Georgia Labor Law Guide

A comprehensive guide to Georgia labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- Georgia's minimum wage is set at $5.15 per hour

- Tipped employees must receive at least $2.13 per hour in base pay

- Total earnings for tipped employees must meet or exceed $7.25 per hour, otherwise, employers are required to compensate the difference

- Employees earn 1.5 times their regular rate for hours over 40 in a workweek

- While not mandated by FLSA or state law, short breaks of up to 20 minutes are common practice

- Federal law allows up to 12 weeks of unpaid leave per year for certain family and medical reasons

- Minors under 16 need a work permit and must get a 30-minute break if working over 4.5 consecutive hours

Minimum Wage Regulations in Georgia

In Georgia, the minimum wage is $5.15 per hour.

However, the federal minimum wage rate of $7.25 per hour applies to most employees in Georgia, with some limited exceptions, such as smaller businesses not covered by the Fair Labor Standards Act (FLSA) that have annual sales of less than $500,000 and do not engage in interstate commerce.

This applies to most employees, as the FLSA covers any enterprises with an annual volume of sales or business done of at least $500,000 or ones that engage in interstate commerce.

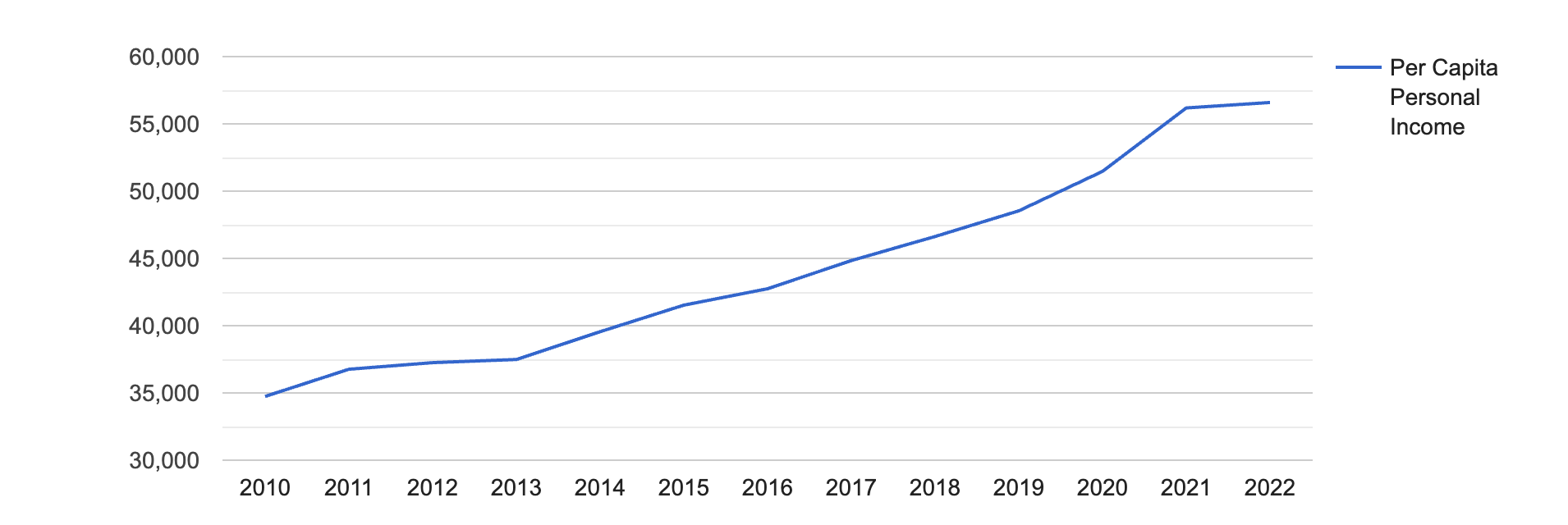

While Georgia's minimum wage may be perceived as modest, there is a consistent upward trend in per capita personal income within the state, as shown in the graph below.

[Source: FRED]

You can also compare the Georgia minimum wage with the minimum wage in other US states by interacting with the map below.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Tipped Employees

In Georgia, tipped employees are required to receive a base pay of at least $2.13 per hour directly from their employer, as long as their tips bring their total earnings up to the federal minimum wage of $7.25 per hour.

If their base pay — including tips — does not equal the federal minimum wage, their employer must pay the difference.

Tip pooling is not required by law in Georgia. However, employers can implement a tip pooling arrangement among employees who regularly receive tips.

This typically includes workers such as bartenders, servers and other front-of-house staff in the restaurant industry.

Overtime Rules and Regulations in Georgia

Overtime pay is structured to offer employees additional compensation for their efforts, ensuring fair compensation when they dedicate extra time to fulfill job responsibilities beyond the standard workweek.

In Georgia, overtime pay is calculated at a rate of 1.5 times the regular hourly wage for any hours worked beyond 40 in a single workweek.

Nonexempt Employees

According to the FLSA, non-exempt employees are entitled to overtime pay.

Non-exempt employees are those who do not meet the FLSA's criteria for exemption from overtime pay requirements.

These criteria typically depend on the type of work performed, the employee's salary and their level of responsibility.

Exempt Employees

Exempt employees in Georgia, just like in the other states in the United States, are not entitled to overtime pay under the FLSA. Exempt positions are typically executive, administrative and professional roles.

Break Periods in Georgia

Neither the FLSA nor state law mandates that employees receive breaks or meal periods. However, it's common for employers to offer short breaks, usually lasting between 5 and 20 minutes.

Family and Medical Leave Laws in Georgia

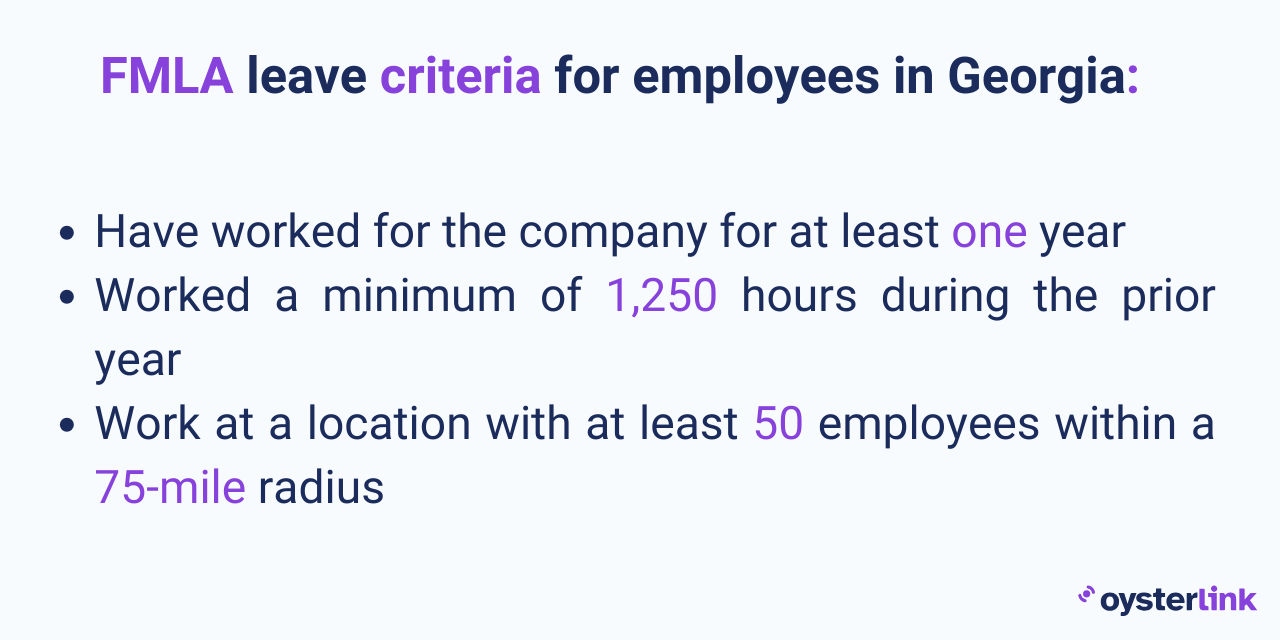

In Georgia, family and medical leave is primarily governed by federal law or the Family and Medical Leave Act (FMLA). The FMLA provides eligible employees with up to 12 weeks of unpaid leave per year for certain family and medical reasons.

To be eligible for FMLA leave, an employee must:

- Work for an employer that has 50 or more employees within a 75-mile radius of the workplace

- Have worked for the employer for at least 12 months (not necessarily consecutively)

- Have worked at least 1,250 hours during the 12 months immediately preceding the start of the leave

Eligible employees can use their leaves for the following reasons:

- Care for their newborn child within one year of birth

- Child adoption or foster care within one year of placement

- Taking some time off work because of a serious health condition

- Care for an immediate family member (spouse, child or parent) with a serious health condition

- Care for an immediate family member who is on active duty or called to active duty status in the National Guard or Reserves

Child Labor Laws in Georgia

Child labor laws in Georgia are designed to protect the safety and well-being of minors while they work and ensure that work does not interfere with their education.

These laws address the hours that minors can work and the types of employment they can engage in.

Work Permits

Minors under the age of 16 must obtain a work permit, also known as an employment certificate, before they can begin work.

Age Restrictions

- Children under the age of 12 cannot be employed. Exceptions are made for businesses owned by the child's parents or guardians and minor chores around private homes.

- Children who are 12 and 13 years old can work in occupations not prohibited by the Department of Labor, but only with written parental consent.

- Children who are 14 and 15 years old have more employment options but are still restricted from working in certain hazardous occupations, such as the agriculture or construction industry.

Working Hours and Maximum Number of Hours Children Can Work

In Georgia, the maximum number of hours a minor can work will depend on the minor's age, whether or not school is in session, and the type of work being performed.

Minors 14-15 years of age:

- When school is in session: They can work up to 4 hours on school days, 8 hours on non-school days, and a maximum of 40 hours during non-school weeks, but not during school hours (between 7 a.m. to 7 p.m., extended to 9 p.m. from June 1 through Labor Day).

- When school is not in session: They can work up to 8 hours per day and up to 40 hours per week, and they may work between the hours of 6 a.m. and 9 p.m.

Minors 16-17 years of age:

- There are no hour restrictions for 16- and 17-year-old workers when school is not in session. However, during the school term, they may not work during school hours unless they are enrolled in a work-study program or have completed high school.

Breaks:

- Georgia law requires a 30-minute break for any minor who works more than four and a half consecutive hours.

Workplace Safety and Health Regulations in Georgia

Workplace safety and health in Georgia are regulated by both federal and state laws. The primary federal law governing workplace safety is the Occupational Safety and Health Act (OSHA).

Private sector employers and employees in the state are covered by the federal OSHA jurisdiction and must adhere to national safety and health standards.

Federal OSHA provides guidance, support and enforcement to ensure employers provide a safe and healthful workplace for their employees.

Employers are required to provide a workplace free of recognized hazards, provide training, and keep records of any workplace injuries and illnesses.

On the other hand, the Georgia Department of Public Health's Occupational Health Surveillance Program is designed to monitor the incidence of work-related injuries and illnesses, identify the risks associated with them and develop strategies to prevent these injuries and illnesses.

This program is not federally funded or governed by federal OSHA standards. The state program requires public employers to provide information to their employees about hazardous chemicals they may be exposed to at work.

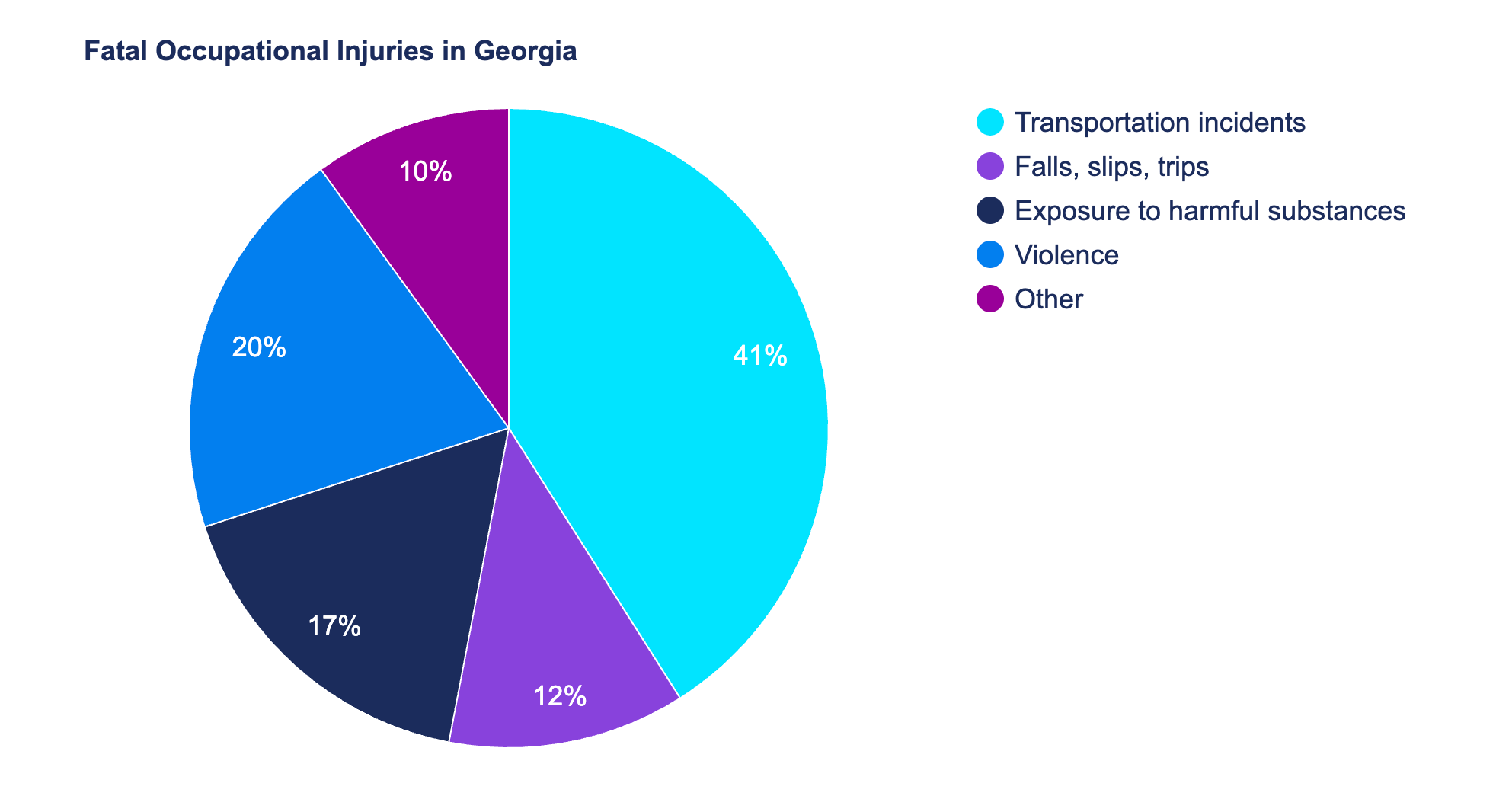

Based on the most recent data, there have been 187 fatal occupational injuries in Georgia.

[Source: U.S. Bureau of Labor Statistics]

This number is significantly higher than the average number of fatal injuries, which is approximately 85 across all 50 states plus Washington, D.C.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Anti-Discrimination and Fair Employment Practices in Georgia

Anti-discrimination and fair employment practices in Georgia are governed by a combination of federal laws and state regulations.

While Georgia does not have a comprehensive state statute that covers all aspects of employment discrimination, it does adhere to federal guidelines and provides additional protections through various state laws and policies.

The Georgia Fair Employment Practices Act (FEPA) specifically protects state employees and applicants for state employment from discrimination based on race, sex, age, disability, national origin, color or in retaliation for opposition to prohibited practices or participation in the complaint process.

Georgia law also requires equal pay and opportunity for all state employees, regardless of sex.

In the workplace, these laws ensure that employers cannot make job decisions, such as hiring, firing, promotion or pay, based on a person's protected characteristics.

Employers are also required to provide reasonable accommodation for employees with disabilities unless doing so would cause undue hardship to the business.

In addition to anti-discrimination laws, fair employment practices in Georgia also entail the enforcement of laws that protect against sexual harassment and ensure workplace safety and health, as previously mentioned.

If an individual believes they have been discriminated against, they may file a complaint with the U.S. Equal Employment Opportunity Commission (EEOC), the federal agency that enforces these laws.

On the other hand, state employees can turn to the Georgia Commission on Equal Opportunity (GCEO), which is responsible for enforcing the state's Fair Employment Practices Act.

Termination in Georgia

Georgia is an at-will employment state, in which the absence of a written employment contract or collective bargaining agreement, allows employers to terminate employees at any time and for any reason, except for an illegal reason, without notice or cause.

In addition, employees are free to leave their job at any time without reason or notice.

However, there are exceptions. For example, if an employee is fired because they filed for workers’ compensation, they can take legal action. State law clearly forbids firing someone for this reason.

Final Paychecks in Georgia

Since state law doesn't provide specific guidelines for how to pay an employee's final wages after they leave the company, employers should follow the FLSA.

This requires them to provide the final paycheck on the next scheduled payday, regardless of whether the employee resigned or was terminated.

To better understand the state’s termination laws better, it’s key to grasp your financial situation.

Leverage our Paycheck Calculator, which can help you estimate your net pay after taxes and deductions based on Georgia’s tax regulations.

Summary of Georgia Labor Laws

In Georgia, the minimum wage is $5.15 per hour. But for most businesses, excluding smaller ones not covered by the Fair Labor Standards Act (FLSA) with annual sales under $500,000 and no interstate commerce involvement, the federal minimum wage rate of $7.25 per hour applies.

The state enforces that tipped employees must get a minimum base pay of $2.13 per hour from their employer, as long as their tips add up to reach the federal minimum wage of $7.25 per hour.

If their combined pay (base pay + tips) falls short of the federal minimum wage, the employer must make up the difference.

In Georgia, if the employee works more than 40 hours in a workweek, they will be paid 1.5 times their regular hourly wage for those extra hours.

Both the FLSA and state law do not require employees to receive breaks or meal periods. However, many employers commonly provide short breaks, typically lasting from 5 to 20 minutes.

In Georgia, family and medical leave is mainly regulated by federal law known as the Family and Medical Leave Act (FMLA). The FMLA allows eligible employees to take up to 12 weeks of unpaid leave per year for specific family and medical reasons, such as caring for a newborn.

Regarding child labor laws, minors who are under 16 years of age require a work permit before they can start working. The state law also mandates a 30-minute break for minors working over four and a half consecutive hours.

The state aligns with the Occupational Safety and Health Act (OSHA) regarding employees' workplace safety and health.

The Georgia Fair Employment Practices Act (FEPA) offers protection against discrimination to state employees and applicants for state employment. It covers factors such as race, sex, age, disability, national origin and color.

Georgia is an at-will employment state, meaning that unless there is a written employment contract or a collective bargaining agreement in place, employers can terminate employees without notice or cause, as long as it's not for an illegal reason.

Likewise, employees have the freedom to quit their job at any time without providing a reason or notice.

In Georgia, the final paycheck must be given on the next scheduled payday, whether the employee quits or is let go.

Frequently Asked Questions About Georgia Labor Laws

Have more questions we didn’t cover? Explore frequently asked questions about Georgia labor laws below.

How many hours can you work in Georgia?

In Georgia, the state limits the regular weekly working hours for adults to 40 hours.

What is the salary of tipped employees?

Employers must pay tipped employees at least $2.13 an hour in direct wages, provided that the amount, including tips, is equal to at least the federal minimum wage of $7.25 per hour.

Are meal breaks required in Georgia?

Neither the Fair Labor Standards Act nor Georgia law requires employers to provide breaks or meal periods. However, employers can choose to provide breaks or meal periods for employees.

How many days in a row can you work without a day off in Georgia?

In Georgia, employers can schedule you to work for many consecutive days, but you cannot be required to work for 28 straight days without a day off.

Disclaimer: This information serves as a concise summary and educational reference for Georgia state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.