South Carolina Labor Law Guide

A comprehensive guide to South Carolina labor laws: Covering essential topics, including minimum wage guidelines, overtime regulations, mandatory rest breaks, and other key employment provisions specific to the Palmetto State.

Key Takeaways

- South Carolina minimum wage is $7.25

- Employers with tipped employees can apply a tip credit of up to $5.12

- Full-time students in South Carolina may be paid no less than 85% of the standard South Carolina minimum wage

- In South Carolina, employees do not have specific legal rights to rest and meal breaks

Minimum Wage Regulations in South Carolina

The minimum wage in South Carolina has remained at $7.25 per hour since 2008 when it was raised from $6.55.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

South Carolina does not have its own state-specific minimum wage law, relying instead on the Federal Minimum Wage as a reference point.

South Carolina employers are prohibited from paying their employees less than $7.25 per hour unless the employee or their occupation is exempt from the minimum wage requirements under either state or federal law.

Tipped Minimum Wage

Employers with tipped employees such as bartenders and waiters/waitresses can apply a tip credit of up to $5.12.

This means that if you get enough tips to make at least $5.12 per hour, your boss is permitted to pay you $2.13 per hour as long as the total money you make (including your $2.13 and your tips) is at least $7.25 (Federal minimum wage) per hour.

Should your tips combined with your base wage of $2.13 per hour not amount to $5.12, the employer is obligated to ensure your compensation reaches a minimum of $7.25 per hour.

South Carolina law does not specify a minimum amount of tips an employee must receive to be considered a "tipped employee." This is unlike federal law, which has specific requirements for what constitutes a tipped employee.

Exceptions to Minimum Wage Requirements

In South Carolina, minimum wage requirements are primarily governed by the federal Fair Labor Standards Act (FLSA), and there are specific occupations that are exempt from these requirements, including:

- Farm workers: Individuals employed in agriculture, including on farms, are exempt from certain minimum wage requirements.

- Seasonal workers: Workers engaged in seasonal or temporary positions may be exempt from standard minimum wage regulations.

- Newspaper deliverers: People who deliver newspapers are among those exempt from certain wage requirements.

- Casual babysitters: Individuals who provide occasional babysitting services as a part-time or casual activity are exempt.

- Seasonal amusement park employees: Employees working in seasonal amusement parks may not be subject to standard minimum wage requirements.

- Executive, administrative, and professional employees: These employees, whose wage exceeds $684 per week, are typically exempt from minimum wage and overtime provisions.

Subminimum Wage

Full-time students in South Carolina can be paid no less than 85% of the standard South Carolina minimum wage, which amounts to $6.16 per hour. This applies when they work for certain employers, particularly in work-study programs.

These students are allowed to work up to 20 hours per week at this reduced wage rate.

Employees under the age of 20 can be paid a training wage of $4.25 per hour during their first 90 days of employment. This training wage is meant to provide a lower starting point for young workers as they gain experience in their jobs.

While these exceptions exist at the state level, some counties, cities and towns in South Carolina may have their own specific minimum wage laws.

When discussing wages, it’s important to keep in mind the taxes for complete financial clarity. Our South Carolina Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state’s tax laws.

Overtime Rules and Regulations in South Carolina

South Carolina does not have its own state statute on overtime law. Instead, it follows the regulations established by the FLSA. For hourly employees, overtime pay is calculated as 1.5 times the regular rate for hours worked over 40 hours per workweek.

For hourly employees who receive bonuses and/or commissions, the regular rate is determined by adding the total hours worked times the hourly rate, plus the workweek equivalent of the bonus and/or commission.

This is divided by the total hours in the workweek, and then half of that regular rate is paid for each overtime hour.

For instance, let's say you work and earn $10 per hour. If you work 45 hours in a week, you should get extra pay for those 5 extra hours (because the normal workweek is usually 40 hours).

If you also got a bonus of $50 that week, that bonus also counts toward your overtime pay:

45 hours x $10 + $50

This gives you a total of $500 (your regular pay plus the bonus).

To calculate how much extra pay you get for each of those 5 overtime hours, you divide that $500 by the total hours you worked (45 hours):

$500 ÷ 45 = about $11.11

Finally, you divide that number by two to get the overtime rate for each hour:

$11.11 ÷ 2 = about $5.56

And that's how much extra you get paid for each of those 5 overtime hours.

For salaried employees, the regular rate is calculated by dividing the salary by the number of hours the salary is intended to compensate.

If the regular hours are less than 40, the regular rate is added for each hour up to 40, regular pay is for hours worked up to 40, and overtime pay begins after 40 hours.

Only then time and a half is paid for hours over 40. If the regular hours are equal to 40, time and a half is paid for hours worked beyond 40.

For example, let's say you get paid $400 for a week for 40 hours of work. In this case, your regular rate would be:

$400 ÷ 40 = $10

If you work more than 40 hours (let's say you work 45 hours), you would get extra pay for those extra 5 hours. That extra pay is 1.5 times your regular rate for each of those extra hours.

So, for those 5 extra hours, you get $15 per hour:

1.5 x $10 = $15

Overtime Exceptions and Exemptions

Exceptions to South Carolina Overtime Laws include:

- Employees responsible for managing others: Employees who have the responsibility of managing more than one other employee may be exempt from certain federal overtime regulations.

- Employees engaged in other occupations: Workers who spend more than 20 percent of their employment engaged in other occupations may also be exempt from federal overtime laws.

Exemptions from Overtime in South Carolina under Federal Law:

- Sales employees: Employees whose primary job is sales may be exempt from federal overtime laws.

- Administrative employees: Workers whose work tasks are mainly administrative in nature could be exempt from overtime regulations under federal law.

- Salaried professional employees: Salaried professionals whose jobs require specialized skills and knowledge might be exempt.

- Executives: Executives of companies may also be exempt from certain federal overtime laws.

These exceptions and exemptions are in place to recognize the unique roles and responsibilities of certain employees and ensure that they are not entitled to overtime pay as defined by federal regulations.

Rest and Meal Breaks

In South Carolina, employees do not have specific legal rights to rest and meal breaks. No state law mandates time off for lunch or other meals, and employees are not legally entitled to take short breaks during the workday.

However, if an employer chooses to allow shorter breaks during the day, employees must be paid for the time spent on those breaks.

Family and Medical Leave Laws in South Carolina South Carolina does not have its own state-specific family and medical leave laws, so employees in the state rely on the protections provided by the federal Family and Medical Leave Act (FMLA).

To be eligible for FMLA leave, employees must meet specific criteria, including:

- Having worked for the company for at least a year

- Having worked at least 1,250 hours during the previous year

- Working at a location with at least 50 employees within a 75-mile radius

Employees in South Carolina can take FMLA leave for various reasons, including:

- Bonding with a newborn or adopted child

- Recuperating from a serious health condition

- Caring for a family member with a serious health condition

- Handling qualifying exigencies related to a family member's military service

- Caring for a family member who was injured during active duty in the military

South Carolina employees can take up to 12 weeks of leave in a 12-month period. This 12-week leave period renews every 12 months, provided the employee continues to meet the eligibility requirements.

Exceptions to the South Carolina Paid Leave Program

South Carolina law does not require employers to provide:

- Vacation leave, either paid or unpaid

- Paid or unpaid sick days

- Paid or unpaid bereavement leave

Additionally, private employers in South Carolina are not obligated to provide paid or unpaid leave for state holidays.

Family Members That Qualify for Paid Leave Care

Under the FMLA, the covered family members are as follows:

- Spouse: This includes same-sex spouses, as recognized in all 50 United States since June 26, 2015.

- Child: This includes biological, adopted or foster children and stepchildren.

- Parent: This includes biological, adoptive, step or foster fathers and mothers, as well as any other individual who stood in loco parentis (a Latin term that means "acting as a parent.") to the employee when the employee was a minor.

In addition to these immediate family members, the FMLA also allows employees to take leave to care for a covered service member or veteran with a serious injury or illness if the employee is the spouse, child, parent or next of kin of the service member or veteran.

Salary Percentage During Paid Leave Eligible employees are entitled to four weeks of paid leave at 100% of their salary followed by an additional two weeks of paid leave at 50% of their salary following the birth of a child.

An eligible employee's salary for paid parental leave is calculated using their earnings at the same employer for the period before the beginning of the second trimester of pregnancy.

In simple terms, the amount of money they get paid during this time off is based on how much they earned from the company before the pregnancy has reached the "second trimester."

When an eligible employee is pregnant, they should work no more than twenty hours per week and maintain benefits as if they were working full time.

Private employers found to be in violation of this section may incur a fine of 0.75% of their annual revenue per violation, while public employers may incur a fine of five percent of the salary of the director, agency head or other chief executives per violation.

Workplace Safety and Health Regulations in South Carolina

In South Carolina, workplace safety and health regulations are governed by the South Carolina OSHA (SC OSHA), which is part of the South Carolina Department of Labor, Licensing, and Regulation.

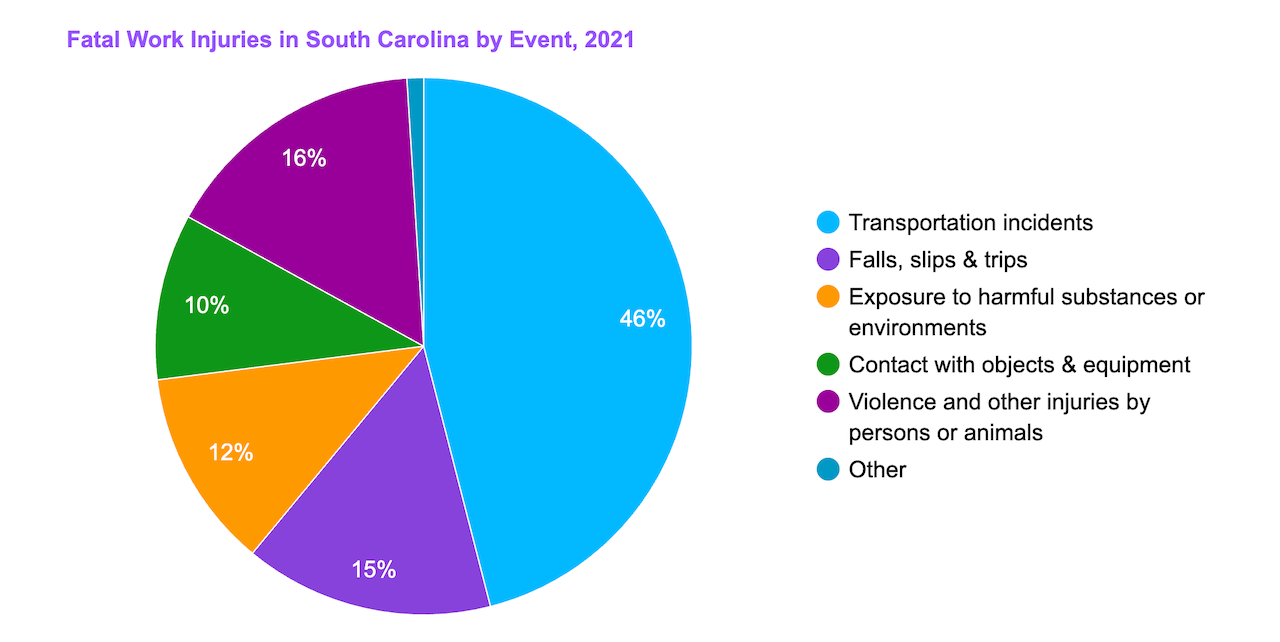

The last known data shows there have been 107 fatal occupational injuries in the South Carolina state, most of which are related to transportation accidents.

[Source: U.S. Bureau of Labor Statistics]

You can see how South Carolina compares to other states in the US when it comes to occupational fatal injuries by browsing our interactive map below.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

SC OSHA covers private sector, state and local government workplaces within the state. It excludes specific areas such as maritime employment, contract workers in USPS mail operations, employment on military bases and more.

At the same time, Federal OSHA covers issues not addressed by SC OSHA and retains authority over certain standards and anti-retaliation provisions.

SC OSHA is also responsible for enforcing occupational safety and health standards through compliance officers who inspect workplaces for hazards and issue citations for violations.

Inspections can be scheduled or initiated in response to reports of imminent danger, fatalities, worker complaints or referrals.

It’s worth mentioning that SC OSHA provides on-site consultation services for employers, both in the public and private sectors.

Anti-Discrimination and Fair Employment Practices in South Carolina

South Carolina has implemented the South Carolina Human Affairs Law to protect individuals against employment discrimination, promoting fairness and equal opportunities in the workplace.

The South Carolina Human Affairs Law is designed to safeguard employees against various forms of employment discrimination. This protection extends to:

- Race

- Color

- Religion

- Sex, including protection against sexual harassment and pregnancy discrimination

- National origin

- Age, applies to individuals aged 40 and above who are protected from age-related discrimination by this law

- Disability

If an employee has raised a complaint about job discrimination or assisted in an investigation or lawsuit regarding job discrimination, they are protected from retaliation. Retaliation against such employees is prohibited.

Independent Contractor Classification in South Carolina

South Carolina has not established a specific statutory definition for independent contractors. Instead, the state relies on case law to define independent contractors as individuals who:

- Exercise independent employment: They work on their own terms and independently, without direct control or supervision from the hiring party.

- Contract work with autonomy: They agree to do a particular job their own way.

- Have limited employer control: They are not subject to excessive control by their employers except for the final result of the work.

Courts apply a four-factor right-to-control test to determine if a worker is an employee or an independent contractor. These factors include direct evidence of the right to control, the furnishing of equipment, the right to terminate the worker and the payment method.

Independent contractors in South Carolina are not entitled to workers' compensation benefits. Employers are not obligated to provide workers' compensation coverage for independent contractors.

There are no specific penalties solely for misclassifying a worker in South Carolina. However, employers must insure their employees for workers' compensation, and failing to do so can lead to financial penalties.

Termination and Final Paycheck Laws in South Carolina

State law mandates that employers must provide employees with their final pay within specific timeframes, depending on the circumstances of the separation.

- Voluntary resignation: When an employee voluntarily resigns, the employer is required to pay all wages owed to the employee within 48 hours of the employee's last working day.

- Involuntary termination: In cases where an employee is terminated by the employer, the final paycheck must be issued within 48 hours of the termination date.

- Regularly scheduled payday: In situations where it's not feasible to provide the final paycheck within 48 hours, the final pay can be given on the next regularly scheduled payday, but not exceeding 30 days from the separation date. This provision allows for some flexibility in cases where immediate payment is not possible.

Summary

South Carolina labor laws encompass various aspects of employment, including minimum wage regulations, overtime rules, meal breaks, family and medical leave, workplace safety, anti-discrimination measures and independent contractor classification.

Here are key points:

- South Carolina adheres to the federal minimum wage of $7.25 per hour. Tipped employees can receive a minimum of $2.13 per hour if their tips bring their total earnings to at least $7.25.

- Overtime rules follow the federal FLSA. Hourly employees are entitled to 1.5 times their regular rate for hours worked beyond 40 hours per workweek.

- South Carolina doesn't mandate specific rest or meal breaks. If employers offer shorter breaks during the workday, employees must be paid for this time.

- South Carolina defers to the federal FMLA, providing up to 12 weeks of unpaid leave for eligible employees for various family-related reasons.

- Workplace safety is governed by SC OSHA, which enforces safety standards and conducts inspections. It coexists with Federal OSHA for comprehensive coverage.

FAQ About South Carolina Labor Laws

Let’s answer some of the most frequently asked questions related to South Carolina Labor Laws.

What is considered wrongful termination in South Carolina?

Wrongful termination in South Carolina occurs when an employer violates state and federal laws by firing an employee for prohibited reasons, such as race, gender, disability or religious beliefs.

Retaliation for legal actions or exercising rights, breaching employment contracts, violating public policy and firing whistleblowers are also considered wrongful termination.

Is it illegal to discuss your salary in South Carolina?

In South Carolina, it is not illegal to discuss your salary or wages with coworkers. The National Labor Relations Act (NLRA) provides protections for employees, allowing them to freely discuss and disclose their pay, as well as other benefits, with their colleagues.

Is working 6 hours without a lunch break in South Carolina legal?

Yes, working 6 hours without a lunch break in South Carolina is generally legal. South Carolina labor laws do not mandate that employers provide breaks or a lunch period to employees.

Therefore, it is up to the employer's discretion whether or not to offer such breaks, and they are not legally required to do so.

Does South Carolina have daily overtime?

No, South Carolina does not have daily overtime requirements. Instead, the state adheres to federal labor laws outlined in the FLSA.

Under the FLSA, employers are obliged to provide overtime pay, which is set at 1.5 times the regular rate of pay, for employees who work more than 40 hours in a workweek.

Can an employer withhold a paycheck for any reason in South Carolina?

In South Carolina, employers are generally prohibited from withholding an employee's paycheck without a valid reason.

They must not do so unless they are compelled or allowed to under state or federal laws or if they have provided written notice to the employee that specifies the amount and terms of any deductions.

Disclaimer: This information serves as a concise summary and educational reference for South Carolina state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.