Wisconsin Labor Law Guide

A comprehensive guide to Wisconsin labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- The minimum wage for regular employees in Wisconsin is $7.25 per hour.

- Tipped employees must receive a minimum cash wage of $2.33 per hour, with tips making up the difference to reach the regular minimum wage.

- Nonexempt employees are entitled to 1.5 times their regular rate for hours worked beyond 40 hours a week.

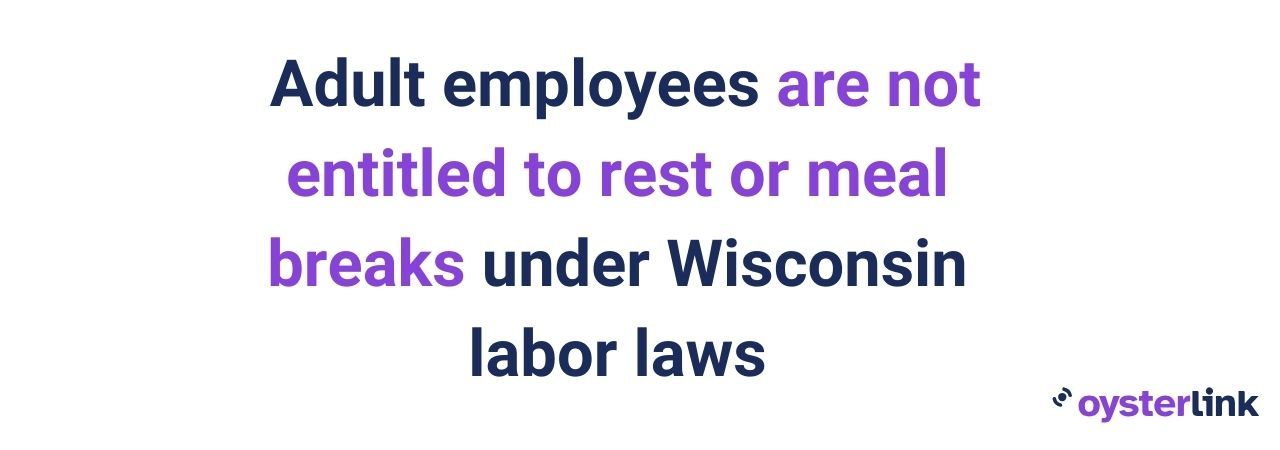

- Wisconsin labor laws mandate meal breaks for employees under 18, but not for those 18 or older.

- The Wisconsin Family and Medical Leave Act allows eligible employees to take unpaid leave for specific reasons.

Minimum Wage Regulations in Wisconsin

Wisconsin provides specific regulations for minimum wage, which establish distinct minimum hourly rates for both regular and tipped employees. These regulations ensure that employers adhere to fair and equitable compensation standards, promoting economic stability for workers across the state.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

The minimum wage for regular adult employees in Wisconsin stands at $7.25 per hour. This rate also applies to minor workers, ensuring that individuals under the age of 18 are entitled to the same minimum wage as their adult counterparts.

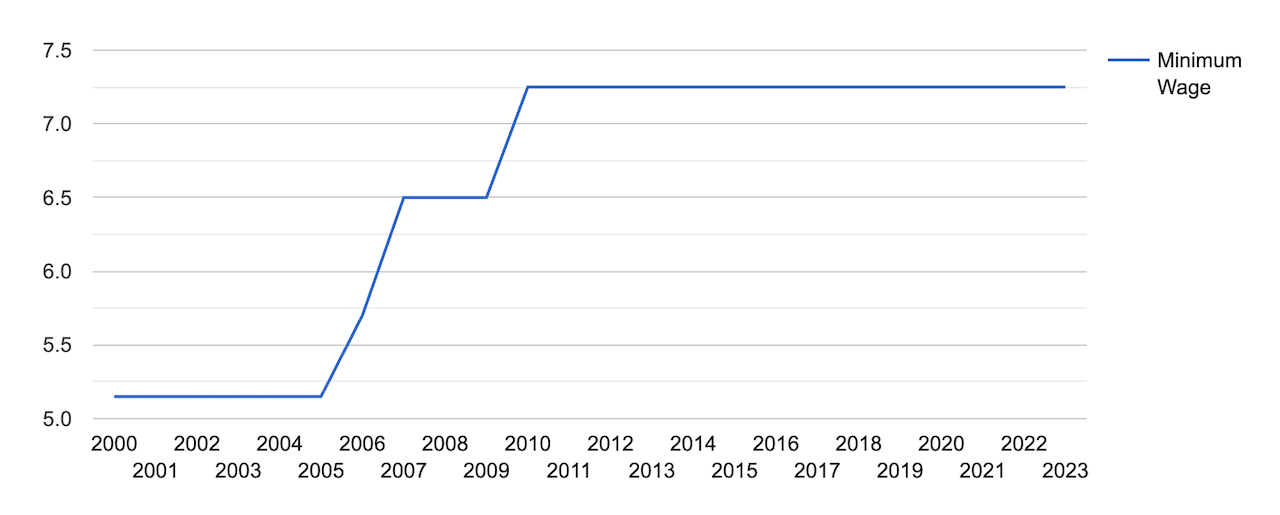

The minimum wage for regular employees in Wisconsin hasn't changed since 2010:

[Source: FRED]

Wisconsin also recognizes the category of "opportunity employees" and mandates a minimum wage of $5.90 per hour for them. Opportunity employees are individuals who are relatively new to the workforce or have limited experience.

Tipped Employees

Tipped employees, such as those in the restaurant or hotel industry, have their own minimum wage rate. Tipped employees are required to receive a minimum cash wage of $2.33 per hour. This minimum cash wage, combined with the tips they earn, must total at least the regular minimum wage rate.

If the combination of cash wage and tips does not reach the regular minimum wage, the employer is obligated to make up the difference. Tipped opportunity employees have a separate minimum cash wage of $2.13 per hour, again with the requirement that their combined earnings (cash wage and tips) meet or exceed the regular minimum wage.

Overtime Rules and Regulations in Wisconsin

Overtime rules and regulations are instrumental in ensuring the protection of workers' rights and securing fair compensation for extra hours worked. In Wisconsin, these regulations are applied differently to nonexempt and exempt employees.

The accurate classification of employees as nonexempt or exempt is a vital obligation for employers, necessitating adherence to the criteria outlined in the Fair Labor Standards Act (FLSA) and state labor laws.

Misclassifying employees can lead to legal complications and potential violations of wage and hour laws.

Nonexempt Employees

Nonexempt employees in Wisconsin are entitled to receive 1.5 times their regular rate of pay for all hours worked beyond 40 hours in a given week. These regulations encompass a broad spectrum of industries, such as:

- Factories

- Mercantile establishments

- Mechanical facilities

- Restaurants

- Hotels

- Motels

- Resorts

- Beauty parlors

- Retail and wholesale stores

- Laundries

- Express and transportation firms

- Telegraph offices

- Telephone exchanges

The state has a specific regulation for 16 and 17-year-old workers. They must be compensated at 1.5 times their regular rate of pay for all hours worked in excess of 10 hours per day or 40 hours per week.

Exempt Employees

Certain establishments and categories of employees are exempt from these overtime regulations, meaning they’re not entitled to overtime pay no matter how many hours they work in a week. These exemptions apply to employees engaged in:

- Executive roles: Those managing enterprises or departments, directing two or more employees, with hiring or firing authority, exercising discretionary powers, and not dedicating over 20% (or 40% for retail or service employees) of their work time to non-directly related tasks. They should earn a salary of $700 or more per month.

- Administrative positions: Employees handling office or non-manual work linked to management policies, exercising discretion, assisting higher-ranking staff or working under general supervision in specialized fields. They should earn a salary of $700 or more per month.

- Professional work: Employees performing advanced, intellectual, non-standardized work that requires discretion, creativity and judgment. They must not spend over 20% of their workweek on non-essential tasks and should earn a salary of $750 or more per month.

- Specific categories of employees: These include salespersons, commission-based employees, drivers, taxicab drivers, certain auto-related roles and employees of amusement/recreational establishments operating seasonally or with specific revenue limits.

- Agricultural workers: Employees engaged in various farming activities.

- Employees in specific industries: This covers motion picture theaters, hospitals, funeral establishments, forestry, lumbering operations and skilled computer workers earning at least $27.63 per hour.

Break Periods in Wisconsin

For employees under 18, Wisconsin labor laws mandate that they can't work for more than six consecutive hours without having a 30-minute meal break.

In contrast, if the employee is 18 or older, employers in Wisconsin are not legally obligated to provide rest, meal or coffee breaks. However, it's a good practice, as suggested by the Department of Labor.

If any employee, regardless of age, takes a break of less than 30 minutes, their employer must include that time when calculating their total work hours. In other words, it's considered paid working time.

However, if the break extends to 30 minutes or longer and the employee is completely relieved of duty and free to leave the premises during that time, it doesn’t have to be paid.

Family and Medical Leave Laws in Wisconsin

The Wisconsin Family and Medical Leave Act, or FMLA, provides certain employees with the opportunity to take unpaid leave for specific reasons. These include:

- Attending to their own serious health condition

- Taking care of a family member with a serious health condition

- Birth or adoption of a child

To be eligible for this leave, a covered employer must have a minimum of 50 permanent employees for at least six of the last 12 months. For employees, they need to have worked for their employer for at least 52 consecutive weeks and put in at least 1,000 hours of work in the preceding 52-week period.

A 'serious health condition,' under Wisconsin law, refers to a debilitating physical or mental illness, injury or condition that requires inpatient or outpatient care, along with continuous treatment or supervision from a healthcare provider.

Here's what's required for both employers and employees.

Employers must:

- Maintain the employee's health insurance during their leave under the same conditions as before

- Allow employees to use any accrued paid or unpaid leave offered by the employer

- Ensure that when the employee returns from leave, they are reinstated to the same or an equivalent position with the same terms and conditions

Employees must:

- Be prepared to provide medical certification if the employer requests it

- Make planned leave requests in advance whenever feasible

Workplace Safety and Health Regulations in Wisconsin

Worker safety and health in Wisconsin is governed by a combination of federal and state regulations to ensure comprehensive protection. A safe workplace offers a multitude of advantages for:

- Workers: The benefits include a reduction in injuries, heightened morale, enhanced confidence and a reliable source of income, enabling workers to provide for themselves and their families. A safe environment fosters a collective focus among workers and employers on meeting production schedules, delivering top-quality products and providing excellent customer service.

- Employers: Prioritizing workplace safety can yield cost-saving benefits for businesses. A well-executed safety plan coupled with reduced injury rates results in a workforce that is not only safer but also more loyal. This, in turn, elevates workplace productivity and morale. Moreover, it translates into cost savings for employers by lowering worker's compensation insurance premiums and reducing the overall cost of conducting business.

- Customers and the general public: The ripple effect of enhanced workplace safety is felt by customers through lower costs for goods and timely services. This not only directly benefits consumers but also adds value to the broader community by contributing to the public's well-being and economic prosperity.

Private-sector workers in Wisconsin who have concerns about workplace safety have the option to file a complaint with the U.S. Occupational Safety and Health Administration (OSHA).

For public-sector workers in Wisconsin, the safety regulations and standards largely mirror those applied in the private sector, with Federal OSHA serving as the governing body. Public-sector workplace safety regulations are administered in partnership with the State of Wisconsin Department of Safety and Professional Services and the Department of Administration.

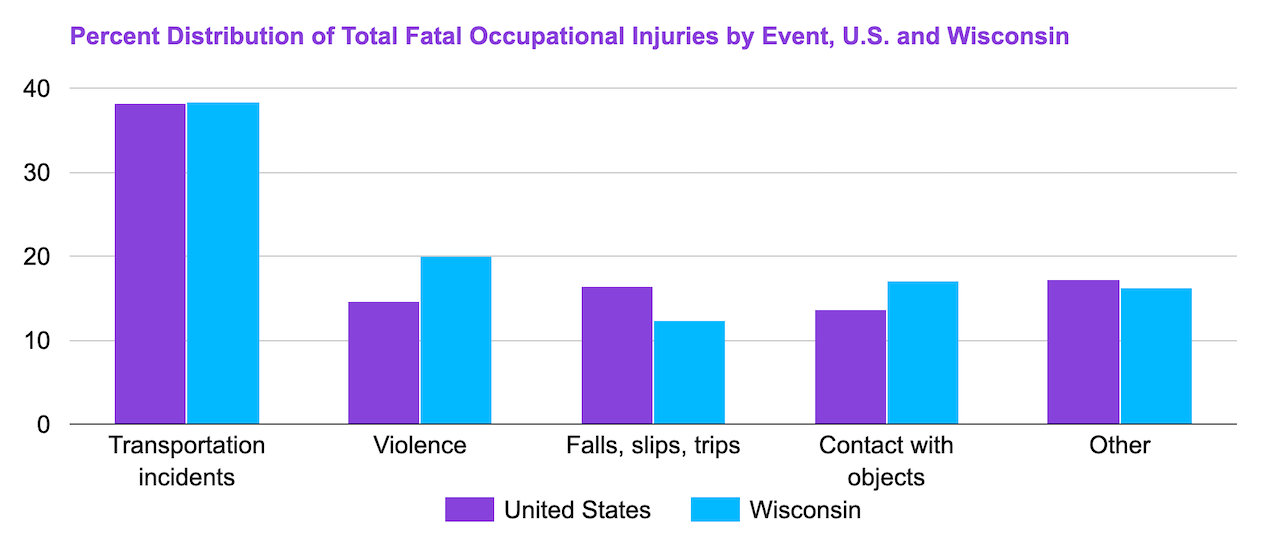

The following chart illustrates the incidence of fatal occupational injuries in the U.S. and Wisconsin, shedding light on the importance of workplace safety:

[Source: U.S. Department of Labor]

Anti-Discrimination and Fair Employment Practices in Wisconsin

In the state of Wisconsin, the Wisconsin Fair Employment Law stands as a guardian against discrimination in the workplace. Under its jurisdiction, both public and private employers, employment agencies, labor unions and licensing agencies are prohibited from discriminating against employees and job applicants based on:

- Age

- Arrest and conviction records

- Ancestry

- Color

- National origin

- Race

- Creed (religion)

- Disability

- Genetic testing results

- Honesty testing

- Marital status

- Military service

- Pregnancy or childbirth

- Sex

- Sexual orientation

- Use of lawful products outside the employer's premises during nonworking hours.

The law sets a statute of limitations for filing a complaint at 300 days from the date the discriminatory action was taken or when the individual became aware of the action. It prohibits discrimination across the following employment aspects:

- Recruitment

- Job assignments

- Compensation

- Leave

- Benefits

- Promotions

- Licensing

- Union membership

- Training

- Layoffs

- Terminations.

Harassment within the workplace based on a protected status is strictly prohibited, as is retaliation against those who file complaints, assist in complaint procedures or oppose discrimination in the workplace.

Some exceptions exist under the law, where limited instances may permit employers to engage in otherwise discriminatory actions. These exceptions are few and uncommon, and they may apply in cases like an applicant or employee having a conviction record substantially related to the job, setting maximum age requirements in physically dangerous occupations or preventing an individual from directly supervising their spouse, among other specific scenarios.

Independent Contractor Classification in Wisconsin

In Wisconsin, the classification of an individual as an independent contractor, rather than an employee, is a matter governed by specific criteria outlined in the Worker's Compensation Act.

It's essential to understand that simply stating one's status as an independent contractor or having this designation asserted by the hiring entity or even receiving recognition from other regulatory bodies, does not automatically confer independent contractor status for worker's compensation purposes.

To be considered an independent contractor, an individual must satisfy a rigorous nine-part statutory test. Meeting and maintaining the following requirements is the key to establishing one's status as an independent contractor rather than an employee:

- Maintain a separate business: The individual must operate and maintain a separate business with their own office, equipment, materials and facilities.

- Obtain a FEIN or file tax returns: The individual should obtain a Federal Employer Identification Number (FEIN) from the IRS or file business or self-employment tax returns with the IRS based on previous work or services.

- Operate under specific contracts: The individual is required to work under contracts that specify services, payments, and control over how the work is performed.

- Incur main expenses: The individual must incur the primary expenses related to the services or work performed under the contract.

- Ensure satisfactory completion of work or services: The individual is responsible for ensuring that the work or services are satisfactorily completed and may be held liable for any failure to do so.

- Receive compensation under a specific basis: Compensation should be based on a commission, per job or competitive bid, and not on any other basis.

- Realize a profit or suffer a loss: The individual should have the potential to make a profit or incur a loss under the contracts they enter into.

- Have recurring business liabilities or obligations: The individual must have ongoing business liabilities or obligations that continue even when they're not performing work for a specific employer.

- Establish a relationship between business receipts and expenditures: The success or failure of the independent contractor's business depends on the relationship between business receipts and expenditures, meaning they must face a realistic prospect of incurring expenditures without corresponding income. Guaranteed income without the potential for loss does not satisfy this requirement.

It's crucial to underscore that compliance with all nine requirements of the statutory test is mandatory for an individual to be recognized as an independent contractor. Even if the worker satisfies the conditions of eight out of the nine requirements but falls short in one, they will be considered an employee.

Termination and Final Paychecks in Wisconsin

Wisconsin is an employment-at-will state, which means both employers and employees can terminate their work relationship at any time without a specific reason. Unless there's a different contract in place, an employer can let an employee go whenever, and the employee can also quit whenever they choose. This applies to most individuals unless there's a contract or employment agreement that takes precedence.

There are exceptions to employment-at-will, particularly concerning protected groups. Termination based on discrimination, such as race, religion, gender or disability, is not allowed. When an employee resigns or is terminated, the employer is obligated to provide the final paycheck on or before the subsequent regular payday. This requirement does not extend to sales agents who are remunerated on a commission basis.

When navigating Wisconsin labor laws and termination procedures, ensure you're equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state's tax laws.

Summary of Wisconsin Labor Laws

In the state of Wisconsin, $7.25 per hour is the minimum wage for regular employees while $2.33 per hour is the minimum cash wage for tipped employees. Nonexempt employees in the state are entitled to 1.5 times their regular rate for hours worked beyond 40 hours a week.

When it comes to break regulations, employees under 18 cannot work more than six consecutive hours without a 30-minute meal break. Those 18 or older aren't legally mandated to receive rest, meal or coffee breaks.

The Wisconsin Family and Medical Leave Act indicates eligibility criteria for unpaid leave related to health conditions, birth or adoption while underscoring the obligations of both employers and employees.

Wisconsin’s workplace safety and health regulations emphasize the protection and advantages of a safe working environment for workers, employers and the general public, while anti-discrimination and fair employment practices list the protected categories and areas where discrimination is strictly prohibited.

When it comes to employment termination and final paychecks, Wisconsin follows at-will employment, allowing employers and employees to terminate employment at any time, with certain exceptions related to discrimination.

Frequently Asked Questions About Wisconsin Labor Laws

Is it legal to work eight hours without a break in Wisconsin?

In Wisconsin, if you are under 18 years of age, you cannot work for more than six consecutive hours without having a 30-minute meal break. However, if you are 18 or older, employers are not legally obligated to provide rest, meal or coffee breaks.

How many hours is full-time in Wisconsin?

The definition of full-time employment in Wisconsin can vary depending on the employer and industry. Typically, full-time employment is considered to be around 40 hours per week.

Is holiday pay mandatory in Wisconsin?

Holiday pay in Wisconsin is not mandatory under state law. Whether or not you receive holiday pay depends on your employer's policies and any agreements or contracts in place.

How many sick days do you get in Wisconsin?

Wisconsin workers typically accumulate sick leave at a rate of five hours every two weeks, with a maximum accrual of 16.25 days per year. Any unused sick leave hours roll over from year to year and, upon retirement, are converted into funds for covering health insurance premiums.

At what age can you get a job in Wisconsin?

Although the minimum working age is 14 in Wisconsin, certain exceptions permit children as young as 12 to work in this state. These exceptions encompass various roles in agriculture, street trades (such as newspaper delivery), school lunch programs, private home babysitting and working as golf course caddies.

Additionally, a 12-year-old minor can work in a business owned by a parent, provided that the job adheres to state labor laws.

Disclaimer: This information serves as a concise summary and educational reference for Wisconsin state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.