New Hampshire Labor Law Guide

A comprehensive guide to New Hampshire labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways:

- New Hampshire’s minimum wage aligns with the federal rate of $7.25 per hour.

- Employees are entitled to a 30-minute break every 5 hours of consecutive work.

- Eligible employees are entitled to overtime pay of 5 times their regular hourly rate when they exceed 40 hours of work in a single week.

- New Hampshire is an at-will employment state.

- New Hampshire does not enforce right-to-work laws.

- The state adheres to the federal Family and Medical Leave Act (FMLA).

Minimum Wage Regulations New Hampshire

As of 2023, New Hampshire’s minimum wage aligns with the federal minimum, which is at $7.25 per hour.

Any fluctuations in the national rate will directly impact the rate in New Hampshire.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

Regular employees are entitled to a minimum wage of $7.25 per hour, which has not changed since 2009.

However, there are several exemptions to the standard minimum wage, which include students working for non-profit organizations, certain seasonal employees and newspaper carriers under 18 years old.

Additionally, employees in training might not receive the standard minimum wage but must earn at least 75% of the minimum wage during their training period, which is limited to 90 days.

Tipped Minimum Wage

For tipped employees, things differ slightly, as employers can use tips to fulfill part of their wage obligations.

This means the minimum wage for tipped employees in New Hampshire is $3.27 per hour (45% of the regular minimum wage), with the caveat that the total hourly earnings (base wage plus tips) must reach the threshold of the federal minimum wage.

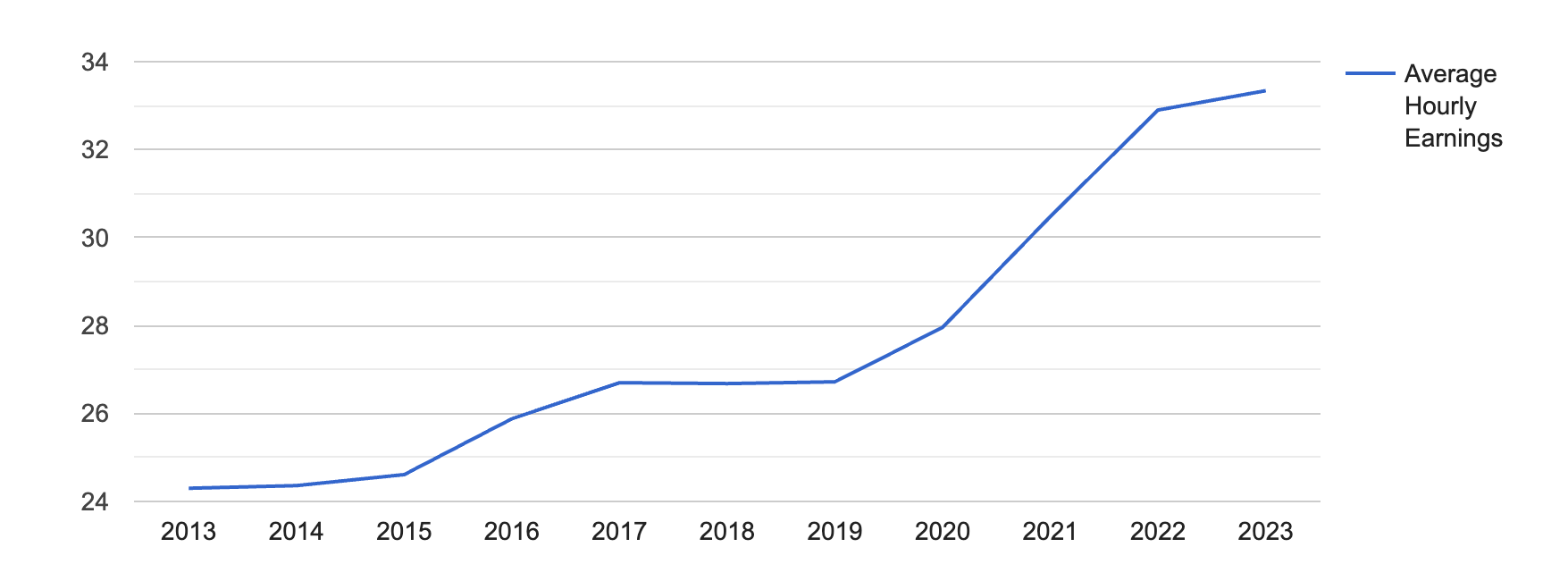

Keep in mind that the minimum wage is not representative of the average hourly earnings in New Hampshire, which is now $33.34 per hour.

[Source: FRED]

This graph is interactive. Hover your mouse over different parts of the graph to see detailed data.

Subminimum Wage

New Hampshire permits a subminimum wage for learners, apprentices and workers with disabilities.

This allows employers to pay these workers below the standard federal minimum wage, but only under specific conditions.

A special license must be acquired from the New Hampshire Department of Labor to utilize the subminimum wage provision.

State Income Taxes

New Hampshire has been considered one of the most tax-friendly states, with no state income tax, sales tax and social security tax.

Moreover, public and private pension income and withdrawals from retirement accounts are also not taxed.

Both regular and tipped employees can easily calculate their earnings, factoring in taxes and deductions, with OysterLink’s Paycheck Calculator.

Overtime Rules and Regulations New Hampshire

New Hampshire’s stand on overtime aligns closely with federal directives.

Nonexempt Employees

Nonexempt employees are entitled to overtime pay when they exceed 40 hours of work in a single week.

The overtime rate is 1.5 times the employee’s regular hourly rate. For instance, if an individual usually earns $10 per hour, their overtime rate would be $15 for every hour worked beyond 40 hours.

Typically, nonexempt employees are hourly workers, but the classification also considers the nature of job duties and salary thresholds.

Exempt Employees

Exempt employees are generally not entitled to overtime pay. However, in return, they often receive salaries instead of hourly wages and might have more flexible working hours.

To qualify as an exempt employee in New Hampshire, individuals must meet specific criteria, which often revolve around their job duties, the manner of their compensation (usually a salary) and, occasionally, a minimum salary threshold.

Rest and Meal Break Laws in New Hampshire

New Hampshire’s labor laws recognize the need for intermittent rest to maintain productivity and well-being.

Employees working a stretch of more than 5 consecutive hours are entitled to a 30-minute meal break. This break is typically unpaid unless the employee is required to perform duties during this period.

Rest and Meal Break Exceptions

While New Hampshire mandates breaks for most workers, there are exceptions.

Employees who can eat a meal during the course of their duties, or those under a collective bargaining agreement that stipulates different break provisions, may not be entitled to the standard break regulations.

Additionally, workers in certain sectors, like transportation, might have separate break requirements due to the nature of their jobs.

Family and Medical Leave Laws in New Hampshire

New Hampshire adheres to the federal FMLA, which entitles eligible employees to up to 12 weeks of unpaid leave in a 12-month period without the fear of losing their jobs.

Reasons for such leave can range from personal health conditions to caring for a newborn or an adopted child.

During this leave, employers are also required to maintain the employee’s health benefits.

To qualify, employees should have worked for their employer for at least 12 months and have clocked in over 1,250 hours during the 12 months preceding the leave.

Qualifying family members for whom employees can take leave include a child, spouse or parent with a serious health condition.

This extends to biological, adopted or foster children, stepchildren, legal wards or a child of a person standing in loco parentis.

Child Labor Laws in New Hampshire

New Hampshire enforces the provisions of both federal and state child labor laws.

These laws establish various restrictions and requirements to ensure that minors can gain work experience while also receiving a proper education and maintaining their health and safety.

Work Permit

Minors under the age of 16 must obtain a New Hampshire Youth Employment Certificate within three days of commencing employment.

This requirement is accompanied by the submission of proof-of-age documents, which helps verify the eligibility of the minor for employment.

Working Hours

Minors aged 14 and 15 can work for a maximum of three hours per day on school days and eight hours per day on non-school days.

Their working hours should not be before 7:00 a.m. or after 7:00 p.m., except from June 1 through Labor Day.

Occupational Restrictions

Like other states, New Hampshire strictly prohibits minors from engaging in hazardous or dangerous occupations, which include manufacturing, mining, construction, public utilities and so on.

For a complete list of occupations, consult the New Hampshire Department of Labor.

At-Will Employment in New Hampshire

New Hampshire enforces an at-will employment doctrine, which means that either the employer or the employee can choose to terminate their working relationship at any time, with or without cause—in the absence of an employment contract.

No Right-to-Work Laws in New Hampshire

New Hampshire does not have any right-to-work laws, despite several attempts to pass one. This means that employers can require labor union participation as a condition for employment.

Workplace Safety and Health Regulations in New Hampshire

New Hampshire, in tandem with federal regulations, prioritizes the safety and health of its workforce, striving to reduce workplace accidents and ensure overall employee well-being.

OSHA in New Hampshire

Unlike some states that have a state-specific occupational safety and health agency, New Hampshire operates under the federal Occupational Safety and Health Act (OSHA) regulations.

OSHA’s regulations lay down standards that employers must adhere to, ensuring a hazard-free workplace.

These standards encompass a broad spectrum of workplace scenarios, from handling hazardous materials and machinery safety to protocols in case of emergencies, such as work injuries.

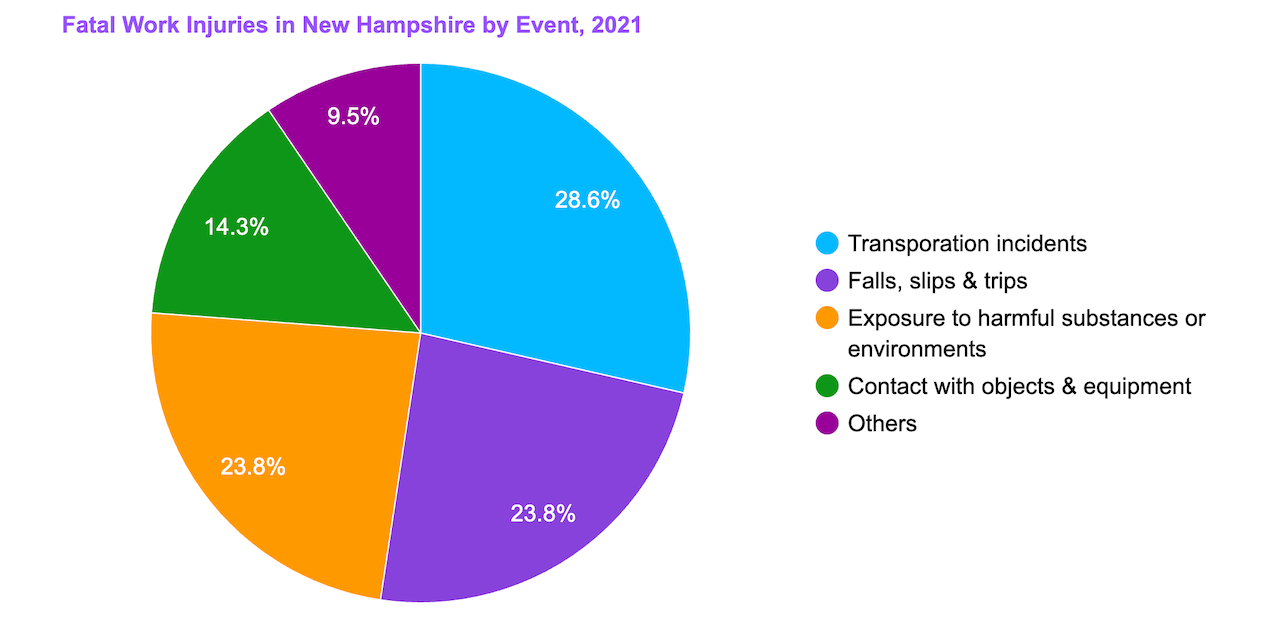

[Source: U.S. Bureau of Labor Statistics]

There were a total of 21 fatal work injuries that occurred in New Hampshire in 2021, with 6 cases due to transportation incidents.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

The total number of fatal work injuries in New Hampshire (21) is around 79% lower than the national average (102).

Employee Protections

Central to the OSHA mandate is the implementation of safety measures and the protection of employee rights. Workers in New Hampshire have the right to:

- Request an OSHA inspection if they believe there are violations or hazards

- Obtain workplace injury and illness records

- Report a work-related injury or illness without facing retaliation from the employer

Retaliation or discrimination against employees exercising their rights under OSHA can lead to severe legal consequences for the employer.

Anti-Discrimination and Fair Employment Practices in New Hampshire

The state of New Hampshire makes considerable efforts to ensure that its workforce is diverse and free from discrimination and bias.

Specifically, the New Hampshire Commission for Human Rights plays a pivotal role in combating discrimination in the state.

The commission enforces laws prohibiting employment discrimination based on race, color, national origin, religion, sex, disability and more.

It acts as a recourse for employees who believe they have been subjected to discriminatory practices, conducting investigations and offering resolutions.

The state also has specific laws that address equal pay, age-based discrimination and sexual harassment. Notably, New Hampshire has other specific regulations to address more niche aspects of the work environment, which include:

- Whistleblower protection: Employees have the right to report illegal or unsafe practices at their workplace without fear of retaliation. New Hampshire law protects whistleblowers, ensuring they are not unjustly terminated or discriminated against for upholding ethical standards.

- Workplace privacy: From personal locker searches to monitoring electronic communications, employers must respect the privacy rights of their employees. While employers can take measures to ensure security and productivity, they cannot infringe on the personal privacy of their staff without valid reasons and proper notifications.

Independent Contractor Classification in New Hampshire

In New Hampshire, distinguishing between an employee and an independent contractor is based on multiple criteria.

These often revolve around the degree of control the employer has over the worker, the economic realities of the relationship, and the nature of the work itself.

Misclassification can have serious implications. Employers might find themselves paying back wages, overtime and even penalties.

For workers, the correct classification can mean the difference between receiving essential benefits, such as health insurance and retirement contributions, or going without.

Termination and Final Paycheck Laws in New Hampshire

When an employee is terminated, whether they have resigned or been dismissed, employers must provide their final wages by the next regular payday.

This can be through the usual payment methods or via mail if the employee makes such a request.

New Hampshire laws ensure employees are compensated for all their work, including accrued vacation or leave, without undue delays.

Keep in mind that employers are required to provide a pay stub, or any written pay statement, with every paycheck to their employees.

Official Holidays in New Hampshire

New Hampshire labor laws do not require employers to provide paid or unpaid time off to employees for holidays. For a list of the official state holidays in New Hampshire, see the table below.

[Source: New Hampshire Department of Administrative Services]

Summary of New Hampshire Labor Laws

The labor laws in New Hampshire serve to craft a harmonious, fair and prosperous work environment.

For starters, the minimum wage in New Hampshire is aligned with the federal wage rate of $7.25 per hour.

Moreover, New Hampshire follows FLSA regulations for overtime pay wherein employees are entitled to 1.5 times their daily rate for work hours exceeding 40 in 1 workweek.

For breaks, employees are entitled to a 30-minute break for 5 hours.

Frequently Asked Questions About New Hampshire Labor Laws

What are the labor laws in the state of New Hampshire?

The labor laws in New Hampshire cover a broad range of topics, including minimum wage, overtime pay, breaks, family and medical leave, anti-discrimination policies and more.

Both federal and state-specific laws dictate these regulations to ensure a fair and inclusive work environment.

Can I work six hours without a lunch break in New Hampshire?

No. In New Hampshire, if you work more than 5 consecutive hours, you are entitled to a 30-minute meal break.

How many breaks do I get during an 8-hour shift in New Hampshire?

During an 8-hour shift, an employee is entitled to a 30-minute meal break.

Does New Hampshire have a right-to-work laws?

As of 2023, New Hampshire does not have any right-to-work laws.

What protections does New Hampshire provide for whistleblowers?

New Hampshire law protects whistleblowers, ensuring they can report illegal or unsafe workplace practices without retaliation.

This means that employees cannot be unjustly terminated, demoted or discriminated against for reporting or providing information on unethical activities within their organization.

Disclaimer: This information serves as a concise summary and educational reference for New Hampshire labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.