Hawaii Labor Law Guide

A comprehensive guide to Hawaii labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

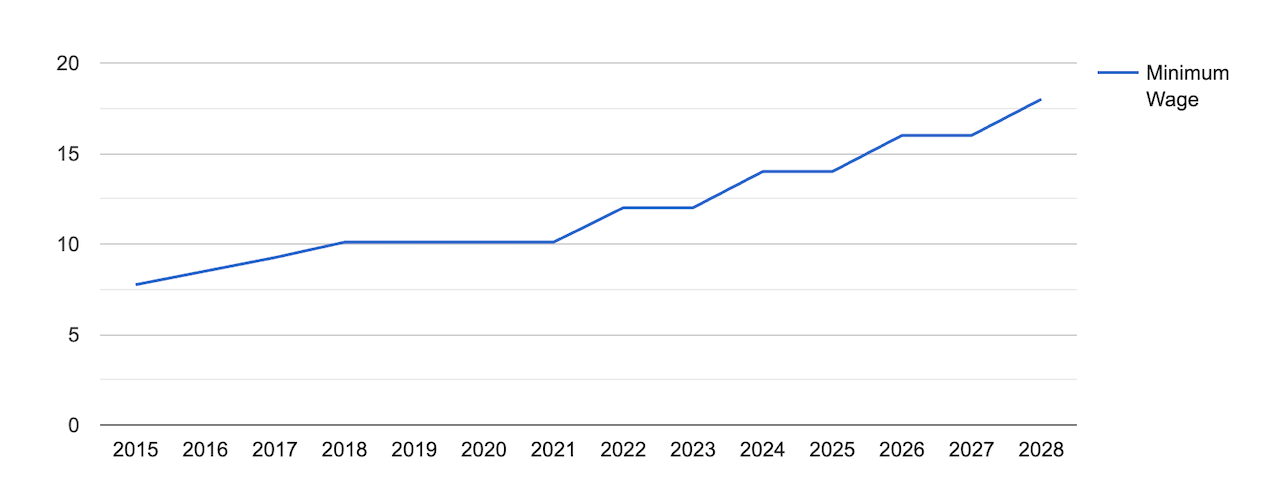

- The minimum wage of regular employees in Hawaii is currently at $14.00 per hour, but it is set to increase incrementally.

- Overtime rules differ between nonexempt and exempt employees based on their roles and salaries.

- Specific break regulations apply to minors, while there are no stipulated rest or meal break requirements for adult employees.

- Family and Medical Leave Laws provide support for significant life events.

- Termination procedures vary for voluntary and involuntary separation.

Minimum Wage Regulations in Hawaii

Hawaii’s minimum wage regulations are designed to protect the rights of workers and ensure fair compensation. These regulations apply differently to regular employees and tipped employees.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

The minimum wage for regular employees is currently at $14 per hour but is set to incrementally increase to:

- At least $16 per hour beginning January 1, 2026

- At least $18 per hour beginning January 1, 2028

[Source: FRED]

This graph is interactive. Hover your mouse over different parts of the map to see detailed data.

Tipped Employees

Employers are allowed to pay tipped employees, such as restaurant servers, a lower base wage than the standard minimum wage if certain conditions are met. Specifically, if a tipped employee consistently receives over $20 per month in tips and the total of their wages and tips surpasses the minimum wage set by law, this reduced base wage is permissible.

The aim is to ensure that tipped employees still earn at least the minimum wage when considering both their base wage and tips, as illustrated in the table below.

[Source: State of Hawaii Department of Labor and Industrial Relations]

Overtime Rules and Regulations in Hawaii

Overtime rules and regulations are critical for protecting workers' rights and ensuring fair compensation for their extra hours of work. In Hawaii, these rules apply differently to nonexempt and exempt employees.

Nonexempt Employees

Hawaii's labor laws mandate that nonexempt employees (those who are eligible for overtime pay) receive compensation at a rate of 1.5 times their regular rate for all hours worked in excess of 40 hours in a workweek.

Exempt Employees

Under Hawaii Wage and Hour Law, certain employees may be classified as exempt from overtime and minimum wage provisions based on their job duties, responsibilities and salary level.

Exempt employees include:

- Those engaged in executive, administrative, supervisory or professional roles, as well as those serving as outside salespersons or collectors

- Employees who receive a guaranteed compensation of $2,000 or more per month, regardless of whether they are paid on a weekly, biweekly or monthly basis

Break Periods in Hawaii

Break periods in Hawaii are primarily governed by the Hawaii Child Labor Law, specifically aimed at ensuring the well-being of minors in the workplace. For minors aged 14 and 15, Hawaii labor laws require employers to provide a minimum of a 30-minute rest or meal break after five consecutive hours of work.

In contrast to the specific requirements for minors, Hawaii labor laws don’t stipulate rest or meal break regulations for adult employees. However, employers are encouraged to consider the well-being and productivity of their workforce and may choose to provide rest breaks as part of their employment practices.

Family and Medical Leave Laws in Hawaii

Hawaii recognizes the importance of supporting its employees during significant life events and difficult situations. Two essential leave laws, the Hawaii Family Leave Law and the Hawaii Victim Leave Law, offer crucial protections and opportunities for eligible employees.

Hawaii Family Leave Law

Under the Hawaii Family Leave Law, eligible employees have the right to receive up to four weeks of unpaid, job-protected leave for the birth or adoption of a child or caring about their child, spouse or parent with a serious health condition.

To qualify for this leave, an employee must have at least six consecutive months with the State, and the employer must have 100 or more employees.

During this leave, accrued paid leaves may be used to substitute for any part of the four-week period. If the employer offers paid sick leave, employees can use up to ten days of accrued and available sick leave per year, unless a collective bargaining agreement provides for more than ten days.

Hawaii Victim Leave Law

As prescribed in the Victim Leave Law, employers with 50 or more employees must grant up to 30 days of unpaid victim leave per year, while employers with fewer than 50 employees must provide up to five days of unpaid leave per year to employees or their minor children who are victims of domestic or sexual abuse.

This leave can be used for the following purposes:

- Seeking medical attention

- Accessing victim services

- Receiving counseling

- Relocating

- Taking legal action related to the violence

Workplace Safety and Health Regulations in Hawaii

The Hawaii Occupational Safety and Health Law serves as the primary framework for workplace safety and health regulations in the state. The Hawaii Occupational Safety and Health Division (HIOSH), operating under the state's Department of Labor and Industrial Relations, is responsible for administering and enforcing these regulations.

Key aspects of HIOSH regulations include:

- Confidential reporting: HIOSH allows employees to confidentially report workplace hazards without revealing their identity to employers. This provision encourages open reporting of safety concerns.

- Inspections: HIOSH conducts inspections to identify workplace hazards and ensure compliance with safety and health standards. Employers are required to address identified hazards promptly.

- Citations: Employers who fail to rectify identified hazards may receive citations. These citations must be posted at or near the location of the alleged violation for employee awareness.

- Corrective action: Employers are obligated to correct workplace hazards by the specified deadline and certify that the hazards have been mitigated.

- Employee rights: Employees have the right to be informed about HIOSH citations and participate in inspections when appropriate.

The last known data show there have been 15 fatal occupational injuries in the state of Hawaii.

You can see how Hawaii compares to other states in the US when it comes to occupational fatal injuries by browsing our table below.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Anti-Discrimination and Fair Employment Practices in Hawaii

In the state of Hawaii, employees have the right to be free from employment discrimination. This protection applies to all job applicants, employees in private and public sectors, union members and those seeking employment through agencies.

Discrimination based on various factors, such as race, sex, gender identity, sexual orientation, age, religion, disability and more, is strictly prohibited.

If an employee experiences discrimination, they can file a complaint with the Hawaii Civil Rights Commission within 180 days. Additionally, they are protected from any retaliation or discriminatory actions by their employer for reporting discrimination.

Independent Contractor Classification in Hawaii

The distinction between employees and independent contractors is significant because it affects various aspects of labor law, including tax obligations, workers' compensation and employment benefits.

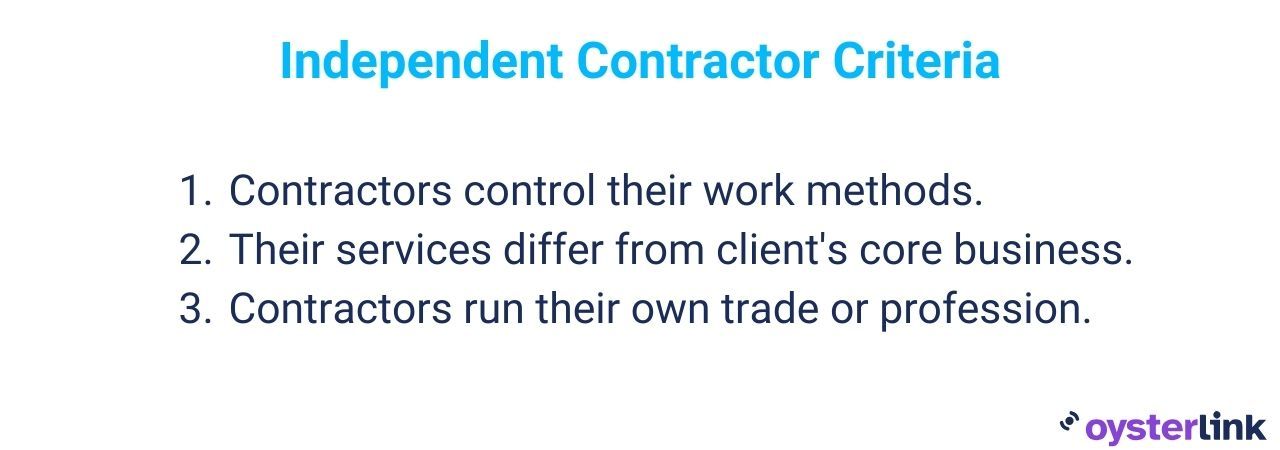

In Hawaii, the classification of workers as independent contractors is governed by the following criteria and guidelines to determine their status for employment purposes:

- Control over work: Independent contractors must exercise a significant level of control over how their work is performed. This means that they determine the methods and procedures for completing tasks, with minimal direction from the client.

- Distinctive business activities: The work performed by the individual should be outside the usual scope of the client's regular business operations. Additionally, the services may be rendered away from the client's premises.

- Independently established trade or profession: Independent contractors typically engage in an independently established trade, occupation, profession or business that aligns with the nature of the contracted services. This indicates they operate as distinct business entities.

Hawaii provides a list of 20 factors to assist in assessing an individual's independent contractor status. These factors serve as guidelines and consider the nature of the working relationship, control and other relevant aspects.

Not all factors need to be met and their significance may vary based on the specific job and circumstances. The factors include considerations such as control over work methods, flexibility in scheduling, provision of tools and materials and the ability to earn a profit or incur a loss.

In Hawaii, misclassifying employees as independent contractors can lead to legal consequences, including:

- Tax-related issues

- Employees not receiving the compensation they are legally entitled to

- Employees not getting proper coverage in case of injuries

- Employees being denied benefits such as health insurance, retirement plans and paid leave

- Employers facing legal penalties and fines for misclassification

- Employers being required to pay back wages and benefits owed to misclassified employees

Termination and Final Paychecks in Hawaii

In Hawaii, private sector employees are generally employed at will, meaning that either the employer or the employee can terminate the employment relationship at any time, with or without cause, as long as it's not for discriminatory or unlawful reasons.

Now, let's explore the differences between voluntary and involuntary separation, as well as immediate termination.

Voluntary Separation

Voluntary separation occurs when an employee decides to resign or quit. In such cases, employers in Hawaii must follow these guidelines for final paychecks:

- If the employee provides at least one pay period's notice before resigning, their final paycheck should be issued on their last day of work.

- If the employee resigns without providing at least one pay period's notice, the final paycheck must be provided no later than the next regularly scheduled payday.

Involuntary Separation

Involuntary separation is initiated by the employer and may involve firing an employee due to poor performance or layoffs. Hawaii's final pay rules for involuntary separation are as follows:

- Employers must pay all earned wages in full to the terminated employee on their effective date of termination.

- If circumstances prevent immediate payment on the effective date, final paychecks must be given no later than the next working day.

When navigating Hawaii labor laws and termination procedures, ensure you're equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state's tax laws.

Summary of Hawaii Labor Laws

Hawaii's comprehensive labor laws protect various workplace aspects. The minimum wage gradually increases for regular and tipped employees, while overtime rules apply differently to nonexempt and exempt employees based on roles and salaries. When it comes to break regulations, they cater to minors but not adult employees.

Family and Medical Leave Laws offer support during significant life events, while workplace safety is overseen by the Hawaii Occupational Safety and Health Division. Moreover, anti-discrimination laws safeguard employees from bias.

Lastly, termination procedures vary for voluntary and involuntary separation, and the state has clear guidelines for classifying independent contractors.

Frequently Asked Questions About Hawaii Labor Laws

Does Hawaii have right-to-work laws?

"Right-to-work" laws are found in approximately half of all U.S. states, and they prevent unions and employers from making union membership or dues payment a job requirement. Hawaii, however, does not have right-to-work laws. Instead, the state laws safeguard employees' rights to self-organize, form unions and protect these rights from interference.

Are lunch breaks required in Hawaii?

Hawaii labor laws do not mandate lunch breaks for adult employees. However, minors aged 14 and 15 are entitled to a minimum 30-minute rest or meal break after working for five consecutive hours.

Is it illegal to talk about wages in Hawaii?

Hawaii labor laws do not prohibit discussing wages. Employers cannot retaliate against employees who reveal, discuss or inquire about their own or their colleagues' wages.

What is the maximum number of hours you can work in Hawaii?

Hawaii labor laws do not specify the maximum number of hours that an adult employee can work in a day. However, overtime pay must be provided for nonexempt employees who work over 40 hours in a workweek.

Is 30 hours full-time in Hawaii?

Hawaii's wage laws do not specify criteria for determining full-time or part-time employee status, leaving it to the employer's discretion. However, if you work a minimum of 20 hours per week, your employer is obligated to offer specific benefits under the Hawaii Prepaid Health Care Law.

Can you get fired for calling in sick in Hawaii?

Hawaii is an "at-will" employment state, which means that employers can generally terminate employees for any reason, including calling in sick, as long as it's not for discriminatory or unlawful reasons. However, there may be protections under the Hawaii Family Leave Law, which allows employees to take unpaid, job-protected leave for certain medical reasons.

Disclaimer: This information serves as a concise summary and educational reference for Hawaii state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.