New Mexico Labor Law Guide

A comprehensive guide to New Mexico labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- The minimum wage for regular employees in New Mexico is $12.00 per hour as of January 1, 2023, with tipped employees receiving a lower minimum wage of $3.00 per hour.

- Overtime rules vary for nonexempt and exempt employees, with nonexempt employees eligible for overtime pay at 1.5 times their regular hourly wage for hours worked beyond 40 hours in a week.

- Family and Medical Leave Act (FMLA) provisions offer up to 12 weeks of unpaid, protected leave for eligible employees, covering various qualifying circumstances.

- Workplace safety is regulated by the New Mexico Occupational Health and Safety Act, focusing on safety standards, inspections, training, whistleblower protection and more.

- New Mexico enforces anti-discrimination and fair employment practices through the Human Rights Act, prohibiting discrimination based on various factors.

- Independent contractor classification in New Mexico follows the ABC test, determining tax obligations and worker rights.

- Termination involves specific rules, including prompt issuance of final paychecks.

Minimum Wage Regulations in New Mexico

In New Mexico, minimum wage regulations are outlined in the New Mexico Minimum Wage Act (MWA), which governs the minimum wage rates for both regular employees and tipped employees.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

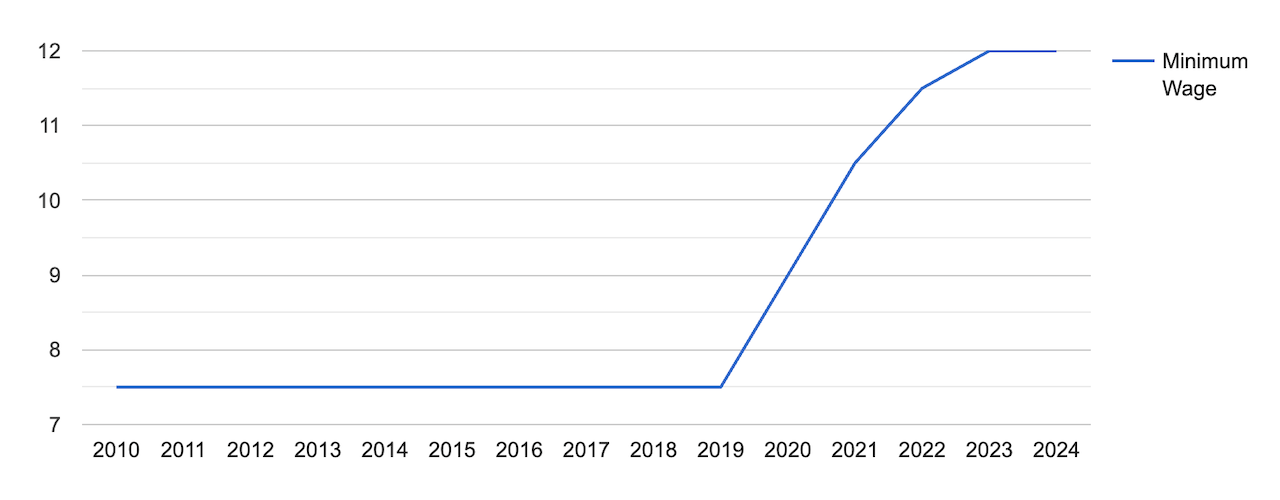

As of January 1, 2023, the minimum wage for regular employees in New Mexico is $12.00 per hour. The MWA sets this minimum wage to ensure that workers receive fair and competitive compensation for their labor.

Here's how the minimum wage increased in New Mexico over the years:

[Source: FRED]

Tipped Employees

New Mexico recognizes the concept of tipped employees, who typically work in service industries such as restaurants, bars and hospitality. These employees receive a lower minimum wage rate, with the expectation that tips they earn will supplement their income.

As of January 1, 2023, the minimum wage for tipped employees in New Mexico is $3.00 per hour. However, this rate applies as long as the tipped employee's total earnings (including tips) reach or exceed the regular minimum wage rate.

If a tipped employee's hourly wage of $3.00 combined with their tips falls short of the regular minimum wage rate, the employer is obligated to make up the difference.

The MWA also allows for tip pooling among employees working in the same establishment, provided that all tips are retained by the employees and not taken by the employer.

Overtime Rules and Regulations in New Mexico

Overtime rules and regulations play a crucial role in protecting the rights of workers and ensuring fair compensation for their additional work hours. In New Mexico, these regulations apply differently to nonexempt and exempt employees.

It's essential for employers to accurately classify their employees as either nonexempt or exempt based on the criteria provided by the Fair Labor Standards Act (FLSA) and state labor laws. Misclassifying employees can lead to legal complications and potential violations of wage and hour regulations.

Nonexempt Employees

Nonexempt employees in New Mexico are those who are eligible for overtime pay. The MWA stipulates that nonexempt employees must be paid overtime at a rate of 1.5 times their regular hourly wage for each hour worked beyond 40 hours in a seven-day workweek.

Nonexempt employees in Ohio typically include those who do not meet the specific criteria outlined in the Fair Labor Standards Act (FLSA) and Ohio labor laws for exempt status. These criteria usually involve earning a minimum salary and performing specific job duties that are considered exempt.

Common categories of nonexempt employees may include:

- Hourly workers: Employees who are paid on an hourly basis and do not meet the criteria for exempt status.

- Administrative support staff: Administrative assistants, secretaries and other support roles

- Blue-collar workers: Many manual labor or production workers

- Service industry employees: Workers in industries like retail, hospitality and food service

- Healthcare support staff: Employees in roles such as nursing assistants or medical assistants

Exempt Employees

Exempt employees in New Mexico receive a predetermined salary regardless of the number of hours they work in a week. However, they may be entitled to other employment benefits, such as healthcare coverage, retirement plans and other perks as outlined by their employment agreements and company policies.

To qualify for exempt status, employees must meet specific criteria as defined by the FLSA and MWA. Common exemptions include executive, administrative and professional roles, which typically involve managerial responsibilities, specialized knowledge or other qualifying factors.

Break Periods in New Mexico

New Mexico labor laws do not mandate that employers provide specific break periods, such as lunch breaks, coffee breaks or rest periods, for their employees. Consequently, the provision of breaks, their duration, and whether they are paid or unpaid are generally left to the discretion of employers.

Employers often consider industry standards, the nature of the work and employee needs when determining break policies within their organizations.

Family and Medical Leave Laws in New Mexico

Family and Medical Leave Act (FMLA) regulations in New Mexico provide eligible employees with the opportunity to take protected leave for various qualifying circumstances.

Here is an overview of FMLA provisions, eligibility criteria and the responsibilities of both employees and employers in New Mexico.

Eligibility for FMLA Leave in New Mexico

To be eligible for FMLA leave in New Mexico, employees must meet the following criteria:

- Employees must have been employed by the State for at least 12 months (consecutive employment is not required).

- Employees must have worked at least 1,250 hours in the 12 months preceding the leave.

FMLA Provisions in New Mexico:

Once eligible, employees in New Mexico are entitled to the following FMLA provisions:

- FMLA provides up to 12 weeks, or 480 hours, of protected leave.

- FMLA leave is unpaid but can be used concurrently with an employee's accrued leave time.

- If both partners are State employees, they qualify for a combined total of 12 weeks of FMLA leave.

- An employee has 12 months from the first day they go on leave to utilize the 12 weeks of FMLA leave.

- If the need for additional leave arises after FMLA is exhausted, the employee may re-apply after the 12-month period is completed, provided they still meet the original eligibility requirements.

Qualifying Circumstances for FMLA Leave in New Mexico

Employees in New Mexico can request FMLA leave for the following qualifying circumstances:

- The birth and care of a newborn child

- The placement of a child for adoption or foster care

- Caring for immediate family members (children, parents, or spouse) with a serious health condition (in-laws or domestic partners are not covered)

- Having a serious health condition

- Caring for covered service members with a serious injury or illness for up to 26 weeks.

Employee Responsibilities for FMLA Leave in New Mexico

Employees seeking FMLA leave in New Mexico have the following responsibilities:

- Provide 30 days' notice if the need for FMLA leave is foreseeable. If the need is not foreseeable, employees must provide notice as soon as possible.

- Supply sufficient information to the employer to determine if their situation qualifies for FMLA leave, including submitting the appropriate application and a doctor's certification.

Employer Responsibilities for FMLA Leave in New Mexico

Employers in New Mexico have specific responsibilities regarding FMLA leave:

- Employers must respond within five business days after receiving documentation from an employee to notify them if their situation qualifies them for FMLA leave.

- Employers must inform employees of specific expectations and obligations, such as providing status updates and/or continued documentation.

- Employers must post relevant information about employee eligibility and changes to FMLA regulations.

Workplace Safety and Health Regulations in New Mexico

Workplace safety and health regulations in New Mexico are primarily governed by the New Mexico Occupational Health and Safety Act. This act serves as the cornerstone of efforts to promote and maintain safe and healthy working conditions for employees across the state.

It accomplishes this mission through several key provisions, each designed to safeguard the well-being of workers and promote a culture of safety in the workplace. Let's explore some of the fundamental aspects of this act:

- Safety standards: These standards cover a wide range of industries and workplaces, encompassing guidelines for safe equipment usage, hazard communication and measures to prevent accidents and injuries.

- Inspections and enforcement: To ensure compliance with safety regulations, the act authorizes regular inspections of workplaces by the New Mexico Environment Department. This department has the authority to investigate complaints, issue citations for violations and, when necessary, impose fines to incentivize compliance.

- Training and education: The act encourages employers to provide appropriate training and education programs to their employees. This empowers workers with the knowledge and skills needed to identify and mitigate workplace hazards effectively.

- Whistleblower protection: Employees who raise safety concerns or report violations are protected from retaliation under the act. This provision promotes a culture of transparency and encourages workers to speak up when they encounter unsafe conditions.

- Record-keeping: Employers are required to maintain records of workplace injuries and illnesses, helping to track trends and identify areas for improvement in safety practices.

- Cooperation and consultation: The act fosters collaboration between employers and employees to jointly address safety concerns. It encourages the establishment of safety committees and consultation with employees on safety matters.

- Special protections: Certain worker populations, such as young workers, receive specific protections and regulations to ensure their safety on the job.

Anti-Discrimination and Fair Employment Practices in New Mexico

New Mexico upholds a strong commitment to anti-discrimination and fair employment practices through its Human Rights Act, as outlined in Section 28-1-7 of the 2021 New Mexico Statutes. This legislation ensures that all individuals are afforded equal opportunities in the workplace and beyond, irrespective of various protected characteristics.

In New Mexico, employers are expressly forbidden from engaging in discriminatory practices against any qualified individual in matters pertaining to employment. These prohibited actions encompass a range of behaviors, such as declining to hire, terminating, promoting, demoting or practicing discrimination in terms of compensation or employment privileges, on the basis of factors such as:

- Race

- Age

- Religion

- Color

- National origin

- Ancestry

- Sex

- Sexual orientation

- Gender identity

- Pregnancy, childbirth or related conditions

- Physical or mental handicap

- Serious medical condition or spousal affiliation (if the employer has fifty or more employees)

Employers, labor organizations, and joint apprenticeship committees are also obligated to provide equal opportunities in apprenticeship or other training programs, regardless of the protected characteristics mentioned in the act.

Individuals who oppose discriminatory practices are safeguarded from retaliation or adverse actions by their employers or labor organizations for filing complaints or participating in investigations related to alleged discriminatory practices.

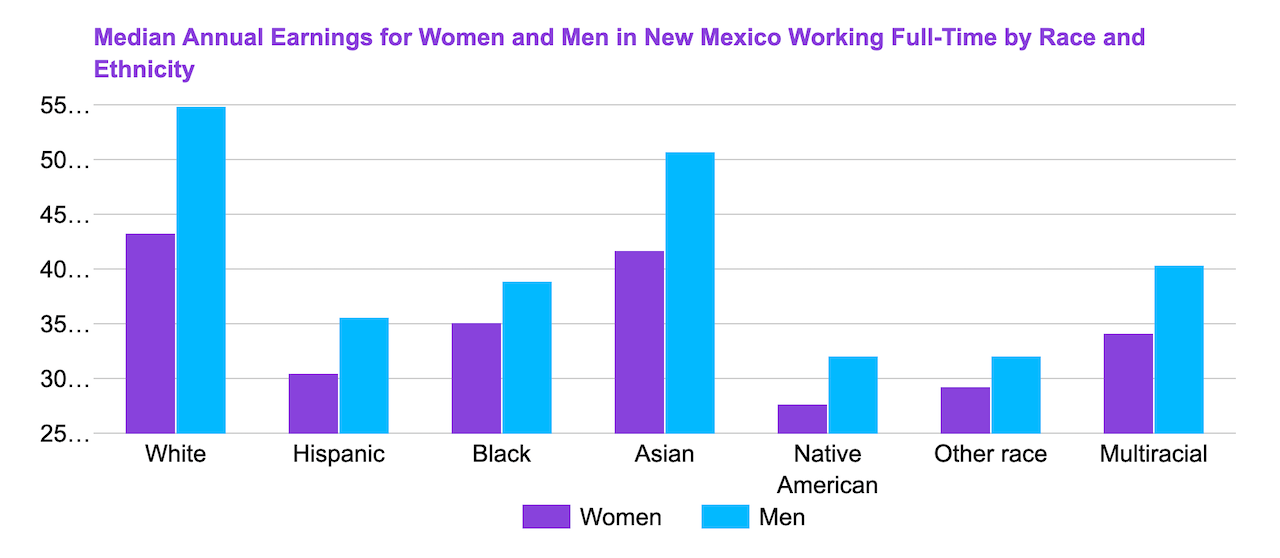

In the pursuit of fair and equitable labor practices, it is essential to examine the data that reveals disparities in earnings among different demographic groups. The data shown in the chart below serves as a stark reminder of the challenges faced by certain communities in New Mexico.

This data not only highlights the existing wage gaps but also underscores the importance of robust labor laws to address and rectify such disparities.

[Source: Status of Women Data]

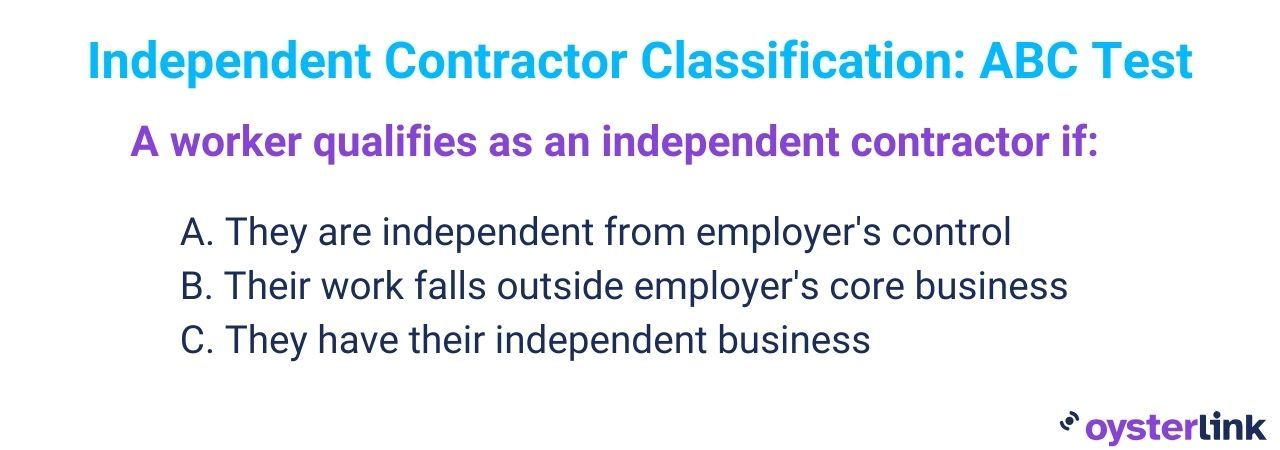

Independent Contractor Classification in New Mexico

In New Mexico, the ABC test is used to help determine independent contractor classification. Under this test, for a worker to be classified as an independent contractor, all three of the following criteria must be met:

A. The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact.

B. The worker performs work that is outside the usual course of the hiring entity's business.

C. The worker is customarily engaged in an independently established trade, occupation, profession or business of the same nature as the work performed.

This classification process helps determine tax obligations, benefits eligibility and the rights and responsibilities of both workers and employers.

Termination and Final Paychecks in New Mexico

Termination of employment in New Mexico involves specific rules and requirements for both employers and employees. Understanding these regulations is crucial to ensure a smooth transition when an employment relationship ends, particularly when it comes to final paychecks.

Termination Notice

Private-sector employers in New Mexico are generally not required to provide advanced notice of termination to employees. Employment is presumed to be at will unless there is a specific contract stating otherwise.

Final Paychecks

Upon termination, employers in New Mexico must pay an employee's final wages promptly. The state's labor laws require that final wages be paid within five business days from the date of termination or the next regular payday, whichever comes first.

If an employee resigns, the final paycheck must be issued on the next regular payday following the date of resignation. Final wages should include all unpaid wages, including regular wages, overtime, unused vacation days (if part of the company policy), and any other earned but unpaid compensation.

New Mexico labor laws do not mandate the payout of unused vacation or paid time off (PTO) upon termination, unless an employer has a policy or employment contract specifying otherwise.

Any accrued benefits, such as retirement contributions or accrued bonuses, should be addressed in the termination agreement or employment contract, specifying whether and when such benefits will be paid.

When navigating New Mexico labor laws and termination procedures, ensure you're equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state's tax laws.

Summary of New Mexico Labor Laws

New Mexico mandates a minimum wage of $12.00 per hour for regular employees, enforces overtime pay for nonexempt workers, and allows flexible break policies. The state offers Family and Medical Leave Act (FMLA) provisions, granting up to 12 weeks of unpaid, protected leave.

Workplace safety is regulated by the New Mexico Occupational Health and Safety Act, while the Human Rights Act ensures protection against employment discrimination. The ABC test is utilized for independent contractor classification, clarifying tax and benefit responsibilities. Additionally, termination necessitates prompt issuance of final paychecks.

Together, these laws work to establish equitable, safe and fair employment conditions in New Mexico.

Frequently Asked Questions About New Mexico Labor Laws

Is it legal to work eight hours without a break in New Mexico?

New Mexico labor laws do not mandate that employers provide meal or rest breaks for employees, regardless of the length of their shift. Therefore, it is generally legal to work eight hours without a specific break under New Mexico labor laws.

However, employers and employees may mutually agree in writing to take meal breaks, but these breaks are typically unpaid. Keep in mind that specific industries and occupations may have different regulations and requirements regarding breaks.

How many hours is full-time in New Mexico?

New Mexico labor laws do not specifically define the standard number of hours that constitute full-time employment. Full-time employment typically depends on the employer's policies and industry standards.

In New Mexico, as in many other states, a standard full-time workweek often consists of 40 hours, typically divided into five eight-hour workdays. However, employers may have their own definitions and variations of full-time employment based on their needs and employment contracts.

How many hours can you legally work in New Mexico?

Under New Mexico labor laws, there are no daily limits on the number of hours an employee can work. However, employees must be paid overtime for hours worked beyond 40 hours in a workweek, at a rate of 1.5 times their regular hourly wage.

Is holiday pay required in New Mexico?

New Mexico labor laws do not require employers to provide holiday pay to employees. Whether or not an employee receives holiday pay is generally a matter of company policy or employment contract.

What happens if I don't get paid on payday in New Mexico?

If you do not receive your wages on your designated payday in New Mexico, you may file a wage claim with the New Mexico Department of Workforce Solutions (NMDWS).

How old do you have to be to work in New Mexico?

In New Mexico, the minimum age for most types of employment is 14 years old. However, there are restrictions on the types of work that minors under 16 can perform, and special permits may be required for certain jobs.

What is wrongful termination in New Mexico?

Wrongful termination in New Mexico refers to the illegal or unlawful firing of an employee. While New Mexico is an "at-will" employment state, meaning that employers can generally terminate employees for any reason (as long as it's not discriminatory or in violation of a contract), wrongful termination can transpire if an employee is dismissed for the following reasons:

- Violation of state or federal anti-discrimination laws

- Retaliation

- Breach of an agreement or contract

If you believe you've been wrongfully terminated, consider seeking legal counsel or filing a complaint with the appropriate agency.

Disclaimer: This information serves as a concise summary and educational reference for New Mexico state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.