Washington Labor Law Guide

A comprehensive guide to Washington labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- Minimum wage regulations in Washington establish a minimum hourly wage for regular which is $16.28 per hour.

- Overtime pay is required for nonexempt employees who work more than 40 hours in a workweek.

- Exempt salaried employees do not receive overtime pay but must meet specific criteria.

- Washington employees are entitled to rest breaks and meal periods.

- Washington offers paid family and medical leave.

- Child labor laws dictate the employment of minors, including work permits and prohibited duties.

- Safety and health regulations are enforced by the Division of Occupational Safety and Health (DOSH).

- Anti-discrimination laws protect employees from discrimination based on various factors.

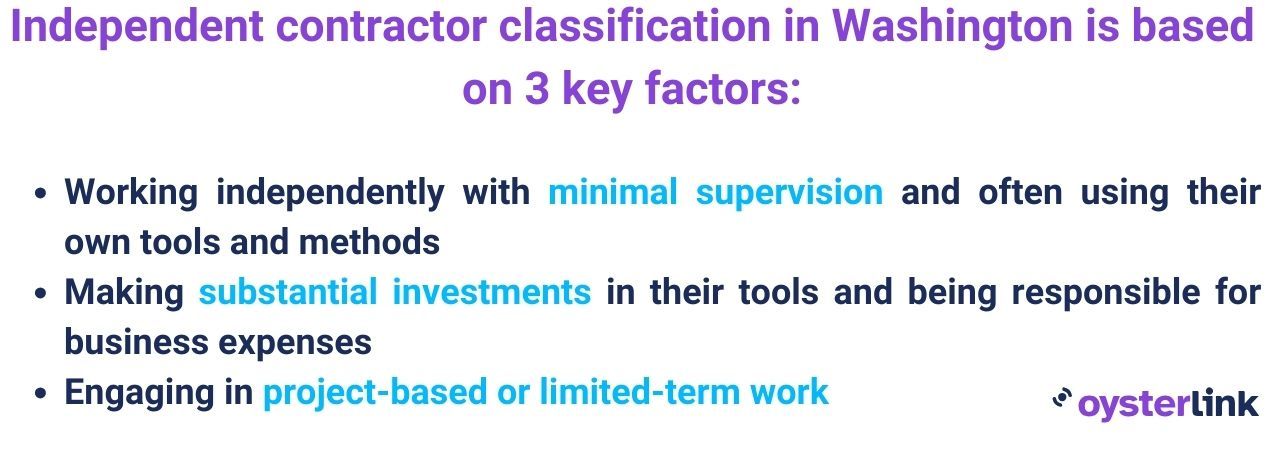

- Independent contractor classification is based on behavioral control, financial control and relationship type.

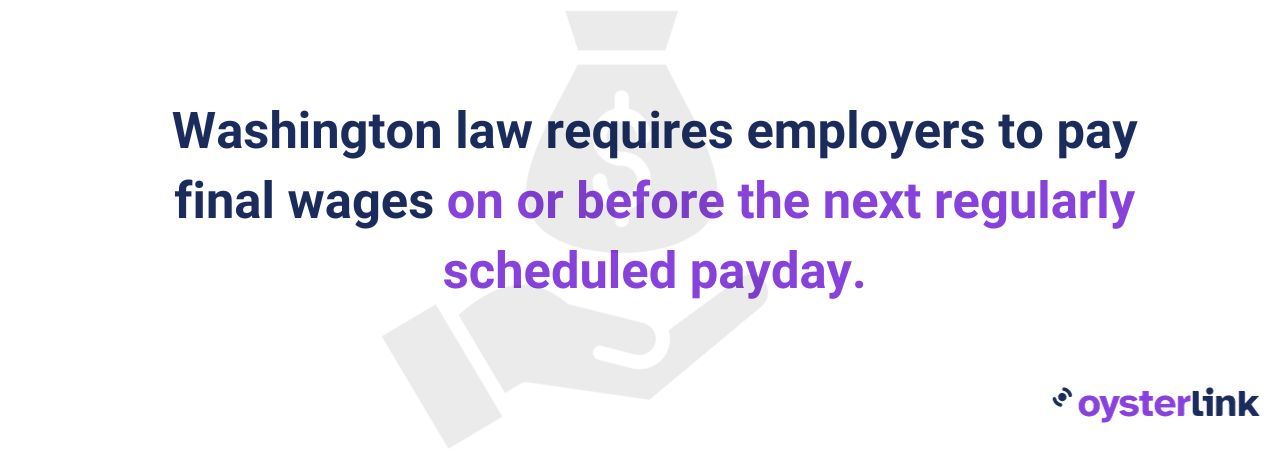

- Termination and final paycheck regulations require employers to pay final compensation promptly upon termination or resignation.

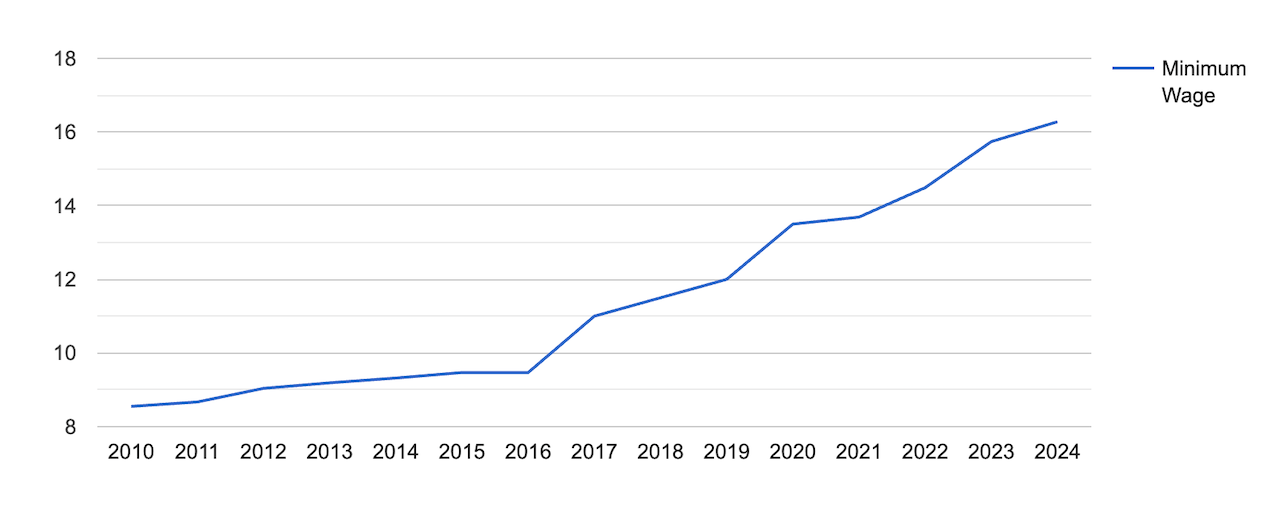

Minimum Wage Regulations in Washington

Washington's minimum wage regulations aim to ensure fair compensation, bolstering economic stability for employees throughout the state. These regulations define minimum hourly rates for both regular and tipped employees.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

The minimum wage in Washington is $16.28 per hour.

[Source: Washington State Department of Labor & Industries]

Tipped Employees

The minimum cash wage for tipped employees in Washington is the same as for regular employees—$16.28 per hour. Tipped employees must be paid at least this amount per hour in direct wages.

In Washington, tips are considered a voluntary sum of money that customers freely give to workers for their services.

The state law also mandates that employers must pay all tips to employees. Employers are not allowed to take tips for company use or to supplement employee wages.

Moreover, tip crediting is not allowed. Tips are separate from and must be in addition to an employee's state hourly minimum wage.

When it comes to tip pooling, employers are allowed to establish tip pools or require employees to "tip out" other employees. However, there are specific guidelines in place:

- Tip pools can’t include salaried managers and business owners.

- They can include employees who are not directly serving a customer, such as kitchen staff and hourly lead workers.

- The total amount in the tip pool must be in addition to and not a part of an employee's state hourly minimum wage.

- Employees cannot be required to contribute more than they received in tips to a mandatory tip pool.

Employees may also voluntarily enter into tip-sharing agreements, but employers are not required to assist in administering such agreements.

Overtime Rules and Regulations in Washington

Overtime regulations play a crucial role in protecting workers' rights and ensuring fair compensation for their extra hours of work.

In Washington, the eligibility of salaried employees for overtime pay hinges on their classification as either exempt or nonexempt.

Nonexempt Employees

Nonexempt employees are entitled to receive overtime pay for any hours worked beyond a specific threshold in a defined workweek. In the United States, this threshold is typically 40 hours per workweek.

When nonexempt employees work more than 40 hours in a workweek, they must be paid at a rate of at least 1.5 times their regular hourly wage for those additional hours.

Employers can mandate overtime work, with the exception of certain healthcare facility employees. Additionally, collective bargaining agreements and employers have the flexibility to provide overtime pay that is more generous than what Washington law requires.

Exempt Employees

Salaried exempt employees in Washington, falling under categories such as executives, administrators and professionals, are exempt from the Minimum Wage Act's protections.

To qualify for this exemption, they must:

- Receive a fixed salary

- Maintain a specified salary level ($65,478.40 annually or $5,456.55 monthly)

- Perform duties aligned with their exemption category

They are not entitled to overtime pay or paid sick leave, as their salary remains constant and is not subject to reductions based on work quantity or quality.

Break Periods in Washington

In Washington, employee break regulations are established to promote workplace fairness, protect employees' well-being and ensure consistent practices.

Rest Breaks

Employees are entitled to a paid rest break of at least 10 minutes for every four hours worked. These breaks must be scheduled as closely as possible to the midpoint of the work period.

Employers can require employees to remain on-site during their rest breaks, but unauthorized salary deductions are not permitted.

Importantly, rest breaks are considered "hours worked" when calculating paid sick leave and overtime. In some cases, "mini" rest breaks, totaling at least 10 minutes over a four-hour period, can be taken in lieu of a scheduled rest break.

Meal Periods

Employees who work more than five hours in a shift must be given a meal break. A meal break must be at least 30 minutes long, starting between the second and fifth hour of the shift. Additional meal periods may be required depending on shift length and timing.

Meal periods can be either paid or unpaid, depending on the following circumstances:

- Paid meal periods: Employees must be paid for meal breaks if they are required to remain on duty, remain on-call or are called back to work during the meal period. The entire meal period must be paid, irrespective of interruptions.

- Unpaid meal periods: Employers are not obligated to pay for meal breaks when employees are completely free from work duties. During unpaid meal periods, employees may be required to remain on the premises if they are free from work.

Employees can waive their meal break requirement if both parties agree. However, rest break requirements can’t be waived.

Family and Medical Leave Laws in Washington

The state of Washington offers paid leave to provide support to workers in various family and medical situations.

To qualify for paid leave, an employee must have worked at least 820 hours in their qualifying period, which is approximately 16 hours per week.

Most workers in Washington can qualify for paid leave, including full-time, part-time, temporary and seasonal employees. All hours worked in the state count towards eligibility, even if they have multiple jobs or change employers.

Workers who are not automatically eligible for paid leave include:

- Federal employees

- Individuals employed by businesses on tribal land

- Self-employed individuals who have not opted into the state program

- Those covered by specific collective bargaining agreements or employer-approved voluntary plans.

Paid leave can be taken incrementally or all at once, depending on the employee’s needs. However, they must claim a minimum of eight consecutive hours of leave each week, or zero hours if they are taking intermittent leave.

Employees taking paid leave can receive up to 90% of their weekly pay, with a maximum of $1,427 in 2023.

Employers are not required to hold their jobs in the following situations:

- If the company employs fewer than 50 people

- If the employee has worked for less than a year

- If the employee has worked less than 1,250 hours (about 24 hours per week) for the company in the year before taking leave.

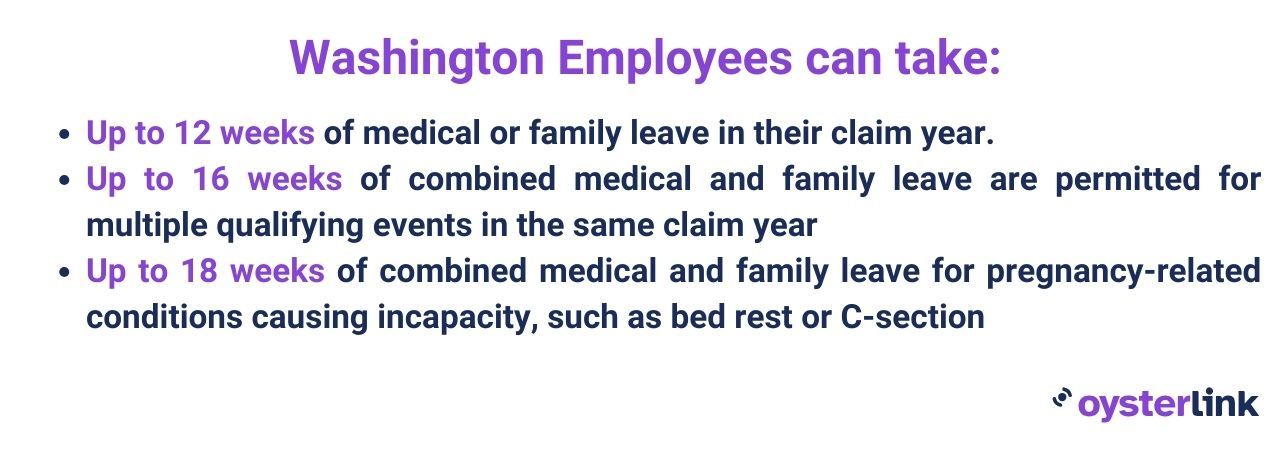

There are two primary categories of paid leave available: medical leave and family leave.

Within their claim year, an employee can take up to 12 weeks of medical leave, family leave or a combination of both, depending on their qualifying events.

Up to 16 weeks of combined medical and family leave are allowed if an employee has multiple qualifying events within the same claim year.

Family Leave

Family leave allows employees to take paid time off for various family-related situations. These include:

- Caring for a family member with a serious health condition

- Bonding with a new baby or child

- Spending time with a family member who is about to be deployed overseas or returning from overseas deployment

Eligible family members who can be cared for include

- Spouses and domestic partners

- Children (biological, adopted, foster or stepchildren)

- Parents

- Siblings

- Grandchildren

- Grandparents

- Son-in-law

- Daughter-in-law

- individuals who rely on the caregiver for assistance, regardless of shared residence.

Medical Leave

In Washington, medical leave is available when a serious health condition prevents an employee from working.

This can include major surgeries, treatment for chronic health conditions, inpatient treatment for substance abuse or addressing mental health concerns.

The amount of paid medical leave an employee can take is determined by the employee’s medical provider, with a maximum limit of up to 12 weeks per year.

However, for pregnancy-related conditions that result in incapacity, such as bed rest or a C-section, an employee can take up to 18 weeks of combined medical and family leave.

Child Labor Laws in Washington

Washington has specific laws and rules governing the employment of individuals under the age of 18, and employers must adhere to these regulations. Violations can lead to fines and civil penalties.

Federal child labor laws also apply, and employers must follow whichever regulations provide greater protection for minors.

Before hiring minors, employers must:

- Obtain a minor work permit endorsement on their business license from the Department of Revenue. This updated license must be posted and renewed annually.

- Obtain a completed parent/school or summer authorization form. Minors cannot start work until both their parent or legal guardian and school (when in session) have completed the appropriate authorization form.

- Verify the minor's age and maintain documentation on file. For non-agricultural jobs, employers should have copies of their birth certificate and Social Security card, driver's license, baptismal record, a notarized statement from the parent or legal guardian or a completed federal employment eligibility verification (I-9). For agricultural jobs, requirements may vary slightly.

Legal Age To Work

The legal age for work in Washington varies based on factors such as:

- The type of work (agricultural or non-agricultural)

- Hazardous duties

- School schedules

- The minor's status (e.g., emancipated)

- Exemptions from the Fair Labor Standards Act (FLSA).

Regulations for non-agricultural work include the following:

[Source: Washington State Department of Labor and Industries]

Various exceptions also exist for certain jobs, such as theatrical employment for minors under 14 and soccer refereeing for national youth soccer organizations.

For hiring minors under 14, superior court approval, parent/school authorization, minor work permits and proof of the minor's age are mandatory.

Superior court approval can be obtained by filing an Employer’s Petition for Permission to Employ Minors Under 14, and a copy of this court permission should be submitted to the Washington State Department of Labor & Industries.

Click here to learn all about agricultural job requirements for minors in Washington.

Hours of Work

Let's explore the permissible work hours for individuals aged 14 to 17 in non-agricultural sectors, which encompass fields like retail, restaurants, manufacturing and construction.

For information about work hours for minors working in agriculture, click here.

Individuals Under 14 Years Old

In most cases, obtaining approval from a superior court is necessary for minors under the age of 14 to engage in employment. If they are allowed to work, minors under 14 must adhere to the same work regulations as 14–15-year-olds, as outlined below.

Individuals Aged 14 to 15

The work hours shown below should not be exceeded.

[Source: Washington State Department of Labor and Industries]

Individuals Aged 16 to 17

*8 hours Sat.–Sun.

**9 p.m. June 1 to Labor Day

The work hours shown below should not be exceeded.

*8 hours Fri.–Sun.

**Midnight Fri.–Sat. or the day before a school holiday

***Midnight Fri.–Sat.

[Source: Washington State Department of Labor and Industries]

Important Notes:

- Minors employed in restaurants and retail establishments require adult supervision after 8 p.m.

- Overtime work is exclusive to teenagers aged 16–17, and standard overtime regulations are in effect for hours exceeding 40 in a week.

- These work-hour regulations are consistent for minors attending home school, alternative schools and those who are not currently enrolled in formal education.

- Employers may request variances for minors to work additional hours, earlier or later than usual, during school hours, as actors or performers or in paid worksite learning programs.

Wages, Rest Breaks and Meal Periods

When it comes to wages and break regulations for minors in Washington, there are specific guidelines in place to ensure fair treatment and work conditions for young workers.

Wages

Youth under 16 years old must receive compensation that is at least 85% of the minimum wage. Youth aged 16–17 must be paid at least the state minimum wage.

Rest Breaks

Minors, regardless of age, must be provided with paid rest breaks, allowing them to be free from work-related duties. Additional provisions apply to different age groups:

Minors are not allowed to waive their meal break requirement, nor can they waive rest break requirements.

Meal Breaks

Youth under 16 isn’t allowed to work for more than four hours without being provided with an uninterrupted meal period. A meal break must be separate and distinct from and in addition to the rest breaks.

When it comes to employees aged 16–17, they are entitled to an uninterrupted meal break of at least 30 minutes if their shift exceeds five hours in a day.

Prohibited Duties

It's important to be aware of the prohibited duties and conditions for young workers, which can vary depending on the minor's age and the nature of the job (agricultural or non-agricultural).

The following jobs and duties are prohibited for minors working in any industry:

- Slaughtering, meat processing, rendering and packing

- Any activities that entail operating, repairing, lubricating, cleaning, adjusting or configuring:

- Power-driven woodworking machines

- Circular, band or chain saws

- Power-driven metal forming, punching, and shearing machines, including guillotine shears

- Wrecking, demolition and excavation

- Roofing

- Handling or exposure to highly hazardous, cancer-causing, corrosive or poisonous substances, particularly agricultural chemicals categorized as Category I or II toxicity (Excluding the handling of sealed containers in retail environments)

- Using, handling or production of explosives or blasting agents

- Working in situations involving a strike, labor dispute or lockout

See WAC 296-125-030 (non-agricultural) and WAC 296-131-125 (agricultural) for a full list of prohibited duties.

Here are some additional prohibited duties for minors under 16:

- Operating a motor vehicle

- Conducting door-to-door sales

- Engaging in cooking and baking activities

- Handling or cleaning meat slicers

- Operating food processors

- Using any power-driven machinery

- Involvement in construction work

- Tasks related to manufacturing and processing operations

- Serving as a public messenger

- Participating in amusement park activities

- Loading or unloading trucks

- Engaging in tasks related to transportation, warehousing, storage, and conveyor work

- Using ladders and scaffolds, including window washing

- Conducting maintenance and repairs in gas stations

Workplace Safety and Health Regulations in Washington

Washington State ensures workplace safety and health through Safety and Health Core Rules that cover:

- Accident prevention

- Personal protective equipment

- First aid

- Basic electrical guidelines

These rules are enforced by the Division of Occupational Safety and Health (DOSH), a part of the Department of Labor and Industries (L&I). DOSH carries out inspections, provides consultation and issues penalties for violations.

The Washington Industrial Safety and Health Act (WISHA) empowers DOSH to establish and enforce safety and health rules, applying to nearly all employers and employees in the state.

Washington runs its own safety program, separate from the federal Occupational Safety and Health Administration (OSHA), with exceptions for specific workplaces. WISHA covers a wide range of employment scenarios, including as hiring, ownership, contracts, and volunteering.

In addition to core rules, specific industries and workplaces may have additional safety and health requirements. Compliance with fire, building and electrical codes may be necessary, depending on the nature of work and construction or remodeling.

DOSH offers consultation and various resources to assist employers and employees in maintaining a safe and healthy workplace.

Anti-Discrimination and Fair Employment Practices in Washington

Employment discrimination is prohibited in Washington State and covers a wide range of protected classes, including:

- Race

- National origin

- Creed

- Sex

- Sexual orientation

- Gender identity

- Disability

Discriminatory practices can occur during the application process or while on the job, encompassing various forms like disparate treatment, disparate impact, harassment and retaliation.

To file an employment discrimination complaint in Washington, individuals must do so with the Washington State Human Rights Commission (WSHRC) within specific timeframes.

The WSHRC has jurisdiction over employers with more than eight employees but not over certain entities like Native American tribes, the federal government and employers with fewer than right employees.

Independent Contractor Classification in Washington

In Washington, the classification of workers as independent contractors is a critical legal distinction that impacts labor laws, taxation and the rights of both workers and employers.

The state enforces the following criteria to differentiate between independent contractors and employees:

- Behavioral control: Independent contractors have the freedom to perform their work without extensive direction or supervision from the hiring entity. They often use their methods and tools.

- Financial control: Independent contractors usually have a significant investment in their own tools, equipment, and facilities. They are also typically responsible for their own business expenses.

- Relationship type: The nature of the relationship between the worker and the hiring entity is crucial. Independent contractors often have a defined project-based or limited-term engagement, while employees typically have ongoing, long-term relationships with their employers.

Misclassifying workers as independent contractors when they should be employees can lead to significant legal and financial consequences for employers.

Termination and Final Paychecks in Washington

In the state of Washington, the process of ending employment carries with it a set of regulations and responsibilities designed to ensure that employees receive their final compensation in a timely and fair manner.

Termination

Washington is an at-will employment state, meaning that employers can terminate employees without establishing a specific cause or providing notice, as long as they don’t violate employee protection laws.

While at-will employment allows for termination without notice, it is against the law for employers to terminate or retaliate against employees who discuss or file complaints about violations of their protected rights.

Terminating employment in Washington involves specific rules and obligations for employers, ensuring that employees receive their final paychecks promptly and in accordance with legal requirements.

Final Paychecks

When an employee quits or is terminated, their final paycheck must be issued on or before the next regularly scheduled payday, as mandated by Washington labor law.

Employers can’t withhold an employee's final paycheck, even if the individual has not returned keys, uniforms, tools or equipment. These items are typically separate from the final payment process.

Severance, personal holidays and vacation time are considered voluntary benefits. Employers may choose to include these in an employee's final paycheck. If there are disputes regarding these benefits, individuals can consult with an attorney or file claims in small claims court.

Paid sick leave balances have distinct requirements that employers must adhere to when addressing them in an employee's final paycheck.

Certain deductions from paychecks are permissible, even if they reduce the employee's wages below the state minimum wage. These include:

- Deductions required by state or federal law, such as income taxes, Medicare and workers' compensation

- Court-ordered wage garnishments

- Deductions benefiting the employee, provided there is prior written agreement, even if these deductions occur during ongoing employment

- Deductions for hospital, medical or surgical care or service

Any deductions from final paychecks that would push the employee's earnings below the minimum wage are not allowed, except under specific circumstances, such as:

- Covering a cash shortage in the till

- Covering the cost of lost or damaged equipment if employee wrongdoing is established

- Accepting a "bad check" or credit card purchase based on existing business policies

- Worker theft, if dishonest or willful actions are proven and a police report is filed

When navigating Washington labor laws and termination procedures, make sure you're equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state's tax laws.

Summary of Washington Labor Laws

The state of Washington sets a minimum wage, which is $16.28 per hour for both regular employees and tipped employees.

Nonexempt employees are entitled to overtime pay for work exceeding 40 hours per week, with certain exceptions. Exempt, salaried employees, such as executives and professionals, are not eligible for overtime pay.

Washington mandates rest breaks and meal periods. Employees are entitled to a 10-minute paid rest break every four hours and a 30-minute meal break for shifts exceeding five hours.

The state offers paid leave to support employees in various family and medical situations. Qualifying employees can receive up to 90% of their weekly pay for up to 12 weeks.

Specific regulations govern the employment of individuals under 18, with legal requirements for work permits and prohibited duties. Both state and federal laws apply.

Washington ensures workplace safety through the Division of Occupational Safety and Health (DOSH). Various rules cover accident prevention, personal protective equipment and more. The state also prohibits employment discrimination based on factors like race, creed, gender and disability.

Distinguishing between independent contractors and employees is essential. It's based on behavioral control, financial control and the nature of the employment relationship.

Washington is an at-will employment state, allowing employers to terminate employees without cause. Final paychecks must be issued promptly upon termination or resignation, with specific rules and responsibilities.

Frequently Asked Questions About Washington Labor Laws

What is the seven-minute rule in Washington state?

The "seven-minute rule" in Washington state refers to a common practice where employers may round an employee's time worked to the nearest 15-minute interval.

If an employee clocks in or out within seven minutes of the beginning or end of a 15-minute interval, the time may be rounded to that interval.

For example, if an employee clocks in at 8:08 AM, their time may be rounded to 8:15 AM.

How many hours can you legally work in Washington?

For adult employees, there are no statutory daily limits on the number of hours they can work in Washington. However, for certain jobs and industries, there may be federal or state regulations governing maximum work hours, such as those related to transportation or workplace safety.

However, there are specific regulations regarding the maximum hours minors can work. Generally, minors may not work during school hours, and the specific limitations depend on the minor's age and the type of work they are performing.

Can I skip my lunch break in Washington State?

Employees have the option to waive their meal break requirement, provided both the employee and the employer are in agreement. However, rest break requirements can’t be waived.

Employers also have the option to submit a Variance Application to request modifications to rest and meal break requirements.

How much paid sick leave do I get in Washington?

At a minimum, employees must be provided one hour of paid sick leave for every 40 hours worked. Paid sick leave must be provided to all employees, irrespective of their full-time, part-time, temporary or seasonal employment status.

Can my employer fire me for being sick in Washington state?

Employers are prohibited from taking disciplinary actions against any employee for utilizing paid sick leave for authorized purposes or for filing a complaint under the law. This encompasses actions such as termination, suspension, demotion or withholding a promotion.

Disclaimer: This information serves as a concise summary and educational reference for Washington state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.