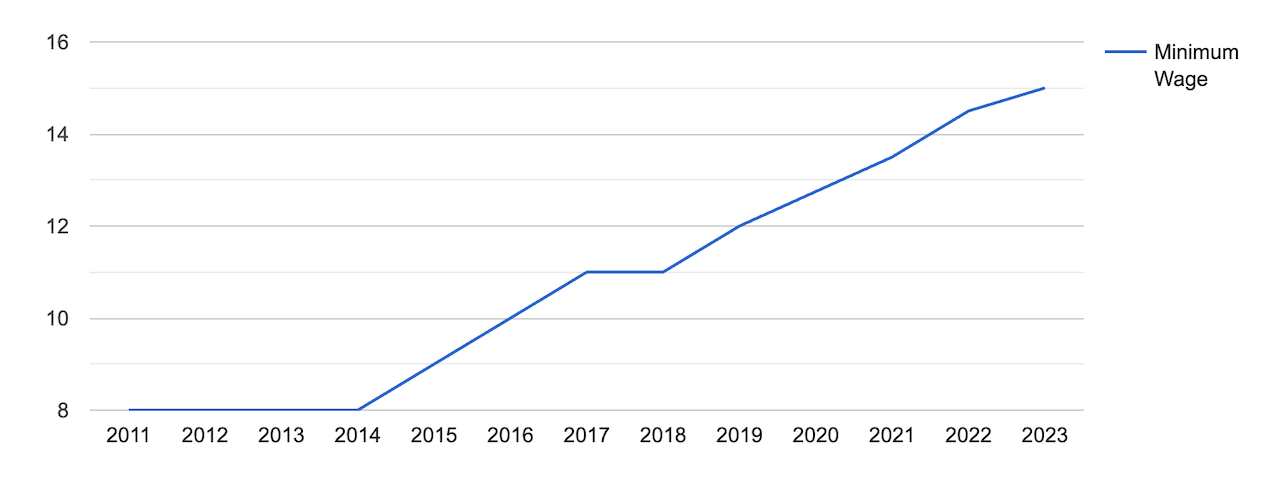

The minimum wage in Massachusetts has been on a steady upward trajectory, with the state witnessing a 5.26% increase compared to the previous year.

[Source: FRED]

Currently, in Massachusetts, the minimum wage for regular employees is $15.00 per hour. You can also compare the Massachusetts minimum wage with the minimum wage in other states by checking the table below.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Tipped Employees

In Massachusetts, tipped employees are required to receive a base pay of $6.75 per hour, as long as their total earnings — including tips — amount to a minimum of $15 per hour.

The state allows employers to conduct tip pooling, in which employees contribute some of their tips to a shared pot, which is then distributed among the rest of the team.

However, keep in mind that only service bartenders, wait staff and other service employees can participate in tip pooling, as they directly interact with customers.

When discussing wages, it’s important to keep in mind the taxes for complete financial clarity. Our Massachusetts Paycheck Calculator gives you an estimate of your earnings after accounting for taxes and deductions, in adherence to your state’s tax laws.

Overtime Rules and Regulations in Massachusetts

Overtime rules and regulations in Massachusetts are designed to ensure that workers are fairly compensated for working extended hours.

In Massachusetts, both state and Federal law requires overtime pay once an employee has worked 40 hours within a week.

Nonexempt Employees

Standard employees typically receive 1.5 times their standard hourly rate for any hours worked beyond 40 in a week.

For example, if an employee earns $15 per hour and works 45 hours in a week, they will receive their standard rate for the first 40 hours ($600) and 1.5 times that rate or $22.50 per hour, for the additional 5 hours ($112.50).

This would result in a total weekly pay of $712.50.

Exempt Employees

In Massachusetts, exempt employees are not entitled to receive overtime pay for working over 40 hours in a week.

Exemptions include:

- Executive, administrative and professional employees who meet certain salary and duty criteria

- Certain seasonal workers in recreational or agricultural settings

- Workers in specific roles in retail or service establishments, based on their compensation structure and job duties

- Employees in certain transportation sectors, such as taxi drivers or certain railroad employees

- Independent contractors who are not considered employees under Massachusetts law

- Agricultural and farm workers, due to the seasonal nature of their work

Under the Fair Labor Standards Act (FLSA), the salary for exempt employees should be at least $684 per week.

Break Periods in Massachusetts

Employees who work more than six-hour shifts are entitled to a 30-minute meal break in Massachusetts. During their break, they must be allowed to eat their meal free from all duties. They are not required by their employer to work during this time.

If an employer asks an employee to work or remain at the workplace during their meal break, the employee must be paid during that time.

Family and Medical Leave Laws in Massachusetts

Massachusetts follows the Family and Medical Leave Act (FMLA) to provide workers with job-protected leave for specific family and medical reasons, such as the birth or adoption of a child, recovering from a serious health condition or caring for a family member with a serious health condition.

Employees qualify for FMLA if they’ve worked for the company for at least a year, clocked in over 1,250 hours in the past year and work at a site with 50 or more employees within a 75-mile radius.

Eligible employees are entitled to:

- 12 work weeks of leave: Eligible employees can use up to 12 work weeks of leave within a year to attend to childbirth or care for a spouse, child or parent with a severe health issue.

- 26 work weeks of leave: Eligible employees can use up to 26 work weeks of leave within a year to care for a family member who is part of the military with a serious injury or illness.

Child Labor Laws

Child labor laws in Massachusetts are built to ensure the safety and well-being of young workers. They achieve this by mandating work permits for minors and regulating the hours they are allowed to work, to prevent employment from threatening their health or interfering with their education.

Work Permits

Teens under the age of 18 must get a work permit before starting a new job. This ensures that their employment aligns with state regulations, safeguards their well-being, and does not interfere with their educational commitments.

Working Hours and Maximum Number of Hours Children Can Work

In Massachusetts, the maximum number of hours a minor can work varies based on the age of the child and whether school is in session.

Minors 14-15 years of age:

School Days:

- Maximum of 3 hours per day

- Not before 7 a.m. or after 7 p.m.

- Maximum of 18 hours per week

Non-School Days or During School Vacations:

- Maximum of 8 hours per day

- Not before 7 a.m. or after 7 p.m.

- Maximum of 40 hours per week

Weekends and Holidays During School Weeks:

- Maximum of 8 hours per day

- Not before 7 a.m. or after 7 p.m.

- Maximum of 6 days in a week

Minors 16-17 years of age:

School Days:

- Maximum of 4 hours per day on school days

- Maximum of 8 hours on the last school day of the week

- Not before 6 a.m. or after 10 p.m. (or after 11:30 p.m. if no school the next day)

- Maximum of 48 hours per week

Non-School Days or During School Vacations:

- Maximum of 9 hours per day

- Not before 6 a.m. or after 11:30 p.m.

- Maximum of 48 hours per week

Weekends and Holidays During School Weeks:

- Maximum of 9 hours per day

- Not before 6 a.m. or after 11:30 p.m.

- Maximum of 6 days in a week

Workplace Safety and Health Regulations

Workplace safety and health are critical aspects of employment law, and Massachusetts has established various regulations to ensure the well-being of its workers.

In Massachusetts, state and local government workers fall under an Occupational Safety and Health Act (OSHA) approved State Plan, while private sector employers and their employees are governed by federal OSHA regulations.

While OSHA provides federal guidelines, the state of Massachusetts operates its own safety and health programs under the Division of Occupational Safety (DOS). The DOS oversees and enforces safety regulations for both public and private sector employees in the state.

Still, the latest data from 2021 show there have been 97 work-related fatal injuries in Massachusetts.

[Source: U.S. Bureau of Labor Statistics]

Key provisions of the DOS include:

- Right to a safe workplace: All employees in Massachusetts have the right to a workplace free from hazards that may cause death or serious physical harm, such as chemical and electrical hazards.

- Employee responsibilities: Workers are expected to use all equipment safely and as intended, follow safety guidelines and report hazards to their employers.

- Employer responsibilities: Employers are required to provide a safe working environment, offer necessary safety training, ensure machinery and equipment are safe to use and report workplace accidents.

- Inspections: The DOS conducts workplace inspections based on complaints, referrals, targeted industries or following severe incidents. These can be announced or unannounced.

- Workers’ compensation: Employers are required to have workers' compensation insurance to cover work-related injuries and illnesses. This type of insurance provides benefits and protection to both employers and employees in the event of an accident.

- Whistleblower protection: Workers who report safety and health violations are protected from retaliation under Massachusetts law. Employers cannot fire, demote or discriminate against employees for reporting unsafe conditions.

- Training: Specific job roles — for example, machine operators and chemical plant workers — may require specific safety training, which employers must provide. This training can include equipment use, hazardous material management or emergency response planning.

- Record keeping: Employers must maintain records of work-related injuries and illnesses. These records can be requested by the DOS during inspections or investigations.

You can see how Massachusetts compares to other states in the US when it comes to occupational fatal injuries by browsing the table below.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Anti-Discrimination and Fair Employment Practices in Massachusetts

Pursuant to MGL Ch. 272:92A, 98, and 98A, the Massachusetts Commission Against Discrimination bans discrimination in public spaces based on factors including:

- Race

- Color

- Religion

- National origin

- Gender

- Sexual orientation

- Blindness

- Deafness

- Disability

Employers are prohibited from retaliating against employees who assert their rights under anti-discrimination laws, participate in an investigation or oppose discriminatory practices.

Independent Contractor Classification in Massachusetts

The classification of workers as independent contractors or employees is a key distinction in Massachusetts, as it affects matters such as wage and hour laws, tax implications and various employee rights and benefits.

The misclassification of workers can result in substantial penalties for employers.

The Massachusetts "Three-Part" or "ABC" Test

To classify a worker as an independent contractor in Massachusetts, the employer must satisfy all three parts of the so-called "ABC" test, as outlined in the Massachusetts General Laws Chapter 149, Section 148B:

- Part A: The individual must be free from control and direction in connection with the performance of the service, both under his contract for the performance of service and in fact.

- Part B: The service must be performed outside the usual course of the business of the employer. This means that if the service provided is within the employer's regular business operations, the worker must be classified as an employee.

- Part C: The individual must be customarily engaged in an independently established trade, occupation, profession, or business of the same nature as that involved in the service performed.

All three parts must be met for a worker to be classified as an independent contractor. If all three parts do not apply, the worker should be considered an employee under Massachusetts law.

Implications under the Massachusetts law include:

- Wage and hour laws: Employees are entitled to protections under wage and hour laws, such as minimum wage, overtime, and breaks. Independent contractors do not receive these protections.

- Benefits: Employees might be entitled to benefits such as health insurance, paid leave, or retirement contributions, which aren't typically provided to independent contractors.

- Taxes: Independent contractors are responsible for their own taxes, including self-employment tax. In contrast, employers withhold taxes for employees and pay a portion of some taxes, like Social Security and Medicare.

- Liability and insurance: Employers are generally liable for the actions of their employees but not for their independent contractors. However, businesses might require independent contractors to have their own insurance.

Termination in Massachusetts

Massachusetts operates under the doctrine of "at-will" employment, in which either the employer or the employee can end the employment relationship at any time and for any reason, as long as that reason isn't illegal.

However, when it comes to termination and final paychecks, Massachusetts has specific regulations that employers must follow:

- “At-will” exceptions: While the general rule is "at-will" employment, there are exceptions. For example, an employer cannot terminate an employee for discriminatory reasons, in retaliation for certain protected activities (like whistleblowing), or in violation of an employment contract or agreement.

- Notice requirements: Unless stipulated in an employment contract or collective bargaining agreement, Massachusetts law generally does not require employers to provide advance notice or severance pay for terminations.

Final Paychecks in Massachusetts

In Massachusetts, the regulations surrounding final paychecks are straightforward. If the employee is terminated or laid off, they are entitled to receive their final paycheck on the day of separation.

However, if they resign, their final paycheck should be provided on the next regular payday. For example, if the employee is typically paid on Fridays and they resign, they can expect their last paycheck on the upcoming Friday.

Summary of Massachusetts Labor Laws

In Massachusetts, the established minimum wage stands at $15.00 per hour. However, for tipped employees, a base wage of $6.75 per hour is set, with the stipulation that their combined earnings, including tips, reach at least $15.00.

Workers are entitled to overtime pay, at 1.5 times their regular rate, if they exceed 40 hours in a week. In addition, those working shifts longer than six hours must be given a 30-minute meal break.

The guidelines for child labor vary with the child's age and the employer's compliance with the Fair Labor Standards Act. The state upholds OSHA's safety standards in workplaces.

The state abides by the Family and Medical Leave Act (FMLA), offering workers job-protected leave for distinct family and health-related situations. Discriminatory practices based on factors such as race, religion and age are strictly prohibited.

The principle of "employment at will" is recognized, allowing employment relationships to be terminated at any time, provided the reasons are lawful.

Employees who are terminated should immediately receive their final paycheck, while those who resign should get their final salary by the next scheduled payday.

FAQs About Massachusetts Labor Laws

Find answers to commonly asked questions about Massachusetts labor laws.

How many hours can you work in Massachusetts?

In Massachusetts, adults can work up to a maximum of 40 hours in a standard workweek without being entitled to overtime pay.

If an employee works more than 40 hours in a week, they should be compensated at a rate of 1.5 times their base rate for all additional hours.

There are special restrictions for minors regarding the number of hours they can work, which vary based on age and whether school is in session.

What is the minimum hour requirement for full-time employment in Massachusetts?

Typically, full-time employment in Massachusetts is considered to be 40 hours per week.

Are lunch breaks required in Massachusetts?

Yes, employees who work more than six hours in a shift are entitled to a 30-minute meal break in Massachusetts.

During this time, employees must be free of all work-related duties and cannot be required to stay at the workplace unless they are compensated for that time.

What Is the Massachusetts Equal Pay Act?

The Massachusetts Equal Pay Act (MEPA) is legislation designed to ensure that all workers are paid equally for comparable work, regardless of gender. It strengthens protections against wage discrimination based on gender.

In addition, this Act restricts the employer from inquiring about a job applicant's salary history, with the following exceptions:

- The applicant willingly shares their previous salary

- The employer presents the applicant with a job offer that includes specified compensation

Disclaimer: This information serves as a concise summary and educational reference for Massachusetts state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.