District of Columbia Labor Law Guide

A comprehensive guide to District of Columbia labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways of District of Columbia Labor Laws

- The District of Columbia’s minimum wage is $17 per hour.

- Employers in the District of Columbia do not have to provide paid breaks to employees.

- Eligible employees in the District of Columbia must be paid 1.5 times their regular pay (time and a half) for overtime for every hour over 40 in a workweek.

- The District of Columbia is an at-will employment district, where employment can be terminated by either the employer or employee without cause.

- The District of Columbia is not a right-to-work district.

Minimum Wage Regulations in the District of Columbia

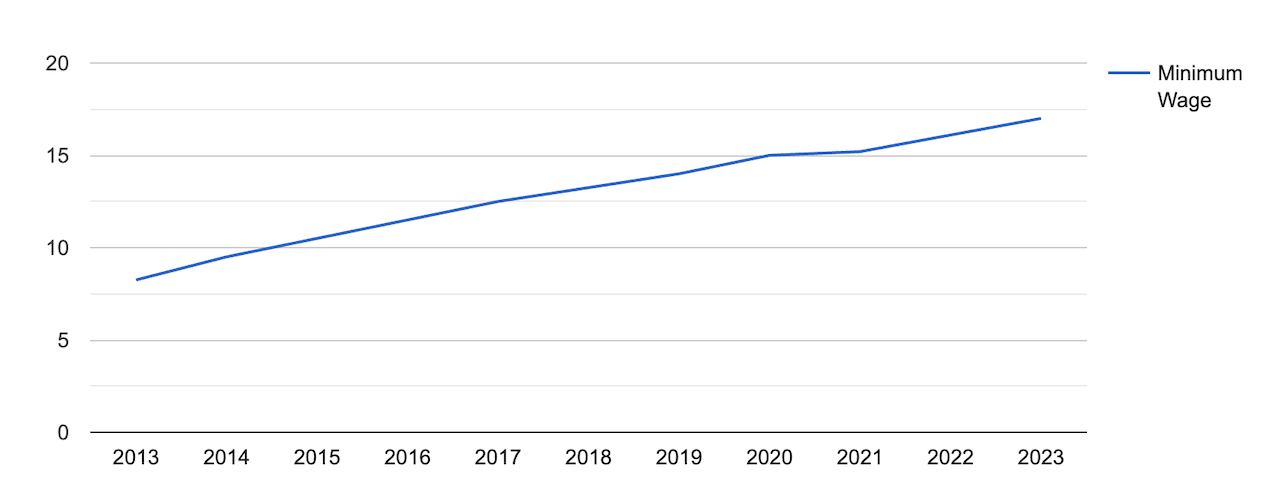

The minimum wage in Washington D.C., or the District of Columbia, is $17.00 per hour, which is higher than the federal wage rate by a whopping 134%. The district’s minimum wage is adjusted every year on July 1 in response to inflation.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

The minimum wage in the District of Columbia for eligible regular employees is $17 per hour, in response to the district’s official living wage rate of $16.50 per hour.

[Source: FRED]

The District of Columbia’s minimum wage has been on a fast-increasing trend since the Fair Shot Minimum Wage Emergency Amendment Act of 2016.

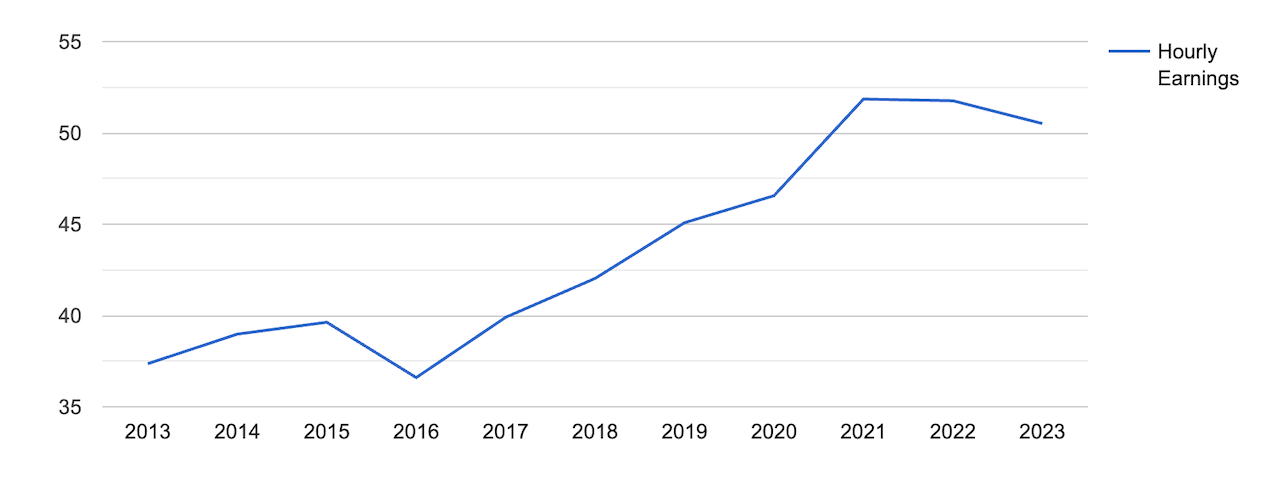

Despite this trend, the average hourly earnings for employees in the district are already high, standing at $50.51 per hour.

[Source: FRED]

Tipped Employees

Tipped employees are required to receive a minimum cash wage of $8.00 per hour as of July 2023.

If the workers’ tip earnings plus this minimum cash wage do not equal the district’s minimum wage, employers are required to pay the difference.

State Income Tax Rates in the District of Columbia

In the District of Columbia, the individual income tax is tiered, ranging from 4% to 10.75%. The corporate income tax is a flat 8.25%, and the sales tax rate is 6%.

Overall, the district’s tax system is ranked 48th on the 2023 State Business Tax Climate Index.

Both tipped and nontipped (regular) employees can calculate their earnings easily, factoring in taxes and deductions, with OysterLink’s Paycheck Calculator.

Overtime Rules and Regulations in the District of Columbia

The overtime regulations in the District of Columbia adhere to the Fair Labor Standards Act (FLSA), which stipulates that employees must be compensated at a rate of 1.5 times their regular hourly wage for hours worked beyond 40 in a single workweek.

Non-Exempt Employees

For non-exempt employees in the District of Columbia, overtime pay is calculated at time and a half, equivalent to 1.5 times their standard hourly rate.

To calculate your overtime earnings, use our time and a half calculator.

Exempt Employees

Exempt employees in the District of Columbia follow the federal FLSA guidelines, which exempt certain categories of employees from receiving overtime pay.

Examples of exemptions include:

- Executives, administrators and professionals earning a minimum of $684 per week

- Independent contractors

- Transportation employees

- External salespersons

- Workers in computer-related roles

- Specific agricultural and farm laborers

- Live-in staff such as housekeepers

At-Will Employment in the District of Columbia

In the District of Columbia, the employment relationship operates under the at-will principle.

This means that unless a contractual agreement explicitly outlines the duration of employment and conditions for termination, either the employer or employee has the liberty to conclude their association without providing a reason.

This right persists, provided the termination lacks indications of discrimination or any violation of the employee’s rights.

No Right-To-Work Laws in the District of Columbia

The District of Columbia lacks right-to-work legislation, which means that employees in companies with unionized workforces may need to remit union dues, irrespective of their membership status.

The District of Columbia’s union membership rate is at 9.1%, which is lower than the national average at 10.1%.

Rest and Meal Breaks in the District of Columbia

District of Columbia labor laws do not mandate employers to provide either rest or meal breaks to their employees, similar to federal rule.

Keep in mind that many employers do provide break policies as a matter of custom and policy, mainly to boost morale and productivity.

Employers and employees or applicants should clarify this during interviews in the hiring process.

Family and Medical Leave Laws in the District of Columbia

The District of Columbia Family and Medical Leave Act (DCFMLA) requires companies with 20 or more employees to provide eligible employees with 16 weeks of unpaid family leave and 16 weeks of unpaid medical leave over 24 months.

Family Leave

Qualifying situations for family leave include the birth or adoption of a child, the need to care for a child in foster care and the need to tend to a seriously ill family member.

Medical Leave

Eligible circumstances for medical leave occur when an employee is recovering from a serious illness that prevents them from working.

Employees can take DCFMLA leave in different ways, such as in blocks, intermittently or with a reduced schedule. They can also use accrued time off instead of unpaid leave.

Employers may request medical certification and reasonable notice when applicable.

Other Leave Laws

The conditions for other types of leaves under District of Columbia labor laws include:

- District of Columbia Parental Leave Act: Employees who are parents or guardians are allowed to take 24 hours of leave for a 12-month period to attend school activities.

- Jury duty: Individuals serving as jurors in the Superior Court shall receive a $30 attendance fee for each day they physically attend a trial or hearing. However, jurors employed by a federal, state or local government or by a private employer providing regular compensation during jury service are exempt from receiving the attendance fee.

- Voting: Employees are entitled to at least two hours of paid leave to vote in person in an election.

- Donor: District government employees are eligible for paid leave of up to seven days, while private employers are eligible for a tax credit should they grant up to seven days of paid leave to their employees.

- Bereavement: The District of Columbia does not mandate employers to provide bereavement leave to employees.

Workplace Safety and Health Regulations in the District of Columbia

The Office of Occupational Safety and Health (OSH) assists employers in ensuring the safety and health of their employees, following the United States’ Occupational Safety and Health Administration (OSHA) standards.

This includes providing free services for safety and health consultation visits, worksite surveys, technical and educational assistance or training and recommendations for corrective actions for abating hazards.

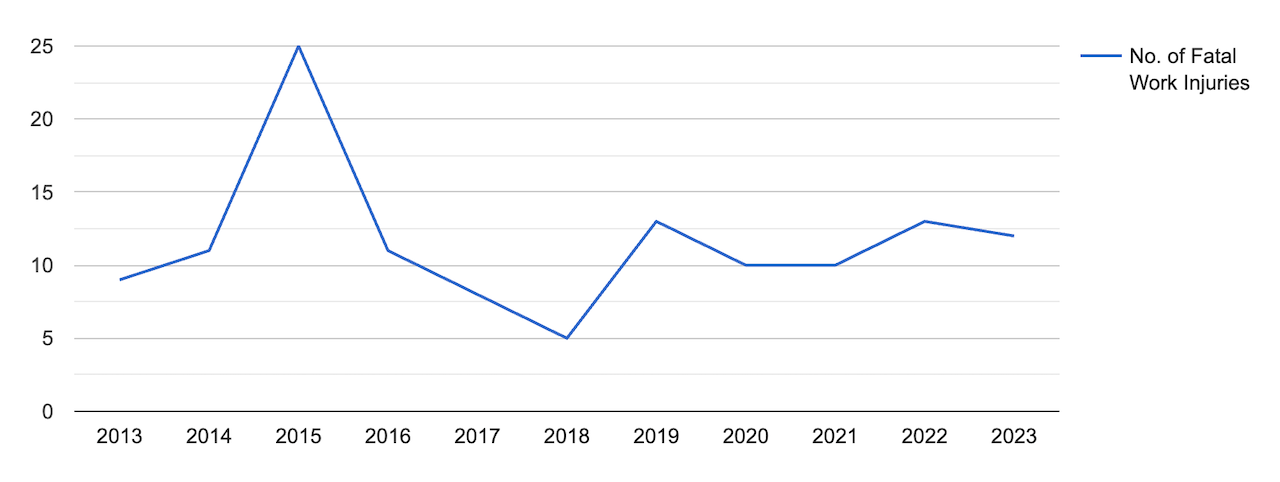

[Source: U.S. Bureau of Labor Statistics]

This graph is interactive. Hover your mouse over different parts of the graph to see detailed data.

A total of 12 fatal occupational injuries in the District of Columbia were recorded in 2021 — 7 of which were caused by violence and related incidents by persons or animals.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

The number of fatal injuries in the District of Columbia (12) is significantly lower than the national average of 102.

Child Labor Laws in the District of Columbia

The minimum age of employment in the District of Columbia is 14. All minors need a work permit prior to employment.

Individuals aged 16 or 17 can work a maximum of 6 consecutive days, not exceeding 48 hours weekly, between 6:00 a.m. and 10:00 p.m. Restrictions include tasks like operating elevators and certain manual labor.

Individuals aged 14 or 15 can work a maximum of 6 consecutive days, not exceeding 48 hours weekly, with daily limits between 7:00 a.m. and 7:00 p.m. (9:00 p.m. during summer). Prohibited tasks include using electric machinery unless in an approved education program.

Minors under 14 cannot be employed except for theatrical performers.

Additional rules apply, and three types of permits (work, vacation, theatrical) are required unless work is irregular and unrelated to the employer’s business.

Anti-Discrimination Laws in the District of Columbia

The District of Columbia’s Office of Human Rights was built to prevent discrimination, increase equal opportunity and protect the rights of locals and workers of the district.

District of Columbia Human Rights Act

This Act protects people from discrimination based on 23 protected traits:

- Age

- Color

- Credit information

- Disability

- Family responsibilities

- Familial status

- Gender identity and expression

- Genetic information

- Homeless status

- Marital status

- Matriculation

- National origin

- Personal appearance

- Place of residence or business

- Political affiliation

- Race

- Religion

- Sealed eviction record

- Sex

- Sexual orientation

- Source of income

- Status as a victim of domestic abuse, a sexual offense or stalking (DVSOS), or as a family member of such victim

- Status as a victim of an intrafamily offense

District of Columbia Language Access Act

The District of Columbia Language Access Act mandates that the district government ensure equitable access and engagement in public services, programs and activities for District of Columbia residents with limited or no proficiency in speaking, reading or writing English.

Independent Contractor Classification in the District of Columbia

Determining the classification of workers — whether they are employees or independent contractors — is important for both employers and contractors, as this affects tax responsibilities and legal protections.

Keep in mind that independent contractors are not covered under the district’s unemployment insurance law.

Official Holidays in the District of Columbia

Employers in the District of Columbia are not required to provide paid time off, unpaid time off or premium wages to employees for holidays. For a list of the official holidays in the District of Columbia, check the table below.

[Source: District of Columbia Department of Human Resources]

Note: If a legal holiday falls on a weekend, it is observed on the nearest Monday (for a Sunday holiday) or the preceding Friday (for a Saturday holiday).

Termination and Final Paychecks in the District of Columbia

An employer is required to provide a terminated employee with their final paycheck by the next business day.

In the case of an employee who resigns, the final paycheck should be given on the next regularly scheduled pay date or within seven days — whichever comes earlier.

Employers are also required to provide a written statement, or a pay stub, to employees by each payday.

Summary of District of Columbia Labor Laws

In the District of Columbia, the minimum wage stands at $17.00 per hour, surpassing the federal rate of $7.25. Employers are not obligated to offer paid breaks.

The district also adheres to the at-will employment doctrine, enabling termination by both employers and employees without notice or cause, with exceptions for discriminatory reasons or violations of employee rights.

Additionally, eligible employees in the District of Columbia are entitled to overtime pay at a rate of 1.5 times their regular pay for hours exceeding 40 in a workweek.

Lastly, the District of Columbia does not operate as a right-to-work district.

Frequently Asked Questions About District of Columbia Labor Laws

Discover answers to frequently asked questions regarding District of Columbia labor laws.

What is the legal working age in the District of Columbia?

Employees need to be at least 14 years old to work in the district.

How is overtime paid in the District of Columbia?

Overtime pay is set at a rate of time and a half or 1.5 times the employee’s regular pay for hours worked beyond 40 in a workweek.

What is considered wrongful termination in the District of Columbia?

While at-will employment is generally accepted, wrongful termination in the District of Columbia occurs when there is a clear violation of employment contracts, collective bargaining agreements or when termination is based on discriminatory reasons prohibited by federal or district laws.

Are employers required to provide holiday pay in the District of Columbia?

District of Columbia labor laws do not mandate employers to provide time off or premium pay for work on holidays. However, employers may choose to offer such benefits voluntarily or as part of employment contracts.

What are the average earnings of employees in the District of Columbia?

The average hourly earnings of employees in the District of Columbia are $50.51 per hour, as per FRED.

What is a livable salary in the District of Columbia?

The livable salary for a single-person household in the District of Columbia is at least $22.51 per hour, as per a study by MIT, which is slightly higher than the minimum wage of $17.00 per hour.

Disclaimer: This information serves as a concise summary and educational reference for District of Columbia labor laws. It does not constitute legal advice. For personalized legal guidance, please consult an attorney.