Texas Labor Law Guide

A comprehensive guide to Texas labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways of Texas Labor Laws

- Texas’ minimum wage has been $7.25 per hour since 2010.

- There are no Texas labor laws that require employers to provide paid breaks to employees.

- Eligible employees in Texas must be paid 5 times their regular rate of pay for hours worked over 40 in a workweek.

- Texas has adopted employment-at-will since 1888, allowing either the employer or employee to terminate the working relationship for any reason or no reason at all.

- Texas is a right-to-work state, ensuring that individuals cannot be denied employment based on their affiliation with a labor organization.

Minimum Wage Regulations in Texas

Texas does not have its own set minimum wage rate and instead adopts the federal minimum wage rate of $7.25 per hour.

All information related to state minimum wage requirements is provided by the Texas Workforce Commission.

The Texas Minimum Wage Act allows employees to engage in collective bargaining with their employers when negotiating a higher wage.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

Regular employees who fall under the coverage of the Fair Labor Standards Act (FLSA) are eligible to receive a minimum wage rate of $7.25 per hour.

In this context, “regular” refers to employees who do not receive tips as part of their compensation.

Employers can include the value of meals and lodging when determining minimum wage compliance — subject to restrictions.

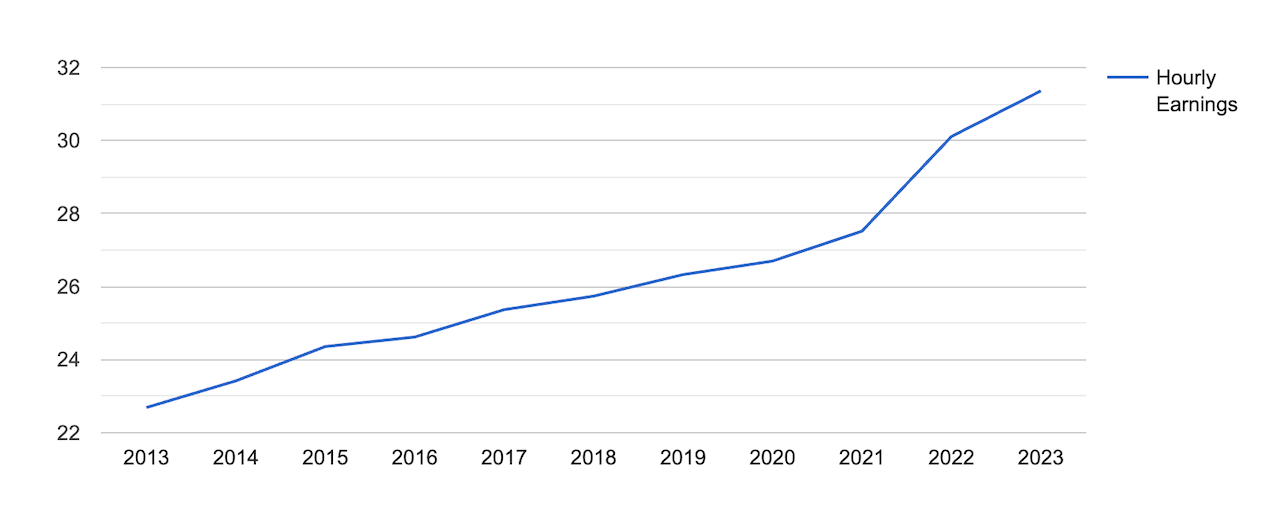

While the minimum wage has remained fixed, the surge in average hourly earnings primarily mirrors the negotiating power and market demand influencing salaried employees in Texas, reaching $31.36 per hour as of January 2023.

[Source: FRED]

Tipped Employees

Tipped employees must be paid a direct cash wage of at least $2.13 per hour, provided that they get at least $5.12 per hour in tip earnings. Employers can apply a tip credit against wages.

If employees’ tip earnings plus the direct cash wage fall below the minimum wage rate, employers must make up the difference.

State Income Tax Rates in Texas

Texas is one of seven states that do not levy state income taxes. Instead, the state relies on income from sales tax and excise taxes to fund its operations.

Through our Paycheck Calculator, both regular and tipped employees can calculate their earnings efficiently, while factoring in taxes and deductions.

Overtime Rules and Regulations in Texas

Texas’ overtime regulations follow the FLSA, which requires employers to pay employees at a rate of 1.5 times their regular hourly wage for hours worked beyond 40 in a single workweek.

Non-Exempt Employees

Non-exempt employees in Texas are entitled to overtime pay calculated at time and a half, equivalent to 1.5 times their standard hourly rate.

To calculate overtime earnings, use our Time and a Half Calculator.

Exempt Employees

Texas overtime laws follow federal FLSA regulations that specify which employees are exempt from receiving overtime pay, including, but not limited to:

- Executives, professionals and administrators earning at least $684 per week or $35,568 per year

- Independent contractors

- Transportation employees

- Workers in computer-related roles

- Specific agricultural and farm laborers

- Live-in staff such as housekeepers

- External salespersons

At-Will Employment in Texas

Like in many other states, employers in Texas must abide by at-will employment laws. Under at-will employment, either the employer or employee can terminate a working relationship for any reason or no reason at all.

Termination resulting from a breach of contract, discrimination, retaliation or violation of employee rights is deemed wrongful and will not be upheld.

Right-To-Work Laws in Texas

As a right-to-work state, Texas ensures that no individual can be refused employment based on their participation or non-participation in a labor organization.

Employers are also prohibited from obstructing or denying an employee’s right to engage in collective bargaining or organizing a labor union.

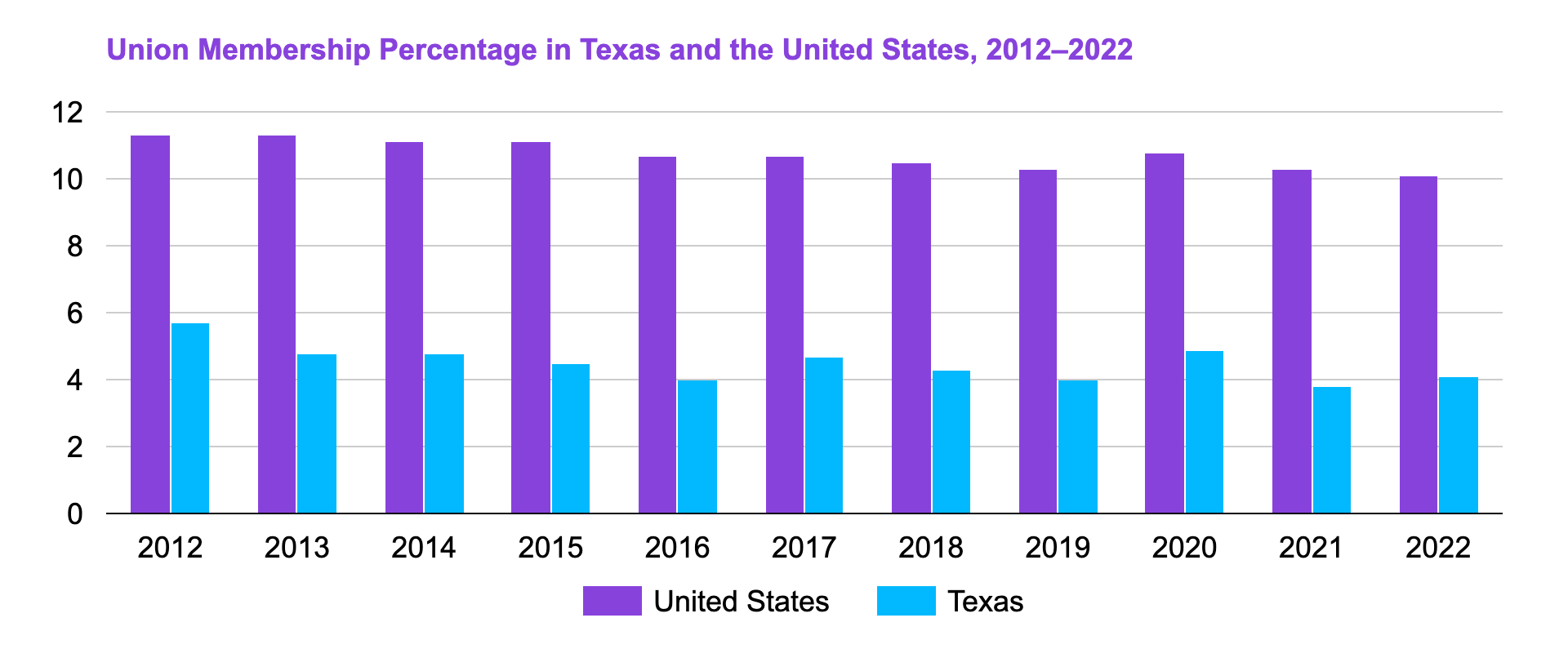

Since 1989, union membership rates in Texas have consistently been below the United States’ (U.S.) average.

[Source: U.S. Bureau of Labor Statistics]

Rest and Meal Breaks in Texas

Texas does not mandate employers to provide rest and meal breaks to their employees, regardless of the shift duration.

Because of the Texas Regulatory Consistency Act, signed in June 2023, cities and counties in Texas cannot pass stricter regulations compared to those set by the state.

Although not required, many Texan employers have more employee-friendly break policies in place. Discussions about these policies can take place between the employer and employee during the interview and hiring process.

Family and Medical Leave Laws in Texas

Texas labor laws observe federal law — specifically, the Family and Medical Leave Act (FMLA) — in its leave policies. The FMLA entitles eligible employees to take up to 12 weeks of unpaid, job-protected family leave during a 12-month period.

This applies to state, local and federal employers, schools and local education agencies and private employers with 50 or more employees for at least 20 workweeks.

Qualifying reasons for the FMLA leave include:

- Birth and bonding

- Adoption or placement of a foster child, and bonding

- Serious health condition

- Family member’s serious health condition

- Military family member on active duty

- Military family member’s serious injury or illness

Other Leave Laws

Conditions for other types of leaves under Texas labor laws include:

- Voting leave: Employees must be given paid time off to give them a reasonable amount of time to vote, provided that they do not have two hours on either side of their work day to vote.

- Jury duty leave: There is no mandated paid leave for jury duty in Texas.

- Military leave: Public employees in Texas military forces, reserves or authorized search and rescue teams are entitled to up to 15 paid workdays for training or duty, with no loss of time or benefits. Private employers with 15+ employees must provide eligible employees with unpaid military leave.

- Bereavement leave: There is no mandated bereavement leave in Texas.

Workplace Safety and Health Regulations in Texas

The state of Texas is under federal Occupational Safety and Health Administration (OSHA) jurisdiction, which applies to most private employers.

Texas does not have its own OSHA agency, so related standards and regulations are set at the federal level.

Employers are required to follow OSHA standards when ensuring a safe and healthful workplace for their employees. This applies to all employers with at least one employee.

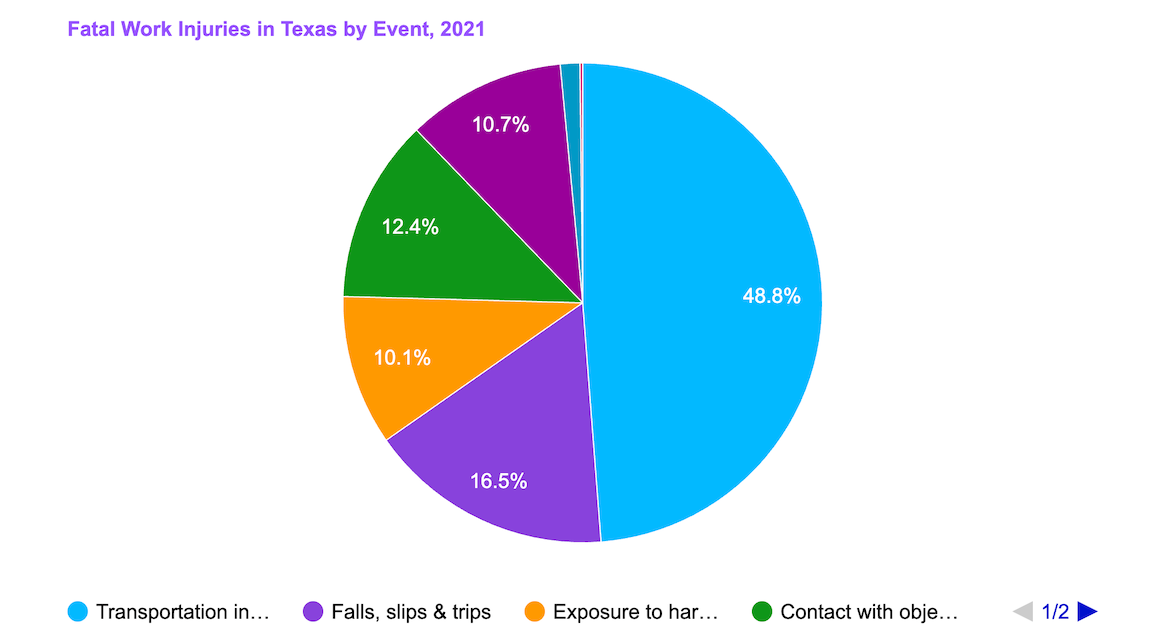

[Source: U.S. Bureau of Labor Statistics]

A total of 533 fatal occupational injuries in Texas were recorded in 2021 — 260 of which were caused by transportation incidents.

The number of fatal injuries in Texas (533) is alarmingly higher than the national average of 102, reflecting a staggering 422% increase.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Child Labor Laws in Texas

The minimum working age in Texas is 14, with restrictions outlined by state and federal laws.

Work permits are not required, but minors can secure a certificate of age document to prove their age.

Employers are not required to provide breaks, even to minor employees.

Working Hours

Texas follows state and federal laws for work-hour guidelines regarding child labor. ederal child labor law has stricter limitations compared to state laws on working hours for children ages 14–15.

State Law

- Limits for 14- and 15-year-old employees in Texas include 8 hours per day or 48 hours per week

- Prohibits work between 10:00 p.m. and 5:00 a.m. on days preceding a school day or midnight to 5:00 a.m. on non-school days (if enrolled), and midnight to 5:00 a.m. during the summer recess (if not enrolled in summer school)

Federal Law (FLSA)

- Prohibits work during school hours. Limits work to 8 hours on a non-school day or 40 hours on a non-school week

- Restricts work to a maximum of 3 hours on a school day or 18 hours in a school week

- Prohibits work between 7:00 p.m. and 7:00 a.m. during the school year

- Prohibits work between 9:00 p.m. and 7:00 a.m. from June 1 to Labor Day

Anti-Discrimination Laws in Texas

Federal and state laws prohibit employment discrimination based on the following traits:

- Age

- Citizenship status

- Color

- Disability

- Gender

- Genetic traits

- National origin

- Pregnancy

- Race

- Religion

- Sex

- Sexual orientation

- Gender identity

The Texas Workforce Commission (TWC) is responsible for enforcing state employment discrimination laws. Employees must file discrimination charges with the TWC before filing a lawsuit in state court.

The majority of employment discrimination laws are applicable to employers with a minimum of 15 employees. However, there are two notable exceptions:

- Age Discrimination in Employment Act: Applicable to employers with 20 or more employees

- Immigration and Nationality Act: Applicable to employers with four or more employees

Independent Contractor Classification in Texas

Properly determining worker classification is crucial to adhere to tax regulations. If an employer has control over the worker’s service, wages and direction, then that worker is an employee.

On the other hand, an independent contractor operates with more autonomy in these aspects.

Employers are subject to the Texas Unemployment Compensation Act, which makes them liable to pay unemployment taxes on wages paid to employees.

Official Holidays in Texas

Employers in Texas are not required to pay additional wages or provide time off to their employees for holidays. For a list of the official holidays in Texas, check the table below.

[Source: Texas State Library and Archives Commission]

Termination and Final Paychecks in Texas

Terminated employees must be given their final pay in full within six days.

Employees who choose to quit must be paid on the next regularly scheduled pay date.

Employers must pay for unused benefits, including vacation leaves, severance pay and holidays.

As per the Texas Payday Law, employees must be paid on time and in full on scheduled paydays, and employers are required to provide a written statement, or a pay stub, within each payday.

Summary of Texas Labor Laws

Texas follows the federal minimum wage of $7.25 per hour, lacking its own set minimum. Tipped employees must earn a direct cash wage of at least $2.13 per hour, with a tip credit.

Employers can include meals and lodging for compliance with minimum wage regulations. Texas has no state income tax.

Overtime aligns with the FLSA, requiring time and a half for hours worked beyond 40 in 1 workweek.

At-will employment is standard, allowing either party to terminate for any reason, except in specific cases (discrimination, retaliation, etc.).

Texas, as a right-to-work state, ensures employment is not conditional on labor organization participation, and employers cannot impede collective bargaining or union organization.

Frequently Asked Questions About Texas Labor Laws

Read on for answers to frequently asked questions regarding Texas labor laws.

Is overtime pay mandatory in Texas?

Texas law mandates that employers pay all non-exempt employees at least time and a half, or 1.5 times an employee’s regular hourly rate of pay, for all hours worked over 40 in 1 workweek.

Exempt employees are not entitled to overtime pay.

How many hours can an employee work without a break in Texas?

Employers in Texas are not required to provide breaks to employees, regardless of the work hours.

What is considered wrongful termination in Texas?

While at-will employment is followed in Texas, where employers and employees can end a working relationship for any or no reason, wrongful termination occurs when there is a clear breach of contract, discrimination, retaliation or violation of employee rights.

Are employers required to provide holiday pay in Texas?

Texas labor laws do not mandate that employers provide time off or premium wages for work on holidays.

How much does the average employee make in Texas?

In Texas, the average employee makes $31.36 per hour, as per Federal Reserve Economic Data.

What is the livable wage in Texas, and how does it compare to the minimum wage?

The livable wage for a single-person household in Texas is at least $16.79 per hour, as per a study by MIT, which is higher than the minimum wage of $7.25 per hour.

Disclaimer: This information serves as a concise summary and educational reference for Texas labor laws. It does not constitute legal advice. For personalized legal guidance, please consult an attorney.