Virginia Labor Law Guide

A comprehensive guide to Virginia labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- The minimum wage for regular employees in Virginia is $12.00 per hour.

- The minimum wage for tipped employees is $2.13 per hour.

- Nonexempt employees are entitled to overtime pay at 1.5 times their regular hourly wage for hours worked beyond 40 in a week.

- Exempt employees, paid a fixed salary of at least $684 per week, are not eligible for overtime pay.

- Virginia doesn't have specific break requirements for adult employees except for nursing mothers.

- Eligible employees can take up to 12 workweeks of unpaid leave for various reasons, with job security and continued health insurance coverage.

- Minors aged 14 or 15 have specific restrictions on working hours, school attendance and types of jobs.

- Virginia follows the at-will employment doctrine, allowing both employers and employees to terminate the employment relationship at any time.

- Employers are required to provide departing employees with compensation for wages earned before termination.

Minimum Wage Regulations in Virginia

Virginia's minimum wage policies aim to ensure equitable pay and bolster economic security for all workers within the state. These policies establish specific hourly wage standards for both regular and tipped employees.

Regular Employees

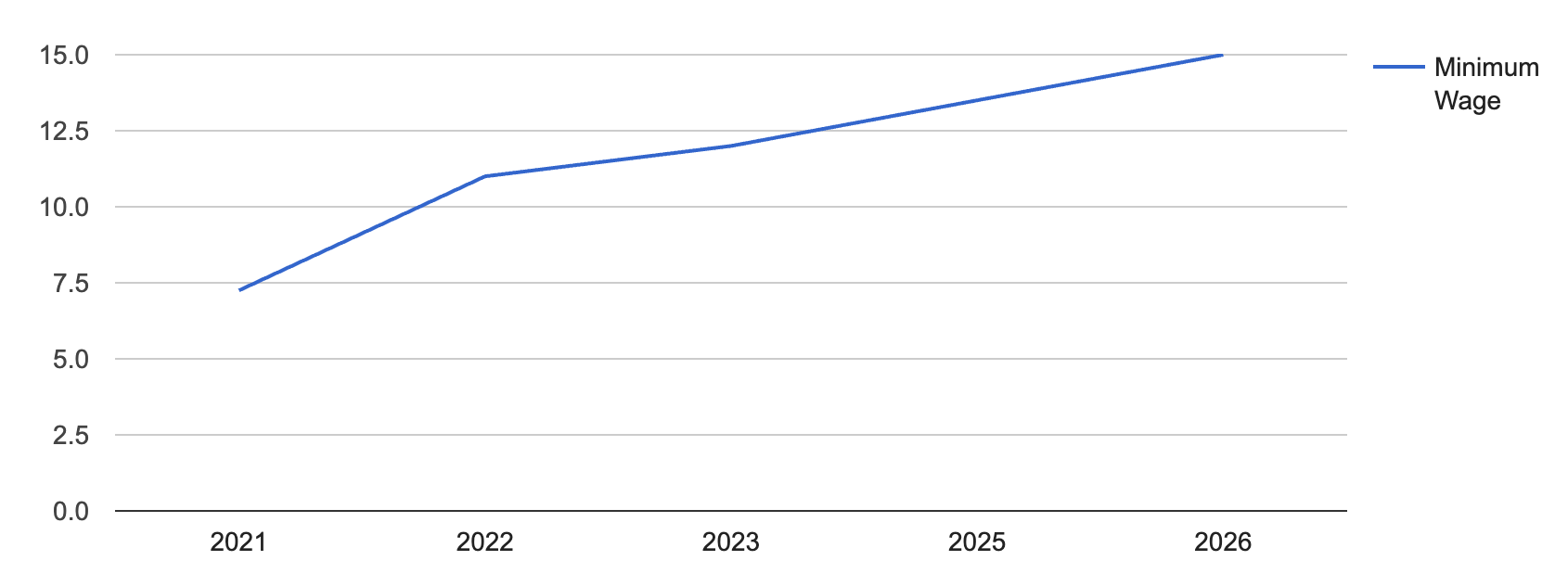

The minimum wage for regular employees in Virginia is $12.00 per hour.

[Source: Virginia’s Legislative Information System]

However, over the next couple of years, the minimum wage will grow, reaching $15.00 per hour in 2026.

This gradual progression towards a higher minimum wage reflects the state's commitment to fair compensation and the well-being of its workers. It acknowledges the importance of keeping the minimum wage in pace with the rising cost of living and the evolving economic landscape.

Here is the overview of minimum wages across the United States:

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Tipped Employees

Virginia labor laws define a "tipped employee" as someone who, in the course of their employment, customarily and regularly receives tips totaling more than $30 each month from customers.

The minimum wage for tipped employees in Virginia is currently set at $2.13 per hour. However, employers must make sure that the combined total of the employee's hourly wages and tips equals or exceeds the Virginia minimum wage rate of $12.00 per hour.

Overtime Rules and Regulations in Virginia

Overtime regulations are a fundamental component of labor laws, serving to guarantee that employees receive fair compensation for their additional hours of work.

In Virginia, these regulations follow the guidelines established by the Fair Labor Standards Act (FLSA), and they differ for nonexempt and exempt employees.

Nonexempt Employees

Nonexempt employees are entitled to overtime pay for any hours worked beyond the standard 40-hour workweek.

Overtime pay for nonexempt employees in Virginia is calculated at a rate of 1.5 times their regular hourly wage.

Exempt Employees

Exempt employees are not eligible for overtime pay in Virginia. For an employee to be considered exempt, they must be paid a fixed salary of at least $684 per week.

Exempt employees are further evaluated based on their job duties and responsibilities, as these criteria play a crucial role in determining their exempt status. These job duties must align with the following exemption categories:

- Executive exemption: Employees classified under this category generally hold managerial roles, overseeing other employees. Their primary duties often revolve around managing a department or division, making critical decisions, and having the authority to hire and fire employees.

- Administrative exemption: Administrative exempt employees are typically engaged in tasks directly related to the management or operations of the business. Their duties may involve using discretion and independent judgment to make significant decisions.

- Professional exemption: Exempt professionals are employees who work in fields that require advanced knowledge or specialized education. Examples include lawyers, doctors, engineers and other occupations where advanced knowledge and specialized skills are essential.

- Outside sales exemption: This exemption applies to employees who are primarily engaged in making sales or obtaining orders for services or goods while working away from the employer's place of business. Their primary duties involve conducting sales activities, often involving substantial travel and client interactions.

Break Periods in Virginia

Virginia, like many other states, doesn’t have specific requirements for providing breaks to adult employees, with the exception of nursing mothers.

Every nursing mother employed in Virginia is covered by the FLSA's Providing Urgent Maternal Protections (PUMP) for Nursing Mothers Act, which grants them the right to a reasonable break period and access to a private, non-bathroom space for pumping at their workplace for up to one year.

When it comes to minors, employers must provide a 30-minute lunch break to employees under 16 years of age after they have worked five consecutive hours.

This regulation is specifically designed to ensure the welfare of young workers and to prevent them from working extended hours without a break.

Family and Medical Leave Laws in Virginia

In Virginia, family and medical leave laws are anchored in the federal Family and Medical Leave Act (FMLA).

This legislation forms the basis of the state's policy, ensuring that eligible employees are afforded specific leave entitlements to address a range of family and medical needs.

Under the FMLA, eligible employees are granted up to 12 workweeks of unpaid family and medical leave within a rolling 12-month period.

FMLA leave is not compensated, but its value lies in the job security it provides. Those eligible have the right to reoccupy their former role or a similar one once their FMLA leave ends.

Notably, their health insurance coverage persists throughout the leave duration, guaranteeing uninterrupted access to essential medical services.

Family and medical leave can be utilized for several distinct purposes including:

- Serious health condition: Employees may take FMLA for their own serious health condition or that of an eligible family member. This provision provides essential time off for medical treatment and recovery, acknowledging the importance of health and well-being.

- Military caregiver leave: In cases involving a covered service member with a serious injury or illness, eligible employees can access up to 26 workweeks of unpaid leave. This extended leave period is available to those who are the spouse, son, daughter, parent or next of kin of the servic member, recognizing the unique challenges and responsibilities they may face.

- Exigency leave: FMLA leave is also accessible for any qualifying exigency stemming from a family member's military service. This includes situations where a spouse, son, daughter or parent is a covered military member on active duty or has received notice of impending call or order to active duty.

To qualify for FMLA leave in Virginia, employees must meet specific criteria, including a minimum of 12 months of employment with a covered employer and the completion of at least 1,250 hours of service over the previous 12 months.

Child Labor Laws in Virginia

The minimum age for employment in Virginia varies depending on the nature of the job.

Individuals of any age are allowed to:

- Work from home, performing domestic tasks like house cleaning or taking out the trash for their parents

- Engage in agricultural activities on their parents' farm, garden or orchard, such as planting and feeding animals

- Work in businesses owned by their parents, except for manufacturing, mining or other high-risk occupations

- Work at someone else's house for housecleaning or babysitting, provided they have their parents' permission

- Participate in a volunteer rescue squad

Children aged 12 and above, with their parents' consent, can:

- Work on any farm, garden or orchard not owned by their family

- Deliver newspapers

- Serve as a referee at sporting events for charitable or government organizations

- If aged between 12 and 18, they can work as a page or clerk for the Virginia General Assembly

Children aged 14 and 15 (with an Employment Certificate) are eligible for employment in various roles, including:

- Office jobs

- Kitchen duties and cleaning in hospitals and nursing homes

- Cashier positions at dry cleaners (with no on-site processing)

- Food service roles such as dishwashing, table waiting (excluding serving alcoholic beverages) and cashier or kitchen helper (with certain limitations)

- Employment at bowling alleys and swimming pools as gatekeepers or in concessions and handling beach equipment at the beach

Minors aged 16 and 17 are not required to obtain an employment certificate and can take on a wide range of job types. However, there are restrictions in place to prevent them from working in particularly hazardous occupations.

Occupations that are off-limits to minors under 16 include:

- Manufacturing or mechanical establishments

- Construction trades

- Scaffolding

- Commercial canneries

- Operating passenger or freight vehicles

- Dance studios

- Laboratory assisting, therapy, orderly work or nursing aide duties in establishments providing resident patient care

- Veterinary businesses, particularly when treating farm animals or horses

- Warehouses

- Dry cleaning or laundry processing

- Undertaking establishments or funeral homes

- Curb service restaurants

- Hotel and motel room service

- Usher positions in theaters

- Work in brick, coal or lumber yards

- Jobs in outdoor theaters

- Employment in cabarets, carnivals, fairs, floor shows, pool halls, clubs or roadhouses

- Lifeguarding at beaches (individuals can work as lifeguards at swimming pools at age 15, but not at beaches where conditions can be more hazardous)

Working Hours

Working hours for minors in Virginia are subject to specific regulations to ensure the safety, well-being and education of young workers.

Let's take a closer look at the working hours applicable to minors aged 14 or 15, whose work schedules are influenced by factors such as their school timetable, day of the week and occupation.

[Source: A Commonwealth of Virginia Website]

Minors 16 and 17 years of age have no restrictions on the number of hours worked. They must, however, comply with the compulsory school attendance law and curfew ordinances that may apply and these will influence times they can lawfully work.

Exceptions to the limitation on hours for any teens include work in the following situations:

- Non-manufacturing parent-owned businesses

- Parent-owned farms, orchards or gardens

- Around parents’ or someone else’s home

- Page/clerk for the Virginia General Assembly

- Performing or acting

- Activities for a volunteer rescue squad

Workplace Safety and Health Regulations in Virginia

Virginia places a strong emphasis on ensuring the safety and well-being of workers through the Virginia Occupational Safety and Health (VOSH) Law.

The primary objective of this law is to establish and enforce job safety and health protections for employees across the state. It aims to create and maintain safe working conditions to prevent accidents, injuries and health hazards.

The key elements of VOSH include:

- Promulgation of standards: The Virginia Safety and Health Codes Board plays a pivotal role in developing and adopting job safety and health standards. These standards serve as a framework for employers and employees to follow in order to maintain a safe work environment.

- Employer responsibilities: Employers are mandated to provide their employees with employment and workplaces that are free from recognized hazards. Employers are also required to adhere to occupational safety and health standards established under the law.

- Employee obligations: Employees are expected to comply with all occupational safety and health standards, rules, regulations and orders relevant to their job responsibilities and actions.

- Inspection and compliance: A representative of the employer and a representative authorized by the employees have the opportunity to accompany VOSH inspectors to assist in the process. If no authorized employee representative is available, the inspector must consult with a reasonable number of employees regarding safety and health conditions in the workplace.

- Citations and penalties: If an employer violates the VOSH Law, they will be issued a citation specifying the alleged violations and a time frame within which they must be rectified. Penalties are imposed for non-compliance, with mandatory penalties for private sector employers reaching up to $13,047 for each serious violation. Optional penalties of up to $13,047 are applicable for other-than-serious violations. Additional penalties of up to $13,047 per day can be proposed for failure to correct violations within the specified time frame. Employers who willfully or repeatedly violate the law may face penalties of up to $130,463 for each such violation. Public sector employers are also subject to penalties under specific provisions.

- Criminal penalties: The law includes provisions for criminal penalties, particularly for willful violations resulting in the death of an employee. Upon conviction, fines can reach up to $70,000, with potential imprisonment for up to six months, or both. Subsequent convictions can lead to double penalties.

- Reporting requirements: All fatalities must be reported to VOSH within eight hours. Additionally, injuries or illnesses resulting in in-patient hospitalization, amputation or loss of an eye must be reported within 24 hours. Failure to report these incidents may result in significant monetary penalties.

- Protection against retaliation: It is essential to note that it is illegal to retaliate against an employee for exercising their rights under the VOSH Law. This includes raising safety or health concerns with the employer or VOSH, as well as reporting work-related injuries or illnesses.

- Exemptions and scope: The VOSH program applies to all public and private sector businesses in Virginia, with specific exceptions for federal agencies, businesses under the Atomic Energy Act, certain railway operations, some federal enclaves and businesses governed by federal maritime jurisdiction.

- Voluntary compliance: Employers are encouraged to make voluntary efforts to ensure their workplaces comply with the VOSH Law. Voluntary Safety and Health Consultation and Training Programs are available to assist employers in achieving and maintaining compliance.

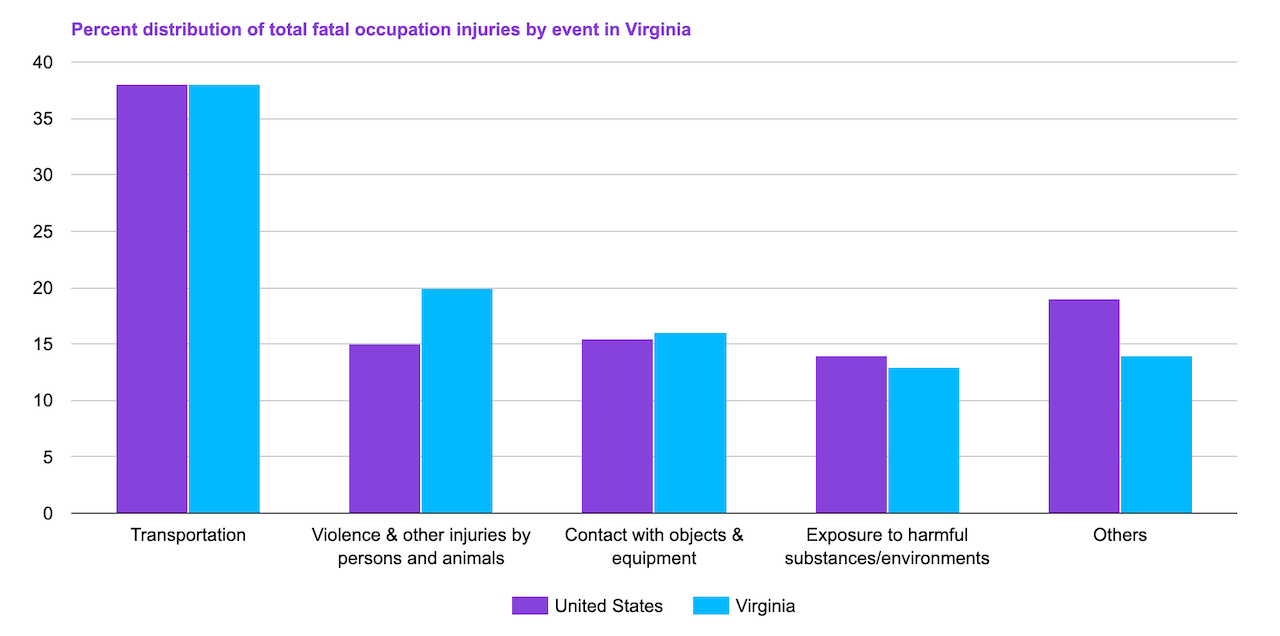

The chart below offers a comparative analysis of occupational fatal injuries in Virginia in contrast to the United States as a whole.

[Source: Virginia Department of Labor and Industry Annual Report]

Anti-Discrimination and Fair Employment Practices in Virginia

Virginia has taken significant steps to protect the rights and well-being of employees through the enactment of state laws that address various forms of discrimination and ensure fair employment practices.

These protections apply to all employees working in Virginia for employers with 15 or more employees.

The protected categories include:

- Race and color

- Religion

- Sex

- Sexual orientation

- Gender identity

- Marital status

- Pregnancy and related medical conditions

- Age

- Status as a Veteran

- National origin

Employees who choose to wear natural hairstyles, such as afros, braids, locks or twists, are also protected from discrimination under Virginia’s civil rights protections.

If employees experience discrimination, they can file a complaint to the Division of Human Rights within the Office of the Attorney General.

This department is authorized to conduct investigations and take action on discrimination complaints, including the option to take legal action against employers suspected of violating the law.

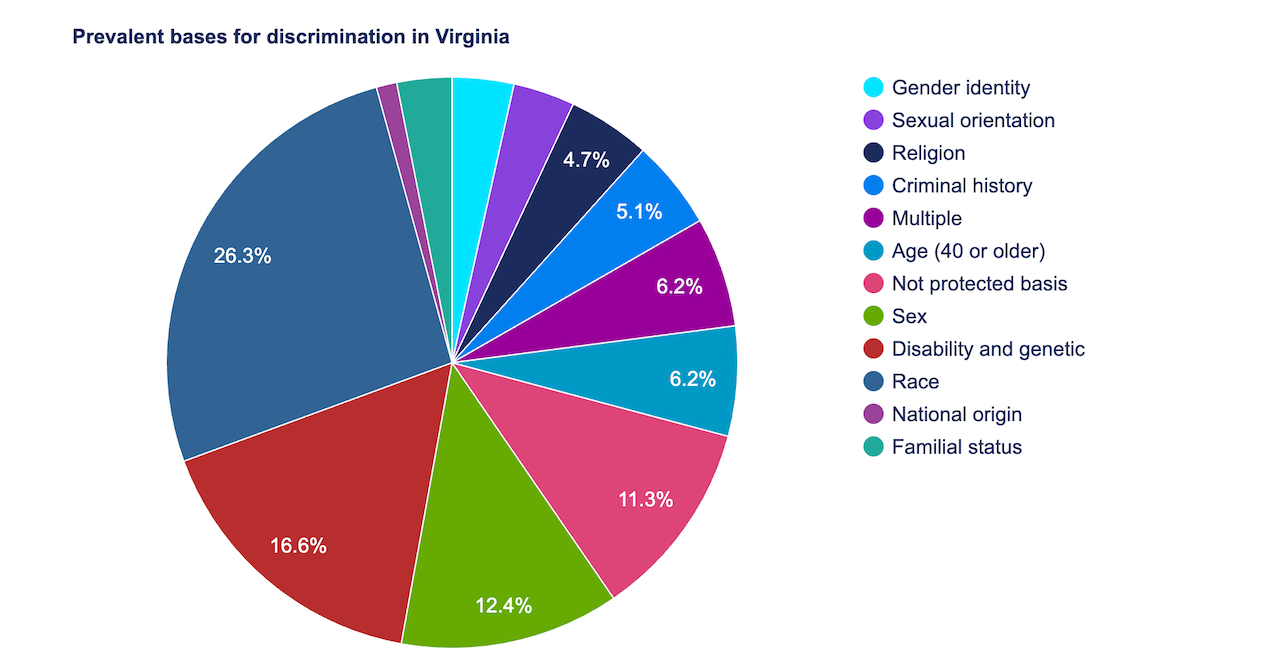

The pie chart below shows the prevalent bases for discrimination in Virginia.

[Source: FRED]

This chart is interactive. Hover your mouse over different parts of the chart to see detailed data.

Independent Contractor Classification in Virginia

The primary factor distinguishing an employee from an independent contractor in Virginia is the degree of control an employer exercises over the employee's tasks and the manner in which they are executed.

An employee is characterized by the fact that the employer possesses the authority to determine not only the scope of the work but also how it is executed. This is true even if the employee enjoys a substantial degree of freedom in their actions.

Conversely, an independent contractor is responsible for delivering services as specified by the employer but retains autonomy over the methodology employed to fulfill the requirements.

Simply put, a worker can be classified as an employee if the employer:

- Supplies the necessary tools, materials and equipment for the job

- Dictates the work hours

- Withholds federal and state income taxes, along with Social Security taxes

- Provides guidance and training concerning the task execution

- Compensates the worker based on hourly, weekly or monthly wages instead of on a per-job basis

Termination and Final Paychecks in Virginia

Virginia adheres to the principle of at-will employment. The at-will employment doctrine is a legal framework that grants both employers and employees the liberty to terminate the employment relationship at any point and for any reason.

Nevertheless, it's important to understand the implications of this doctrine, particularly concerning final paychecks upon termination.

Upon termination of employment in Virginia, the employer is legally required to provide the departing employee with compensation for all wages or salaries earned as a result of work performed before the termination.

The specific deadline for this payment is on or before the date the employee would have typically received their regular paycheck had their employment not been terminated.

When navigating Idaho labor laws and termination procedures, make sure you're equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state's tax laws.

Summary of Virginia Labor Laws

Virginia's minimum wage for regular employees currently stands at $12.00 per hour but is set to increase gradually to $15.00 per hour by 2026. Tipped employees must ensure that their combined hourly wages and tips meet or exceed this minimum.

Overtime regulations, following federal standards, ensure that nonexempt employees are compensated at a rate of 1.5 times their regular hourly wage for hours worked beyond 40 in a week. Exempt employees paid a fixed salary do not qualify for overtime pay.

Break periods in Virginia are primarily governed by federal laws, with specific provisions for nursing mothers and minor employees. The state adheres to the federal Family and Medical Leave Act, providing unpaid leave with job security for eligible employees facing various family and medical needs.

Virginia's child labor laws set minimum age requirements for different types of employment, with various exceptions for tasks like working on family farms or volunteering. The safety and well-being of young workers are emphasized, and working hours are regulated to accommodate school schedules.

The state places a strong emphasis on workplace safety and health through the Virginia Occupational Safety and Health (VOSH) Law, which establishes safety standards, employer responsibilities, and employee obligations. Violations can lead to penalties, including fines and criminal charges.

Anti-discrimination laws in Virginia protect employees from various forms of discrimination, including those based on race, religion, sex, age and more. Employees facing discrimination can file complaints with the Division of Human Rights within the Office of the Attorney General.

Independent contractor classification depends on the degree of control exercised by employers over workers' tasks and methods. Factors like tool supply, work hours and payment structure play a role in determining classification.

Finally, Virginia operates under the at-will employment doctrine, allowing both employers and employees to terminate the employment relationship at any time. Upon termination, employers are legally obligated to compensate departing employees for wages earned before termination.

Frequently Asked Questions About Virginia Labor Laws

How many hours can you work without a break in Virginia?

In Virginia, there is no specific state law that mandates breaks for adult employees. However, employees under the age of 16 are required to have a 30-minute lunch break after working five consecutive hours.

Does Virginia require paid lunch breaks?

Virginia labor laws do not require employers to provide paid lunch breaks. Whether lunch breaks are paid or unpaid depends on the employer's policies and practices.

Is working 32 hours considered full-time in Virginia?

In Virginia, a full-time classified employee typically works a schedule of 40 hours per week, designated as "F" status. Some employers may also consider employees who work between 30 to 39.9 hours per week, categorized as "Q" status, as full-time employees.

Therefore, working 32 hours a week could be considered full-time, depending on the employer's policies and their use of these status designations.

Is it illegal to work off the clock in Virginia?

Yes, it is generally illegal for employees to work off the clock in Virginia. Employers are required to compensate employees for all hours worked, including overtime if applicable.

Do I have to give a two weeks notice in Virginia?

In Virginia, as in many other states, there is generally no legal requirement for employees to give a two weeks notice before resigning from their job.

Employment in Virginia often operates under the at-will doctrine, which means that both the employer and the employee can terminate the employment relationship at any time and for any reason unless a specific employment contract or agreement states otherwise.

Disclaimer: This information serves as a concise summary and educational reference for Virginia state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.