Missouri Labor Law Guide

A comprehensive guide to Missouri labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways of Missouri Labor Laws

- Missouri’s minimum wage is $12.30 per hour, which is higher than the federal rate of $7.25.

- Missouri employers are not required to provide their employees with any rest or meal breaks.

- Nonexempt employees are entitled to 1.5 times their regular rate of pay for overtime at a minimum of $18.45 per hour for hours worked after the first 40 in 1 workweek.

- Missouri observes an at-will doctrine where both employers and employees in Missouri can terminate their employment relationship without cause.

- Missouri is not a right-to-work state.

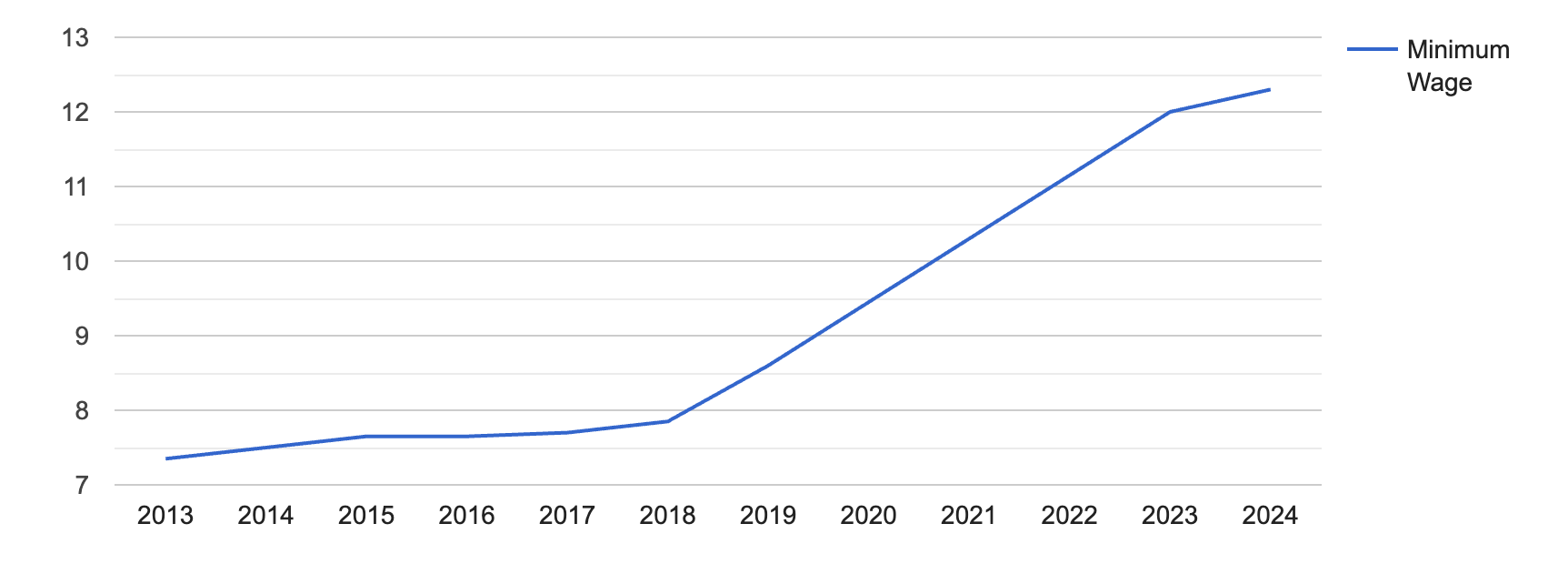

Minimum Wage Regulations in Missouri

The minimum wage in Missouri is $12.30 per hour, which is $5.05 higher than the federal minimum wage.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

Regular employees are entitled to the current state minimum wage rate of $12.30 per hour in Missouri. This is set to increase or decrease with inflation or the consumer price index.

However, employees working for employers in the retail or service industry with an annual gross income of less than $500,000 can be paid a rate different from the state minimum wage.

[Source: FRED]

Tipped Employees

Employees who receive tips in Missouri are entitled to be paid half of the state minimum wage, or $6.15 per hour.

However, if an employee’s earnings with tips do not meet the state minimum wage ($12.30 per hour), the employer should pay the difference.

To navigate wages more easily and get a full picture of your earnings, check out our Paycheck Calculator, which takes into account state taxes and other deductions.

Overtime Rules and Regulations in Missouri

Missouri follows federal regulations under the Fair Labor Standards Act (FLSA), wherein employees are entitled to time and a half, or 1.5 times their regular pay when their work hours exceed 40 in 1 workweek.

Nonexempt Employees

Missouri law does not have any state-specific laws for classifying nonexempt employees. Instead, the state follows FLSA regulations. Nonexempt employees in Missouri should be paid a minimum of $18.45 per hour or 1.5 times their regular rate of pay for hours worked over the first 40 in 1 workweek.

Nonexempt employees typically fall into technical, clerical, skilled crafts or service work.

To calculate your overtime pay, check out our time and a half pay calculator.

Exempt Employees

Exempt employees are paid on a salary basis and are not entitled to overtime pay. These employees typically have executive, managerial, administrative or other professional roles.

They are also commonly not required to keep a record of their hours per workweek but are still required to apply for leaves or report time away from work.

At-Will Employment in Missouri

Missouri is an at-will employment state, which means that, unless there is a specific contract in place, employers or employees can terminate their working relationship at any time with or without cause, except for reasons prohibited by law, such as discrimination or a violation of public policy.

[Source: Missouri Department of Labor]

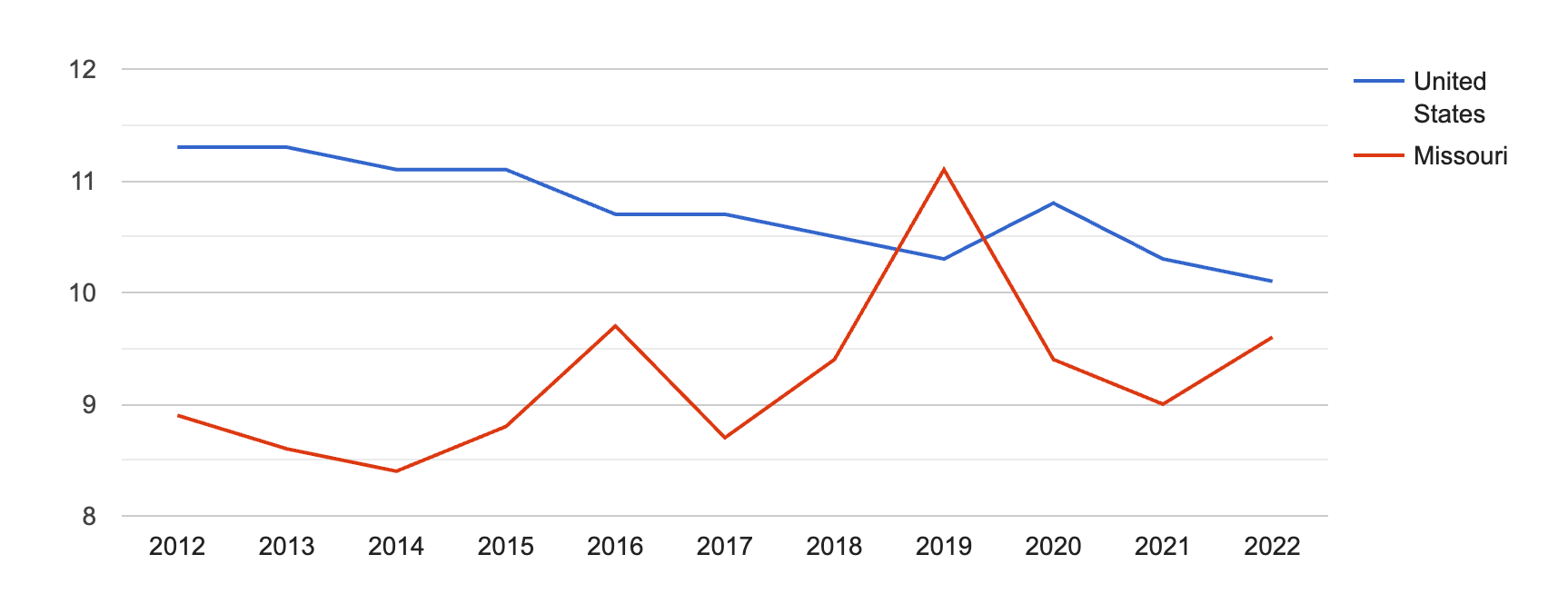

No Right-To-Work Laws in Missouri

Missouri is not a right-to-work state, which means that employers cannot require employees to join or leave a labor union or pay labor organization charges as a condition of employment.

[Source: The Bureau of Labor Statistics]

In 2022, about 9.6% of all wage and salary workers in Missouri are union members, which is an increase from 9% in 2021.

Rest and Meal Breaks in Missouri

Rest or meal breaks are up to the discretion of employers in Missouri, as there are no state laws requiring breaks of any kind.

Following federal law, any break that lasts between 5 and 20 minutes is part of the employee’s workday, and employees must thereby be paid for this time.

Family and Medical Leave Laws in Missouri

Employees in Missouri are solely protected by the Family and Medical Leave Act (FMLA), which provides them time off for family and medical purposes.

Family and Medical Leave Act

Employees in Missouri are entitled to time off under the federal FMLA for different reasons.

To be eligible for FMLA leave, you must meet the following conditions:

- Worked for the company for at least 12 months (1 year)

- Worked for at least 1,250 hours in the previous year

- Work at a site where there are a minimum of 50 employees within a 75-mile vicinity

Employers should comply with FLMA if they have a minimum of 50 employees for at least 20 weeks.

Other Leave Laws

Here is an overview of other types of leaves under Missouri labor laws:

- Jury duty: Employers are not allowed to penalize employees who receive a jury summons or force them to use their leave. If an employee is discharged due to jury duty, they can file a lawsuit within 90 days to seek compensation, reinstatement and attorney’s fees. Employers are not required to provide paid time off.

- Voting: Missouri labor laws grant employees a three-hour window to vote, provided they give prior notice.

- Donor: State employees are entitled to up to 5 days of paid leave as a bone marrow donor and up to 30 days as an organ donor.

- Bereavement: Missouri laws do not require employers to grant time off for bereavement.

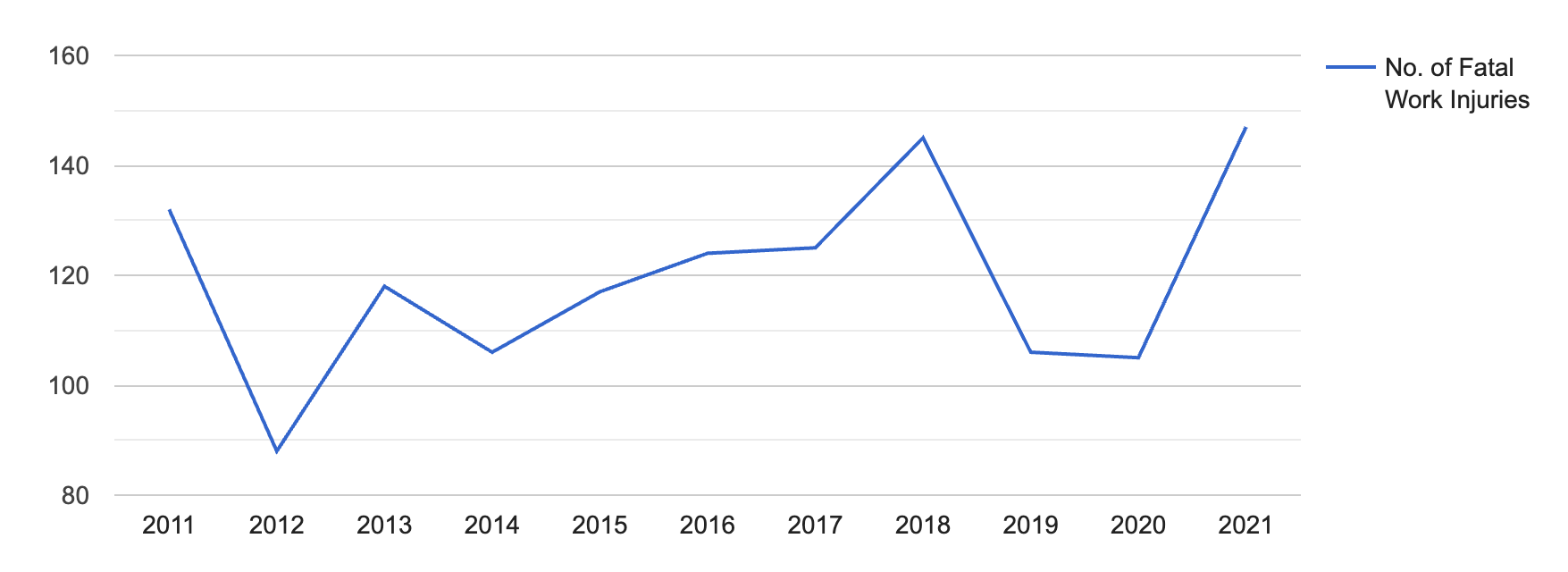

Workplace Safety and Health Regulations in Missouri

Missouri follows federal Occupational Safety and Health Administration (OSHA) regulations in ensuring employee and workplace safety and does not have its own state-specific occupational health and safety regulatory program.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Although the number of fatal occupational injuries in Missouri, which is 147 in 2021, is lower compared to other states in the U.S., it is still 44% higher than the average in the U.S. at 102 fatal work injuries.

[Source: U.S. Bureau of Labor Statistics]

Missouri also has the Construction Safety Training Act, which requires training for on-site construction workers, those at nearby facilities, transport personnel and drivers aiding in loading/unloading materials or equipment.

Child Labor Laws in Missouri

Minor employees must be paid the state minimum wage of $12 per hour. Work permits are required for employees under 16.

Moreover, minors cannot work for more than three hours per day on a school day, and eight hours on a non-school day.

They also cannot work for more than 6 days or 40 hours in any week.

Minor employees cannot also work in many occupations, including those involving sales, heavy machinery, manufacturing, alcoholic beverage establishments, hazardous materials, woodworking and so on.

Antidiscrimination Laws in Missouri

As per the Missouri Human Rights Act, employers are prohibited from discriminating against any employee or potential employee based on age, ancestry, color, disability, national origin, race, religion and sex.

Any discrimination-related complaints must be filed with the Missouri Commission on Human Rights within 180 days.

Independent Contractor Classification in Missouri

Employers in Missouri should properly classify whether a worker is an employee or an independent contractor so they can properly adhere to local tax and wage laws.

An employee is defined as an individual who works for an employer and is subject to their control and direction in performing their work. Employees often receive benefits such as workers’ compensation, minimum wage protection and eligibility for overtime pay following state regulations.

On the other hand, independent contractors are individuals who are “self-employed” or operate their own businesses or provide services to clients. They have a higher degree of independence and control over their work and are not typically eligible for employment benefits.

Official Holidays in Missouri

Employers in Missouri are not required to provide holiday pay to employees working on those days. Any premium wages for these holidays are at the employer’s discretion.

[Source: Missouri Office of Administration]

Termination and Final Paychecks in Missouri

Employers in Missouri must pay all final wages following termination to their employees on the day of dismissal.

If all wages due are not given to the employee at the time of their dismissal, the employee should request in writing that all wages be paid. Employers have seven days to respond and pay all wages due.

Should payment not be made, the employee’s final wages will accrue until the employee is paid—for not more than 60 days.

All wages due generally do not include unused vacation pay or leave credits, unless outlined in the employer’s company policy.

Miscellaneous Missouri Labor Laws

Here are other Missouri labor laws in employment and labor relations.

Wage Payment

Employers should pay wages to employees at least on a semimonthly basis within 16 days of each regular payday. Pay statements or pay stubs should be provided to employees at least on a monthly basis. Noncompliance can result in penalties for employers.

Employers must keep payroll records for at least three calendar years.

Unemployment Insurance

Missouri has a state unemployment insurance system for which most employers are required to contribute. This is to provide unemployment insurance benefits for those who lost their job through no fault of their own, because of a natural disaster or other reasons.

Immigration Verification

State laws require employers to ensure that no unauthorized aliens are employed in Missouri. In addition, all public employers and any business entity with a contract or grant over $5,000 with the state are required to use E-Verify.

Drug Testing

Missouri does not have specific regulations governing drug and alcohol testing during employment. However, contractors and subcontracts working with public and charter elementary and secondary schools are required to undergo random drug and alcohol testing programs.

Smoking Laws

Missouri law prohibits employers from discriminating against individuals for legal off-premises use of tobacco or alcohol products, except when such use interferes with their job responsibilities or the employer’s operations.

Employers are also permitted to offer reduced health insurance benefits premiums to employees who do not use tobacco products, with some exceptions for certain organizations (religious, nonprofit, etc.).

Gun Laws

Missouri allows employers to set company policies related to guns in the workplace. A recent decision by the Supreme Court rejected an act aimed at curbing the authority of state and local law enforcement to enforce federal gun laws following the state’s high gun death rates.

Frequently Asked Questions About Missouri Labor Laws

Keep yourself updated on Missouri labor laws by checking out answers to some commonly asked questions by Missouri locals.

What is the legal working age in Missouri?

The legal working age in Missouri is 14 years old. Youth under 14 years old are only allowed to work casual jobs or in the agriculture or entertainment industry.[caption id="attachment_15477" align="aligncenter" width="1280"]

[Source: Missouri Department of Labor]

What is the minimum wage in Missouri?

The minimum wage in Missouri is $12.30 per hour. This is set to change depending on the inflation rate or consumer price index.

Can you be fired without cause in Missouri?

In general, yes. As long as the termination does not violate any legal statutes, employers in Missouri can fire employees for any reason and at any time. Employees also have the right to resign for any reason and at any time.

Is it illegal to work for eight hours without any breaks in Missouri?

In short, no. Missouri does not mandate employers to provide breaks even through an entire eight-hour shift. However, some employers do provide breaks for employees, so employees should ask about this during the hiring process.

Do Missouri-based employers provide holiday pay?

Employers in Missouri are not required to provide holiday pay, and getting higher daily earnings for holidays is up to employers’ discretion.

How much is overtime pay in Missouri?

Overtime pay in the state is set to time and a half or 1.5 times your regular rate of pay. This means that employers are required to pay eligible employees a minimum overtime pay rate of $18.45 ($12.30x1.5) per hour.

Disclaimer: This information serves as a concise summary and educational reference for Missouri labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.