Minnesota Labor Law Guide

A comprehensive guide to Minnesota labor laws: Covering essential topics like minimum wage guidelines, overtime regulations, mandatory rest breaks and other key employment provisions specific to the North Star State.

Key Takeaways

- Minimum wage rates are $10.85 for large companies and $8.85 for small ones

- Overtime pay must be at least 1.5 times the employee's regular rate

- Rest and meal breaks are mandatory in Minnesota

- Family and medical leave rights extend beyond federal FMLA

- Child labor laws set the minimum employment age at 14, with exceptions

- Independent contractor classification depends on behavioral control, financial control and the relationship

- Termination and final paycheck laws mandate prompt payment for terminated employees

Minimum Wage Regulations in Minnesota

The minimum wage rates in Minnesota vary depending on the size of the company.

Any enterprise with annual gross revenues of $500,000 or more must pay a minimum wage of $10.85.

At the same time, any enterprise with annual gross revenues of less than $500,000 must pay a minimum wage of $8.85.

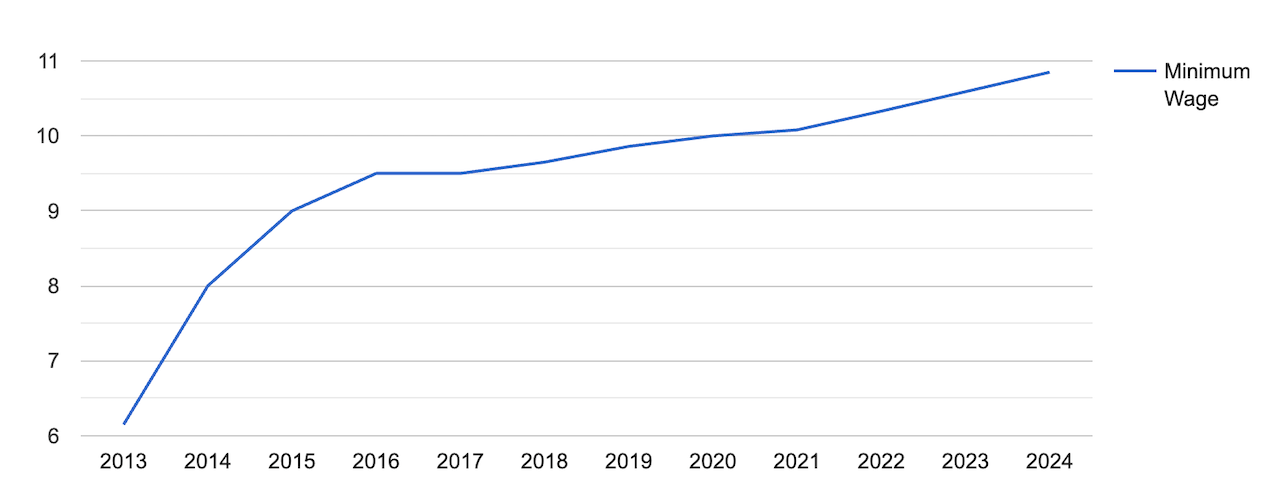

[Source: FRED]

The minimum wage in Minnesota has had a steady climb, as it increased by approximately 76.42% from $6.15 in 2013 to $10.85 in 2024.

You can also compare the Minnesota minimum wage with the minimum wage in other states using the table below.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Tipped Minimum Wage

In Minnesota, there are no tip credits permitted against the minimum wage.

This means that employers, especially those in the restaurant industry or with tipped employees, are not allowed to use tips received by employees to offset the minimum wage.

Tipped employees must receive the full minimum wage for all hours worked, independent of the tips they may earn during their shifts.

Exceptions to Minimum Wage Requirements

While Minnesota's minimum wage laws ensure fair compensation for most workers, there are certain exceptions and exemptions from these requirements, such as:

- Babysitters

- Taxicab drivers

- Volunteers of nonprofit organizations

- Public safety workers

- Employees subject to U.S. Department of Transportation Regulations

Subminimum Wage

In Minnesota, subminimum wage rates apply to specific groups of employees based on factors such as age and employment type.

Subminimum wage breakdown:

- Training rate: An hourly rate of $8.85 may be paid to employees aged 18 and 19 during the first 90 consecutive days of their employment. The training rate allows employers to pay a reduced wage to younger employees who are new to the workforce, to provide them with training and work experience.

- Youth rate: The youth rate of $8.85 is paid to employees aged 17 or younger who are not covered under federal law.

- J-1 visa rate: The J-1 Visa rate stands at $8.85 per hour and applies to employees of hotels, motels, lodging establishments and resorts working under the authority of a summer work, travel Exchange Visitor (J) non-immigrant visa.

When discussing wages, it’s important to keep in mind the taxes for complete financial clarity. Our Minnesota Paycheck Calculator gives you an estimate of your earnings after accounting for taxes and deductions, in adherence to your state’s tax laws.

Overtime Rules and Regulations in Minnesota

Overtime regulations in Minnesota are governed by both federal and state laws, which set the criteria for when and how employers are required to pay overtime to their employees.

The federal Fair Labor Standards Act (FLSA) mandates that certain employers must pay overtime to their employees for all hours worked over 40 in a workweek.

The types of employers subject to federal overtime regulations include:

- Employers that produce or handle goods for interstate commerce

- Businesses with gross annual sales of more than $500,000

- Hospitals and nursing homes, as well as personal care assistant (PCA) and community first services and support (CFSS) agencies

- Private and public schools

- Federal, state and local government agencies.

Under federal law, overtime pay must be at least 1.5 times the employee's regular rate of pay for hours worked beyond 40 in a workweek.

In addition to federal regulations, the Minnesota Fair Labor Standards Act (MNFLSA) further refines overtime requirements in the state.

Under Minnesota law, employers are required to pay overtime for all hours worked over 48 in a workweek, which is a key distinction from the federal standard of 40 hours.

Overtime Exceptions and Exemptions

Overtime regulations in Minnesota adhere to both federal and state laws, which provide guidelines for when employees are exempt from receiving overtime pay.

Under federal law, the following employees and professions are generally exempt from receiving overtime pay:

- Highly compensated employees: Individuals earning over $107,432 annually are typically exempt from federal overtime requirements.

- Executive and administrative employees: Employees earning at least $684 per week, who primarily perform executive or administrative duties, are often exempt from federal overtime regulations.

- Professional employees: Certain professional employees, such as artists, researchers, scientists and skilled computer professionals, may be exempt from overtime pay under federal law.

- Outside salespeople: Outside salespeople who regularly conduct their work away from the employer's place of business are often exempt from overtime requirements.

- Specific occupations: Some specific occupations, such as mechanics, taxi drivers, seasonal employees, sugar beet hand laborers, babysitters and agricultural technicians, are also subject to exemptions under federal law.

In addition to the federal exemptions, Minnesota has its own state-specific exemptions and exceptions.

These exemptions are outlined in Minnesota Statutes and include categories such as:

- Agricultural workers: Certain agricultural employees may be exempt from overtime regulations based on their job roles and responsibilities.

- Certain professionals: This includes some specific medical professionals, lawyers and teachers.

Rest and Meal Breaks

Minnesota labor laws require employers to provide their employees with restroom breaks and sufficient time for meal breaks.

Minnesota law requires paid restroom breaks for employees for every four consecutive hours of work to meet their basic needs and ensure workplace comfort.

Employees working eight or more consecutive hours in Minnesota are entitled to a meal break. The law requires employers to provide "sufficient" unpaid time for employees to have a meal.

For rest breaks, the law in Minnesota doesn't specify a specific duration, using terms like "adequate" and "within each four consecutive hours of work."

This flexibility allows employers and employees to determine what is reasonable based on the circumstances.

Employers have the authority to set the hours when these breaks can be taken. However, for a break to be unpaid, the employee must be entirely relieved of their work duties for at least 20 minutes.

Family and Medical Leave Laws in Minnesota

Minnesota provides certain family and medical leave rights for employees, in addition to the federal Family and Medical Leave Act (FMLA).

Minnesota employers must adhere to the FMLA, which grants eligible employees up to 12 weeks of unpaid leave for various reasons, including:

- Recuperating from a serious health condition

- Bonding with a new child

- Handling family members' military service obligations.

Employees are eligible for FMLA leave if they have worked for the company for at least a year, worked at least 1,250 hours during the previous year, and worked at a location with at least 50 employees within a 75-mile radius.

A state-specific leave laws breakdown:

- Minnesota Family and Medical Leave: Employers with at least 21 employees must allow eligible employees to take up to twelve weeks off for prenatal care, pregnancy, childbirth and bonding with a new child. Bonding leave is available to biological and adoptive parents.

- Military family leave in Minnesota: All employers must provide time off for eligible employees who have a family member on active military duty. This includes attending send-off or homecoming ceremonies and taking time off if a family member is injured or killed in active military service.

- Minnesota small necessities law: Employers with at least two employees must grant eligible employees up to 16 hours of unpaid leave in any 12-month period to attend school conferences or other school-related activities for their child if these activities cannot be rescheduled outside of work. Employers with 20 or more employees must provide up to 40 hours of paid leave to their employees for the purpose of bone marrow donation.

Minnesota is set to introduce a Paid Family and Medical Leave program starting on January 1, 2026.

This program will offer paid time off for employees facing serious health conditions, needing to care for family members, attending military-related events or addressing personal safety issues.

Family Members That Qualify for FMLA

Under the FMLA, the covered family members include:

- Spouse: You can take FMLA leave to care for your spouse if they have a serious health condition.

- Child: Your child, whether biological or adopted, is also covered. This includes caring for a child with a serious health condition or for the birth or placement of a child.

- Parent: If your parent has a serious health condition, you are eligible to take FMLA leave to care for them.

- Next of kin: You can also use FMLA leave to care for a next of kin who is a covered military member on active duty or called to active duty status, and who has a serious injury or illness incurred or aggravated in the line of duty.

- In loco parentis: The FMLA can extend to situations where you are acting "in loco parentis" to a son or daughter, which means you are responsible for the day-to-day care or financial support of a minor child.

- Same-sex spouses: As of 2013, spousal leave based on same-sex marriages is protected under the FMLA, ensuring equal protection for all married couples.

Workplace Safety and Health Regulations in Minnesota

The Minnesota Occupational Safety and Health Administration (MNOSHA) is responsible for ensuring workplace safety and health regulations within the state of Minnesota.

MNOSHA primarily enforces safety and health standards for state and local government employers and employees, excluding Federal government employers and private-sector employers, for whom federal OSHA retains enforcement authority.

While MNOSHA has adopted many OSHA standards by reference, it has also established unique state plan standards covering various aspects of workplace safety, including general industry and construction.

These unique standards aim to address specific needs within the state, such as personal protective equipment, ventilation, and safety programs.

MNOSHA also conducts inspections to identify hazardous conditions in workplaces, issuing citations for violations of its standards.

These inspections can be initiated through various means, including regular scheduling, imminent danger reports, fatalities, worker complaints and referrals.

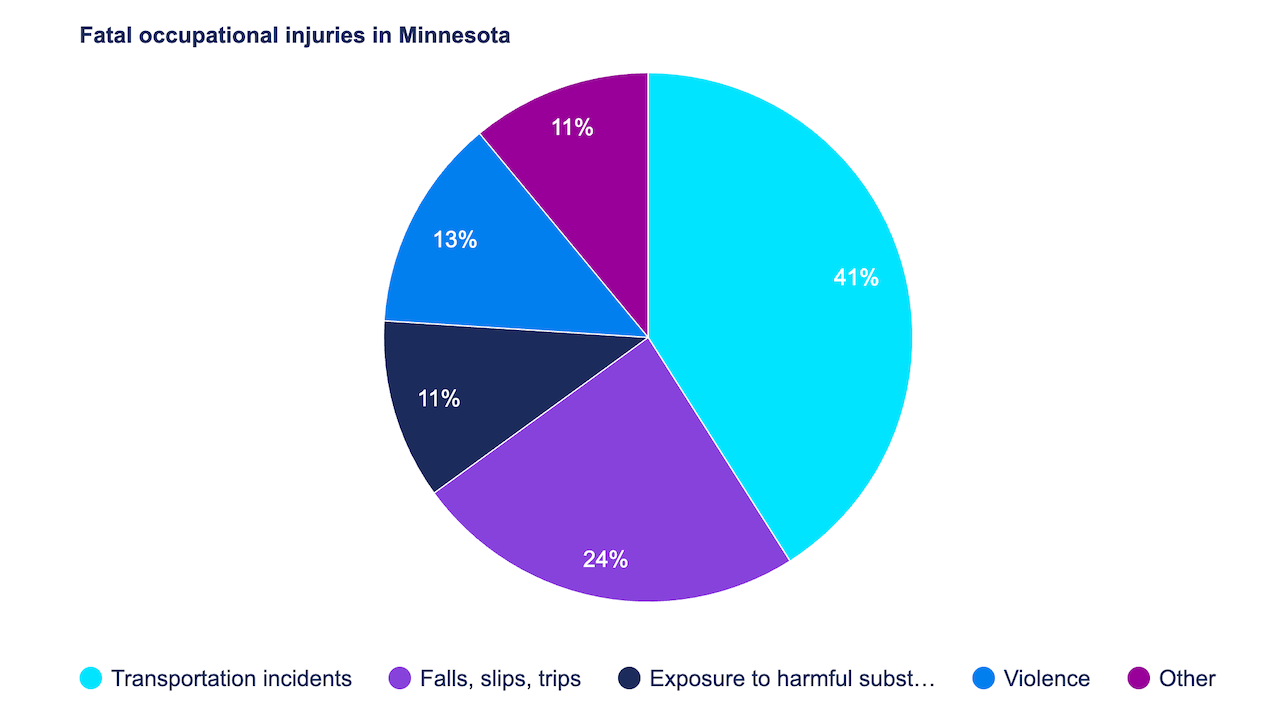

Still, in 2021, fatal work injuries in Minnesota totaled 80, as reported by the U.S. Bureau of Labor Statistics, which is around a 19% increase compared to the previous year.

[Source: U.S. Bureau of Labor Statistics]

Additionally, MNOSHA offers voluntary and cooperative programs designed to reduce workplace injuries, illnesses and fatalities.

It provides on-site consultation services to help employers comply with MNOSHA standards and identify and correct potential safety and health hazards.

You can see how Minnesota compares to other states in the US when it comes to occupational fatal injuries by browsing the table below.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Child Labor Laws in Minnesota

Child labor laws in Minnesota are in place to ensure the well-being of young workers while balancing their educational and work responsibilities.

The minimum age for employment in Minnesota is generally 14 years old. However, there are some exceptions:

- Newspaper carrier: Individuals as young as 11 years old can work as newspaper carriers.

- Agriculture: In agriculture, the minimum age is 12, and parental or guardian consent is required.

- Actor, actress or model: There is no specific age restriction for individuals working in these capacities.

- Youth athletic program referee: Children aged 11 and above can work as youth athletic program referees with parental or guardian consent.

Workers under the age of 16 have specific restrictions such as:

- Working hours: Minors under 16 may not work before 7 a.m. or after 9 p.m., except for newspaper carriers.

- Weekly hours: They are not allowed to work more than 40 hours a week or more than eight hours in a 24-hour period, except in agriculture.

- School days: On school days during school hours, minors under 16 can work only if an employment certificate has been issued by the school district superintendent and the worker is allowed to work during school hours under federal law. During the school year, federal law further restricts hours worked to no later than 7 p.m., no more than three hours a day, and not more than 18 hours in a week.

16- and 17-year-old high school student work hour restrictions include:

- Evenings before school days: They are not allowed to work after 11 p.m.

- School days: They are not allowed to work before 5 a.m. on school days.

- Exceptions with permission: With written permission from a parent or guardian, these hours may be expanded to 11:30 p.m. and 4:30 a.m. No other limit is set for the hours that 16- and 17-year-olds can work. High school graduates who are 17 years old do not have work hour restrictions.

Anti-Discrimination and Fair Employment Practices in Minnesota

Employers in Minnesota are prohibited from discriminating against employees or job applicants based on:

- Race

- Color

- Creed

- Religion

- National origin

- Sex

- Marital status

- Disability

- Public assistance

- Age

- Sexual orientation

- Gender identity

- Familial status

Labor organizations, employers, and employment agencies are restricted from engaging in various discriminatory practices, which include but are not limited to:

- Refusing to interview or hire someone based on their protected class

- Denying opportunities for training or promotion due to an individual's protected class

- Creating or allowing a hostile working environment to exist

- Refusing to reasonably accommodate an individual with a disability

- Terminating the employment of an individual based on their protected class

- Seeking or gathering information about a job applicant’s protected class status for the purpose of making an employment decision

Independent Contractor Classification in Minnesota

To make an independent contractor determination, various factors related to behavioral control, financial control and the relationship of the parties must be taken into account.

Behavioral control relates to the degree of control or direction a business exerts over how the work is performed.

If the business has the right to direct or control the manner and means of service delivery, it is an indication of behavioral control, which is often associated with an employer-employee relationship.

Key behavioral control factors include:

- Specifying how, when or where the work will be done

- Determining the tools or equipment to be used

- Establishing the sequence in which services are to be performed

- Deciding who will be hired to assist with the work

- Choosing where supplies and services will be purchased

- Setting work hours

- Requiring reports to be submitted

- Providing training on procedures and methods

Financial control pertains to the right to direct or control the administrative aspects of the work. When a business has significant control over these financial aspects, it often indicates an employer-employee relationship.

Relevant financial control factors include:

- Reimbursing or paying travel and business expenses.

- Paying workers at regular intervals (hourly, weekly, etc.)

- Providing tools, materials, and other equipment

- Offering employee benefits

- The worker having an opportunity for profit or risk of loss

- The worker having a significant investment in the work

- The worker offering services to the general public

- The services provided not being an integral part of the business (e.g., a bank hiring a plumber)

The nature of the relationship between the business and the worker can also be a critical factor in determining worker classification.

Key aspects of this relationship include:

- Whether the worker has the right to quit without incurring liability

- Whether the business has the right to terminate the worker

- Whether the worker is entitled to employee benefits

- Whether there is a continuing and ongoing relationship between the business and the worker

- Whether the services performed by the worker are integral to the regular business activities of the business

While written contracts may be considered when determining worker classifications, having a contract in place does not automatically make a worker an employee or an independent contractor.

The actual relationship and the practical application of control and independence must be examined.

Not all of these factors need to be present to determine worker status, but all factors should be thoroughly considered.

The classification of workers as employees or independent contractors has legal and financial implications for both parties, and misclassification can lead to legal and financial consequences.

Termination and Final Paycheck Laws in Minnesota

Employees who are terminated, discharged or fired are entitled to receive all their wages and commissions within 24 hours of making a written demand for payment to the employer.

For employees who voluntarily leave their employment (quit), are terminated, discharged or fired, but do not make a written demand for payment, their wages and commissions should be paid on the next regularly scheduled payday.

However, if the payday falls within five days of the last day of work, the employer may have up to 20 days to make the final payment.

Summary

Minnesota's minimum wage rates differ based on a company's annual gross revenues.

Larger enterprises with $500,000 or more in annual revenues must pay a minimum wage of $10.59, while smaller companies with less than $500,000 in annual gross revenues pay $8.63.

Minnesota permits employers to pay lower cash wages to tipped employees, which is common in industries where employees receive tips. The tipped minimum wage depends on the company's size, with different rates for large and small employers.

Overtime regulations in Minnesota are governed by both federal and state laws. Federal law mandates that certain employers pay overtime for all hours worked beyond 40 in a workweek.

Minnesota law, however, requires overtime pay for hours worked over 48 in a workweek.

Employees working eight or more consecutive hours in Minnesota are entitled to a meal break. Employers have the authority to set the hours for these breaks.

Minnesota is set to introduce a Paid Family and Medical Leave program in 2026.

FAQs About Minnesota Labor Laws

For more info, find frequently asked questions about the labor laws in Minnesota below.

How many hours can you legally work in a week in Minnesota?

Minnesota places no restrictions on the maximum number of hours adult employees can work in a week.

What is considered full-time employment in Minnesota?

In Minnesota, full-time or part-time employment is not officially defined by state law.

Instead, the concept of a workweek is established in Minnesota Rules 5200.0170, where a workweek is specified as a consistent and repetitive span of 168 hours, equivalent to seven consecutive 24-hour periods.

Is Minnesota a right-to-work state?

Minnesota is not considered a right-to-work state.

This means that in Minnesota, employees who are part of a unionized workforce are typically required to either become union members or make "fair share" payments, which are equivalent to the cost of union dues, even if they choose not to join the union.

Can employees discuss wages in Minnesota?

Under the Minnesota Wage Disclosure Protection law, you are allowed to disclose the amount of your own wages to any person, and your employer is prohibited from retaliating against you for sharing this information.

What qualifies as wrongful termination in Minnesota?

Wrongful termination in Minnesota is primarily governed by the Minnesota Human Rights Act (MHRA).

Under the MHRA, it is considered wrongful termination if an employee is fired based on factors such as religion, race, national origin, familial status, sexual orientation and more.

Notably, sex is a protected class under this act, ensuring that women, including those who are pregnant, are not discriminated against based on their gender or ability to become pregnant.

Furthermore, the MHRA safeguards employees from retaliation for exercising their rights.

Even if the termination is not motivated by unlawful reasons, it could still be considered a breach of the employment contract, making it a wrongful termination under the law.

Disclaimer: This information serves as a concise summary and educational reference for Minnesota state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.