New York Labor Law Guide

A comprehensive guide to New York labor laws: Covering essential topics like minimum wage guidelines, overtime regulations, mandatory rest breaks and other key employment provisions specific to the Empire State.

Key Takeaways

- In most areas, the minimum wage is set at $15.00 per hour; however, in New York City, Long Island, and Westchester, it is higher at $16.00 per hour.

- In New York, the overtime pay at a rate is 1.5 times the regular pay for employees who work over 40 hours a week

- Non-factory workers are entitled to a 30-minute lunch break between 11:00 a.m. and 2:00 p.m. for shifts lasting six hours or longer within that period

- New York offers Paid Family Leave (PFL) for various family care situations

- Following an employee's resignation or firing, New York labor laws require employers to provide final paychecks on the next scheduled payday

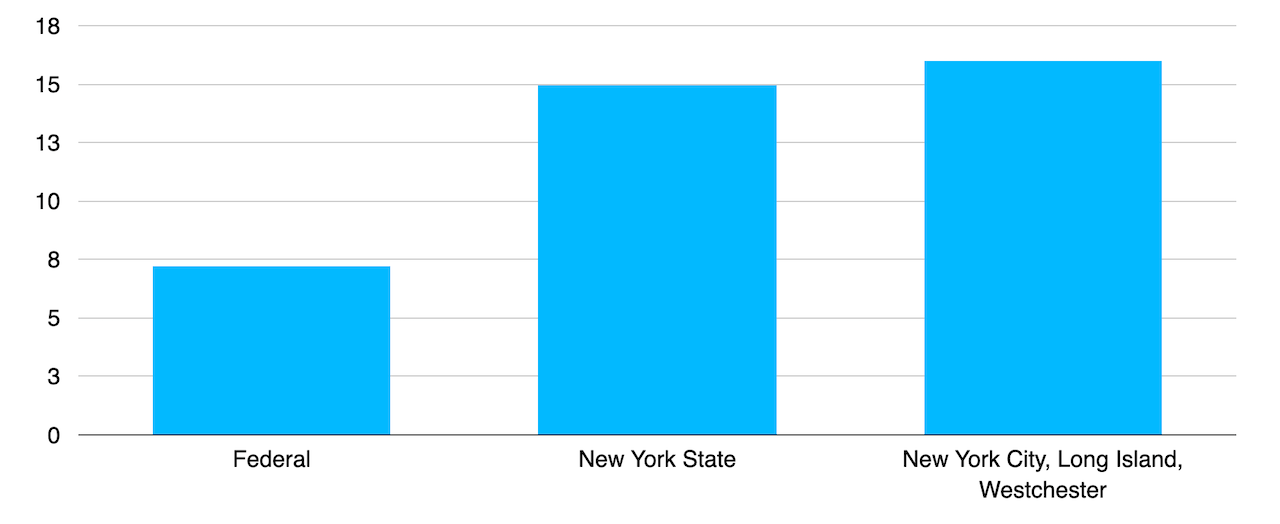

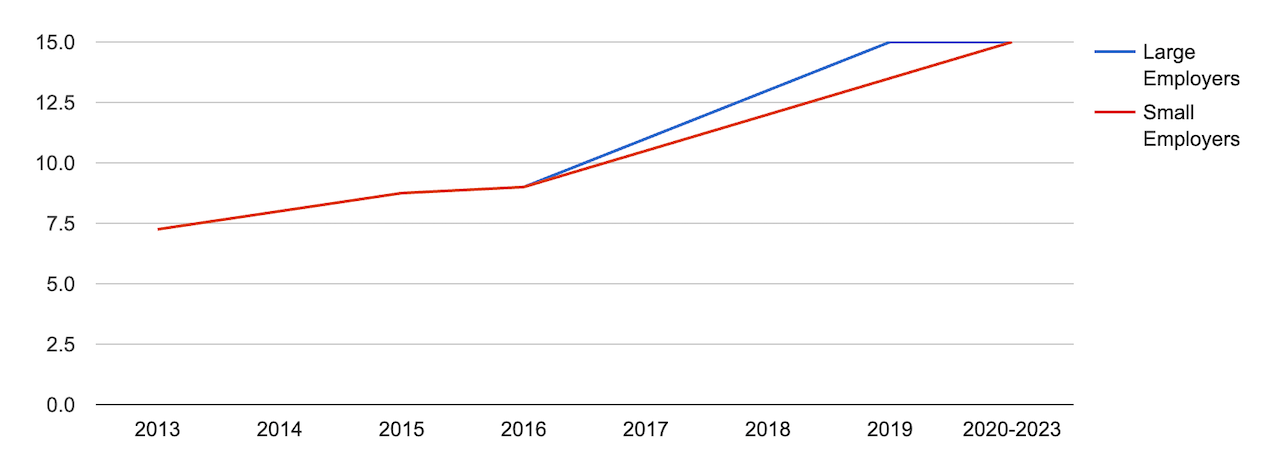

Minimum Wage Regulations in New York

In New York state the minimum wage stands at $15.00 per hour, with the exception of New York City, Long Island and Westchester where the minimum wage is $16.00 per hour.

[Source: Department of Labor - NY]

Moreover, further increments of $0.50 per year are planned for January 1, 2025, and January 1, 2026.

[Source: Comptroller]

You can also compare the New York minimum wage with the minimum wage in other states using the table below.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Tipped Minimum Wage

In New York State, the tipped minimum wage varies depending on the region and whether the employee is classified as a service employee or a food service worker.

In New York City, Long Island and Westchester, tipped service employees receive a minimum wage of $12.50 per hour with a $2.50 tip credit. While tipped food service workers receive a minimum wage of $10.00 per hour with a $5.00 tip credit.

In the remainder of New York State, tipped service employees have a cash wage of $11.85 per hour with a $2.35 tip credit. At the same time, tipped food service workers receive $9.45 per hour with a $4.75 tip credit.

Exceptions to Minimum Wage Requirements

While most individuals are covered by minimum wage requirements, there are exceptions that exclude certain groups from these regulations, such as:

- Executives and administrators earning more than 75 times the minimum wage rate: Individuals in executive and administrative positions who earn more than 75 times the current minimum wage rate are exempt from minimum wage requirements.

- Professionals: Professionals, such as doctors, lawyers and other highly skilled individuals, are not subject to minimum wage regulations.

- Outside salespersons: Those working as outside salespersons, who typically earn their income through sales and are not primarily based in a fixed location, are exempt from minimum wage requirements.

- Taxicab drivers: Taxicab drivers, who often operate as independent contractors or own their vehicles, are not covered by minimum wage regulations.

- Government employees: Government employees are generally not subject to minimum wage requirements, although certain non-teaching government employees may be included.

- Part-time babysitters: Part-time babysitters, who provide childcare services on an occasional or part-time basis, are exempt from minimum wage requirements.

- Ministers and members of religious orders: Individuals serving as ministers or belonging to religious orders are not covered by minimum wage regulations.

- Volunteers, learners, apprentices and students working in non-profit institutions: Those participating in volunteer, learning, apprenticeship or educational programs in non-profit institutions are exempt from minimum wage requirements.

- Students obtaining vocational experience: Students gaining vocational experience in certain settings may not be subject to minimum wage regulations.

Additionally, the Labor Law does not consider independent contractors, individuals who are in business for themselves, as "employees." This means that minimum wage requirements do not extend to independent contractors.

Subminimum Wage

In New York State, there are some exceptions to the minimum wage regulations, allowing certain categories of employees to be paid less than the standard minimum wage. These exceptions include:

- Minors

- Full-time and vocational students

- Employees with disabilities

When discussing wages, it’s important to keep in mind the taxes for complete financial clarity. Our New York Paycheck Calculator gives you an estimate of your earnings after accounting for taxes and deductions, in adherence to your state’s tax laws.

Overtime Rules and Regulations in New York

New York State follows the federal Fair Labor Standards Act (FLSA) in requiring overtime pay for employees who work more than 40 hours in a week.

Overtime pay in New York must be provided at a rate of 1.5 times the employee's regular rate of pay. It is essential to note that the regular rate of pay should not be lower than the applicable minimum wage.

Some residential employees, such as those in certain caregiving roles, are eligible for overtime pay when they work more than 44 hours in a workweek.

When employees have varying pay rates, employers are required to use the average pay rate as the regular rate of pay to calculate overtime pay.

Overtime Exceptions and Exemptions

Some categories of workers are exempt from both federal and New York state overtime requirements.

These exemptions include:

- Executive employees

- Administrative employees

- Professional employees

- Outside salespeople

- Individuals working for a federal, state or municipal government

- Farm laborers

- Certain volunteers, interns and apprentices

- Taxicab drivers

- Members of religious orders

- Certain individuals working for religious or charitable institutions

- Camp counselors

- Individuals working for fraternities, sororities, student or faculty associations

- Part-time babysitters

Rest and Meal Breaks

Factory workers are entitled to a 60-minute lunch break, which should be scheduled between 11:00 a.m. and 2:00 p.m.

Additionally, they are entitled to a 60-minute meal break at the midpoint of their shift for shifts lasting more than six hours, starting between 1:00 p.m. and 6:00 a.m.

Non-factory workers are entitled to a 30-minute lunch break between 11:00 a.m. and 2:00 p.m. for shifts of six hours or longer that extend over this period.

For shifts of more than six hours starting between 1:00 p.m. and 6:00 a.m., they are entitled to a 45-minute meal break at the midpoint of their shift.

Additionally, all workers are entitled to an extra 20-minute meal break between 5:00 p.m. and 7:00 p.m. for workdays that span from before 11:00 a.m. to after 7:00 p.m.

Meal periods that meet statutory requirements are not considered as "hours worked," and employees are not required to be paid for this time.

However, if employees work through their meal periods due to one-employee shift requirements, they must be paid for that time.

Rest periods of short duration (5 to 20 minutes) are considered working time, and employees must be paid for such time.

Family and Medical Leave Laws in New York

Paid Family Leave (PFL) in New York State is an essential program that provides employees with valuable benefits for family care situations.

To fund Paid Family Leave benefits, employees make a small weekly payroll deduction. This deduction is a percentage of their employees’ weekly wage, up to a cap set annually.

Full-time employees who work 20 or more hours per week become eligible after 26 consecutive weeks of work.

Part-time employees with a regular schedule of less than 20 hours per week become eligible after working 175 days, which do not need to be consecutive.

An employee in New York State can take Paid Family Leave (PFL) in the following situations:

- Caring for family members with serious health conditions

- Birth, adoption or foster placement

- Bonding with a newly born child, newly adopted child or a child newly placed in foster care

- Employee's own serious health condition

- Assisting loved ones during military deployment

Family Members That Qualify for FMLA

In New York State, Paid Family Leav PFL covers a broad range of family members, including:

- Spouse: Your legally recognized spouse, providing support for same and different-gender couples, without the need for legal registration.

- Domestic partner: This includes a person who is at least 18 years old and is dependent on the employee for support. They should not be related by blood to the employee in a way that would bar marriage. Dependence can be shown through various factors, such as common ownership of property, shared householding, children in common, signs of intent to marry, shared budgeting and the length of the personal relationship with the employee.

- Child/stepchild: This category covers your biological or legally recognized children and stepchildren. It also includes anyone for whom you have legal custody.

- Parent/stepparent: You can take PFL to care for your biological parents, adoptive parents, stepparents or individuals who stood 'in loco parentis' to you when you were a child.

- Parent-in-law: PFL extends to your parents-in-law, allowing you to care for them when needed.

- Grandparent: You can use PFL to provide care for your grandparents.

- Grandchild: This includes the ability to take PFL to care for your grandchildren.

- Sibling: Starting in 2023, employees can use PFL to care for their siblings. However, it's important to check with your employer's Paid Family Leave insurer to confirm when sibling care goes into effect for their policy. For employees working for self-insured employers, coverage began on January 1, 2023.

Salary During Paid Sick Leave

In New York State, the compensation for employees during paid sick leave is determined by the following guidelines:

- Normal rate of pay: Employees are entitled to be paid their normal rate of pay for any paid leave time taken under this law. This means that the rate at which they are typically compensated for their regular work hours should be maintained when they take paid sick leave.

- Applicable minimum wage rate: Alternatively, if the applicable minimum wage rate is greater than an employee's normal rate of pay, the employee should be paid at least the minimum wage rate for the paid leave time.

- No allowances or credits: Employers are not allowed to claim any allowances or credits, such as tip credits, to reduce the compensation for paid sick leave hours. Employees must receive the full compensation they would typically earn during their work hours.

Importantly, employers are prohibited from reducing an employee's rate of pay solely for the purpose of compensating them for sick leave hours.

Workplace Safety and Health Regulations in New York

Private sector employees in New York fall under Federal Occupational Safety and Health Act (OSHA) regulations, and they must adhere to the rules, regulations and safety training requirements established by Federal OSHA standards.

The core elements of OSHA operations include:

- Regulations: OSHA is responsible for establishing and enforcing safety and health regulations applicable to most private sector employers, covering a wide range of industries and workplace hazards.

- Inspections: OSHA conducts regular inspections and promptly responds to complaints or incidents to ensure adherence to safety and health regulations.

- Penalties: Failure to comply with these regulations can lead to penalties, which may include fines, citations, and mandates to rectify safety hazards. OSHA holds the authority to impose substantial fines for severe violations.

- Training and outreach: OSHA offers comprehensive training and outreach initiatives aimed at educating both employers and employees on safety and health topics. These programs provide valuable resources for training and guidance to ensure compliance.

- Whistleblower protection: OSHA takes measures to protect employees who report safety or health violations from facing retaliation by their employers.

- Emergency response: OSHA plays a crucial role in offering guidance on emergency response and preparedness. This includes equipping workplaces to effectively handle various emergencies, such as fires, chemical spills, and natural disasters.

- Small business assistance: OSHA extends specialized assistance and consultation services tailored to the needs of small businesses. These services assist small enterprises in meeting safety and health requirements effectively.

- Partnerships: OSHA actively collaborates with a diverse range of organizations, industries, and labor groups to strengthen workplace safety through cooperative partnerships and alliances.

New York also has the Public Employee Safety and Health (PESH) standards in place that are responsible for enforcing rules for public sector employees, including those working for state, county, town, village governments, public authorities, school districts, paid and volunteer fire departments and certain other public sector entities.

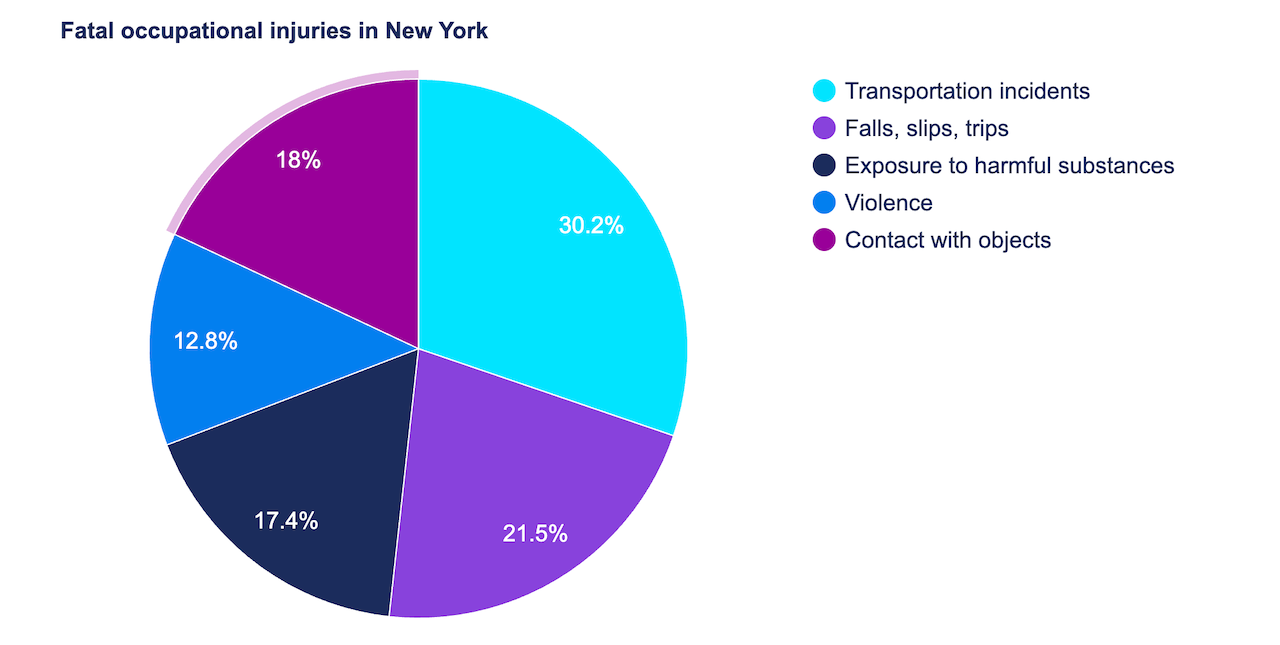

Still, the last available data show there have been 247 fatal occupational injuries in New York State, most of which are related to transportation incidents, falls, slips and trips.

[Source: Bureau of Labor Statistics]

You can see how New York compares to other states in the US when it comes to occupational fatal injuries by browsing the table below.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Child Labor Laws in New York

New York State has some of the strictest child labor laws in the country. The hours that minors can work depend on their age, the type of work, and whether school is in session.

Here are some key points about child labor laws in New York:

Hours of work:

- Minors 14- and 15-year-olds are limited to working no more than 3 hours on any school day

- When school is not in session, minors under 18 may work up to 8 hours a day

- Minors 16- and 17-year-olds can’t work during school hours and no more than 4 hours on school nights

Prohibited work for all minors:

- Minors are prohibited from working in construction, working with dangerous substances, taking care of prisoners or inmates and operating heavy machinery.

- Minors may not be employed in factories or institutions in the Department of Mental Health.

Allowed work for minors aged 14 or 15:

- 14- and 15-year-olds can work in retail, perform office or clerical tasks, engage in intellectual or creative work and do certain kitchen and food service tasks.

- They can also participate in clean-up and yard work that does not involve power-driven equipment.

Minors under 14:

- Minors under 14 are generally not allowed to work, with a few exceptions like acting or performing, delivering newspapers, or working in agriculture.

Anti-Discrimination and Fair Employment Practices in New York

One of the key instruments in ensuring anti-discrimination and fair employment practices is the New York State Human Rights Law.

The State Human Rights Law makes it clear that employers must provide equal opportunities to all individuals, regardless of their:

- Age

- Race

- Creed

- Color

- National origin

- Sexual orientation

- Gender identity or expression

- Military status

- Sex

- Disability

- Predisposing genetic characteristics

- Familial status

- Marital status

- Status as a victim of domestic violence

Discrimination in hiring, employment conditions, compensation or any aspect of the workplace based on these protected classes is strictly prohibited.

Furthermore, employers can not retaliate against employees for opposing discriminatory practices, filing complaints, testifying or assisting in related proceedings.

Pregnant employees also have protections, and employers cannot compel them to take a leave of absence unless it's necessary for job performance. Harassment based on protected characteristics is likewise prohibited.

The New York State Division of Human Rights (DHR) plays a vital role in enforcing the State Human Rights Law. DHR receives, investigates and resolves individual complaints of discrimination.

It also prosecutes unlawful discriminatory practices. In addition, DHR educates the public about the impact of discrimination and individuals' rights and obligations under the law.

Independent Contractor Classification in New York

The New York courts recognize that no single factor or group of factors can conclusively define an employer-employee relationship.

Instead, they evaluate various factors collectively to gauge the level of supervision, direction and control exercised over the services provided, including:

- Control over work: An employer typically controls what, when and how services are performed, including the manner, means and results.

- Provision of resources: Providing facilities, equipment, tools and supplies suggests an employer-employee relationship.

- Direct supervision: Directly supervising the services provided is indicative of an employer-employee relationship.

- Set hours of work: If the employer dictates the worker's hours of work, it points toward an employment relationship.

- Exclusive services: Requiring exclusive services, where the individual cannot work for competitors, supports an employer-employee relationship.

- Rate of pay: When the employer sets the rate of pay, it's a strong indicator of an employment relationship.

- Attendance and reporting requirements: Requiring attendance at meetings or training sessions and asking for oral or written reports leans toward an employer-employee relationship.

- Review and approval: The right to review and approve the work product signifies control over the worker.

- Job performance evaluation: If the employer evaluates job performance, it suggests an employment relationship.

- Absence permissions: Requiring prior permission for absences is a factor considered when classifying workers.

- Hiring and firing rights: The right to hire and fire is a clear indication of an employer-employee relationship.

The independent contractor classification in New York State also takes into consideration the following three aspects:

- Compensation and worker status: Employees typically receive a salary, an hourly rate of pay or a draw against future commissions without the requirement for repayment of unearned commissions. They may also enjoy certain fringe benefits, including allowances or reimbursements for business or travel expenses.

- Nature of services performed: Unskilled or casual workers, often subject to supervision, are usually considered employees. However, even professionals like doctors and lawyers, who have a degree of autonomy in their work, may be classified as employees if they are subject to significant control by their employer.

- Control over important aspects: For example, a referral agency, despite not directly supervising workers, could be considered an employer if it controls essential aspects like client contact, billing, collection from clients, and the individual's wages.

Termination and Final Paycheck Laws in New York

The New York labor laws dictate that when an employee is terminated, the employer must pay all unpaid wages no later than the next scheduled payday for the period when the employee was fired.

When an employee chooses to resign from their role, New York law mandates that they should receive their final paycheck on or before the ordinary, scheduled payday for the pay period in which they submitted their resignation.

In New York, employees can choose how they receive their final paycheck. Whether by direct payment or through the mail, employees have flexibility in receiving their due wages.

Summary of New York Labor Laws

As of 2024, the state minimum wage in New York varies by location, with the highest at $16.00 in New York City with further increases scheduled for 2025.

Tipped employees have their own minimum wage, which depends on the region and job type.

Subminimum wage applies to specific categories, such as young workers, students and employees with disabilities.

Overtime in New York is calculated weekly, with specific rates for tipped employees.

Additionally, family and medical leave laws apply under certain conditions, offering benefits for family care situations.

Anti-discrimination laws protect employees based on various characteristics, ensuring equal employment opportunities.

Independent contractor classification is determined by factors like control, finances, and the work relationship.

Termination and final paycheck laws require prompt payment to employees when they are terminated or resign.

FAQs About New York Labor Laws

For more info, find frequently asked questions about the labor laws in New York below.

Does New York have mandatory sick days?

Employers with 100 or more employees must provide up to 56 hours of paid sick leave per year. At the same time, employers with 5-99 employees must provide up to 40 hours of paid sick leave per year.

And finally, employers with a net income of $1 million or less must provide up to 40 hours of unpaid sick leave per year.

Is 32 hours a week considered full-time employment in New York?

In New York, anyone working 30 hours or more a week, or 130 hours or more a month, is considered a full-time employee.

Do you have to give two weeks’ notice in New York?

In New York, there is no state law that mandates a two weeks' notice requirement for employees.

How many breaks do you get in a 9-hour shift in New York?

In a 9-hour shift in New York, employees are entitled to one 30-minute meal break between 11 a.m. and 2 p.m. This requirement applies to shifts that span that time range and are longer than 6 consecutive hours.

Can you waive your lunch break in New York?

In New York, employees can be required to take a meal break, but they may also request a waiver.

The key is that this waiver must be negotiated voluntarily and knowingly, and the employee should receive a desirable benefit in exchange for giving up the meal break.

Disclaimer: This information serves as a concise summary and educational reference for New York state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.