Indiana Labor Law Guide

A comprehensive guide to Indiana labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways of Indiana Labor Laws

- Indiana’s minimum wage is set at $7.25 per hour.

- Indiana employers are not required to offer any rest or meal breaks.

- Nonexempt employees in Indiana are entitled to overtime pay equal to 1.5 times their regular pay for hours exceeding 40 in 1 workweek.

- Employees and employers can terminate a working relationship without cause following Indiana’s at-will employment doctrine.

- Indiana is a right-to-work state.

Minimum Wage Regulations in Indiana

Indiana’s minimum wage law in 2023 is aligned with federal regulations, with different rates for regular and tipped employees.

These minimum wage laws apply to employers with two or more employees. They ensure that all workers receive fair compensation for their labor, and noncompliance can result in penalties for the employer.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

All employers and employees should grasp these regulations to uphold a just and equitable work environment.

Regular Employees

A regular employee receives a fixed hourly wage or salary. Regular employees in Indiana are provided the current state minimum wage of $7.25 per hour.

[Source: U.S. Department of Labor]

Tipped Employees

Tipped employees like fast-food workers and baristas receive a base wage of $2.13 per hour and more than $30 per month in tips.

When you add tips to the base wage, it should total at least $7.25 per hour. If the tips don’t amount to at least $5.12 an hour, the employer should make up the difference.

Overtime Rules and Regulations in Indiana

A typical workweek comprises 40 hours. If an employee works more hours than that, they should receive overtime pay at a rate of at least 1.5 times their regular hourly wage.

Indiana does not have state-specific laws and instead adopts regulations by the federal Fair Labor Standards Act (FLSA).

Nonexempt Employees

Nonexempt employees encompass various categories, such as hourly workers, part-time staff and individuals in specific job roles or industries that do not fall under the exemptions provided by FLSA wage and hour regulations.

Nonexempt employees are eligible for overtime pay at 1.5 times their regular hourly wage for hours worked beyond the standard 40-hour workweek.

Employers in Indiana are responsible for accurately tracking and compensating nonexempt employees in accordance with federal guidelines.

Exempt Employees

Exempt employees receive a fixed salary regardless of their work hours and are not eligible for overtime pay.

Exempt employees in Indiana, similar to nonexempt employees, are subject to the federal minimum wage rate of $7.25 per hour or $684 per work week.

Employees are considered exempt when they meet specific criteria in terms of job responsibilities, salary and classification (executive, administrative, professional, etc.).

Employers must follow both federal and state labor laws to avoid potential legal complications such as wage and hour violations following misclassification.

At-Will Employment in Indiana

Indiana operates under employment-at-will principles, wherein either the employer or the employee can terminate the employment relationship at any time, with or without cause and notice, except for reasons prohibited by law and unless there is a specific employment contract in place.

Employers can also not terminate employees for reasons that violate state or federal laws, including legislative actions.

Right-To-Work Laws in Indiana

Indiana is a right-to-work state, which means that an employer cannot condition an employee’s right to work on their affiliation with a labor union or organization. Employers cannot impede employees’ rights to organize or engage in collective bargaining through labor organizations.

Rest and Meal Breaks in Indiana

Indiana labor laws do not require employers to provide specific rest and meal breaks for employees.

Indiana employers must adhere to federal rules, so although they are not obligated to provide breaks, they must pay employees for their work time and shorter breaks.

However, if an employer offers a more extended meal break where the employee is entirely relieved of duties, they don’t need to compensate the employee for that time.

Family and Medical Leave Laws in Indiana

Indiana labor laws mostly follow the federal Family and Medical Leave Act (FMLA), which provides eligible employees with up to 12 weeks of unpaid, job-protected leave in a 12-month period for specific family and medical reasons.

This allows eligible employees to take a leave in case of the following:

- Serious health condition: To address their own serious health condition, making it easier to prioritize their well-being

- Family care: To care for an immediate family member (spouse, son, daughter or parent) with a serious health condition

- Childbirth: For the birth and care of their newborn child

- Adoption: For adoption or foster care matters

- Military exigency: To address matters related to a family member’s active duty in the military (e.g., military-sponsored functions, financial and legal arrangements, alternative childcare, etc.)

- Military caregiver: To care for a family member in the military with a serious injury or illness (up to 26 weeks of leave in a 12-month period)

- Funeral: For bereavement

Other Leave Laws

Here’s a quick overview of various types of leave and how Indiana labor laws typically observe them:

- Vacation and holiday: Employers are not required to provide vacation benefits, sick leaves or holiday leaves, paid or unpaid.

- Jury duty: Employers are prohibited from taking adverse actions against employees who fulfill jury duty responsibilities, and employees should not be forced to use their paid leave for such service, except when not eligible for paid leave per company policies. Employers are not required to pay employees for time spent on jury duty.

- Voting: Indiana labor laws do not require employers to provide paid or unpaid leave to vote.

- Donor: State employees are entitled to up to 5 days of paid leave for bone marrow donor duty or 30 days for organ donor duty.

Workplace Safety and Health Regulations in Indiana

Establishing a safe and secure work environment requires giving workplace health and safety the top priority. Employers in Indiana are governed by a combination of federal and state laws pertaining to occupational health and safety.

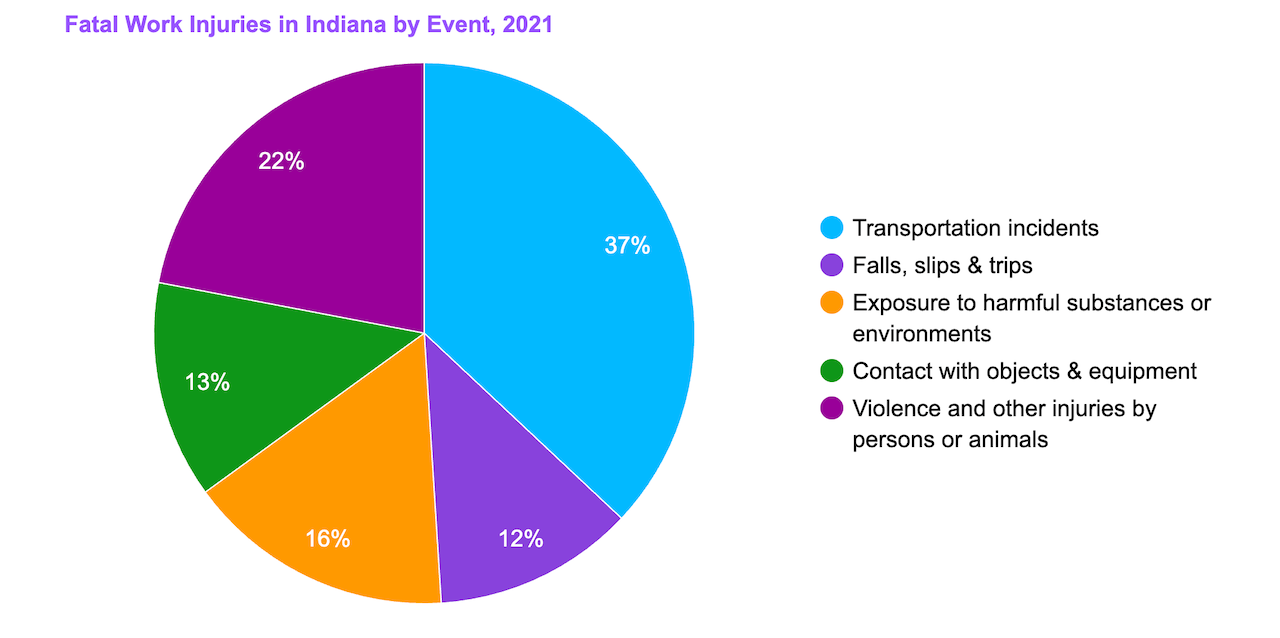

In the latest data, Indiana has recorded 157 fatal occupational injuries, most of which are related to transportation accidents.

[Source: U.S. Bureau of Labor Statistics]

You can see how Indiana compares to other states in the US when it comes to occupational fatal injuries by browsing our interactive map below.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Occupational Safety and Health

The two main divisions in the Indiana Department of Labor overseeing occupational and construction safety and health are Indiana’s Worker Safety Institute (INSafe) and the Indiana Occupational Safety and Health Administration (IOSHA).

Employee Protections

Indiana labor laws provide various protections for employees, including:

- Whistleblower protection: Indiana follows state and whistleblower laws that protect employees from retaliation or adverse consequences for reporting illegal or unsafe activities in the workplace.

- Wage payment: Employers should pay employees accurately, on time and at least semimonthly or biweekly. Employees also have the right to receive detailed pay stubs that outline deductions and earnings. Keep in mind that Indiana has a state income tax of 3.23%, with some counties having their own taxes.

- Workers’ compensation: You are covered by workers’ compensation as soon as your first day. This is an accident insurance program provided by your employer for medical, rehabilitation and income benefits should you be injured on the job.

- Union activity: Employees have the freedom to take part in lawful union activities and are not required to do so, and they are shielded from any form of employer retaliation for their involvement in union-related actions.

- Privacy rights: Employees have some expectations of privacy in the workplace, such as in their personal belongings or communications. Indiana also passed the Indiana Data Privacy Law, which limits the collection of personal data.

Antidiscrimination and Fair Employment Practices in Indiana

Promoting a workplace free from discrimination and ensuring fair employment practices are fundamental principles in Indiana labor law.

Discrimination in Indiana is defined as treating someone differently based on their race, religion, ancestry, gender, disability, national origin, and status as a veteran. Keep in mind that Indiana law does not include sexual orientation or gender identity in its indiscrimination law.

It’s essential to note that this only applies to employers who have six or more employees.

To report any employment discrimination, contact the Indiana Civil Rights Commission.

Other Antidiscrimination Laws

Indiana laws encompass other antidiscrimination laws designed to eliminate bias and promote equal opportunity in the workplace.

Military Protection

There shall be no discrimination following an individual’s military service.

Pregnancy Accommodation

An employee is welcome to request in writing any accommodation related to pregnancy, childbirth and other related medical conditions. However, an employer is not required to abide by this. As per Indiana’s Pregnancy and Childbirth Accommodation law, this applies to employers with 15 or more employees.

Background Checks

Indiana employers can ask employees about their criminal records—except for those sealed or restricted. Although criminal background checks are not compulsory for general employees, some positions would require them.

Job seekers can legally deny any criminal act with regard to sealed or restricted records. They also have the right to be informed if their background affects their eligibility for a job. Employers must establish a clear, written policy on prohibited criminal activities.

Independent Contractor Classification in Indiana

Properly classifying workers as employees or independent contractors is a critical consideration for Indiana employers, as misclassification may lead to legal and financial consequences.

Indiana courts consider several factors to determine if a worker is an employee or an independent contractor.

These factors include workers’ compensation, unemployment insurance, tax liability and common law.

Indiana follows the guidelines of the U.S. Internal Revenue Service, wherein “independent contractors” refer to professionals such as doctors, dentists, lawyers and others who offer services to the general public within their respective trade or profession.

In simpler terms, an individual is deemed an independent contractor if an employer has sole control over the work’s outcome, without dictating how the work is performed or what tasks are to be carried out.

To report employee misclassification, here are guidelines by the Indiana Department of Labor.

Official Holidays in Indiana

Full-time or part-time permanent employees in Indiana get holiday pay if they are in pay status during the holiday week.

Full-timers get 7.5 hours of time off or 7.5 times their hourly rate, and part-timers get pay based on one-tenth of their regular hours.

Those working on holidays can choose pay or time off, while those not working get holiday pay.

Some positions, as well as intermittent and temporary workers, do not qualify for this holiday compensation.

*For operations scheduled Monday–Friday

**For operations scheduled Saturday/Sunday

[Source: Indiana State Government]

Termination and Final Paychecks in Indiana

Employers in Indiana must pay unpaid wages to their employees within the next regular payday. Indiana has no state laws that require payment for unused benefits upon termination.

To avoid legal issues and guarantee a seamless transition for both employers and employees, it is crucial to comprehend the complexities of termination and final paycheck requirements.

When navigating Indiana labor laws and termination procedures, ensure you’re equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions tailored to your state’s tax laws.

Miscellaneous Indiana Labor Laws

Indiana labor laws encompass a variety of regulations that address specific aspects of employment and labor relations.

Immigration Verification

Indiana encourages employers to use E-Verify to verify employee eligibility. However, this is required for state agencies or political subdivisions.

Drug Testing

Indiana has no laws that restrict employers from performing drug tests on employees as long as the tests are not discriminatory or unlawful.

Smoking Laws

As per the Indiana Smoke-Free Air Law, smoking is prohibited in most workplaces, most public spaces, restaurants, areas within eight feet of any public entrance of said workplaces and public spaces and in any vehicle managed by the state during a governmental function.

Gun Laws

Indiana law permits employers to prohibit weapons in the workplace. Individuals with valid concealed handgun licenses to store firearms and ammunition in their private vehicles parked on their employer’s property, with specific storage requirements.

Summary of Indiana Labor Laws

Indiana's minimum wage is set at $7.25 per hour for regular employees and a base wage of $2.13 per hour for tipped employees, supplemented by tips to meet the minimum wage requirement.

Nonexempt employees are entitled to overtime pay at 1.5 times their regular hourly wage for hours worked beyond the standard 40-hour workweek.

The concept of at-will employment in Indiana is elucidated, emphasizing the flexibility for both employers and employees to terminate the employment relationship at any time, with or without cause, following the state's employment-at-will doctrine.

Antidiscrimination and fair employment practices promote a discrimination-free workplace, with a note that the state law does not currently include sexual orientation or gender identity in its antidiscrimination statutes.

Frequently Asked Questions About Indiana Labor Laws

For more info, find frequently asked questions about the labor laws in Indiana below.

What is the legal working age in Indiana?

The minimum employment age in Indiana is 14 years old. Occupations and work hours for minors are limited. Check Indiana’s notice on teen work hours for more information.

[Source: Indiana Department of Labor]

How many hours can you work in Indiana?

As per federal law and Indiana labor laws, eligible employees can work for 40 hours in a work week, and any time exceeding that counts as overtime.

Can you be fired without cause in Indiana?

As long as the termination is not due to discriminatory reasons, an employer in Indiana can fire an employee for any or no reason.

This is because Indiana is an employment-at-will state, which means that either the employer or the employee can end the employment relationship at any time and for any lawful reason without the need for prior notice or cause.

Who is exempt from overtime pay in Indiana?

Indiana follows the same regulations with regard to major exemptions. Some other exemptions include people under the age of 16, religious employees, medical interns and so on.

Do you need a work permit in Indiana?

You do not need a work permit in Indiana as an adult or a minor. Minors may be required to provide documents that prove their age.

Disclaimer: This information serves as a concise summary and educational reference for Indiana labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.