Michigan Labor Law Guide

A comprehensive guide to Michigan labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways of Michigan Labor Laws

- The minimum wage in Michigan is $10.33 per hour, which is greater than the federal rate.

- Michigan employers are not required to provide rest or meal breaks.

- Nonexempt employees are entitled to overtime pay at 5 times their regular rate of pay for hours worked after the first 40 in one workweek.

- Employers and employees can terminate their employment relationship without cause.

- Michigan has repealed its right-to-work state and will take effect on March 30, 2024.

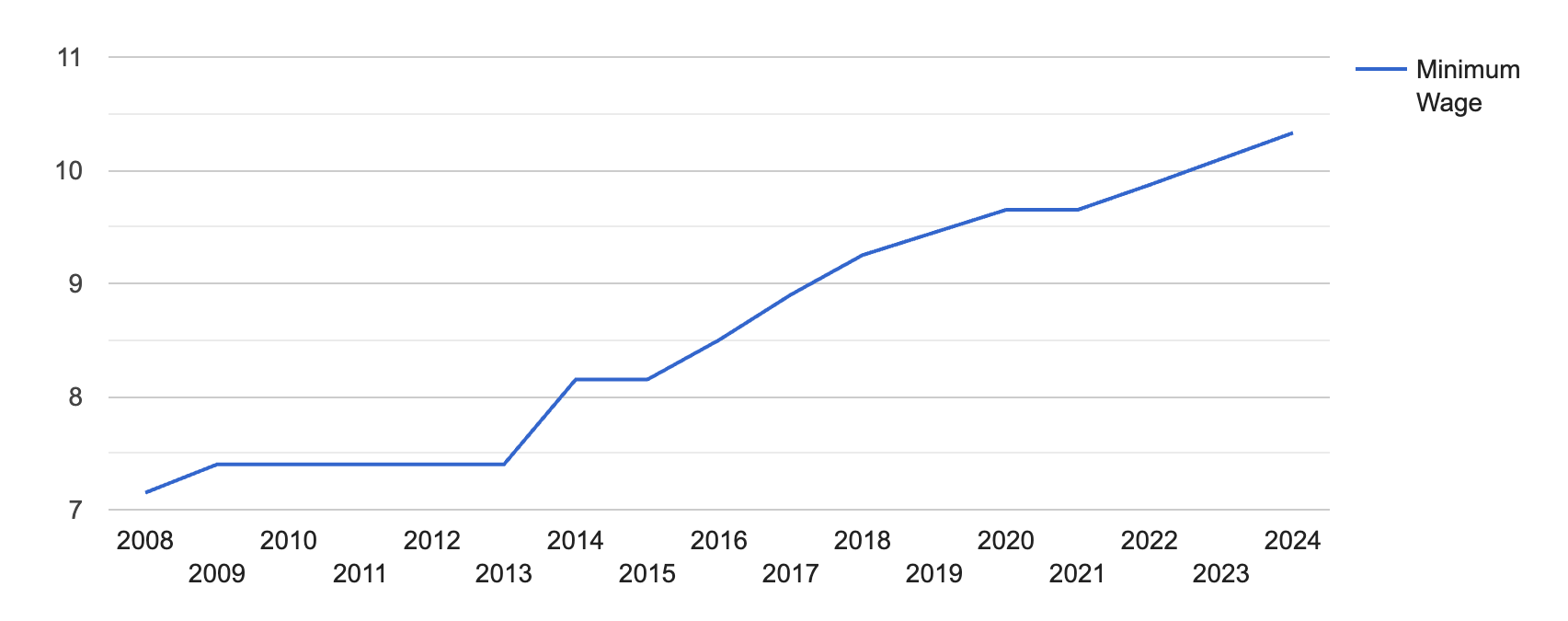

Minimum Wage Regulations in Michigan

The minimum wage in Michigan is set to increase annually from 2019 to 2030 as long as the unemployment rate in the preceding year is not over 8.5%.

As per the Improved Workforce Opportunity Act, state minimum wage and overtime regulations apply to employers with two or more employees. These do not apply to employers covered by the FLSA.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

Regular employees, or workers who receive a fixed hourly wage or salary, are entitled to the current state minimum wage rate of $10.33 per hour in Michigan. This increased from $10.10 per hour in 2023.

Employees between 16 and 17 years old may be paid 85% of this rate.

[Source: FRED]

Tipped Employees

Tipped employees in Michigan must be paid a minimum of $3.93 per hour. The combination of their tips with this amount should at least equal the required minimum hourly wage rate.

If an employee’s tips do not bring their earnings up to at least the standard minimum wage, the employer should make up the difference.

Employees are required to give their employer a signed written tip statement before receiving pay.

When navigating wages and Michigan labor laws, ensure you’re equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions tailored to your state’s tax laws.

Overtime Rules and Regulations in Michigan

As per Michigan’s Improved Workforce Opportunity Wage Act, employees who work more than 40 hours in a workweek are entitled to overtime pay.

Nonexempt Employees

Nonexempt employees should be paid 1.5 times their regular rate of pay for hours worked over the first 40 in one workweek. These include those in positions like hourly workers such as servers and bussers, administrative staff, retain employees, clerical workers or technical staff.

Michigan law is closely aligned with FLSA policy in terms of its classification for both nonexempt and exempt employees.

Exempt Employees

Exempt employees are typically salaried workers receiving a fixed salary of at least $684 a week, which is the current federal wage under FLSA, and are not eligible for overtime pay.

Exempt employees include those in positions like managers and supervisors, professional staff, executives or high-level administrators.

Employers should be mindful of properly classifying employees to adhere to wage regulations and avoid violations.

At-Will Employment in Michigan

Michigan operates as an at-will employment state, which means that either the employer or the employee can terminate the working relationship at any time, with or without cause and notice, except for reasons prohibited by law—breach of contract, discrimination, retaliation and public policy.

Right-To-Work Laws in Michigan

Since 2012, Michigan has observed a right-to-work statute, which prevents employees from being forced to:

- Join or support labor unions

- Pay union dues, fees or charges

- Pay third parties in lieu of union fees

However, on March 24, 2023, Michigan became the first state in the United States (U.S.) to repeal its right-to-work statute, thereby ending these protections, which is set to take effect on March 30, 2024.

Employers should be prepared to deal with union initiatives to reintroduce or establish union security provisions. This includes clarifying the extent of the employer’s negotiation obligations.

Rest and Meal Breaks in Michigan

Employers in Michigan are not required to provide breaks or rest or meal periods for employees (18 years old or older). Employees under 18 years old should have a documented 30-minute break and may not work more than 5 hours, as per the Youth Employment Standards Act.

Family and Medical Leave Laws in Michigan

Employees in Michigan are protected by two major leave laws: (1) the Family and Medical Leave Act (FMLA) and (2) the Michigan Paid Medical Leave Act (PMLA).

Family and Medical Leave Act

Employees in Michigan are entitled to time off under the federal FMLA, which provides up to 12 weeks of unpaid, job-protected leave in a 12-month period for the following cases:

- Childbirth or adopting/fostering a child

- Taking time off within a year of a child’s birth or adoption to bond with them

- Providing care for a spouse, child or parent with a serious health condition

- Taking leave due to an employee’s own serious health condition

- Taking leave for situations related to a military member’s foreign deployment, who is the employee’s spouse, child or parent

- To care for a covered military member with a serious health condition (up to 26 weeks within a 12-month period)

To qualify, employees should have 12 months of employment in Michigan (consecutive or not) and have worked 1,250 hours within the last 12 months.

Employers subject to FMLA include public agencies, private-sector employers with 50 or more employees in at least 20 weeks of the current or previous year and local education agencies.

Michigan Paid Medical Leave Act

Since 2019, Michigan has mandated that employers with 50 or more employees must offer paid medical leave in accordance with PMLA. Employees should earn at least 1 hour of paid medical leave for every 35 hours worked, with a maximum of 40 hours per year.

Under PMLA, employees can use their earned medical leave for:

- Their own or a family member’s physical or mental health needs

- Medical diagnosis, care or treatment

- Preventative care

- Workplace closure due to a public health emergency

- Childcare when a school or care facility is closed due to a public health emergency

- Exposure to a communicable disease that poses a health risk, as determined by health authorities or a healthcare provider

- Medical care or counseling

- Services from a victim support organization

- Relocation

- Legal assistance

- Participation in civil or criminal proceedings related to domestic violence or sexual assault

Paid medical leave under this act is generally available to most employees, excluding those exempted from federal overtime regulations (e.g., executives, administrative, professional or outside sales employees), those under collective bargaining agreements, employees working primarily outside Michigan and part-time, seasonal or variable-hour employees (defined as those working fewer than 25 hours per week on average in the prior year).

Note that employers with fewer than 50 employees are not required to provide PMLA.

Other Leave Laws

Here’s a quick overview of various types of leaves under Michigan labor laws:

- Vacation and holiday: Employers are not required to provide paid or unpaid leaves for vacation benefits, sick leaves or holiday leaves, except as provided under PMLA.

- Jury duty: Employers cannot penalize employees for serving on a jury and should avoid making them use their paid leave for this purpose unless company policies dictate otherwise. Employers are not obligated to provide payment for jury duty time.

- Voting: Michigan labor laws do not require employers to grant employees paid or unpaid leave to vote.

- Donor: Michigan does not have any living donor protection laws or donor leaves provided to employees.

- Bereavement: Michigan does not require employers to provide leaves to attend funerals.

Workplace Safety and Health Regulations in Michigan

Establishing a safe and secure work environment requires giving workplace health and safety the top priority. Employers in Michigan are subject to federal and state-specific regulations governing safety and health in the workplace.

The last known data shows there have been 140 fatal occupational injuries in Oklahoma state, most of which are related to transportation accidents.

You can see how North Carolina compares to other states in the US when it comes to occupational fatal injuries by browsing our table below.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Occupational Safety and Health

The Michigan Occupational Safety and Health Administration (MIOSHA) plays a crucial role in ensuring workplace safety and health within the state of Michigan.

In its efforts to safeguard the well-being of Michigan’s workforce, MIOSHA has adopted numerous federal Occupational Safety and Health Administration (OSHA) standards by reference to the Michigan Occupational Safety and Health Act.

Keep in mind that MIOSHA applies to both public and private employers, unlike OSHA.

Child Labor Laws in Michigan

A minor employee must be at least 14 years old to be allowed to work. An adult must supervise all minor employees at all times. Other important considerations are listed below.

Work Hours

- 14–15-year-old employees’ work and school hours should not exceed 48 hours in a workweek.

- 16–17-year-old employees may work 24 hours per workweek when school is in session, and 48 hours when school is not.

- All minor employees should not work more than six days a week.

- All minor employees should not work more than 10 hours a day.

Exemptions

- 16–17-year-old employees who have completed their requirements for high school graduation

- 17-year-old employees who have passed their GED test

- Emancipated minors

- All minor employees working for their parents’ businesses

Work Permit

- All minor employees are required to have procured a work permit before starting work.

- Work permits can be obtained from their schools’ issuing officers. Check Michigan’s Labor and Economic Opportunity’s work permit guidelines for more info.

Antidiscrimination and Fair Employment Practices in Michigan

The Michigan Civil Rights Commission ensures Michigan citizens are protected and assured of all their civil rights guaranteed by law, including employment.

The Michigan Department of Civil Rights accepts complaints related to factors such as age, arrest record, color, disability, genetic information, height, marital status, national origin, race, religion, sex and weight.

Discrimination based on disability should be directly connected to a person’s job performance or the unalterable use of facilities.

Equal Pay

The Michigan Civil Rights Act prohibits retaliation against employees who report equal pay law violations or participate as witnesses in related proceedings.

Whistleblower Protection

An employee cannot legally be terminated or subjected to discriminatory actions as a response to reporting a suspected violation of any law at the federal, state or local level, or for their involvement in an investigation, hearing, inquiry or legal proceeding.

Wage Statements

Employees have the right to receive detailed pay stubs that outline gross wages, work hours, deductions and earnings. Electronic statements are also allowed, as long as the employee can print them out at the time they are paid.

Workers’ Compensation Insurance

Employers are required to provide workers’ compensation benefits to employees if they have three or more employees or at least one employee working more than 35 hours per workweek for at least 13 weeks.

These benefits include medical, disability, rehabilitation, death, legal costs and more, and are provided to employees starting from their first day on the job.

Independent Contractor Classification in Michigan

Michigan employers should classify whether a worker is an employee or an independent contractor to ensure compliance with tax and wage regulations.

An employee is typically someone who works for an employer, follows their guidelines, and receives regular pay (for instance, a restaurant dishwasher).

Conversely, an independent contractor is paid on a per-project basis and operates without the same level of employer control (as seen with an interior designer hired for a specific project in an office).

To determine a worker’s employment status, Michigan courts use the Internal Revenue Service (IRS) 20-factor test.

Official Holidays in Michigan

Employers are not required to provide paid or unpaid leave for holidays or premium wage rates for employees working on those days. If a holiday falls on a Sunday, it is observed on the following Monday.

[Source: State of Michigan]

Termination and Final Paychecks in Michigan

Employers in Michigan must pay all final wages to their employees on the next regular payday.

An employer must pay all wages earned by an employee involved in crop hand harvesting within one working day after termination.

Suppose the amount owed to a contract worker who leaves voluntarily or is discharged cannot be determined until the contract ends. In that case, the employer should estimate and pay the employee their earnings as soon as possible, with the final payment in full at the contract’s termination.

Miscellaneous Michigan Labor Laws

Here are additional Michigan labor laws regarding specific aspects of employment and labor relations.

Immigration Verification

Michigan labor laws do not require any other procedures for additional employment verification aside from federal I-9 compliance. E-Verify is also not required.

Drug Testing

Michigan does not have specific laws for drug and alcohol testing in hiring or during employment. Employers can, therefore, create their policies about alcohol and drug use at work.

Smoking Laws

As per Michigan’s Smoke-Free Indoor Air Law, smoking is not allowed in most public places, including workplaces and food service establishments.

Employers are required to post “no smoking” signs at the entrances of their establishments and call out any employee who violates this law.

Gun Laws

According to Michigan regulations, an employer is not permitted to prevent an employee from pursuing or obtaining a concealed pistol carry license. Nonetheless, it is within the employer’s rights to forbid an employee from carrying a concealed pistol while performing their job duties.

Summary of Michigan Labor Laws

Michigan's minimum wage is $10.33 per hour, exceeding the federal rate. This rate is set to increase annually until 2030 if the unemployment rate remains below 8.5%.

Tipped employees must be paid a minimum of $3.93 per hour, with tips making up the difference to meet the required minimum wage.

Nonexempt employees are entitled to overtime pay at 1.5 times their regular rate for hours worked over 40 in a workweek. At the same time, exempt employees, typically salaried workers, are not eligible for overtime pay.

Michigan operates as an at-will employment state, allowing either the employer or the employee to terminate the relationship at any time with or without cause.

Employers in Michigan are not obligated to provide specific breaks for employees.

Michigan follows the federal Family and Medical Leave Act (FMLA), providing up to 12 weeks of unpaid, job-protected leave for specific family and medical reasons.

Frequently Asked Questions About Michigan Labor Laws

Stay informed and read on for answers to frequently asked questions about Michigan’s labor laws.

What is the legal working age in Michigan?

The minimum employment age in Michigan is 14 years old, with limitations in occupations and work hours.

[Source: Michigan Department of Labor & Economic Opportunity]

How many hours can you work in Michigan?

The maximum number of hours that eligible employees may work in a workweek is 40, and any time beyond that is considered overtime under both federal and Michigan labor regulations.

Who is exempt from overtime pay in Michigan?

Michigan adheres to federal regulations concerning major exemptions. These include elected officials, executives, administrators, professionals, etc.

Can you be fired without cause in Michigan?

Employers in Michigan can fire employees for any reason and at any time. Likewise, employees can also terminate any working relationship.

Do you need a work permit in Michigan?

All minors (those under the age of 18) are required to have a work permit before starting work.

Disclaimer: This information serves as a concise summary and educational reference for Michigan labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.