West Virginia Labor Law Guide

A comprehensive guide to West Virginia labor laws: Covering essential topics like minimum wage guidelines, overtime regulations, mandatory rest breaks and other key employment provisions specific to the Mountain State.

Key Takeaways

- West Virginia's minimum wage is $8.75 per hour

- Tipped employees receive a minimum cash wage of $2.62 per hour, with a maximum tip credit of $6.13

- Overtime pay is 1.5 times the regular pay rate

- Rest and meal breaks are required for employees who work six or more hours per day or shift

- West Virginia follows the federal Family and Medical Leave Act

- Anti-discrimination laws protect against various forms of employment discrimination

Minimum Wage Regulations in West Virginia

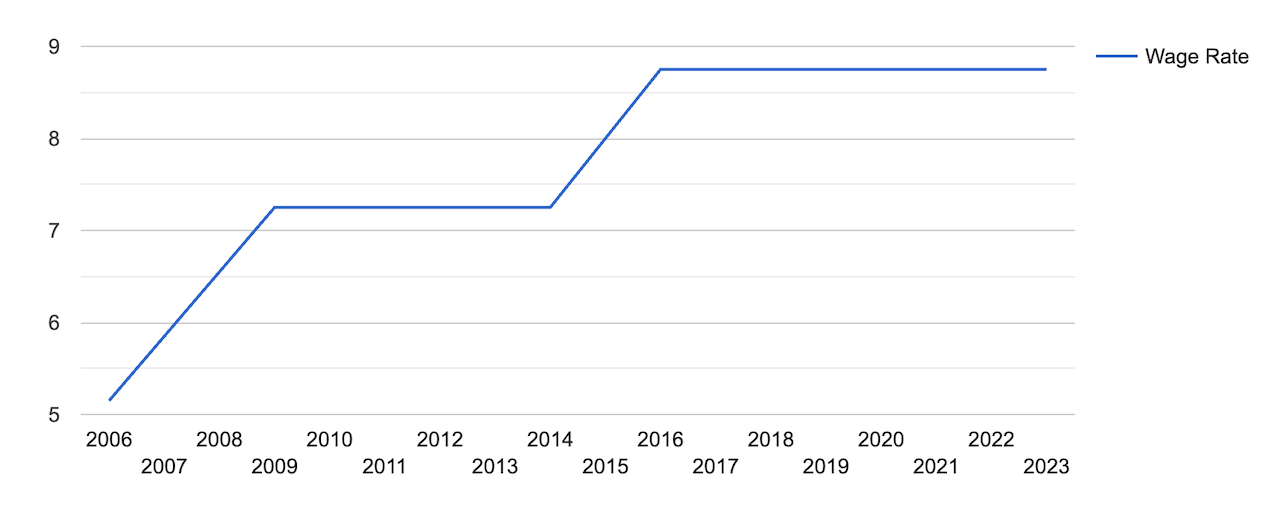

The state's minimum wage rate currently stands at $8.75 per hour, which is slightly higher than the federal minimum wage of $7.25 per hour.

The last time West Virginia's minimum wage was changed was in 2008 when it was raised by $1.50, increasing it from $7.25 to the current rate of $8.75 per hour, which is the highest it has ever been.

[Source: FRED]

You can also compare the West Virginia minimum wage with the minimum wage in other US states by checking the table below.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Tipped Minimum Wage

In West Virginia, tipped employees have their own minimum wage regulations, allowing employers to pay them a lower cash wage than the standard minimum wage, with a portion of their tips counted as a "Tip Credit."

The maximum tip credit allowed is $6.13, which means that with this credit, tipped employees must be paid a cash wage of at least $2.62 per hour.

This ensures that their total compensation, including tips, meets or exceeds the regular minimum wage of $8.75 per hour.

One significant aspect of West Virginia's tipped wage system is that there is no specified minimum amount of tips an employee must receive to be classified as a "tipped employee."

Any employee who receives tips can be paid according to West Virginia's tipped minimum wage laws.

Exceptions to Minimum Wage Requirements

In West Virginia, the state's minimum wage regulations apply to most employees with some exemptions, such as:

- Administrative employees

- Agricultural employees

- Executive employees

- Drivers / Department of Transportation workers

- Federal employees

- Firefighters employed by the state

- Golf caddies

- Handicapped individuals in nonprofit sheltered workshops

- Individuals 62 years of age or older receiving Social Security benefits

- Motorbus carrier employees

- Newsboys & shoe shine boys

- On-the-job trainees in vocational programs

- Outside salespersons

- Part-time students of any recognized school or college working 24 hours or less per week

- Per diem employees working for the West Virginia state Senate, House of Delegates, or Joint Committee on Government and Finance

- Professional employees

- Pinboys and pin chasers in bowling lanes

- Summer camp workers

- Theater ushers

- Volunteer workers engaged in educational, charitable, religious or fraternal activities where an employment relationship does not exist

Subminimum Wage

In West Virginia, subminimum wage provisions allow employers to pay certain categories of employees a wage that is lower than the standard minimum wage.

These categories include:

- Employees with severe physical or mental handicaps: West Virginia minimum wage laws permit employers to pay a subminimum wage to employees with physical or mental handicaps so severe that they prevent their employment or employment training in any facility other than a nonprofit sheltered workshop.

- Trainees: Employers in West Virginia can pay trainees who are under the age of 20 a subminimum wage of $6.40 for a cumulative period of up to 90 days per employee.

- Apprentices: West Virginia minimum wage laws do not specifically permit employers to pay apprentices a subminimum wage rate that is less than the state minimum wage. However, the regulations exclude individuals involved in on-the-job training (vocational) from the standard minimum wage requirements.

- Student workers: West Virginia minimum wage laws exempt part-time student workers from the state's standard minimum wage requirements. This exemption applies to individuals who are students in any recognized school or college.

When discussing wages, it’s important to keep in mind the taxes for complete financial clarity. Our West Virginia Paycheck Calculator gives you an estimate of your earnings after accounting for taxes and deductions, in adherence to your state’s tax laws.

Overtime Rules and Regulations in West Virginia

In West Virginia, overtime rules and regulations are governed by the Fair Labor Standards Act (FLSA).

Most hourly employees in the state are entitled to receive overtime pay of 1.5 times their regular hourly wage for any hours worked over a total of 40 in a single work week.

Since the regular minimum wage in West Virginia is $8.75 per hour, the overtime minimum wage in the state is $13.13 per hour.

If an employee earns more than the West Virginia minimum wage rate, they are still entitled to at least 1.5 times their regular hourly wage for all overtime hours worked.

West Virginia's overtime laws apply to companies that employ six or more workers, with certain exemptions.

Overtime Exceptions and Exemptions

Employee categories excluded from overtime rules in Wes Virginia include:

- Salespeople

- White-collar workers

- Camp employees

- Farm laborers

- Ushers

- Part-time students and learners

- Vehicle drivers and mechanics

- Dome legislative employees

- Disabled people in sheltered workshops

- Any employee over the age of 62 who is receiving Social Security benefits

Rest and Meal Breaks

In West Virginia, employers are required to provide meal breaks to employees who work six or more hours per day or shift.

Employers must make available to employees at least 20 minutes for meal breaks during a workday of six or more hours.

This 20-minute break requirement doesn't have to be provided all at once; it may be provided in smaller increments at the employer's discretion.

The requirement for a 20-minute meal break does not apply under the following circumstances:

- If the employee is already provided with a lunch or break period

- If the employee is allowed necessary restroom breaks and is permitted to eat while working

Bona fide meal periods that typically last for thirty minutes or longer may be paid or unpaid, based on the employer's discretion.

Any meal break or rest period that lasts for twenty minutes or less must be paid.

Family and Medical Leave Laws in West Virginia

In West Virginia, labor laws do not mandate employers to provide family and medical leave to their employees.

Instead, West Virginia is covered by the federal Family and Medical Leave Act (FMLA).

Under the FMLA, employees are eligible for up to 12 weeks of unpaid leave within a 12-month period for specific purposes, which include:

- Caring for a family member

- Caring for an ailing or injured military family member

- Recovering from a severe health condition

- Bonding with a new child

Specific eligibility requirements for FMLA leaves include:

- Employees must have worked for their employer for a minimum of 12 months

- Employees must have worked for their employer for a minimum of 1,250 hours in the previous year

- Employees must work in a location with 50 or more employees within a 75-mile radius

During an FMLA leave, employees have the benefit of continuing to use their original health insurance plans.

Additionally, employees can choose to use their accrued paid leave, such as sick leave or vacation time, to receive pay during their FMLA leave.

Family Members That Qualify for FMLA

The following family members qualify for FMLA leave in West Virginia:

- Spouse: You can take FMLA leave to care for your spouse with a serious health condition.

- Child: You can use FMLA leave to care for your biological, adopted, foster, or stepchild or a legal ward, who has a serious health condition. You can also take leave to bond with a new child.

- Parent: FMLA leave can be used to care for your parent who has a serious health condition.

- Next of kin: You can take FMLA leave to care for a covered military member's next of kin with a serious injury or illness if you are the service member's primary caregiver.

Holiday Leave

West Virginia observes a range of state and national holidays throughout the calendar year. These holidays have implications for both public employers and private employers.

Holidays recognized in West Virginia include:

Workplace Safety and Health Regulations in West Virginia

West Virginia is subject to the federal Occupational Safety and Health Act (OSHA), which governs the safety and health of a significant portion of the state's private-sector workforce.

OSHA operates within West Virginia with several key elements:

- Regulations: OSHA sets and enforces safety and health regulations that pertain to a wide range of industries and workplace hazards in the private sector.

- Inspections: OSHA regularly conducts inspections, responding to complaints or incidents, to assess compliance with safety and health regulations.

- Penalties: Non-compliance with OSHA regulations can result in penalties, which may include fines, citations and requirements to address safety hazards.

- Training and outreach: OSHA offers training and outreach programs aimed at educating both employers and employees on matters related to safety and health in the workplace.

- Whistleblower protection: OSHA is committed to safeguarding employees who report safety or health violations by their employers.

- Emergency response: OSHA provides guidance on emergency response and preparedness, ensuring that workplaces are adequately equipped to handle various emergency situations, including fires, chemical spills and natural disasters.

- Small business assistance: OSHA extends specialized assistance and consultation services to small businesses, aiding them in meeting safety and health requirements while taking into consideration the unique challenges they may face.

- Partnerships: OSHA actively collaborates with a variety of organizations, industries and labor groups, fostering partnerships and alliances that aim to enhance workplace safety through shared knowledge and resources.

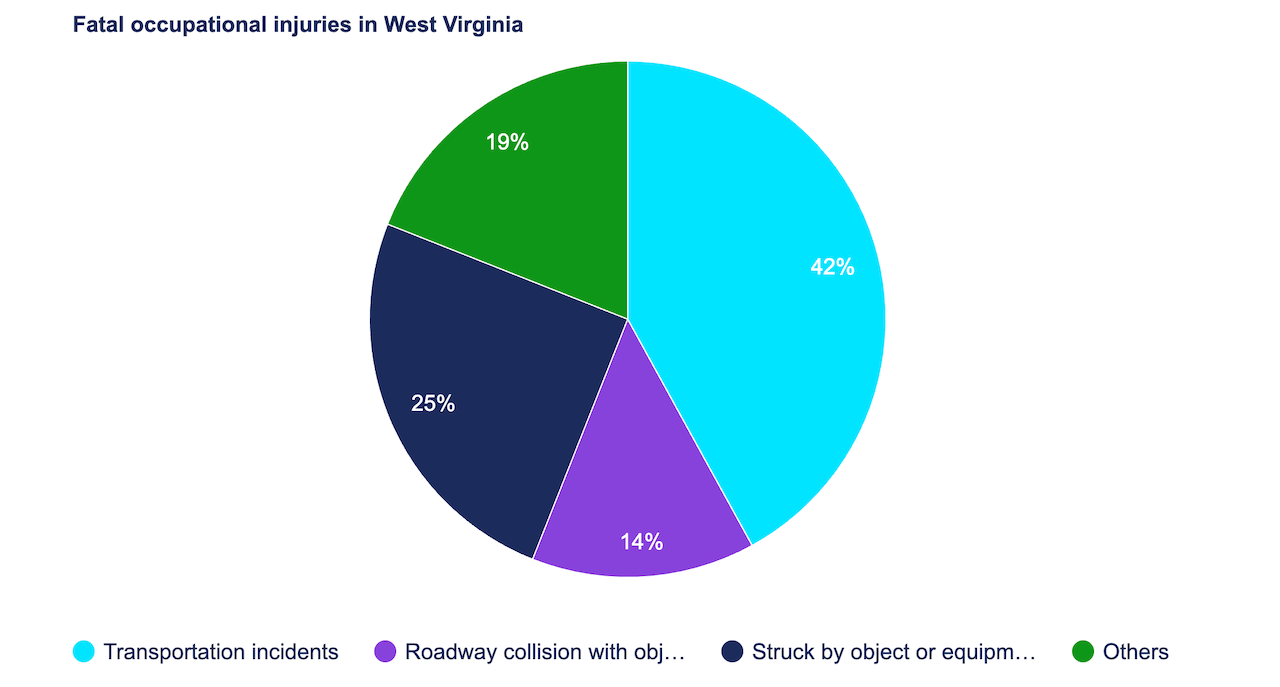

Based on the most recent data, there have been 36 fatal occupational injuries in West Virginia State.

[Source: U.S. Bureau of Labor Statistics]

This number is significantly lower than the average number of fatal injuries, which is approximately 85 across all 50 states.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Child Labor Laws in West Virginia

Child labor laws in West Virginia establish regulations to ensure the welfare and education of young workers. Here is the overview of West Virginia child labor laws.

Minors Aged 14 and 15:

- School days: During school days, minors aged 14 and 15 may work up to 3 hours a day. On non-school days, they can work for a maximum of 8 hours a day. In a school week, they are allowed to work up to 18 hours. The permissible working hours are between 7 a.m. and 7 p.m. Minors in this age group are not allowed to work during school hours.

- Non-school days: On non-school days, they may work up to 8 hours a day and up to 40 hours a week. The working hours must fall between 7 a.m. and 9 p.m., but only during the period from June 1 to Labor Day.

- Breaks: If scheduled to work more than 5 hours, all minors, including those aged 14 and 15, must be provided with a meal break of at least 30 minutes.

Minors Aged 16 and 17:

- Minors in the 16-17 age group are permitted to work the same hours as adult employees. There are no specific restrictions on their working hours during school days or non-school days.

Anti-Discrimination and Fair Employment Practices in West Virginia

The West Virginia Human Rights Act serves as the primary state law that prohibits employment discrimination.

This act makes it illegal for employers to discriminate based on various factors, including:

- Race

- Sex

- Age (40 years old and up)

- Disability

- Religion

- Color

- Ancestry

- National origin

- Disability

In West Virginia, the application of discrimination laws depends on the size of the employer. State laws protect individuals when their employer has 12 or more employees.

On the other hand, if your employer has 15 or more employees, federal discrimination laws come into play.

Independent Contractor Classification in West Virginia

In West Virginia, to be classified as an independent contractor, the worker should meet three or more of the following criteria:

- Control over the amount of time spent providing services

- Control over the location where services are performed

- Not being required to work exclusively for one principal (with exceptions)

- Ability to independently solicit others to purchase their services

- Ability to hire employees or assistants for the work

- Not being required to perform additional services without a new or modified contract

- Obtaining necessary licenses, insurance, certifications or permits

The hiring party can choose to classify a worker who meets the criteria as an employee instead of an independent contractor if they wish.

Termination and Final Paycheck Laws in West Virginia

When an employer terminates an employee, they are required to issue the final paycheck to the terminated employee within 72 hours.

If an employee chooses to quit their job, they must receive their final paycheck immediately if they have given the employer at least one pay period's notice.

If the employee fails to provide one pay period's notice before quitting, their final paycheck must be paid on the next regularly scheduled pay date.

Final wages may be paid through the employer's regular pay channels or by mail if requested by the employee.

Summary

In West Virginia, the minimum wage stands at $8.75 per hour, which is slightly higher than the federal minimum rate of $7.25 per hour.

Tipped employees receive a minimum cash wage of $2.62 per hour, with a maximum tip credit of $6.13. While subminimum wage applies to employees with severe handicaps, trainees and part-time student workers.

Overtime pay follows federal standards, and rest and meal breaks are required for every six hours worked.

West Virginia follows the federal FMLA and OSHA standards for workplace safety and health regulations.

Frequently Asked Questions About West Virginia Labor Laws

For more info, find frequently asked questions about the labor laws in West Virginia below.

Are 15-minute breaks required by law in West Virginia?

In West Virginia, employers are mandated to provide their employees with a minimum 20-minute break if the employee has worked for at least six hours.

Is West Virginia a “fire-at-will” state?

Yes, West Virginia follows the principle of "at-will" employment. In an at-will employment arrangement, employers have the legal right to terminate employees without prior notice and without the need to provide an explanation.

Similarly, employees can also choose to resign from their positions at any time without facing adverse consequences.

Can you be forced to work overtime in West Virginia?

In West Virginia, employers generally cannot force employees to work overtime against their will. Overtime work typically requires the consent of the employee.

How many hours is considered full-time employment in West Virginia?

In West Virginia, there is no specific legal definition of how many hours constitute full-time employment.

The determination of full-time or part-time status typically depends on individual company policies and employment contracts.

How many hours can you legally work a week in West Virginia?

In West Virginia, there are no state laws specifying the maximum number of hours or days that employees over the age of 16 can work in a week. There are no federal guidelines governing these limits either.

Disclaimer: This information serves as a concise summary and educational reference for West Virginia state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.