Montana Labor Law Guide

A comprehensive guide to Montana labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- The minimum wage in Montana is currently at $10.30 per hour, which is higher than the federal wage.

- Montana employees are entitled to 1.5 times their regular rate for overtime for hours worked over 40 in 1 workweek.

- Rest or meal breaks are not required by Montana law.

- Montana is the only state that does not observe “at-will” employment, which means employees in Montana cannot be fired without a just cause.

- Montana is not a “right-to-work” state—union membership can be a condition of employment.

Minimum Wage Regulations in Montana

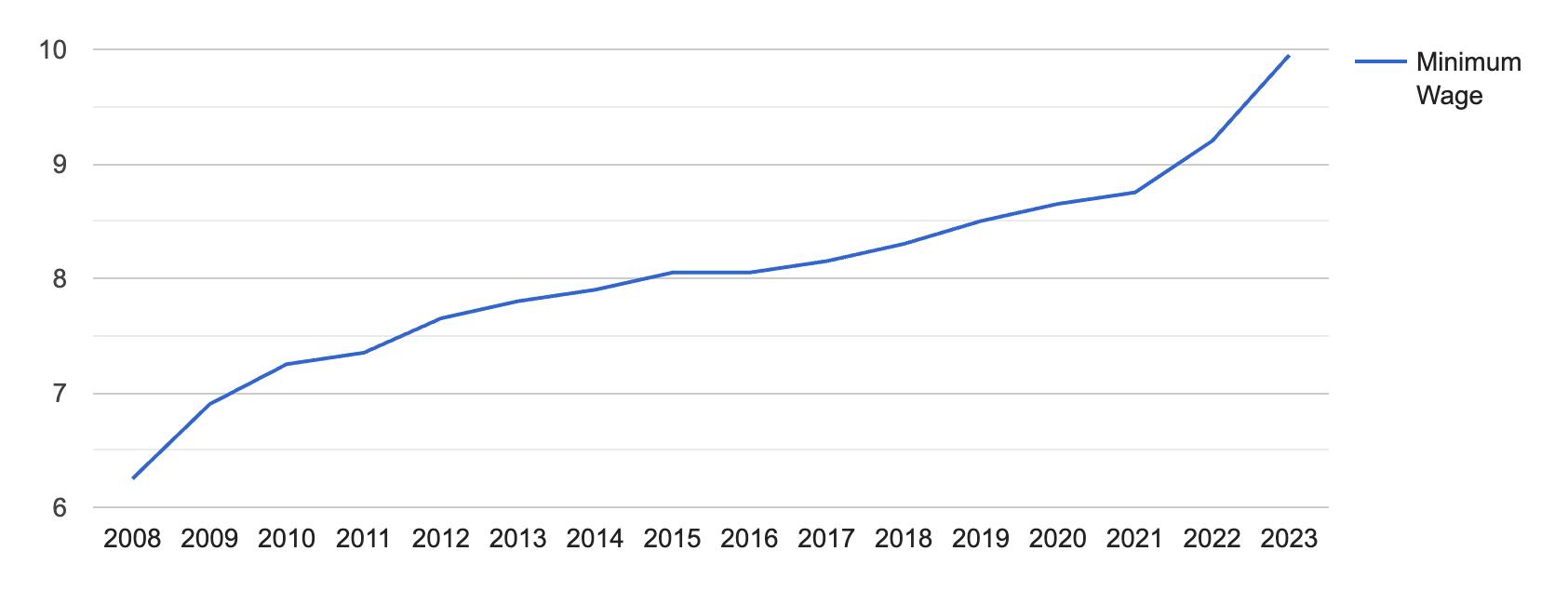

Montana has the Montana Minimum Wage Law of 1971, encompassing state regulations in terms of the minimum wage, maximum working hours and overtime pay. It’s important to know that the minimum wage is adjusted every year based on the cost of living.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

The state minimum wage in 2024 is $10.30 per hour, while the federal minimum wage is $7.25 per hour.

For businesses grossing $110,000 or less annually, this is adjusted to $4.00. If the Fair Labor Standards Act (FLSA) covers an employee of this business or has work that requires them to produce in or move services/goods to different states, the employee must be paid either the state or federal minimum wage.

[Source: Montana Department of Labor & Industry]

Tipped Employees

Tipped employees are entitled to the full minimum wage of $10.30 per hour. Montana employers are not allowed to take tip credits.

This means employees have the opportunity to earn more, keeping as much of their earnings as they make in tips.

Overtime Rules and Regulations in Montana

A typical workweek comprises 40 hours. If an employee works more hours than that, they should receive overtime pay at a rate of at least 1.5 times their regular hourly wage.

Nonexempt Employees

Nonexempt employees encompass various categories, such as hourly workers, part-time staff and individuals in specific job roles or industries that do not fall under the exemptions provided by Montana law and federal law.

Nonexempt employees are eligible for overtime pay at 1.5 times their regular hourly wage for hours worked beyond the standard 40-hour workweek.

Exempt Employees

In Montana, certain categories of employees are exempt from overtime provisions under state statutes.

These exemptions include:

- Agricultural workers

- Air carrier employees arranging voluntary work-hour swaps

- Employees in the transportation industry regulated by specific federal statutes

- Employees of country elevators

- Employees of farm equipment or service establishments with no more than five employees

- Employees of licensed outfitters in outdoor and recreational activities

- Employees of nonprofit educational institutions providing care to orphans or students in residential facilities

- Employees of the consolidated legislative branch, state or political subdivisions occasionally working outside their regular occupation

- Firefighters under collective bargaining agreements

- Forestry and law enforcement personnel

- Hospital employees under specific work period agreements

- Municipal or county government workers under certain work period agreements

- Police department officers with work periods established by the chief of police

- Radio announcers, news editors or engineers in second- or third-class cities or towns

- Salespeople working on commission

- Taxicab drivers

When navigating Montana labor laws, ensure you’re equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions tailored to your state’s tax laws.

No At-Will Employment in Montana

Montana is the only state in the U.S. that does not follow “at-will” employment. This means that as an employee, you cannot be fired by your employer for no reason.

Under Montana’s Wrongful Discharge from Employment Act, if you have already passed a six-month probationary period, you cannot be fired without “good cause,” which is a specific and justifiable reason related to the employee’s job performance or conduct.

This also means that employers can terminate employees without reason only during their introductory probationary period.

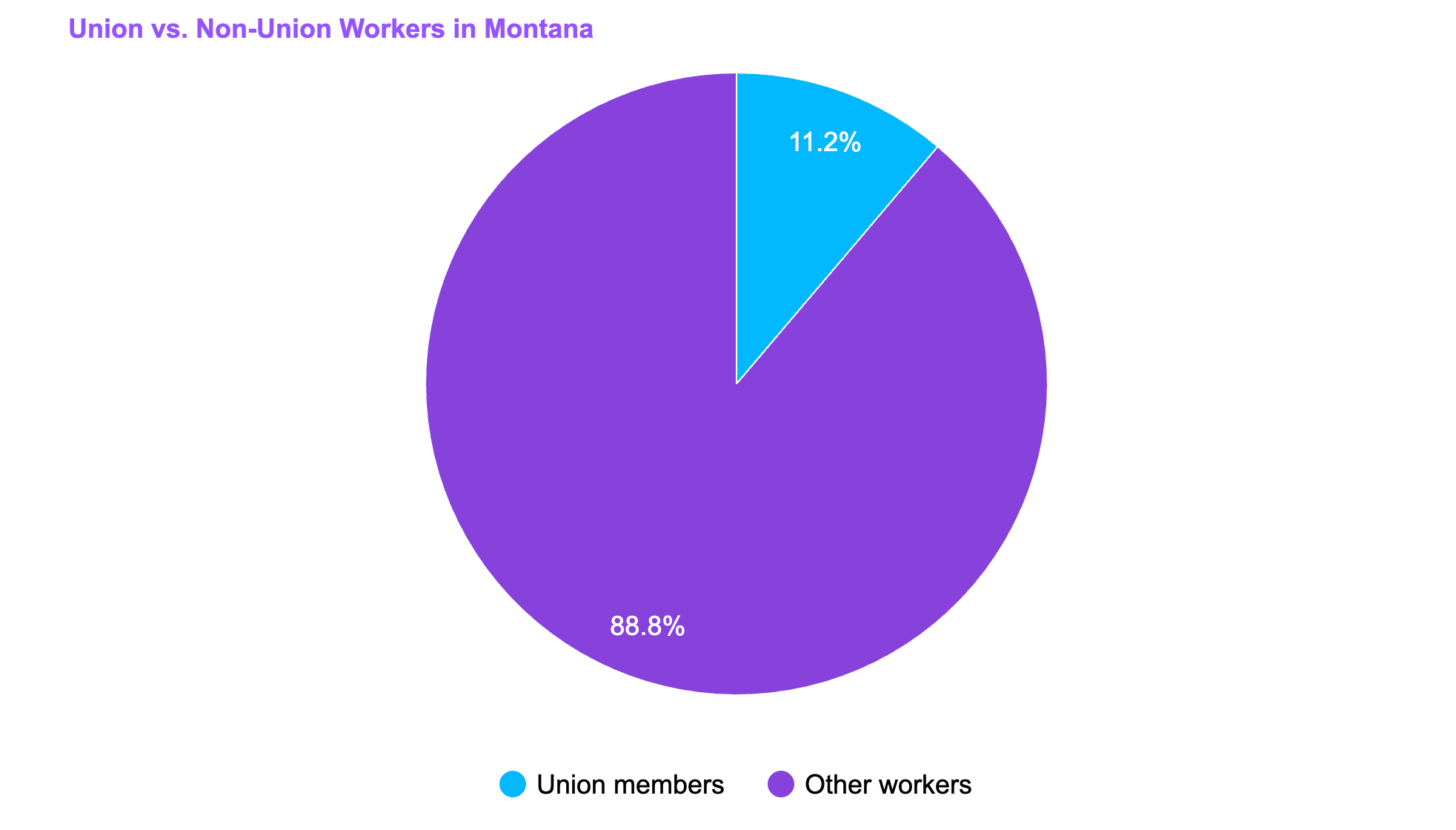

No Right-To-Work Laws in Montana

Montana does not have right-to-work laws in place, which means union membership cannot be compelled or required as a condition of employment.

An employer commits an unfair labor practice when they take actions that impede, restrict or pressure employees in the exercise of their union membership rights.

[Source: MontanaRightNow]

Rest and Meal Breaks

There are no Montana laws that require employers to provide rest or meal break times for employees.

Family and Medical Leave Laws

Montana labor laws follow the federal Family and Medical Leave Act (FMLA), which provides eligible employees with up to 12 weeks of unpaid, job-protected leave in a 12-month period for specific family and medical reasons. This allows eligible employees to take a leave in case of the following:

- Serious health condition: To address their own serious health condition, making it easier to prioritize their well-being

- Family care: To care for an immediate family member with a serious health condition (spouse, son, daughter or parent)

- Childbirth: For the birth and care of their newborn child

- Adoption: For adoption or foster care matters

- Military exigency: To address matters related to a family member’s active duty in the military (e.g., military-sponsored functions, financial and legal arrangements, alternative childcare, etc.)

- Military caregiver: Employees can take up to 26 weeks of leave in a 12-month period to care for a family member in the military with a serious injury or illness

To be eligible for these leaves, an employee should have worked under their employer for at least 12 months and at least 1,250 hours in the 12 months before the leave; and be employed by an employer with 50 or more employees within 75 miles.

In addition to FMLA, Montana has distinct pregnancy and maternity leave laws that apply to all employees, regardless of tenure. These laws allow for reasonable doctor-prescribed leave, forbid mandatory unreasonable leave durations, ensure compensation and mandate job reinstatement.

Employers can request medical verification for pregnancy-related disabilities. Montana’s unique law grants pregnancy-related leave and protections for all employees.

Other Leave Laws

Here’s a quick overview of various types of leave and how Montana labor laws typically handle them:

- Bereavement leave: Employers in Montana are not legally obligated to provide paid or unpaid bereavement leave.

- Jury duty leave: Montana requires employers to provide employees with unpaid time off for jury duty. Employees cannot be punished for missing work for their jury attendance.

- Voting leave: Montana labor laws do not mandate employers to provide time off for voting.

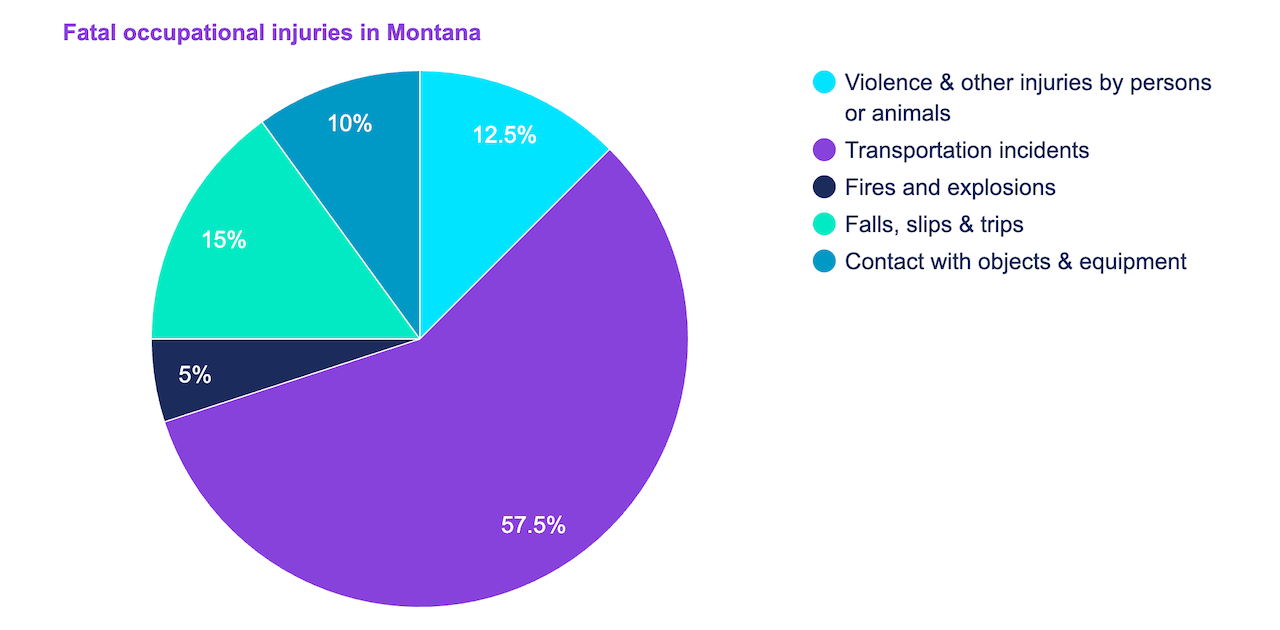

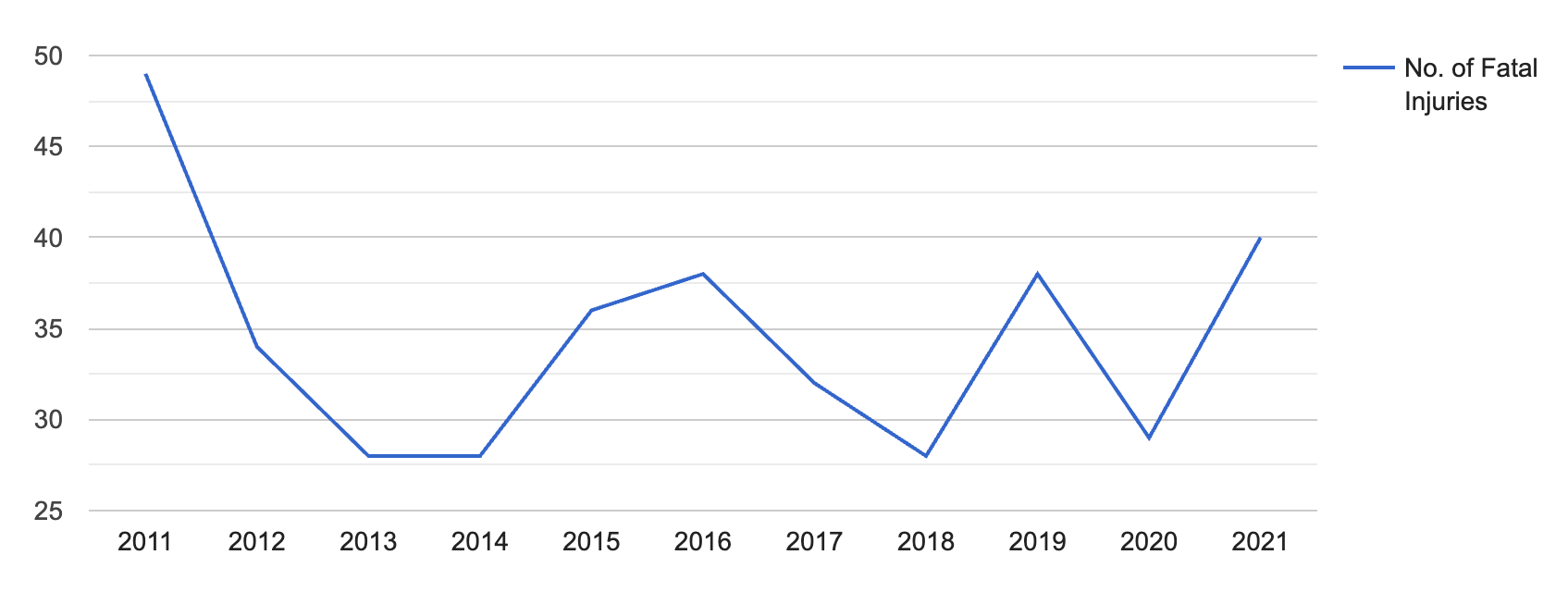

Workplace Safety and Health Regulations

Prioritizing workplace safety and health is paramount to creating a productive and secure work environment. Montana employers are subject to a combination of federal and state-specific regulations governing safety and health in the workplace.

[Source: U.S. Bureau of Labor Statistics]

Montana Safety Culture Act

All employers are encouraged to comply with the Montana Safety Culture Act (MSCA) by establishing an employee training program with the following goals:

- Provide a comprehensive safety orientation to new employees.

- Offer job-specific safety training before unsupervised tasks.

- Conduct regular, ongoing safety training.

- Promote safety awareness through tools like meetings and incentives.

- Periodically self-inspect for hazards, noting corrective actions.

- Document all safety activities, retaining records for three years.

For employers with more than five employees, there are three more goals to accomplish:

- Establish clear policies and procedures for safety, reflecting management commitment, employee involvement and defined responsibilities for all personnel.

- Implement and maintain procedures for reporting and addressing work-related incidents, injuries, illnesses and unsafe conditions, with an emphasis on nonpunitive reporting, effective follow-up and documentation.

- Maintain a safety committee in accordance with specified requirements.

[Source: U.S. Bureau of Labor Statistics]

Montana Occupational Health Act

Montana has its state-level Montana Occupational Health Act with its own occupational safety and health standards and regulations.

Employers in Montana must comply with the state’s occupational safety and health regulations, but they still have access to federal OSHA resources and guidance if needed.

Employee Protections

Montana labor laws provide various protections for employees, including:

- Workplace safety: Montana enforces workplace safety regulations primarily through state-level regulations. Employees can and should report safety concerns without fear of retaliation as per Montana’s Employment Dispute Resolution Policy and Commitment to a Fair and Respectful Workplace.

- Whistleblower protection: Montana has laws that protect employees from retaliation or adverse consequences for reporting illegal or unsafe activities in the workplace.

- Wage payment: Employers should pay employees accurately and on time. Failure by employers to do so may result in penalties. Employees have the right to receive detailed pay stubs that outline deductions and earnings.

- Privacy rights: Employees have some expectations of privacy in the workplace, such as in their personal belongings or communications. Employers must respect these privacy rights within legal boundaries.

Anti-Discrimination and Fair Employment Practices

Promoting a workplace free from discrimination and ensuring fair employment practices are fundamental principles in the Montana Human Rights Law.

It is unlawful to do the following if based on age, color, creed, disability, marital status, national origin, political beliefs or retaliation:

- Discriminate in hiring, firing or employment terms

- Deny reasonable maternity leave or refuse reinstatement post-leave

- Discriminate against members in labor unions

- Fail to refer for employment in employment agencies

- Retaliate against those who report or oppose discrimination

Independent Contractor Classification in Montana

Properly classifying workers as employees or independent contractors is a critical consideration for Montana employers. Misclassification can lead to legal and financial consequences.

In Montana, an “independent contractor” is someone who provides services for an occupation and (a) operates without substantial control or direction over their work and (b) is involved in an independently established trade, profession or business.

Meanwhile, an “employee” is any individual performing services for remuneration.

Official Holidays in Montana

As observed in most U.S. states, private employers in Montana are not required to provide paid or unpaid leave for holidays. Employers can also require all employees to work during holidays as needed. Note that many employers in Montana do extend the benefit of paid holidays to their staff.

When a holiday lands on a Saturday, it is observed on the preceding Friday, and if it falls on a Sunday, it is observed on the following Monday.

Termination and Final Paychecks

When it comes to paying employees, wages are generally due within 10 business days after the agreed-upon pay date, and if an employee quits, they should be paid on the next payday for the period worked or within 15 days, whichever is earlier.

For layoffs or discharges, wages must be paid immediately, except when a written personnel policy extends the payment time, with this extension limited to the next regular payday or 15 days.

Importantly, wages cannot be withheld for shortages, damages or mistakes, and certain deductions are only permissible if the employee has explicitly agreed to them.

Understanding the intricacies of termination and final paycheck requirements is essential to avoid legal disputes and ensure a smooth transition for both employers and employees.

Miscellaneous Montana Labor Laws

Montana labor laws encompass a variety of regulations that address specific aspects of employment and labor relations.

Immigration Verification

Montana only requires federal I-9 compliance for employment verification. E-Verify is not a requirement under Montana labor law.

Drug Testing

In Montana, the Workforce Drug and Alcohol Testing Act is in effect, and all Montana employers must include compliance with this act in their written workplace drug policies. Furthermore, employers have the option to implement drug testing as a prerequisite for hiring new employees.

Smoking Laws

Montana is one of the 28 states in the U.S. that enacted smoke-free laws for workplaces, restaurants and bars, with employers required to post noticeable signs of the smoking ban at the establishment’s entrances.

Employers in Montana cannot discriminate against employees who use lawful products (e.g., tobacco and medical marijuana).

Gun Laws

Montana’s gun laws are notably permissive, allowing for “shall issue” concealed carry permits within 60 days.

Employers and businesses have no obligation to permit firearms on their premises, and recent amendments have eased restrictions on concealed carry within city limits, except in specified locations such as school zones.

Frequently Asked Questions About Montana Labor Laws

What is the legal working age in Montana?

The minimum employment age in Montana is 14 years old. Minors cannot work in hazardous occupations.

[Source: Montana Department of Labor & Industry]

How many hours can you work in Montana?

As per federal law and Montana labor laws, eligible employees can work for 40 hours in a work week and any time exceeding that counts as overtime.

Can you be fired without cause in Montana?

As per the Wrongful Discharge From Employment Act, if you are an employee who has finished their probationary period, you cannot be fired without justifiable cause. This follows the fact that Montana is not an at-will state.

Do salaried employees get overtime in Montana?

If you are not exempt from overtime provisions, an employee must be paid at 1.5 times their regular (hourly) rate for all hours worked over 40 per week.

Disclaimer: This information serves as a concise summary and educational reference for Montana labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.