Tennessee Labor Law Guide

A comprehensive guide to Tennessee labor laws: Covering essential topics like minimum wage guidelines, overtime regulations, mandatory rest breaks and other key employment provisions specific to the Volunteer State.

Key Takeaways

- Tennessee adheres to the federal minimum wage of $7.25 per hour.

- Tipped employees have a base wage of $2.13 per hour.

- Overtime pay at a rate in Tennessee is 1.5 times the regular rate of pay for hours worked beyond 40 in a week.

- Tennessee requires a mandatory 30-minute unpaid meal or rest period for employees scheduled to work six consecutive hours.

- Tennessee has its family leave laws in addition to federal FMLA that covers adoption, pregnancy, childbirth and infant nursing.

- Tennessee uses a 20-factor test to determine employment relationships.

- Employees must be paid in full on the next regular payday following dismissal or voluntary departure, or within 21 days of termination.

Minimum Wage Regulations in Tennessee

Tennessee doesn't have its own minimum wage law. Instead, this state relies on federal regulations to govern minimum wage requirements.

You can check out minimum wages in all US states on out interactive map.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

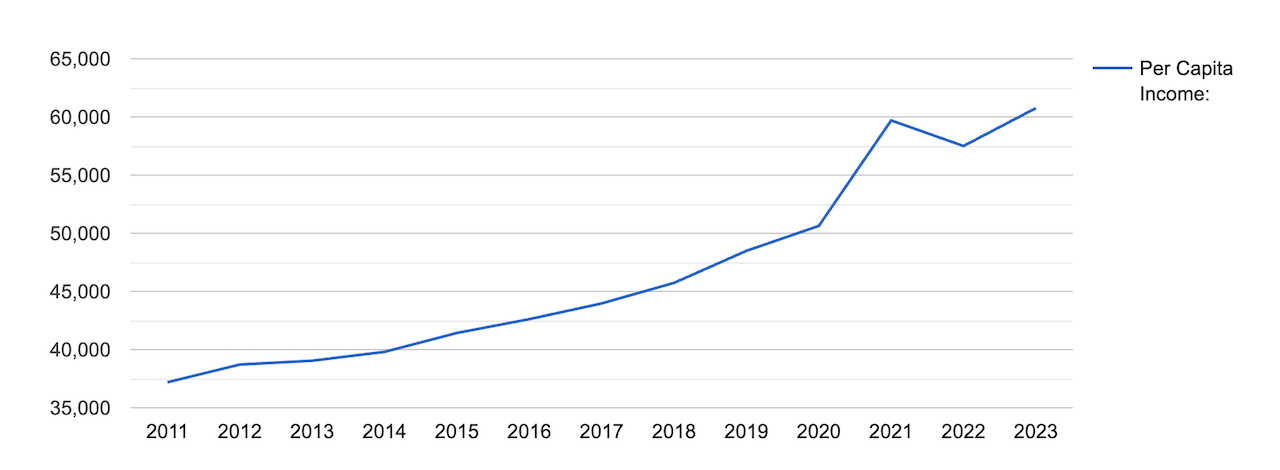

[Source: FRED]

Currently, according to the federal Fair Labor Standards Act (FLSA), the minimum wage has been $7.25 per hour since 2009.

Despite the prolonged stagnation of the minimum wage since 2009, Tennessee has witnessed a consistent upward trend in per capita personal income.

[Source: FRED]

Tipped Minimum Wage

In Tennessee, employers are permitted to pay tipped employees less than the standard minimum wage, which is set at no less than $2.13 per hour.

Employer can pay their employees a base wage of $2.13 per hour, as long as the total earnings, including tips, meet or exceed the federal minimum wage of $7.25 per hour.

To be classified as a tipped employee in Tennessee, an individual must earn a minimum of $30 per month in tips.

Exceptions to Minimum Wage Requirements

The following categories of employees are typically exempt from minimum wage requirements under the FLSA:

- Executive, administrative and professional employees

- Outside sales employees

- Certain computer-related occupations

- Seasonal amusement or recreational establishments:

- Certain farm workers

- Casual babysitters and companions to the elderly or infirm

Subminimum Wage

Under the FLSA, certain individuals are allowed to be employed at wage rates lower than the statutory minimum wage through certificates issued by the Department of Labor.

For instance, employees under the age of 20 may be paid a minimum wage of not less than $4.25 per hour during the first 90 consecutive calendar days of their employment.

By law, employers are prohibited from displacing any existing employees to hire someone at the youth minimum wage.

Other groups of employees that are subjected to subminimum wage regulation include:

- Student learners: Particularly vocational education students who are gaining practical experience as part of their education and training.

- Full-time students: Those working in retail or service establishments, agriculture or institutions of higher education may be eligible for subminimum wage rates.

- Individuals with disabilities: Individuals whose ability to earn or be productive in their work is affected by physical or mental disabilities, including those related to age or injury, may also be granted certificates for subminimum wage employment.

When discussing wages, it’s important to keep in mind the taxes for complete financial clarity. Our Tennessee Paycheck Calculator gives you an estimate of your earnings after accounting for taxes and deductions, in adherence to your state’s tax laws.

Overtime Rules and Regulations in Tennessee

While Tennessee state law does not explicitly address overtime pay, the rights and obligations of both employers and employees regarding overtime are clearly outlined in the FLSA, a federal law that applies to workers in Tennessee.

According to the FLSA, eligible employees must receive overtime pay at a rate of at least 1.5 times their regular rate of pay for each hour worked beyond 40 hours in a workweek.

Since Tennessee's minimum wage is $7.25 per hour, this means the minimum overtime wage in the state is $10.88 per hour.

This additional compensation is mandatory for eligible employees who work more than 40 hours in a workweek. Overtime is calculated based only on weekly hours worked, not on a daily basis.

Overtime Exceptions and Exemptions

FLSA provides guidelines for determining which employees are exempt from receiving overtime pay. Exempt employees are not entitled to overtime compensation.

These exemptions are based on specific job duties and salary thresholds rather than job titles.

The FLSA focuses on an employee's specific job duties and requires that they be paid on a salary basis, earning at least $455 per week. The law does not rely on job titles to determine exempt status. Instead, it examines the nature of the work performed.

Some examples of exempt professionals include:

- Lawyers

- Physicians

- Teachers

- Architects

- Registered nurses

However, these exemptions do not typically apply to skilled trades, mechanical arts or jobs that don't require a college or postgraduate degree.

The following types of employees are commonly exempt from federal overtime rules:

- Executive employees: Those who have managerial responsibilities and the authority to make significant business decisions.

- Administrator employees: Individuals who perform office or non-manual work related to management or general business operations.

- Outside salespeople: Sales representatives who primarily work away from the employer's place of business.

- Inside salespeople with commission-based compensation: Sales employees who earn most of their income through commissions.

- Learned professionals: This category includes employees like CPAs, lawyers and executive chefs who engage in work that requires advanced knowledge and expertise in their field.

Rest and Meal Breaks

In Tennessee, rest and meal breaks are regulated by state law, and there are specific provisions that employers and employees need to be aware of.

According to state law, employees must be provided with a mandatory 30-minute unpaid meal or rest period if they are scheduled to work six consecutive hours.

However, there is an exception to the meal or rest break requirement for workplace environments that, by the nature of their business, already provide ample opportunity for employees to rest or take appropriate breaks.

An example of such environments include the food/beverage industry or security services. In these cases, the specific nature of the work may already allow for necessary breaks, and therefore, the thirty-minute break may be optional.

Tennessee state law does not impose additional break requirements beyond the thirty-minute meal or rest period for employees.

Family and Medical Leave Laws in Tennessee Tennessee has its own set of family and medical leave laws in addition to the federal Family and Medical Leave Act (FMLA).

Here is a comparison of key elements between federal and state regulations.

Employers covered:

- Federal: Private employers with 50 or more employees in at least 20 weeks of the current or preceding year are subject to the FMLA. Public agencies, including state, local and federal employers, are also covered, while local education agencies have special provisions.

- State: In addition to federal FMLA, Tennessee has a family leave law that covers adoption, pregnancy, childbirth and infant nursing. This law applies to employers with 100 or more full-time employees.

Employees eligible:

- Federal: Employees must have worked for their employer for at least 12 months, worked at least 1,250 hours during the 12 months preceding leave, and be employed at a worksite with 50 or more employees within 75 miles.

- State: Employees must have worked for the employer for at least 12 consecutive months on a full-time basis.

Leave amount:

- Federal: Generally, up to a total of 12 weeks during a 12-month period, with up to 26 weeks during a single 12-month period to care for a covered service member

- State: Up to four months of leave for adoption, pregnancy, childbirth and nursing an infant

Type of leave:

- Federal: Federal FMLA provides unpaid leave for various reasons, including the birth of a child, adoption care for a family member with a serious health condition or an employee's own serious health condition.

- State: The state law allows for leave for adoption, pregnancy, childbirth and nursing an infant, with leave being provided with or without pay at the employer's discretion.

Serious health condition/serious injury or illness:

- Federal: FMLA defines serious health conditions and serious injuries or illnesses, including those incurred in the line of duty by members of the Armed Forces.

- State: The state law does not have provisions regarding serious health conditions or serious injuries or illnesses.

Intermittent leave:

- Federal: Intermittent leave is permitted for certain situations, like serious health conditions, but not for newborn or new placement by adoption or foster care unless the employer agrees.

- State: There is no specific provision regarding intermittent leave.

Family Members That Qualify for FMLA

Under the federal FMLA, eligible employees in Tennessee can take leave to care for specific family members.

The family members that qualify for FMLA leave include:

- Spouse: Eligible employees can take FMLA leave to care for their spouse with a serious health condition or for qualifying exigency leave related to their spouse's active duty or call to active duty in the Armed Forces.

- Child: FMLA leave can be taken to care for a child with a serious health condition, to bond with a newborn child, or to a child placed for adoption or foster care.

- Parent: Eligible employees can take FMLA leave to care for their parent with a serious health condition.

- Next of kin in the Armed Forces: FMLA provides for leave to care for a next of kin who is a covered service member with a serious injury or illness incurred in the line of duty while serving on active duty in the Armed Forces.

Salary During Paid Sick Leave In Tennessee, no state law mandates paid sick leave. Therefore, employers in Tennessee are not legally required to provide paid sick leave to their employees.

Sick leave, if offered, is typically a matter of company policy and is not governed by state law.

Employers in Tennessee have the discretion to determine whether they will provide paid sick leave and under what conditions.

If paid sick leave is provided, the terms and conditions, including salary continuation during sick leave, are typically outlined in the company's policy or employment contract.

Workplace Safety and Health Regulations in Tennessee

The Tennessee Occupational Safety and Health Administration (TOSHA) plays a crucial role in promoting workplace safety and health in the state of Tennessee.

Here are some key aspects of TOSHA's functions and services:

- Compliance: TOSHA enforces occupational safety and health standards in various industries, including general industry, construction and agriculture.

- Consultative services: TOSHA provides assistance to employers in creating safe and healthful workplaces for their employees. This service is designed to help employers reduce workplace injuries and illnesses, control costs and increase profits, all while avoiding citations and monetary penalties.

- Training & education: TOSHA offers training services to employers, employees and their representatives. These services aim to reduce safety and health hazards in the workplace and ensure compliance with Tennessee OSHA standards and regulations.

- Fatality, hospitalization & amputation reporting: Employers are legally obligated to report workplace fatalities within eight hours of their occurrence. Additionally, all work-related inpatient hospitalizations, amputations and eye injuries must be reported within 24 hours.

- Filing a safety complaint: Workers have the right to file safety complaints and request inspections if they believe safety and health hazards exist in their workplace. TOSHA takes these complaints seriously and conducts inspections to address potential issues.

- TOSHA online penalty payment: TOSHA provides an online platform for employers to pay penalties using credit cards or electronic checks.

- Search establishment inspections: Employers and the public can access information about a company's inspection history, safety standard violations and penalties assessed by TOSHA.

- Safety conference: TOSHA hosts an annual Safety Conference where professionals can engage in discussions about safety and health topics. This event provides a platform for sharing knowledge and addressing concerns related to workplace safety.

[Source: U.S. Bureau of Labor Statistics]

In addition to these vital services, it's essential to understand the real impact of workplace safety and health.

Of the 132 fatal work injuries in Tennessee, a staggering 85% were waged and salaried workers.

The remaining individuals were self-employed, underlining the widespread nature of this issue.

For comparison purposes, you can examine the number of fatal work injuries across the U.S. on our map below.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Child Labor Laws in Tennessee

Tennessee's Child Labor Law is designed to protect the rights and well-being of minors aged 14 to 17 who are entering the workforce. Its core purpose is to create a safe working environment that doesn't compromise the health, education or future opportunities of these young individuals. Key provisions of Tennessee's Child Labor Act include:

- Occupational restrictions: The law prohibits the employment of minors in certain occupations and under specific working conditions that could pose hazards to their safety or well-being. This ensures that young workers are not exposed to undue risks in the workplace.

- School day limits: The law places restrictions on when minors can work during a school day and the number of hours they are permitted to work. These restrictions are in place to safeguard their educational commitments and prevent overworking during the school week.

In addition to these foundational principles, specific hour restrictions apply based on the age of the minor:

- For minors under 16: Work is prohibited during these hours: 7 p.m. to 7 a.m. (9 p.m. to 6 a.m. before non-school days).

- For minors ages 16 and 17: Work is prohibited during these hours: 10 p.m. to 6 a.m. (Sunday - Thursday before school days) with exceptions allowing work until midnight with parental permission for up to 3 nights a week.

Anti-Discrimination and Fair Employment Practices in Tennessee

Tennessee enforces strict anti-discrimination laws that prohibit employers from making employment decisions based on various factors.

These factors include:

- Age (for those aged 40 and above)

- Color

- Creed

- Disability

- National origin

- Race

- Religion

- Sex

The Tennessee Human Rights Act and Tennessee Disability Act extend their protections to various aspects of employment actions.

This encompasses areas such as:

- Advertising

- Employee benefits

- Discipline

- Compensation

- Discharge

- Harassment

- Hiring

- Layoff

- Leave

- Promotion

- Suspension

- Training

Individuals who believe they have experienced discriminatory employment practices have the right to file a complaint with the state enforcement agency.

Complaints must be lodged within 180 days of the alleged discriminatory act. Upon receiving a complaint, the agency conducts a prompt investigation.

Retaliation against an employee who has filed a complaint, participated in a proceeding or exercised any other rights under these provisions is strictly prohibited.

Employers are barred from discharging, disciplining or discriminating against employees for asserting their rights.

The primary enforcement agency in Tennessee is the Tennessee Human Rights Commission, which is responsible for receiving, investigating, seeking conciliation, holding hearings and issuing findings and orders in response to complaints of human rights law violations.

Independent Contractor Classification in Tennessee

Tennessee implements the 20-factor test to determine whether an employer-employee relationship exists. It's essential to understand that not all factors are given equal weight, and their relevance varies depending on the specific working relationship.

The 20 factors include:

- Instructions: The presence of instructions about when, where and how the employee is to work typically indicates an employer-employee relationship.

- Training: If the person for whom the services are performed requires training or specific methods, it implies control over the worker.

- Integration: When the worker's services are integrated into the business operations, this shows direction and control.

- Services rendered personally: If the services must be rendered personally, the employer has an interest in both the methods and results.

- Hiring, supervising and paying assistants: If the employer hires, supervises, and pays assistants, it generally shows control over the workers.

- Continuing relationship: A continuing relationship suggests an employer-employee relationship, especially if work occurs at recurring intervals.

- Set hours of work: The establishment of set hours of work indicates control.

- Full-time required: Requiring full-time dedication indicates control, as an independent contractor can work on their own schedule.

- Doing work on employer's premises: Work performed on the employer's premises suggests control, but this may vary depending on the nature of the work.

- Order or sequence set: A set order or sequence for work indicates control, even if the employer rarely sets the order.

- Oral or written reports: Requiring regular reports suggests a degree of control.

- Payment by hour, week, month: Payment by time generally implies an employer-employee relationship, but the method of payment should not be a mere convenience for a lump sum.

- Payment of business or traveling expenses: If the employer covers expenses, it indicates control over the worker's activities.

- Furnishing of tools and materials: Providing significant tools and equipment suggests an employer-employee relationship.

- Significant investment: If the worker invests in facilities not typically maintained by employees, it indicates an independent contractor status.

- Realization of profit or loss: A worker who can realize a profit or suffer a loss beyond what is typical for employees is generally an independent contractor.

- Working for more than one firm at a time: Working for multiple unrelated parties concurrently typically indicates an independent contractor status.

- Making service available to the general public: If the worker offers their services to the general public consistently, it indicates an independent contractor relationship.

- Right to discharge: The right to discharge implies an employer-employee relationship, as it demonstrates control.

- Right to terminate: If the worker can end the relationship at any time without incurring liability, it suggests an employer-employee relationship.

Termination and Final Paycheck Laws in Tennessee

Any employee who leaves their job or is discharged is entitled to receive all wages or salary earned without delay.

The law specifies that these earnings must be paid in full no later than the next regular payday following the date of dismissal or voluntary departure.

If the employee is terminated, they should receive their wages within 21 days following the date of discharge or voluntary leaving, whichever occurs last.

Holding a paycheck until an employee returns items such as uniforms or equipment, is only permissible if the employee has previously signed a written policy or agreement permitting such a practice.

If there is no written agreement in place, the employer should follow the standard payment regulations.

Summary

Tennessee follows the federal minimum wage of $7.25 per hour. Tipped employees can be paid $2.13 per hour, with tips making up the difference.

Moreover, overtime pay is mandated by federal law, with a minimum of 1.5 times the regular rate of pay for hours worked beyond 40 in a week.

Employees working six consecutive hours are entitled to a 30-minute unpaid break, with some industry exceptions.

In Tennessee, a 20-factor test is used to determine employment relationships and if the employee is an independent contractor.

Lastly, employees must be paid in full on the next regular payday following termination or departure, or within 21 days of termination. Paycheck withholding for items like uniforms requires a written agreement.

FAQs About Tennessee Labor Laws

For more info, find frequently asked questions about the labor laws in Tennessee below.

Is it illegal to discuss wages in Tennessee?

Under federal law, specifically the National Labor Relations Act (NLRA), it is generally not illegal for private-sector employees in Tennessee, or anywhere in the United States, to discuss their wages and employment conditions with their colleagues.

This means that employees have the right to talk about their pay, benefits, and working conditions without facing retaliation from their employer.

Is working 32 hours per week considered full-time in Tennessee?

In Tennessee, a full-time employee is typically defined as someone who works an average of 30 hours or more per week. So, working 32 hours per week would be considered full-time in Tennessee.

Can you be forced to work overtime in Tennessee?

In Tennessee, employers have the authority to require employees to work mandatory overtime.

However, if employees are asked to work more than 40 hours in a workweek, they are entitled to receive overtime compensation.

Can you be fired without cause in Tennessee?

Yes, employers have the discretion to hire or terminate employees at any time, with or without cause. In other words, they are not required to provide a specific reason for dismissal.

However, both Tennessee state and federal laws prohibit termination based on discrimination.

Is holiday pay mandatory in Tennessee?

In Tennessee, private employers have the discretion to decide whether to provide paid holidays or offer premium pay, which is often set at 1.5 times the regular rate, for hours worked on holidays.

However, it's important to emphasize that offering holiday pay or premium pay for holiday work is not mandatory unless it is explicitly specified in an employment contract as part of the employee's benefits package.

Disclaimer: This information serves as a concise summary and educational reference for Tennessee state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.