Illinois Labor Law Guide

A comprehensive guide to Illinois labor laws: Covering essential topics like minimum wage guidelines, overtime regulations, mandatory rest breaks, and other key employment provisions specific to the Prairie State.

Key Takeaways

- Illinois' minimum wage stands at $14 per hour

- The tipped minimum wage rate in Illinois is $8.40 per hour

- For work exceeding 40 hours in a week, overtime pay is calculated at 1.5 times the standard hourly rate

- Employers must provide an additional 20-minute meal break for each additional 4.5 hours an employee is scheduled to work for the day

- Employees who have worked for the state for at least 12 months qualify for family and medical leave

Minimum Wage Regulations in Illinois

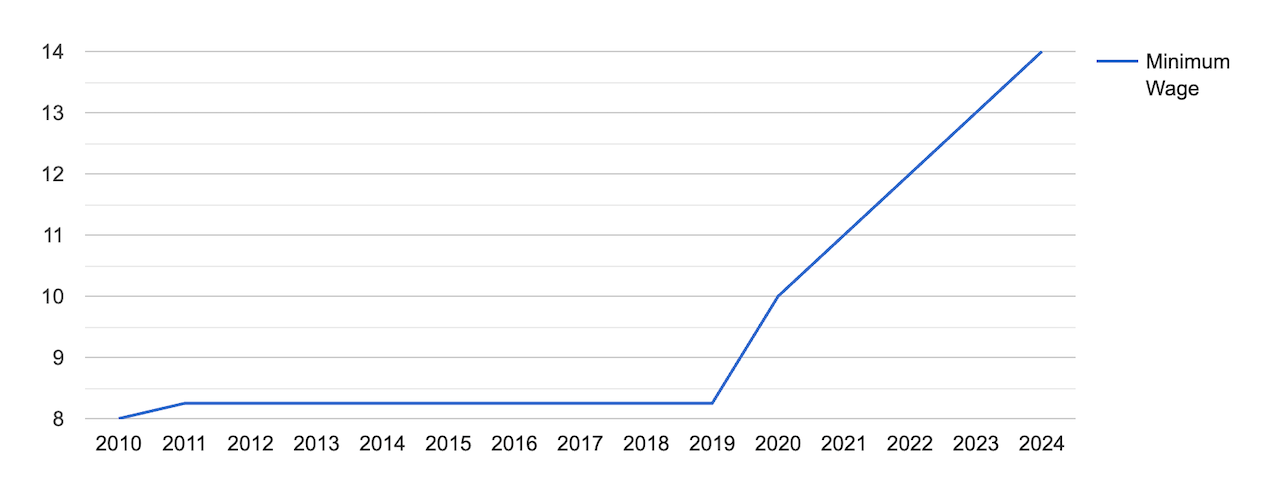

Starting January 1, 2024, Illinois' minimum wage stands at $14 per hour, significantly surpassing the Federal Minimum Wage of $7.25. In the city of Chicago, local minimum wage rates differ based on employer size.

Here's how the minimum wage in Illinois changed over the years:

[Source: FRED]

To learn how the minimum wage in Illinois compares to minimum wages in other states, check out the table below.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Tipped Minimum Wage

In Illinois, the rules regarding tipped minimum wage for workers like servers or bartenders align with the Federal Fair Labor Standards Act (FLSA) but with some state-specific provisions. The state of Illinois places a cap on the tip credit amount at 40% of the state minimum wage.

This means that employers can pay tipped employees less than the standard minimum wage, with the expectation that tips will make up the difference, up to a maximum of 40% of the state minimum wage.

As of January 1, 2024, the tipped minimum wage rate in Illinois is $8.40 per hour.

Exceptions to Minimum Wage Requirements

Certain categories of employees are exempt from minimum wage regulations based on their job duties. These categories include executives, learned and creative professionals, computer workers and administrative workers who earn less than $684 per week.

Outside sales workers are also exempt but there’s no minimum salary required.

Subminimum Wage

Under Illinois rules, new workers over 18 may be paid up to 50 cents per hour less than the standard minimum wage for the first 90 days of their employment. While the state minimum wage typically does not cover minor workers, there is an hourly exemption.

In 2024, Illinois enforces a subminimum wage of $12 for employed minors under 18, with scheduled increases to $13 in 2025.

The subminimum wage can only be applied if the minor works less than 650 hours per year; exceeding this, they must be paid the regular minimum hourly rate of $14.00.

Additionally, employers may request special permission from the state to employ certain mentally or physically handicapped workers at sub-minimum wage rates.

These requests are considered on an individual basis, and rates are determined accordingly. Try our easy-to-use Paycheck Calculator to determine the exact amount of money you’ll receive working in Illinois.

Overtime Rules and Regulations in Illinois

In Illinois, overtime pay is required for employees who work more than 40 hours in a workweek. Overtime compensation is set at 1.5 times the employee's regular rate of pay for hourly workers.

If you work more hours than usual in one week and fewer hours in the following week, your employer can't combine those two weeks to calculate your average hours for overtime pay.

Overtime pay is determined on a weekly basis, and you must be paid extra if you work more than a certain number of hours in a single week, regardless of how many hours you worked in previous weeks.

This rule ensures that you're compensated fairly for each week's work without spreading overtime hours across multiple weeks to avoid paying overtime rates.

Notably, Illinois does not require overtime compensation for time worked more than 8 hours per day, unlike some other states. Instead, overtime is specifically mandated for hours worked beyond 40 hours per workweek.

Overtime Exceptions and Exemptions

Illinois law differs from the federal standard by not recognizing the highly compensated exemption, which typically applies to those earning over $100,000 per year. Instead, Illinois law identifies its own set of exemptions, including:

- Salesmen and mechanics involved in selling or servicing cars, trucks or farm implements at dealerships

- Agricultural labor

- Executive, administrative or professional employees as defined by the FLSA

- Certain employees involved in radio/television in a city with a population under 100,000

- Commissioned employees defined by FLSA Section 7(I)

- Employees who exchange hours under a workplace exchange agreement

- Independent contractors or workers with employment contracts

- Employees of certain educational or residential childcare institutions

Rest and Meal Breaks

In Illinois, employers are required to provide an unpaid meal break to employees who are scheduled to work at least 7.5 hours on a particular day.

As of January 1, 2023, employers must now provide an additional 20-minute meal break for each additional 4.5 hours an employee is scheduled to work for the day.

Unlike the previous provision, the new law does not mandate that the break must be taken by a specific time. The Illinois Department of Labor specifies that the second break must start after 5 hours and within 10 hours from the start of the workday.

There are penalties for non-compliance with meal break regulations. The penalties have been updated with the recent amendments:

- For employers with fewer than 25 employees, the penalties can be up to $250 per offense

- For employers with 25 or more employees, the penalties double, and they can be up to $500 per offense

Illinois law also mandates a "One Day Rest in Seven Act," which requires employees to have a minimum of 24 hours of time off every calendar week. A calendar week is defined as seven consecutive 24-hour periods starting at 12:01 a.m.

Sunday morning and ending at midnight the following Saturday. Starting on January 1, 2024, Illinois will implement a mandatory paid time off law, known as the Paid Leave for All Worker Act.

The law applies to most employers, with exceptions for contractors, railway workers and employees under collective bargaining agreements.

Here are the key points that come with the new law:

- Employees will earn one hour of paid time off for every 40 hours worked, which can be used for various reasons, including vacation and sick leave.

- Employees can earn a maximum of 40 hours of paid time off each year and can carry over up to 40 hours to the next year unless the employer provides the full 40 hours at the start of the year.

- Employees are not required to give a reason for taking leave, but if the leave is foreseeable, employers can require seven days' notice.

- Employers can also require employees to wait 90 days from the start of the year before using any accrued leave.

Family and Medical Leave Laws in Illinois

Employees who have worked for the state for at least 12 months qualify for family and medical leave under conditions similar to the federal Family Medical Leave Act (FMLA).

FMLA allows eligible employees to take up to 12 weeks of unpaid leave in a 12-month period for various qualifying reasons, including the birth or adoption of a child, caring for a seriously ill family member or addressing their health conditions.

The Illinois Religious Freedom Protection and Civil Union Act may impact leave taken under Illinois law for those in civil unions, so consulting with an employment attorney is advisable.

Types of Leave Under Illinois Law:

- Parental and family leave: Employees may request child care leave for adoption or parental reasons, such as caring for a seriously ill child or facing serious family dilemmas. Adoptions, maternity, paternity and adoption leaves are limited to one leave per family per year.

- Maternity Leave: Female employees who pre-certify their pregnancies within the first 20 weeks are eligible for four weeks (20 work days) of paid maternity leave. Pre-certification for a spouse's pregnancy entitles the employee to three weeks (15 work days) of paid leave.

- Family responsibility leave: Employees can receive one year of leave for various family responsibilities, such as nursing care for a newborn infant, caring for a temporarily disabled or incapacitated household member or settling the estate of a deceased family member.

- Organ donation: Employees with at least six months of employment can take paid leave for organ, bone marrow, blood or blood platelet donations.

- Family military leave: Employees who have worked for at least one year can take unpaid leave when their family members are called to military service, with the amount of leave varying based on company size.

- Domestic violence leave: Under the Illinois Victims' Economic Security and Safety Act (VESSA), employers with more than 15 employees must provide employees who are victims of domestic or sexual violence or have family members who are victims, with unpaid leave to address issues arising from such violence. Employers with more than 50 employees must provide at least 12 weeks of unpaid leave.

Exceptions to the Illinois Paid Leave Program

Illinois Paid Leave Laws (PLAWA) generally applies to all employers with at least one employee in the state, but there are some exceptions:

- Employees in the construction and parcel delivery industry who are covered by a collective bargaining agreement are excluded from PLAWA coverage

- Independent contractors

- Employers that are already covered by municipal or county ordinances requiring paid leave, such as paid sick leave (e.g., if an employer is subject to the paid leave mandates in Chicago or Cook County, compliance with those ordinances may fulfill the obligations under PLAWA)

Family Members That Qualify for Paid Leave Care

Family members are typically recognized for various forms of leave, including caregiving and family-related situations:

- Child

- Stepchild

- Spouse

- Domestic partner

- Sibling

- Parent

- Mother-in-law

- Father-in-law

- Grandchild

- Grandparent

- Stepparent

Salary During Paid Leave

At the moment, Illinois doesn’t have a statewide law that mandates a specific rate of pay for employees on paid leave. But starting on March 31st, 2024, the Paid Leave for All Workers Act will be effective.

This act mandates that while on leave, employees will receive their full wage and tipped workers will be paid at least the minimum wage in their respective locale, ensuring that their income remains stable and equitable during their time away from work.

Workplace Safety and Health Regulations in Illinois

In Illinois, workplace safety and health regulations are governed by Illinois OSHA (Occupational Safety and Health Administration).

Illinois OSHA is responsible for enforcing occupational safety and health standards in the state. Compliance officers conduct workplace inspections, and citations are issued for violations of these standards.

Illinois OSHA covers all state and local government workers within the state. However, it does not extend to federal government workers, including those employed by the United States Postal Service and civilian workers on military bases.

Federal OSHA standards apply to federal government workers and private-sector employers in Illinois. Inspections can be initiated through regular scheduling, reports of imminent danger, incidents involving fatalities, worker complaints or referrals.

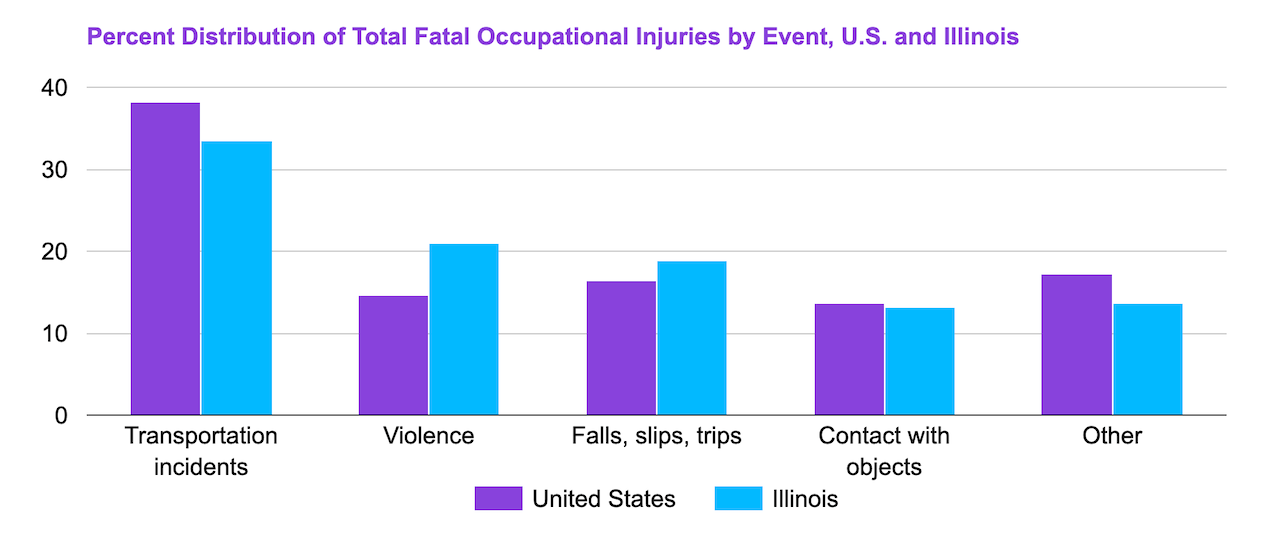

Here is the overview of fatal workplace injuries in the United States and Illinois in 2021:

[Source: U.S. Bureau of Labor Statistics]

This chart is interactive. Hover your mouse over different parts of the chart to see detailed data.

Anti-Discrimination and Fair Employment Practices in Illinois

In Illinois, anti-discrimination and fair employment practices are protected by both state and federal laws.

Here's a breakdown of these regulations:

- Illinois Human Rights Act: Serves as a robust protection against discrimination in various areas, including employment. It prohibits discrimination on the basis of several factors, such as race, color, religion, gender, military status, age, marital status, sexual orientation, disabilities and more.

- Title VII, Civil Rights Act of 1964: This federal law applies to employers with 15 or more employees and addresses discrimination based on race, color, national origin, religion, or gender. It covers all aspects of employment terms and conditions, emphasizing equal treatment for all.

- Equal Pay Act: This act requires employers to provide equal pay for substantially similar work, regardless of gender. While it promotes "equal pay for equal work," it doesn't address differences in pay due to factors like religion or race.

- Pregnancy Discrimination Act: Employers are prohibited from discriminating based on pregnancy and must offer accommodations to pregnant employees in specific situations.

- Americans With Disabilities Act (ADA): ADA requires employers with over 15 employees to provide "reasonable accommodations" for individuals with physical or mental disabilities that significantly limit life activities.

- Age Discrimination in Employment Act (ADEA): ADEA safeguards individuals aged 40 and older from age-based discrimination in hiring, firing, and promotions.

Independent Contractor Classification in Illinois

In the state of Illinois, the classification of an independent contractor is typically based on the same principles as those at the federal level, following the Internal Revenue Code (IRC) guidelines.

Key factors in determining independent contractor status in Illinois include:

- Behavioral control: An independent contractor has the freedom to perform their work without direct control or supervision from the employer. They decide how, when, and where to complete the work.

- Financial control: Independent contractors typically have control over the financial aspects of their business activities.

- Type of relationship: The nature of the relationship between the individual and the employer is essential. Factors such as the existence of a written contract, the provision of employee benefits, the permanency of the relationship, the right to terminate the relationship and the extent to which the services are integral to the employer's regular business activities are considered.

Termination and Final Paycheck Laws in Illinois

Employees in Illinois are entitled to receive their final paychecks promptly after leaving their job, whether through termination, resignation or other means.

According to the Illinois Wage Payment and Collection Act, employers must provide the final paycheck no later than the next scheduled payday.

Employers in Illinois typically have the flexibility to choose the payment method for the final paycheck. While traditional physical checks are common, employers can also use direct deposit if the employee agrees to this method.

Importantly, an employer cannot mandate that an employee receives their final paycheck through direct deposit. The choice of payment method lies with the employee.

The Illinois Wage Payment and Collection Act primarily covers private employees and local government units.

However, it excludes state and federal employees from its protections. If you are a state or federal government employee, you should refer to the specific regulations and protections governing your employment status.

Summary of Illinois Labor Laws

Illinois labor laws encompass minimum wage regulations, with a minimum wage of $13.00 per hour ($15 in Chicago) and provisions for tipped employees.

Overtime pay is mandated for hours worked beyond 40 in a week and compensated 1.5 times your regular hourly wage.

Rest and meal breaks are required, with penalties for non-compliance. Family and medical leave laws align with federal standards, and anti-discrimination laws protect against various factors.

Independent contractor classification in Illinois follows IRS guidelines, focusing on behavioral and financial control, and final paychecks must be provided promptly, with payment method choice given to the employee.

FAQs about Illinois Labor Laws

Here are the answers to some of the most frequently asked questions about Illinois labor laws.

How many working hours are considered full-time in Illinois?

In Illinois, a full-time employee is defined as an individual who is employed for a basic wage for at least 35 hours each week or who renders any other standard of service generally accepted by industry custom or practice as full-time employment.

Therefore, in Illinois, working at least 35 hours per week is considered full-time employment.

Is it illegal to work 7 days a week in Illinois?

Under normal circumstances, employees should not be required to work more than 6 consecutive days in a row.

However, in cases of emergencies or extenuating circumstances, an employer can seek a waiver from the Illinois Department of Labor to allow employees to work seven consecutive days.

Can you work 14 days in a row in Illinois?

Employees in Illinois are generally not allowed to work more than 6 days in a row. They are entitled to one 24-hour rest period within 7 consecutive days.

This means that working 14 days in a row without a rest period would typically not comply with Illinois labor laws unless specific exceptions or waivers have been granted in extenuating circumstances.

Can you be forced to work overtime in Illinois?

In Illinois, employers have the authority to demand that employees work overtime, even with minimal advance notice. There are no state or federal laws in Illinois that impose restrictions on the maximum number of hours a standard employee can be compelled to work.

However, it's worth keeping in mind that there is a requirement under the "One Day Rest in Seven Act" that ensures employees are entitled to at least one day of rest in a seven-day period.

Can your employer change your schedule without notice in Illinois?

An employer in Illinois may change an employee's work hours without giving prior notice or obtaining the employee's consent unless there is a prior agreement between the employer and the employee or the employee's representative that dictates otherwise.

Disclaimer: This information serves as a concise summary and educational reference for Illinois state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.