Connecticut Labor Law Guide

An extensive exploration of Connecticut labor laws: Encompassing essential subjects such as minimum wage statutes, overtime regulations, stipulated rest intervals, the intricacies of recruitment and dismissal processes and an abundance of other diverse employment statutes.

Key Takeaways

- Connecticut’s minimum wage was increased to $15.69 per hour on June 1, 2023, for regular employees.

- Nonexempt employees in Connecticut are entitled to overtime pay at 1.5 times their regular hourly wage when working over 40 hours in a workweek.

- Connecticut has its own family and medical leave laws, allowing eligible employees to take up to 12 weeks of job-protected leave for specific reasons within a 12-month period.

- Service workers in Connecticut can accrue paid sick leave, generally at a rate of one hour for every 40 hours worked, up to a certain annual cap.

- Meal breaks in Connecticut are mandated for workers who complete a 7.5-hour shift or longer, ensuring they receive at least a 30-minute break, though exceptions apply for specific occupations and conditions.

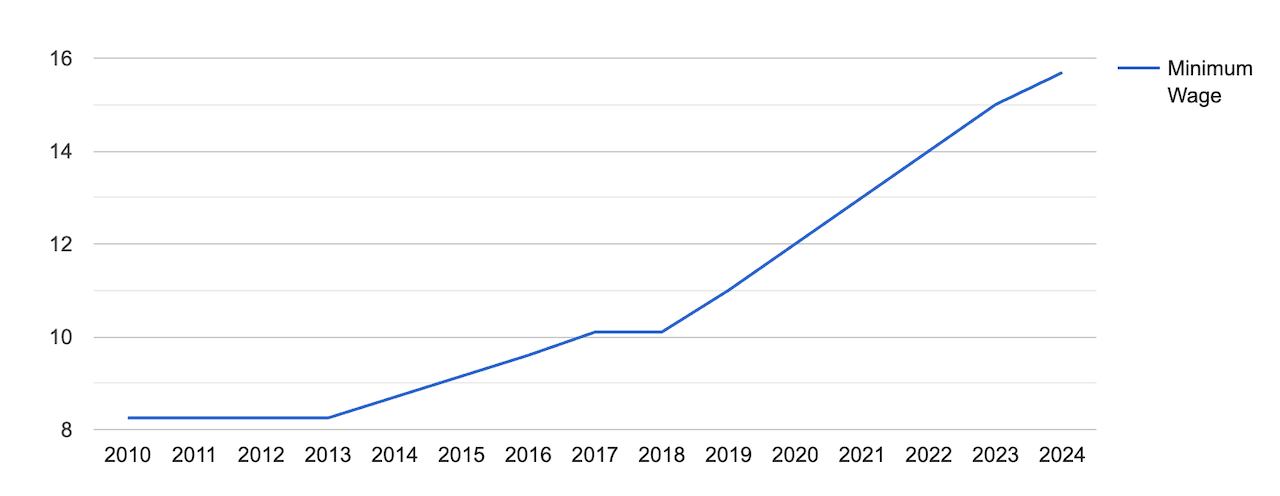

Minimum Wage Regulations in Connecticut

The Connecticut Wage and Hour Act stipulates that the minimum hourly wage in the state is $15.69. There are variations in this rate for tipped and non-tipped occupations, which we'll elaborate on shortly.

[Source: FRED]

This chart is interactive. Hover your mouse over different parts of the chart to see detailed data.

To learn how Connecticut's minimum wage compares to the minimum wages of other U.S. states, check out the table below.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Tipped Minimum Wage

Tipped employees, such as restaurant servers or bartenders, in Connecticut, are defined as those who regularly receive gratuities from customers in recognition of their service. As of 2019 legislation, there are two categories for tipped employees:

- Hourly minimum wage for bartenders: $8.23

- Hourly minimum wage for employees in the hotel and restaurant industry (excluding bartenders): $6.38

It's essential to note that if an employee's tips, when added to the base hourly rate ($8.23 or $6.38), do not reach the minimum wage of $13, employers are obligated to make up the difference.

Exceptions to Minimum Wage Requirements

Connecticut's minimum wage requirements do not apply to individuals employed in the following categories:

- By the federal government

- As volunteers for nonprofit organizations

- As members of the armed forces or those performing military duties

- As head residents or assistants at universities or colleges

- As certified executives, administrative or professional staff

- In camps or resorts open to the public for up to six months per year

- As babysitters

- In outside sales, as defined by the Fair Labor Standards Act (FLSA)

- By nonprofit theaters, provided the institution is open for up to seven months per year

- Engaged in household duties within a private residence or its vicinity

- During a training period lasting no more than six months

- For employees earning more than $375 per week

Subminimum Wage

Connecticut also regulates the minimum wage for employees under the age of 18. The minimum wage for minors is set at 85% of the regular minimum wage rate. However, there are three exceptions to this rule that apply to minors:

- Working for the government

- Working on farms

- Working over 200 hours for the same employer

Try our easy-to-use Paycheck Calculator to determine the exact amount of money you'll receive working in Connecticut.

Overtime Rules and Regulations in Connecticut

Connecticut's overtime regulations, as defined by the Fair Labor Standards Act, stipulate that a working week consists of any seven consecutive working days, with a total of 40 hours considered standard for this period.

Overtime comes into play when an employee exceeds 40 hours of work in a week, at which point they must receive compensation at a higher hourly rate.

However, Connecticut does not have a daily overtime requirement, which means that employees do not receive higher pay rates for working more than 8 hours in a single day.

Instead, the primary focus is on the total hours worked in a week to determine eligibility for overtime pay.

In Connecticut, the standard overtime rate is set at 1.5 times the regular rate of pay. As an example, the current overtime hourly rate for minimum wage employees in the state of Connecticut stands at $23.53.

Overtime Exceptions and Exemptions

In addition to the fact that working more than 8 hours per day does not automatically qualify for overtime in Connecticut, employees should also be aware that employers are not obligated to provide overtime pay for weekend and holiday work.

Following federal requirements regarding overtime exemptions, four main categories of employees are exempt from overtime laws, provided they earn at least $684 per week.

These employees are often referred to as "white-collar" employees and fall into the following categories:

- Administration

- Executives

- Professionals

- Outside sales

In addition to federal government exemptions, Connecticut enforces overtime restrictions on the same categories mentioned in the section on minimum wage exceptions.

The complete list of minimum wage exceptions also applies to overtime regulations (see the Exceptions to Minimum Wage Requirements in Connecticut section above).

Additionally, workers in agriculture, automobile salespeople and drivers (if the US Secretary of Transportation has the authority to establish minimum hours of service) are also exempt from overtime.

It's worth noting that two positions, paralegals and nurses, fall into the exempt category but are specifically protected. This means that they are eligible for overtime pay after working 40 hours a week.

Rest and Meal Break Laws in Connecticut

In the state of Connecticut, employers are obligated to grant meal breaks of at least 30 minutes after an employee has consecutively worked for 7.5 hours. In contrast, when it comes to providing rest breaks, Connecticut employers are not mandated to offer them.

Exceptions to Break Laws

There are specific scenarios where break laws in Connecticut do not apply, and employers are not required to provide a mandated break under the following circumstances:

- Solo duties: If only one employee possesses the necessary skills to perform essential duties

- Public safety concerns: When taking a break could potentially pose a threat to public safety

- Urgent matters: In cases where the operation demands that employees remain available to respond to urgent matters, provided they are compensated during this time as well

- Limited shifts: When there are up to five employees during specific shifts in certain locations

Family and Medical Leave Laws in Connecticut

Connecticut offers paid leave options for workers facing certain family or medical situations. You can use up to 12 weeks of paid leave within a 12-month period if you find yourself unable to work due to any of the following circumstances:

- You or a family member has a serious health condition

- You are bonding with a newborn or a child joining your family through adoption or foster care

- You are a victim of family violence

- You are caring for a family member injured on active duty in the military

- You are addressing issues associated with the overseas active duty of your parent, spouse or child

- You are an organ or bone marrow donor

Additionally, for pregnancy-related situations, you are eligible for up to 12 weeks of paid leave within a 12-month period.

If you are pregnant and cannot work due to a serious health condition related to your pregnancy, there is a possibility of receiving an extra 2 weeks of paid leave.

Exceptions to Connecticut's Paid Leave Program

- In most instances, the following groups of workers are not eligible to participate in Connecticut's paid leave program:

- Unionized employees of the State of Connecticut

- Federal employees

- Municipal employees

- Local or regional Board of Education employees

- Employees of private elementary or secondary schools

Family Members That Qualify for Paid Leave Care

You are eligible to take paid leave to provide care for the following family members:

- Spouses

- Children of any age

- Parents

- Parents-in-law

- Siblings

- Grandparents

- Grandchildren

You can also care for someone linked to you by affinity, meaning that your relationship is akin to a family bond. For instance:

- A significant other with whom you share a spouse-like relationship, even if you are not legally married

- An aunt or uncle with whom you have a strong and enduring relationship, resembling that of a parent, grandparent or sibling

Determining Your Salary Percentage During Paid Leave Laws

If your earnings are at the Connecticut minimum wage level, you will receive approximately 95% of your weekly paycheck.

For individuals earning more than the Connecticut minimum wage, the weekly benefit rate comprises 95% of the Connecticut minimum wage plus 60% of the amount earned above the minimum wage.

Currently, the maximum weekly benefit is $840.

Your paid leave can be combined with any additional benefits offered by your employer, but the total compensation cannot exceed 100% of your regular pay.

Workplace Safety and Health Regulations in Connecticut

CONN-OSHA, established by the Connecticut Occupational Safety and Health Act, is designed with the primary objective of ensuring safe and healthy working conditions for the state's workforce.

Employees who suspect that their employer may be in violation of any CONN-OSHA provisions have the option to submit a complaint through this platform.

For comprehensive insights into compliance requirements, enforcement protocols, and details regarding inspections, refer to the CONN-OSHA Frequently Asked Questions (FAQ) page.

Anti-Discrimination and Fair Employment Practices in Connecticut

There are numerous federal employment anti-discrimination laws, and they prohibit discrimination based on race, color, age, ancestry, religion, sex and disability.

Connecticut state laws also prohibit discrimination for these reasons, but there are some key differences between federal and state regulations.

Connecticut's law has additional provisions, including protecting employees from harmful substances, prohibiting certain inquiries about family planning and reproductive issues and barring discrimination based solely on a prior criminal record in employment and licensing.

Independent Contractor Classification in Connecticut

Connecticut has certain criteria to determine if a worker is considered an independent contractor rather than an employee.

The classification of a worker affects numerous aspects, such as tax withholding, workers' compensation, unemployment insurance, and labor rights.

In Connecticut, the "ABC Test" is often used to make this determination, especially for unemployment purposes. To be considered an independent contractor, all three of the following conditions must be met:

- A. The worker is free from control and direction in connection with the performance of the service, both under the contract of hire and in fact

- B. The service is performed outside the usual course of the business for which the service is performed or outside of all the places of business of the enterprise for which the service is performed

- C. The worker is customarily engaged in an independently established trade, occupation, profession, or business of the same nature as that involved in the service performed

If any of these criteria are not met, the worker will typically be classified as an employee.

Termination and Final Paycheck Laws in Connecticut

In accordance with Connecticut Gen. Stat. Ann. § 31-71c, when an employee is terminated, the employer is required to provide their final paycheck no later than the following business day.

However, if an employee voluntarily resigns from their position, they are entitled to their final paycheck on the next regularly scheduled pay date.

The final pay should encompass all wages that are undisputed as per Sec. 31-71d. The payment of unused vacation time upon separation depends on the specific policies established by the employer.

If the company's rules say you lose your unused vacation days when you leave, you won't get paid for them.

But if the company's rules or an agreement with your union say they should pay you for certain extra benefits when you leave, then they have to include that money in your final paycheck.

Summary

Connecticut's labor laws are comprehensive, covering key aspects of the workplace. Regular employees receive a minimum wage of $15.69 per hour, while tipped employees have their unique rates.

The state enforces robust anti-discrimination laws, aligns with workplace safety regulations, and employs the "ABC Test" for independent contractor classification.

Termination and final paycheck laws ensure prompt payment to employees. Connecticut's labor laws aim to protect workers' rights and maintain fair employment practices.

FAQs

Let's see what are the answers to the most frequently asked questions regarding Connecticut labor laws.

Does your employer have to pay you for unused vacation time in Connecticut?

In Connecticut, whether your employer has to pay you for unused vacation time upon separation depends on the company's policy or contract.

If the employer's policy or contract mandates the payment of accrued vacation time, they are obligated to provide this compensation.

However, if they have such a policy in place but do not follow it, employees may be entitled to recover two times the amount of unpaid wages as a remedy.

How many days in a row can you work without a day off in Connecticut?

In Connecticut, employees can work for a maximum of 12 consecutive days without a day off.

If you are scheduled to work for more than twelve consecutive days, it is advisable to consult with your lawyer to ensure that your rights and the labor laws are being upheld.

Do you have to give 2 weeks' notice in Connecticut?

In Connecticut, there is no legal requirement for employees to give two weeks' notice before leaving their jobs.

However, it is a common practice and often expected by employers for employees to provide this notice as a professional courtesy.

Can you quit and still get unemployment benefits in Connecticut?

In Connecticut, you may be eligible for unemployment benefits if you quit your job, but you will need to demonstrate "good cause" for quitting.

This typically means that you left your job due to unacceptable wages, hours, working conditions or a breach of your employment agreement.

An adjudication specialist will review the information and evidence provided by both you and your former employer to determine your eligibility for unemployment benefits.

How many hours are considered part-time in Connecticut?

In Connecticut, part-time employment is generally defined as any work that amounts to less than 35 hours per week.

Disclaimer: This information serves as a concise summary and educational reference for Connecticut state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.