South Dakota Labor Law Guide

A comprehensive exploration of South Dakota labor laws: Encompassing crucial subjects such as minimum wage guidelines, overtime regulations, mandatory rest breaks and a wide array of other significant employment provisions.

Key Takeaways

- The minimum wage in South Dakota is $11.20 per hour

- The minimum wage for tipped employees stands at $5.60 per hour

- Overtime pay is 1.5 times the regular hourly rate for hours worked over 40 in a workweek

- South Dakota does not have specific state regulations for rest and meal breaks; it's at the employer's discretion

Overview of South Dakota Labor Laws

- South Dakota labor laws offer strong protections and guarantees for employees, creating a foundation for fair and ethical working conditions

- These regulations cover critical aspects such as minimum wage guidelines, overtime pay, mandatory rest and meal breaks and provisions for family and medical leave

- The state places substantial importance on cultivating a safe and inclusive workplace, marked by rigorous safety standards and anti-discrimination laws

- Additionally, supplementary labor rules, including the timely issuance of final paychecks following employment termination, further support the rights and welfare of workers in South Dakota

Minimum Wage Regulations in South Dakota

In South Dakota, the minimum wage is adjusted annually based on the increase in the cost of living, as determined by the Consumer Price Index published by the U.S. Department of Labor.

The increase in the minimum wage is rounded up to the nearest 5 cents and cannot result in a decrease in the minimum wage rate.

As of January 1, 2024, the minimum wage for non-tipped employees in South Dakota is $11.20 per hour.

South Dakota's state minimum wage rate exceeds the Federal Minimum Wage of $7.25 per hour. Therefore, employees in South Dakota are entitled to receive the higher state minimum wage.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Tipped Minimum Wage

For tipped employees, such as bartenders and waiters/waitresses, the hourly minimum wage is no less than $5.60.

Employers must ensure that their tipped employees receive at least the current minimum wage, and they are required to maintain records of all tips received by employees.

Exceptions to Minimum Wage Requirements

In South Dakota, there are certain exemptions and exceptions to the minimum wage requirements:

- Executive workers, administrative workers, learned and creative professionals paid on a salary basis earning $684 or more per week

- Computer employees earning $684 per week or at least $27.63 per hour

- Highly compensated employees earning $107,432 or more annually

- Outside sales employees with no minimum salary requirement

- Tipped employees

- Minors

Additionally, South Dakota state laws exempt:

- Independent contractors

- Seasonal amusement or recreation establishments

- Babysitters

- Outside salespersons

- Apprentices

- Individuals with developmental disabilities

Subminimum Wage

In South Dakota, subminimum wages can be paid to specific categories of workers as outlined by the Fair Labor Standards Act (FLSA). These categories include:

- Student-learners

- Full-time students working in retail, agriculture and service establishments

- Individuals with impaired productive capacity, such as those with physical or mental disabilities

For individuals under 20 years of age during the first 90 days of employment, South Dakota follows federal guidelines, allowing employers to pay a subminimum wage of $4.25 per hour.

Additionally, full-time students in South Dakota are eligible to receive 85% of the federal minimum wage, which currently amounts to $9.52 per hour.

These subminimum wage provisions are in accordance with federal regulations and apply to specific groups of workers in the state.

Try our easy-to-use South Dakota paycheck calculator to determine the exact amount of money you’ll receive working in South Dakota.

Overtime Rules and Regulations in South Dakota

In South Dakota, overtime rules and regulations are governed by federal law, specifically the FLSA. South Dakota does not have its own state law regarding overtime provisions.

Employees in South Dakota are entitled to overtime pay as per the provisions of the FLSA. Overtime pay is 1.5 times the employee's regular hourly rate for all hours worked over 40 in a single workweek.

Overtime is calculated using the following methods:

- For hourly employees: Pay time and a half (1.5 times the regular rate) for hours worked over 40 hours per workweek.

- For hourly employees with bonuses and/or commissions: The regular rate is calculated as the total hours worked multiplied by the hourly rate, plus the workweek equivalent of the bonus and/or commission, divided by the total hours in the workweek. Overtime pay is half of the regular rate for each overtime hour.

- For salaried employees: If you work less than 40 hours a week, you calculate what you'd earn for 40 hours at your regular rate, then get paid extra (time and a half) for hours beyond 40.

Overtime Exceptions and Exemptions

Overtime exceptions and exemptions in South Dakota follow the federal FLSA. This means certain employees may not be eligible for overtime pay if they meet specific criteria:

- Executive, administrative, professional and outside sales employees who earn at least $684 per week

- Highly compensated employees making over $107,432 per year

- Salaried computer employees earning at least $684 per week

These criteria determine whether employees in South Dakota are exempt from receiving overtime pay under the FLSA, which also applies in the state.

Rest and Meal Breaks

In South Dakota, there are no state-specific regulations that compel employers to offer rest breaks or meal periods to their employees.

The provision of such breaks is solely at the discretion of the employer and is typically outlined in company policies or employment contracts.

Furthermore, even at the federal level, the FLSA, which governs labor standards in the United States, does not impose any specific requirements regarding rest breaks or meal periods.

This means that employers in South Dakota, as in most other states, are not legally obligated to provide employees with designated breaks for rest or meals under federal law.

As a result, the availability and terms of rest breaks or meal periods can vary widely among employers in South Dakota. Some employers may choose to offer such breaks as a benefit to their employees, while others may not provide them at all.

Family and Medical Leave Laws in South Dakota

If you're employed in South Dakota, you need to meet the following criteria to be eligible for family and medical leave:

- You have worked for the state for at least 12 months.

- You have worked a minimum of 1250 hours (excluding overtime) during the 12-month period immediately preceding the start of the leave

In South Dakota, eligible employees are entitled to a total of twelve (12) weeks of family medical leave within a 12-month period. Eligible employees can take up to a total of 12 weeks of time off per year for various reasons, including:

- The birth or care of the employee's newborn child

- The placement of a child for adoption or foster care with the employee

- The care of the employee's spouse, child, or parent with a serious health condition

- The employee's own serious health condition that prevents them from performing their job

- Any qualifying exigency arising due to a family member's military service on covered active duty or call to covered active duty status

Exceptions to South Dakota’s Paid Leave Program

There are certain exceptions, such as:

- Individuals working on a freelance basis or as independent contractors

- Federal government employees

- Students in secondary or postsecondary educational institutions engaged in work-study programs offering financial assistance or vocational training opportunities

- Volunteers contributing their time and services

Family Members That Qualify for Paid Leave Care

South Dakota Paid Leave recognizes the importance of family and provides an inclusive definition of "family member." Here's who qualifies as a family member under Paid Leave in South Dakota:

- Spouse or domestic Partner: Your spouse or domestic partner is considered a family member under Paid Leave in South Dakota.

- Children: This includes your biological children, adopted children, stepchildren, or foster children. Additionally, it encompasses the children of your spouse or domestic partner and their respective spouses or domestic partners.

- Parents: South Dakota recognizes various parent-child relationships, including biological parents, adoptive parents, stepparents, foster parents, or legal guardians. Paid Leave also includes the parents of your spouse or domestic partner and their spouses or domestic partners.

- Siblings: Your siblings and stepsiblings, as well as their spouses or domestic partners, are considered family members.

- Grandparents: This category includes your grandparents and their respective spouses or domestic partners.

- Grandchildren: Paid Leave in South Dakota extends coverage to your grandchildren and their respective spouses or domestic partners.

- Other close connections: In addition to these specific relationships, Paid Leave in South Dakota acknowledges that family can extend beyond biological or legal ties. If you have a close and meaningful connection with someone that resembles a family relationship, they can also be considered a family member under the program.

Determining Your Salary Percentage During Paid Leave

To calculate your salary percentage during paid leave, you would need to consider whether you are using paid leave (such as sick leave or personal leave) or taking unpaid leave.

If you are using paid leave, your salary percentage would typically be 100% of your regular salary during that period.

If you are on unpaid leave, your salary percentage would be 0% during that time, as you are not receiving any salary or pay for those weeks.

Workplace Safety and Health Regulations in South Dakota

South Dakota operates under the federal Occupational Safety and Health Act (OSHA), which governs workplace safety and health regulations for the majority of private-sector employees in the state.

The OSHA is a federal agency tasked with ensuring workplace safety and promoting employee health. Here are the key aspects of OSHA's activities in South Dakota:

- Regulations: OSHA establishes and enforces safety and health regulations that pertain to most private sector employers. These regulations encompass a wide array of industries and workplace hazards.

- Inspections: OSHA conducts inspections of workplaces to verify compliance with safety and health regulations. Inspections may be scheduled as routine assessments or prompted by complaints or workplace accidents.

- Penalties: Non-compliance with OSHA regulations can result in penalties, including fines, citations, and requirements to rectify safety hazards. OSHA possesses the authority to impose substantial fines for severe violations.

- Training and outreach: OSHA provides training and outreach programs aimed at educating both employers and employees about safety and health issues. These resources facilitate training and offer assistance in ensuring compliance.

- Whistleblower protection: OSHA safeguards employees who report safety or health violations from retaliation by their employers. It's crucial to maintain an environment where employees feel safe reporting concerns.

- Emergency response: OSHA offers guidance on emergency response and preparedness, ensuring that workplaces are adequately prepared to handle a variety of emergency situations, including fires, chemical spills, and natural disasters.

- Partnerships: OSHA collaborates with various organizations, industries, and labor groups to enhance workplace safety through partnerships and alliances. These collaborations contribute to improving safety practices and standards.

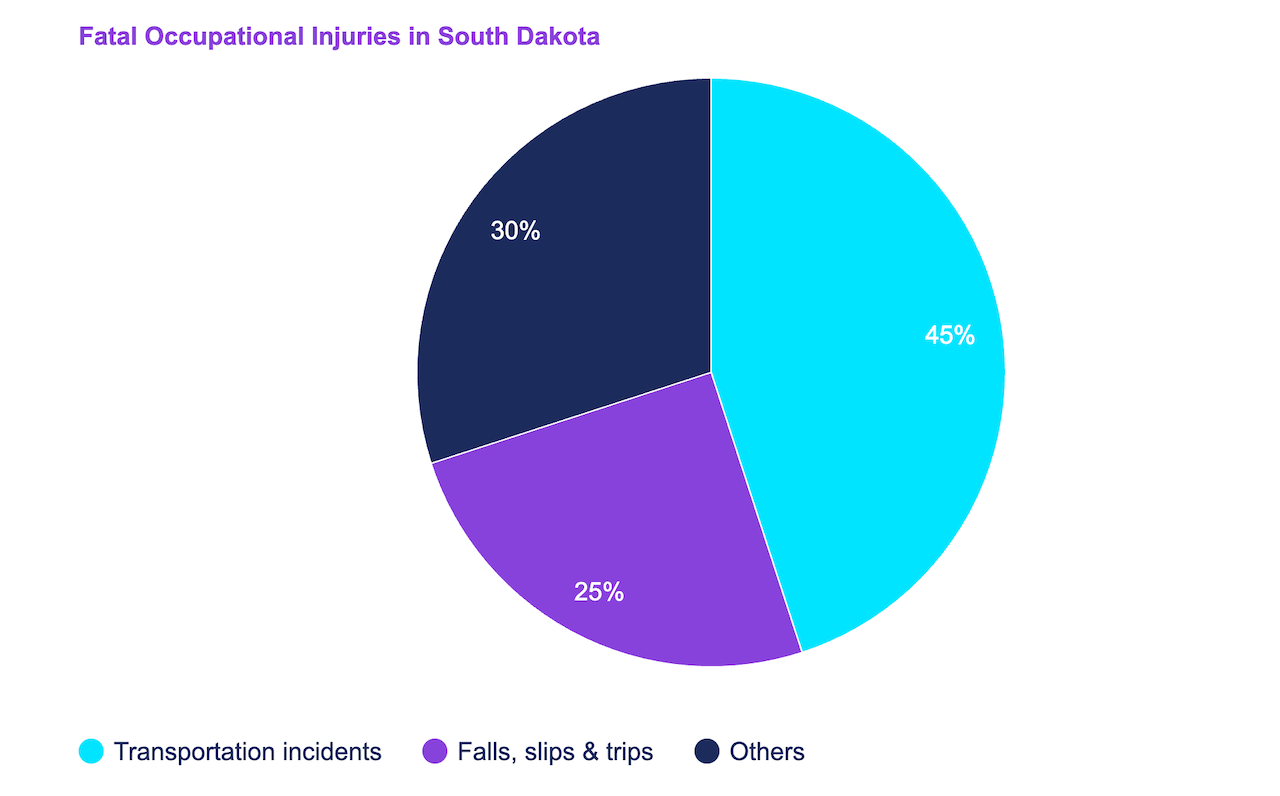

[Source: U.S. Bureau of Labor Statistics]

There were 20 fatal occupational injuries in South Dakota in 2021, which is about 38% higher compared to 32 in 2020.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

In total, the number of fatal injuries in South Dakota is 80% lower than the average number of fatal injuries in all states at 102 fatal work injuries.

Anti-Discrimination and Fair Employment Practices in South Dakota

South Dakota law prohibits discrimination based on specific characteristics. It is illegal for employers to discriminate against employees or job applicants because of:

- Race

- National origin

- Color

- Sex

- Gender identity

- Sexual orientation

- Age

- Religion

- Physical or mental disability

- Military status

- Marital or family status

To ensure a fair and inclusive work environment, certain actions are prohibited, such as

- Terminating or demoting employees based on the aforementioned characteristics

- Gender-based pay disparities

- Assigning less-desirable work tasks

- Promotions or benefits based on an employee's characteristics we discussed above

Additionally, employers cannot retaliate against employees who make a good-faith complaint that the company is violating anti-discrimination laws. Reporting unlawful practices is protected by law.

All employers in South Dakota are required to have written policies in place to prevent and reduce harassment, discrimination and sexual assault in the workplace.

Independent Contractor Classification in South Dakota

South Dakota Codified Law 61-1-11 provides specific criteria for determining whether a worker qualifies as an independent contractor. To be considered an independent contractor in South Dakota, a worker must meet two key criteria:

- Freedom from Direction and Control: Independent contractors must have the freedom to work without being directly controlled or directed by the employer. While workers may have some latitude in how they perform their tasks, control can still be exercised through various means, including written or verbal agreements or contracts.

- Independently Established Business: An individual must be engaged in an independently established trade, occupation, profession, or business that operates separately from the services provided to the alleged employer.

The following criteria are typically associated with independent contractors:

- Realization of a profit or loss based on the success of their work

- Flexibility to work when and for whom they choose

- Provision of their own supplies and equipment

- Significant investment in their facilities or equipment used for work

- Offering their services to the general public

It's essential for employers in South Dakota to carefully consider these criteria and adhere to the law when classifying workers as independent contractors.

A contract labor agreement, even if signed by the worker, does not automatically designate them as an independent contractor; they must genuinely meet the criteria set forth by South Dakota law to be considered anything other than an employee.

Workers cannot sign away their rights to Reemployment Assistance under law, and misclassification can have legal consequences.

Termination and Final Paycheck Laws in South Dakota

In South Dakota, termination and final paycheck laws are governed by specific statutes outlined in the South Dakota Codified Laws. paychecks to employees who have been terminated or who have voluntarily quit their jobs.

When an employee is terminated or has voluntarily resigned, the employer is required to issue the final paycheck on the next regularly scheduled pay date.

If the employee has the employer's property, like tools or equipment, the final paycheck would depend on returning those items. Once they give the stuff back, they get their final paycheck.

Summary

South Dakota's minimum wage for non-tipped employees is $11.20 per hour, exceeding the federal minimum wage.

Overtime pay, as per the Fair Labor Standards Act, is 1.5 times the regular hourly rate for hours worked beyond 40 in a week.

Family and medical leave require a year of employment and 1250 hours worked in the last 12 months, providing up to 12 weeks of leave for various reasons.

Independent contractors must meet specific criteria, and termination and final paycheck laws require payment on the next scheduled pay date, contingent on returning the employer's property.

FAQs About South Dakota Labor Laws

Here are the answers to the most frequently asked questions on South Dakota labor laws.

How much does South Dakota take out of your paycheck?

South Dakota stands out among U.S. states when it comes to income tax, as it does not impose an individual income tax or a corporate income tax.

This means that if you're earning an annual income of $100,000 in South Dakota, you won't have any state income tax deductions from your paycheck.

However, South Dakota does have a state sales tax rate of 4.50%, with the possibility of additional local sales taxes.

The maximum local sales tax rate matches the state rate at 4.50%. On average, when combining state and local sales taxes, you can expect to pay around 6.40% on taxable purchases.

Given this tax landscape, your take-home pay in South Dakota, if you earn $100,000 annually, will be $77,582 per year or approximately $6,465 per month.

Is it illegal to not pay overtime in South Dakota?

In South Dakota, there is no specific state law that governs overtime pay for employees. However, most employees in the state would fall under the purview of the federal FLSA.

Under the FLSA, nonexempt employees are entitled to receive overtime pay at a rate of 1.5 times their regular rate of pay for all hours worked over 40 in a workweek.

So, while South Dakota itself doesn't have a state-level provision for overtime, the federal FLSA sets the standard for overtime pay in the state.

This means that most employees in South Dakota are protected by federal overtime regulations, which ensure that they receive fair compensation for their extra hours of work beyond the standard 40 hours per week.

Employers who fail to comply with these federal overtime requirements may be subject to legal penalties.

How many hours a day can you legally work in South Dakota?

According to South Dakota labor laws, there is no specific limit on the number of hours an adult may work in a week. This means that the state does not impose a maximum cap on the hours that an adult employee can work within a given week.

How many hours can you work at 14 years old in South Dakota?

On school days, 14-year-olds can work for up to four hours per day. On non-school days, such as weekends, 14-year-olds can work for up to eight hours per day. During non-school weeks, they can work up to 40 hours in total.

Do you have to give two weeks’ notice in South Dakota?

In South Dakota, there is no legal requirement that compels you to give two weeks' notice before leaving your job.

However, it is a common practice to provide this notice as a professional courtesy.

Disclaimer: This information serves as a concise summary and educational reference for South Dakota state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.